The right to execute and deliver a stop notice or a notice to withhold funds is a remedy closely related to a mechanic's lien. When a stop notice or a notice to withhold funds is received by an individual or a firm holding the construction funds for a project, the individual or firm must withhold from its disbursements sufficient money to satisfy the stop notice claim. In jurisdictions that provide for stop notices, the notice constitutes a remedy in addition to a mechanic's lien.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

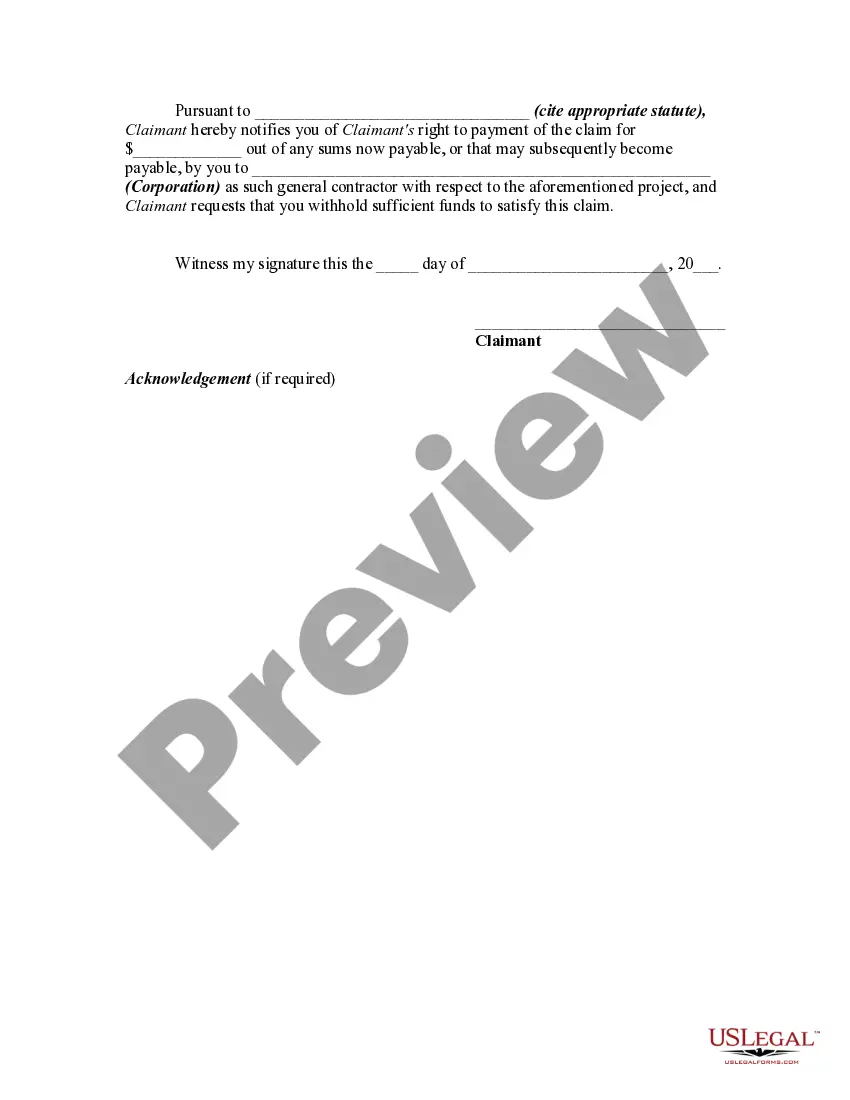

A California Stop Payment Notice by Subcontractor to the Holder of Construction Project Funds is a legal document filed by a subcontractor in California to protect their rights and ensure they receive payment for services rendered on a construction project. This notice is crucial for subcontractors to claim unpaid amounts from the money owed to the general contractor or the owner of the project. Subcontractors may need to file a California Stop Payment Notice when they have not been paid for their work, labor, or materials they have provided on a construction project. By filing this notice, subcontractors can preserve their rights and place a hold on money that has been withheld or disputed. The California Stop Payment Notice is typically sent to the holder of construction project funds, which is the party responsible for distributing payments on the project. This could be the construction lender, the project owner, or someone else with control over the funds. There are two primary types of California Stop Payment Notices that subcontractors can file: 1. Preliminary Notice: This is the initial notice that subcontractors serve to protect their rights before any payment issues arise. By sending a preliminary notice, subcontractors notify the project owner, general contractor, and other parties involved that they are providing services and may file a Stop Payment Notice in the future if necessary. 2. Stop Payment Notice: This notice is filed by subcontractors after they have completed their work or provided materials but have not received full or timely payment. The Stop Payment Notice is a formal demand for payment sent directly to the party holding the construction project funds, requesting that they stop disbursing money until the subcontractor is paid. When filing a California Stop Payment Notice, subcontractors must include specific details such as: — Project information: Subcontractors should provide the project name, address, and legal description if available. — Subcontractor information: This includes the subcontractor's name, address, and contact information. — Notice recipient: The notice should be addressed to the party responsible for disbursing funds, often the construction lender or project owner. The recipient's name, address, and contact information should be clearly stated. — Description of services/materials: Subcontractors must provide a detailed description of the work, labor, or materials they have provided on the project. — Documentation: Supporting documentation, such as invoices, contracts, or proof of delivery, should be attached to the notice. — Amount owed: The subcontractor should state the total amount owed for the services rendered. By filing a California Stop Payment Notice, subcontractors assert their right to collect payment from the construction project funds to ensure they receive what they are owed. It is essential for subcontractors to comply with the specific legal requirements and timelines for filing such notices to protect their interests and navigate payment disputes effectively.