California Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust is a legal document that modifies an existing trust agreement to remove or withdraw specific properties from the trust. This amendment allows the trustee or trust or to make changes to the trust, ensuring that the assets are accurately reflected and managed according to the wishes of the trust or. Keywords: California, Amendment, Inter Vivos Trust, Trust Agreement, Withdrawal of Property. Within the realm of California Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, there are different types available to address specific scenarios and circumstances. These variations include: 1. California Amendment of Inter Vivos Trust Agreement for Partial Withdrawal of Property: This type of amendment is used when the trust or wishes to remove only certain assets or properties from the trust while leaving the remaining ones untouched. It provides the necessary framework to update the trust based on the revised asset allocation. 2. California Amendment of Inter Vivos Trust Agreement for Complete Withdrawal of Property: In some cases, the trust or may decide to withdraw all of their properties from the trust. This type of amendment allows for a comprehensive removal of assets, effectively terminating the trust and distributing the properties back to the trust or. 3. California Amendment of Inter Vivos Trust Agreement for Replacement of Property: Suppose the trust or wants to exchange or substitute a property currently held by the trust with a new one. This type of amendment permits the trustee to remove the existing property and replace it with the desired asset while ensuring the trust's integrity. 4. California Amendment of Inter Vivos Trust Agreement for Dissolution or Termination: In the event that the trust or wishes to dissolve or terminate the trust altogether, this type of amendment is relevant. It outlines the necessary steps to be taken to legally dissolve the trust and distribute the remaining assets to the beneficiaries according to the trust or's instructions. Regardless of the specific type, any California Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust should be prepared in accordance with California state laws and adhere to the original intent and purpose of the trust. It is advisable to consult with a qualified attorney experienced in trust law to ensure that all legal requirements are met during the amendment process. Remember, this is just general information and should not substitute professional legal advice.

California Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust

Description

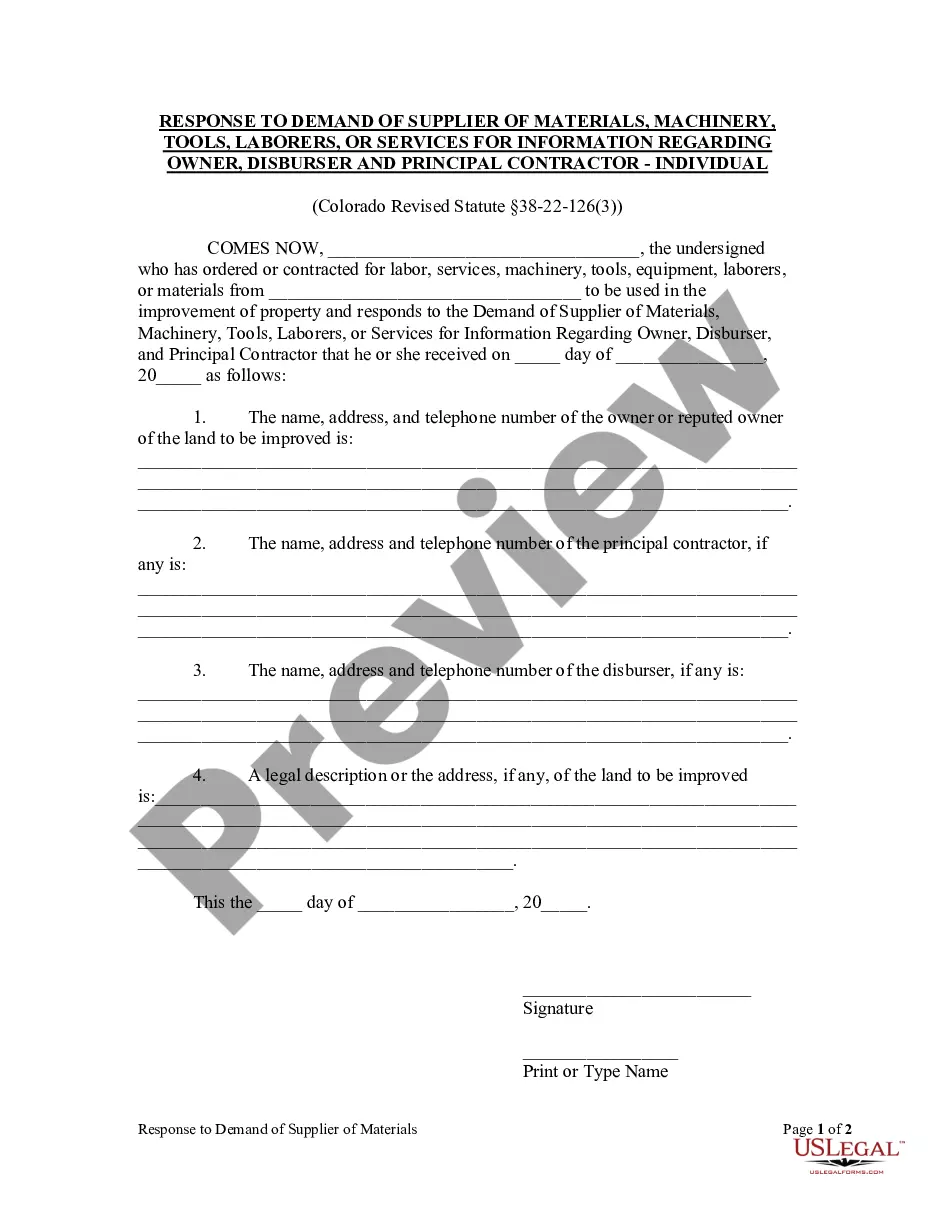

How to fill out Amendment Of Inter Vivos Trust Agreement For Withdrawal Of Property From Trust?

Are you presently in a location where you will require documents for either business or personal reasons almost every weekday.

There are numerous legitimate document templates available online, but finding forms you can trust is challenging.

US Legal Forms provides thousands of document templates, such as the California Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, which are designed to meet state and federal standards.

Once you find the correct document, click Buy now.

Choose the pricing plan you prefer, fill in the necessary information to set up your payment, and complete the order using your PayPal or Visa or Mastercard.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the California Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the template you require and ensure it is for your specific state/county.

- Utilize the Review button to examine the form.

- Check the description to confirm you have selected the correct document.

- If the document is not what you're looking for, use the Search feature to find the form that fits your needs.

Form popularity

FAQ

Yes, you can transfer property from a trust to an individual, and this process is fairly common. To accomplish this, you may execute a quitclaim deed or utilize a California Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust to ensure the transfer complies with legal standards. It’s wise to consult with a professional to ensure simplicity and clarity in the transaction.

In California, the trust itself owns the property, held for the benefit of the beneficiaries named in the trust. The trustee, appointed to manage the trust, has a fiduciary duty to act in the best interests of the beneficiaries. Once you initiate a California Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, ownership can transfer to specific individuals as designated.

Transferring property from a trust to an individual in California involves executing a legal document known as a quitclaim deed. This deed effectively conveys the property from the trust to the individual. If needed, you can also consider drafting a California Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust to facilitate the process, ensuring all necessary legal steps are taken.

To remove assets from a trust, you typically need to follow the terms outlined in the trust agreement. If the trust allows for it, you can create a California Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, which legally modifies the trust to reflect the removal of assets. It is often beneficial to consult an estate planning attorney to ensure you comply with all legal requirements.

A quitclaim deed from a trust to an individual is a legal document that transfers the ownership of property from the trust to a named individual without any warranties. This type of deed is often used during the California Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust process. The individual receives the property as it is, and it’s an efficient way to reallocate assets held in trust.

To write a California Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, begin by clearly labeling the document as an amendment. Specify the trust’s name, date, and all relevant details regarding the property you intend to withdraw. Next, outline the exact changes to the original trust agreement, ensuring clarity and precision. Finally, sign and date the amendment in the presence of a notary to validate your changes.

To amend a trust document in California, you typically need to draft an amendment that outlines the specific changes. For instance, if you're making changes related to a California Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, ensure clarity and compliance with state regulations. Legal assistance can streamline this process, ensuring the amendment aligns with your intentions and remains valid.

Trusts with taxable income or those that retain income must file a California trust return. This includes inter vivos trusts affected by amendments, such as a California Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust. Filing correctly helps ensure that tax obligations are met, and penalties are avoided.

A California partnership return must be filed by all partnerships engaged in business in California. Partners involved in trusts, particularly those undergoing a California Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, need to report their share of income accurately. Thus, it is crucial for trust administrators to understand their obligations related to partnership returns.

California withholding applies to non-resident beneficiaries who receive income from California sources. When you withdraw property from a trust through a California Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, it may trigger withholding requirements. Ensure that you consult the latest guidelines to understand who is affected and what forms are necessary.

Interesting Questions

More info

Agents Search Contact Us.