An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

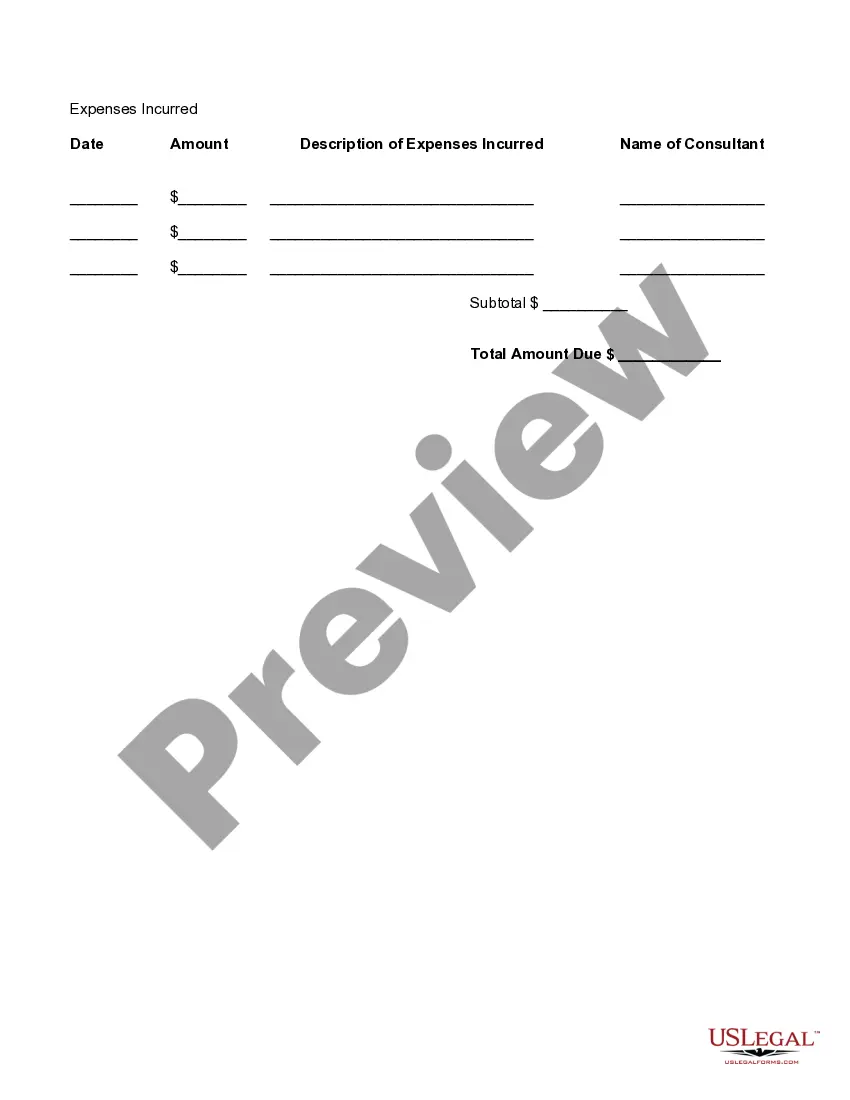

A California Detailed Consultant Invoice is a comprehensive document that provides a breakdown of services rendered, expenses incurred, and the total amount due for consultancy services provided by a consultant to a client in the state of California. This detailed invoice helps ensure transparency and clarity in the billing process. The key components of a California Detailed Consultant Invoice include: 1. Consultant Information: The invoice should begin with the consultant's name, address, contact information, and any relevant business identification numbers such as a tax ID. 2. Client Information: The invoice should include the client's name, address, and contact information to identify who the invoice is being issued to. 3. Invoice Number and Date: A unique invoice number and the date of issuance should be clearly stated on the invoice. This helps both the consultant and client keep track of payment records. 4. Service Description: A detailed breakdown of the services provided by the consultant should be included. This can include the nature of the consultancy, project duration, hourly rates, or any other agreed-upon service terms. 5. Expenses: If there were any expenses incurred during the consultancy period, such as travel expenses, research costs, or material purchases, they should be itemized separately from the consultant's fees. 6. Hourly or Project Rates: The invoice should clearly state the hourly rates or project fees charged by the consultant. If different services are performed at varying rates, they should be clearly specified. 7. Total Amount Due: After calculating the services rendered and expenses, the invoice should clearly state the total amount due, including any applicable taxes or discounts if applicable. Different types of California Detailed Consultant Invoice may arise depending on the specific industry or consultancy services provided. Here are a few examples: 1. Financial Consultant Invoice: This type of invoice is used by financial consultants who provide services such as financial planning, investment advice, or wealth management. 2. Marketing Consultant Invoice: Marketing consultants may issue invoices for services related to market research, marketing strategy development, social media management, or advertising campaigns. 3. IT Consultant Invoice: IT consultants may generate invoices for services like software development, system integration, network setup, or IT support and maintenance. 4. Legal Consultant Invoice: Legal consultants may issue invoices for services related to legal advice, contract drafting, compliance, or representation. In conclusion, a California Detailed Consultant Invoice is a comprehensive billing document that outlines the specific services provided, expenses incurred, and the total amount due from a consultant to a client in California. By providing transparency and clear breakdowns of services and costs, this invoice ensures a smooth payment process for both parties involved.A California Detailed Consultant Invoice is a comprehensive document that provides a breakdown of services rendered, expenses incurred, and the total amount due for consultancy services provided by a consultant to a client in the state of California. This detailed invoice helps ensure transparency and clarity in the billing process. The key components of a California Detailed Consultant Invoice include: 1. Consultant Information: The invoice should begin with the consultant's name, address, contact information, and any relevant business identification numbers such as a tax ID. 2. Client Information: The invoice should include the client's name, address, and contact information to identify who the invoice is being issued to. 3. Invoice Number and Date: A unique invoice number and the date of issuance should be clearly stated on the invoice. This helps both the consultant and client keep track of payment records. 4. Service Description: A detailed breakdown of the services provided by the consultant should be included. This can include the nature of the consultancy, project duration, hourly rates, or any other agreed-upon service terms. 5. Expenses: If there were any expenses incurred during the consultancy period, such as travel expenses, research costs, or material purchases, they should be itemized separately from the consultant's fees. 6. Hourly or Project Rates: The invoice should clearly state the hourly rates or project fees charged by the consultant. If different services are performed at varying rates, they should be clearly specified. 7. Total Amount Due: After calculating the services rendered and expenses, the invoice should clearly state the total amount due, including any applicable taxes or discounts if applicable. Different types of California Detailed Consultant Invoice may arise depending on the specific industry or consultancy services provided. Here are a few examples: 1. Financial Consultant Invoice: This type of invoice is used by financial consultants who provide services such as financial planning, investment advice, or wealth management. 2. Marketing Consultant Invoice: Marketing consultants may issue invoices for services related to market research, marketing strategy development, social media management, or advertising campaigns. 3. IT Consultant Invoice: IT consultants may generate invoices for services like software development, system integration, network setup, or IT support and maintenance. 4. Legal Consultant Invoice: Legal consultants may issue invoices for services related to legal advice, contract drafting, compliance, or representation. In conclusion, a California Detailed Consultant Invoice is a comprehensive billing document that outlines the specific services provided, expenses incurred, and the total amount due from a consultant to a client in California. By providing transparency and clear breakdowns of services and costs, this invoice ensures a smooth payment process for both parties involved.