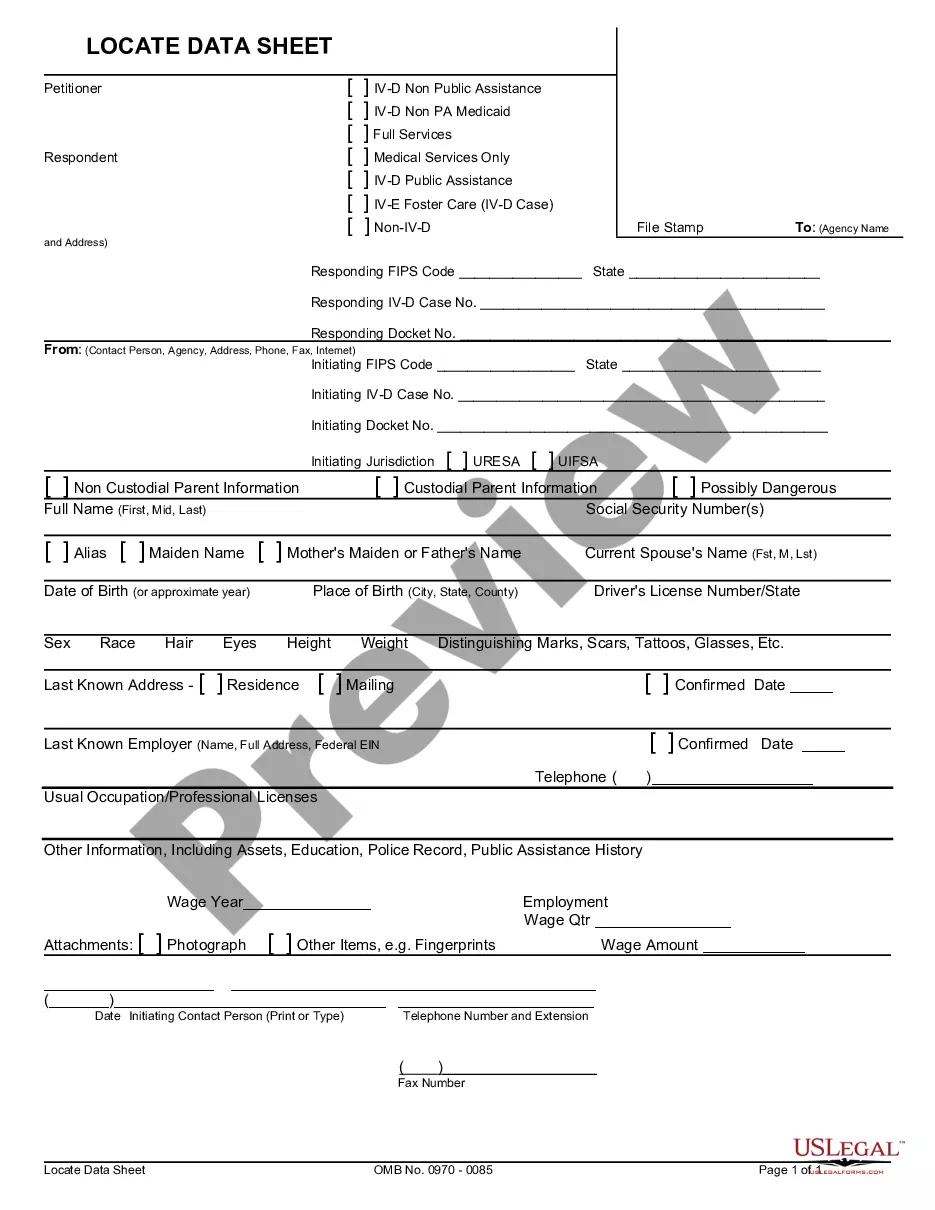

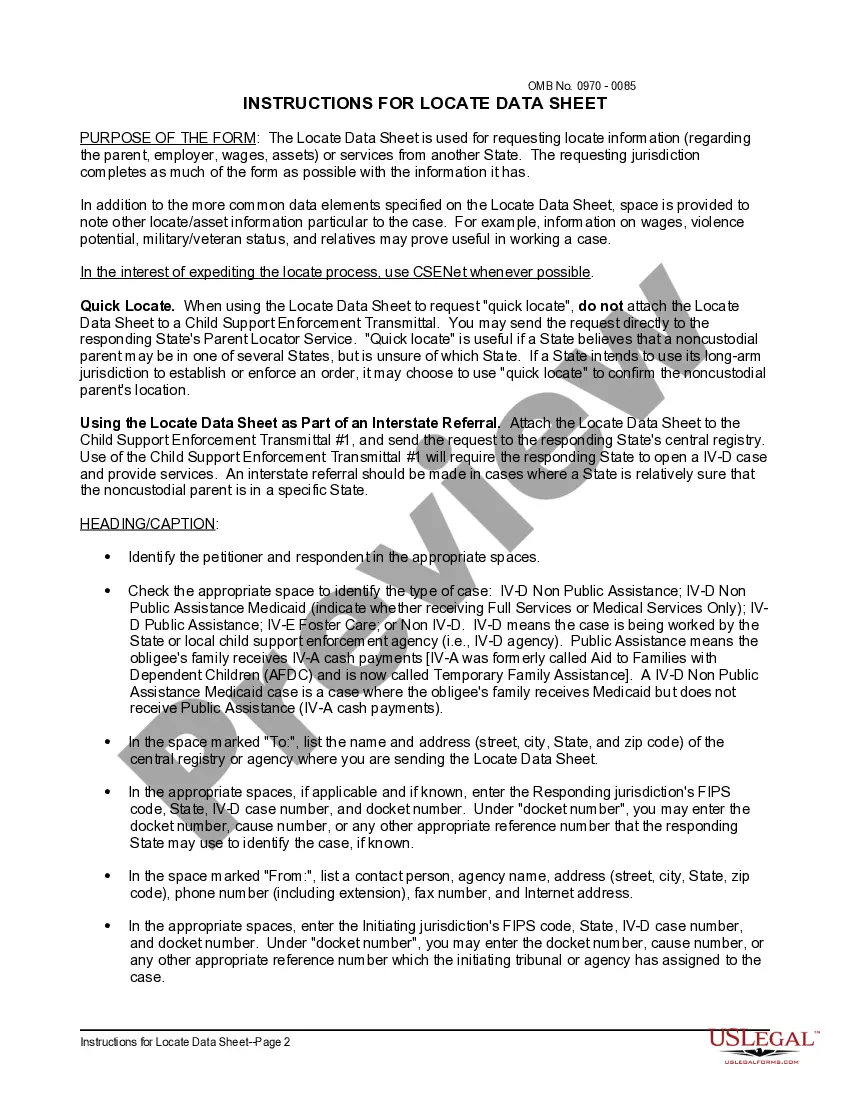

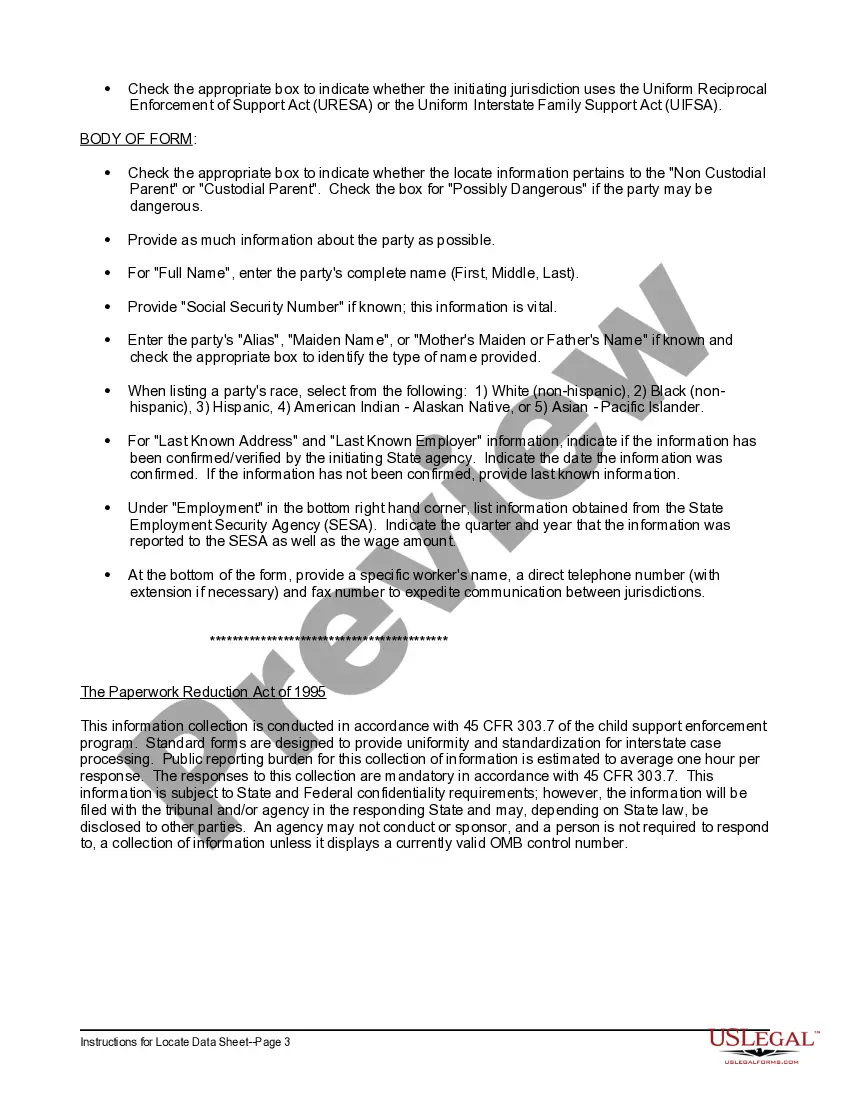

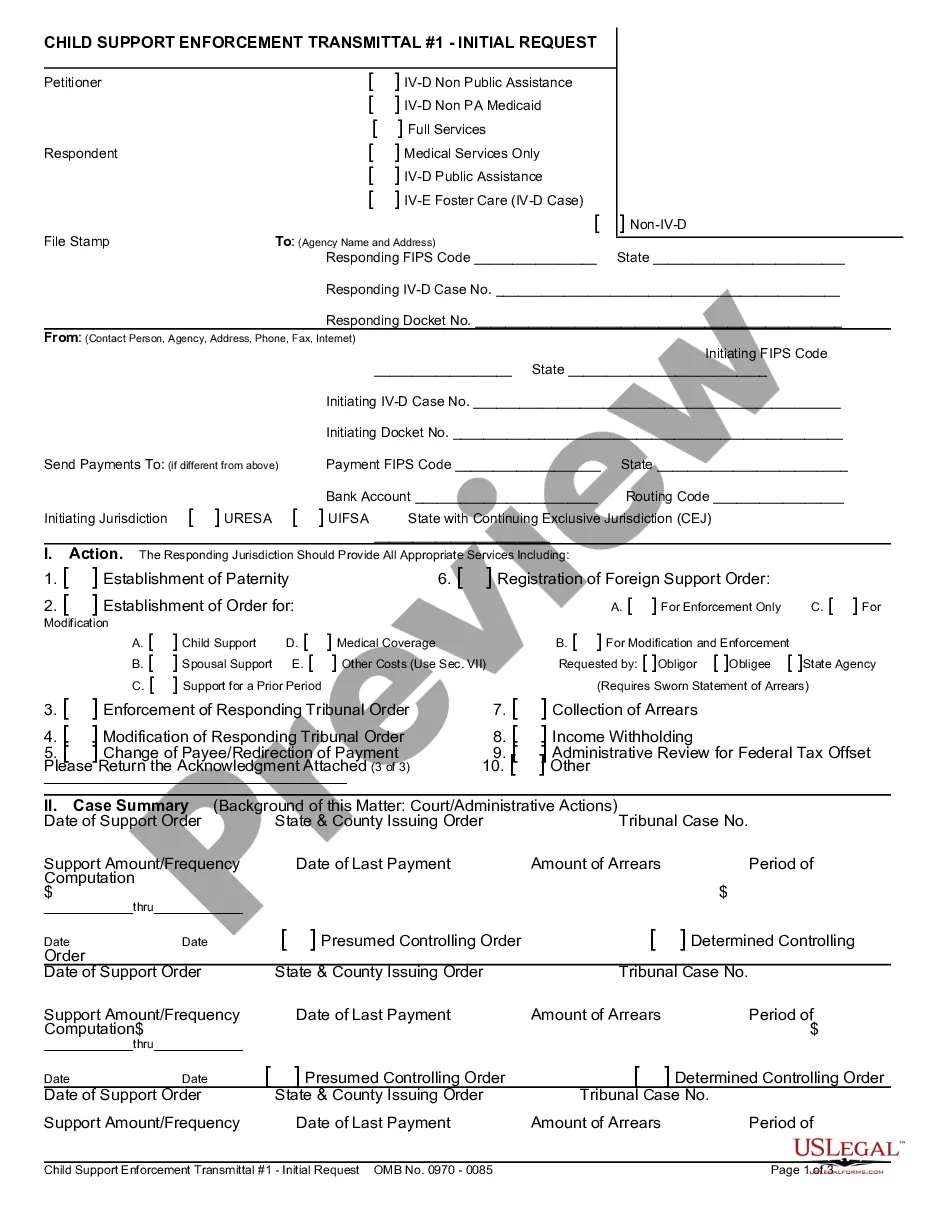

California Locate Data Sheet and Instructions

Description

How to fill out Locate Data Sheet And Instructions?

You can commit hours online looking for the legal papers template that suits the state and federal requirements you need. US Legal Forms offers 1000s of legal types that happen to be evaluated by pros. You can easily obtain or print out the California Locate Data Sheet and Instructions from the service.

If you currently have a US Legal Forms accounts, it is possible to log in and then click the Download switch. Following that, it is possible to complete, modify, print out, or sign the California Locate Data Sheet and Instructions. Each legal papers template you acquire is your own property eternally. To acquire another version for any acquired develop, visit the My Forms tab and then click the related switch.

If you use the US Legal Forms site for the first time, keep to the basic directions beneath:

- Very first, be sure that you have selected the right papers template for the state/area that you pick. Read the develop outline to ensure you have picked out the correct develop. If offered, use the Review switch to search from the papers template as well.

- If you wish to discover another model from the develop, use the Research discipline to find the template that meets your needs and requirements.

- After you have found the template you need, simply click Acquire now to carry on.

- Find the prices strategy you need, enter your qualifications, and register for your account on US Legal Forms.

- Complete the deal. You can use your credit card or PayPal accounts to pay for the legal develop.

- Find the format from the papers and obtain it in your gadget.

- Make changes in your papers if possible. You can complete, modify and sign and print out California Locate Data Sheet and Instructions.

Download and print out 1000s of papers layouts using the US Legal Forms Internet site, that offers the biggest selection of legal types. Use professional and express-specific layouts to handle your company or individual demands.

Form popularity

FAQ

You are single and your total income is less than or equal to $17,252. You are married/RDP filing jointly or a qualifying surviving spouse/RDP and your total income is less than or equal to $34,554. You are head of household and your total income is less than or equal to $24,454.

If you have a tax liability for 2022 or owe any of the following taxes for 2022, you must file Form 540. Tax on a lump-sum distribution. Tax on a qualified retirement plan including an Individual Retirement Arrangement (IRA) or an Archer Medical Savings Account (MSA).

Purpose. Use Schedule CA (540), California Adjustments ? Residents, to make adjustments to your federal adjusted gross income and to your federal itemized deductions using California law.

Form 540 is used by California residents to file their state income tax every April. This form should be completed after filing your federal taxes, such as Form 1040, Form 1040A, or Form 1040EZ, because information from your federal taxes will be used to help fill out Form 540.

All corporations subject to the franchise tax, including banks, financial corporations, RICs, REITs, FASITs, corporate general partners of partnerships, and corporate members of LLCs doing business in California, must file Form 100 and pay at least the minimum franchise tax as required by law.

Use Form 540-ES, Estimated Tax for Individuals, and the 2021 CA Estimated Tax Worksheet, to determine if you owe estimated tax for 2021 and to figure the required amounts. Estimated tax is the tax you expect to owe in 2021 after subtracting the credits you plan to take and tax you expect to have withheld.

Purpose. Use Form 540-ES, Estimated Tax for Individuals, and the 2022 California Estimated Tax Worksheet, to determine if you owe estimated tax for 2022 and to figure the required amounts.

Understanding Your State Income Taxes The Franchise Tax Board (FTB) is the agency responsible for collecting state personal income taxes in California.