California Receipt Template for Child Care

Description

How to fill out Receipt Template For Child Care?

If you need to finalize, acquire, or create sanctioned document templates, utilize US Legal Forms, the largest variety of legal templates that are accessible online.

Leverage the site’s straightforward and user-friendly search feature to find the documents you need. Numerous templates for commercial and personal use are organized by categories and states, or keywords.

Utilize US Legal Forms to access the California Receipt Template for Child Care in just a few clicks.

Every legal document format you obtain is yours permanently. You have access to each form you downloaded in your account. Click the My documents section and select a form to print or download again.

Compete and acquire, and print the California Receipt Template for Child Care with US Legal Forms. There are thousands of professional and state-specific forms you can use for your personal business or personal needs.

- If you are already a US Legal Forms member, Log In to your account and click on the Download button to locate the California Receipt Template for Child Care.

- You can also retrieve forms you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

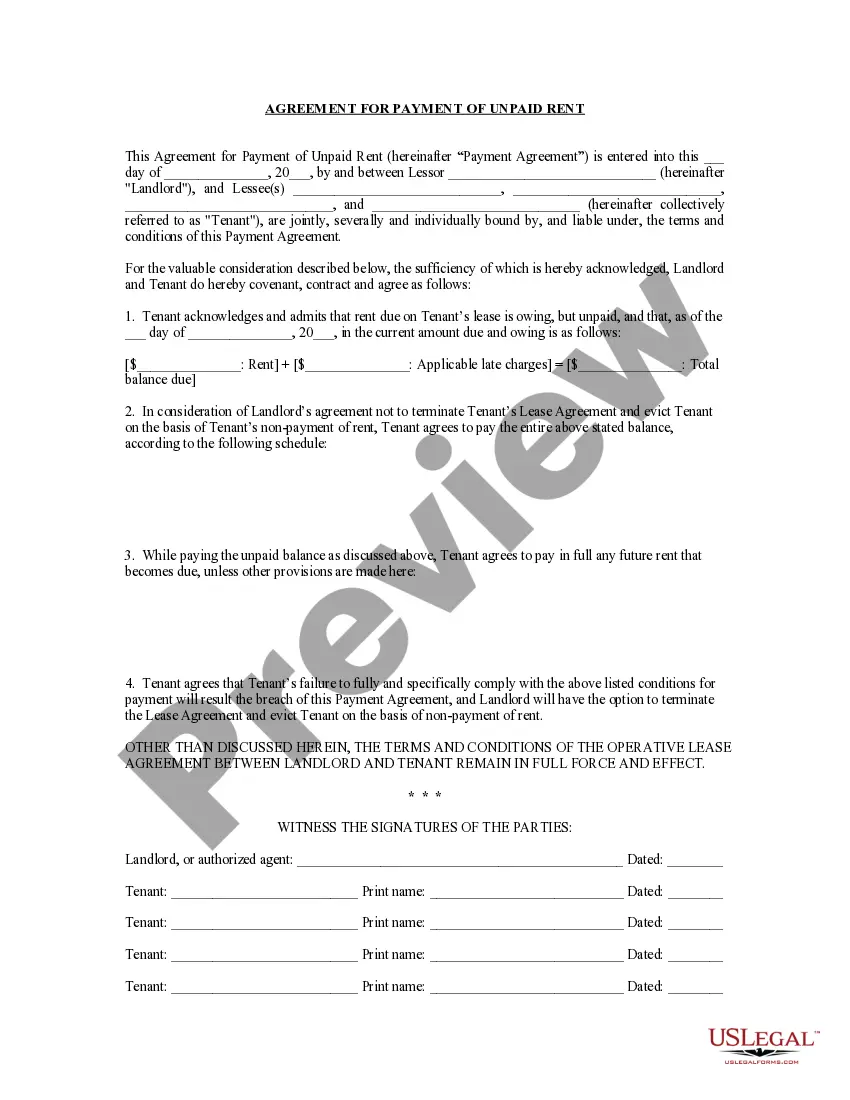

- Step 2. Use the Preview option to review the form’s content. Remember to read through the details.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find alternative versions of the legal document format.

- Step 4. Once you have found the form you require, click on the Purchase now button. Choose the pricing plan you wish and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it onto your device.

- Step 7. Complete, modify, and print or sign the California Receipt Template for Child Care.

Form popularity

FAQ

Yes, receipts are generally required to support child care expense claims on your taxes. They provide proof of your payments, which is essential for IRS verification. Utilizing a California Receipt Template for Child Care can aid in creating accurate and organized receipts, making your record-keeping easier and your claims more credible.

To create a daycare invoice, start with your contact information and the daycare provider's information. Specify the period of care, services rendered, and the total amount due. Utilizing a California Receipt Template for Child Care can enhance clarity and professionalism, making it easier for parents to understand their payment obligations.

To make receipts for daycare, include essential information such as the provider's name, services provided, dates, and payment amounts. A California Receipt Template for Child Care streamlines the process, providing a standardized format that ensures all necessary details are captured. Including both your name and the child's name can further clarify the receipt's purpose.

Claiming child care expenses without receipts can be tricky, but you still have options. You may need to provide alternative documentation, such as bank statements showing payments to the child care provider. A California Receipt Template for Child Care can be helpful by allowing you to create a record of payments, which can support your claims even in the absence of formal receipts.

To write a proof of child care letter, start by including your name and address, as well as the child care provider's name and address. Clearly state that this letter serves as a proof of child care, along with detailing the services provided, dates, and total amounts. Using a California Receipt Template for Child Care can help structure this letter effectively, making it easy for you to claim any necessary deductions.

Yes, the IRS typically requires proof of child care expenses if you claim a tax credit. You should maintain organized records, including receipts, to substantiate your claims. A California Receipt Template for Child Care not only simplifies this process but also ensures you have all necessary documentation ready for any IRS inquiries.

To claim a child care tax credit, you need proper documentation of your expenses. This often includes receipts, invoices, or payment records showing the costs incurred for child care services. Utilizing a California Receipt Template for Child Care can help you organize your proof effectively, making the tax credit application process easier.

Filling out a child care receipt requires you to enter specific information, such as the period of care, the child's name, and the payment method. Using a California Receipt Template for Child Care streamlines this process, ensuring accuracy and completeness. This approach guarantees that all relevant details are included, making it easier to submit for tax deductions.

Yes, you can write off certain child care expenses in California. The state offers various tax credits that allow parents to deduct a portion of child care costs from their taxable income. To ensure you maximize your benefits, use a California Receipt Template for Child Care, which helps you document your expenses accurately.

When writing a child support verification letter, begin with your contact details, followed by the recipient’s. Clearly state the purpose, including relevant dates and amounts of support given or received. Providing a California Receipt Template for Child Care helps itemize these payments in an organized manner, ensuring that your letter is both clear and effective.