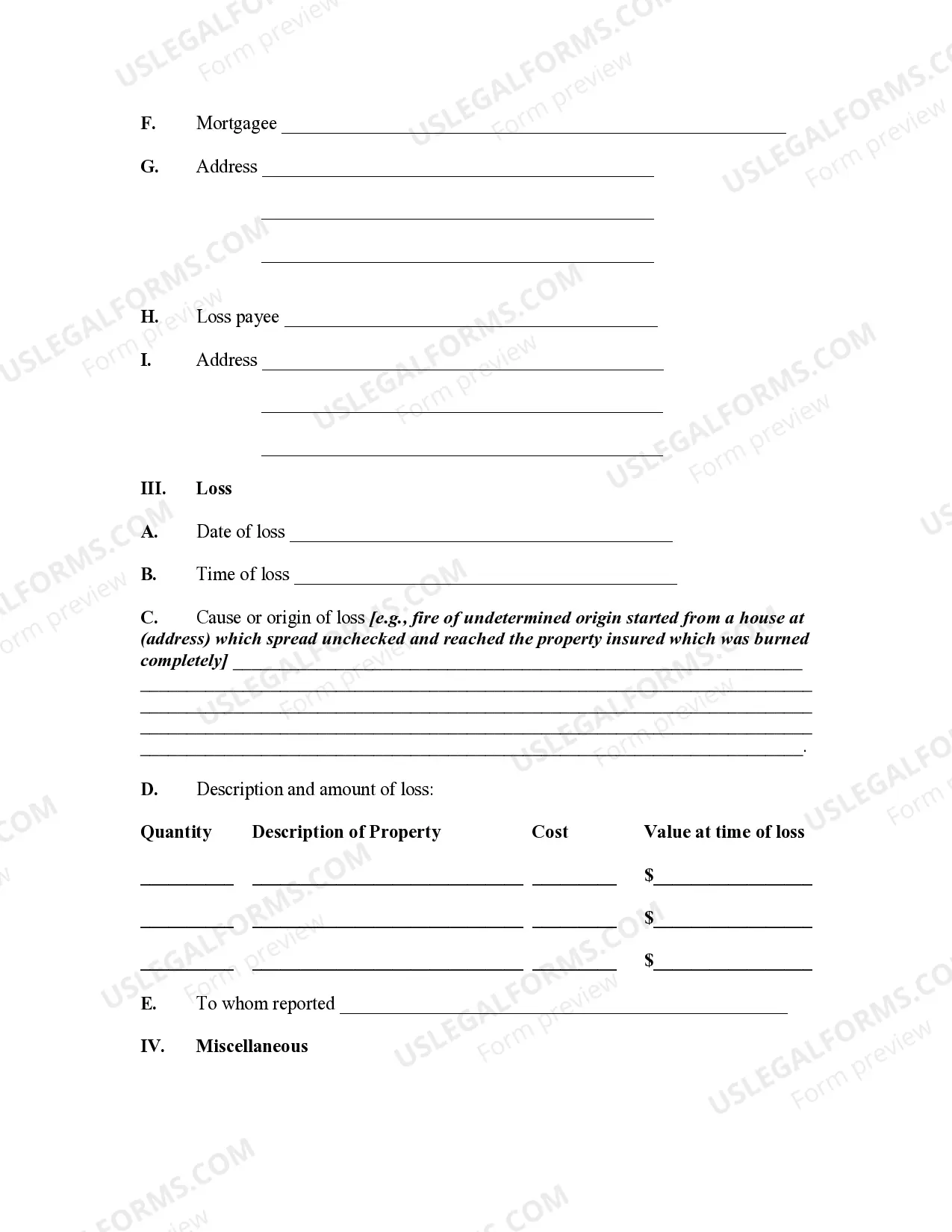

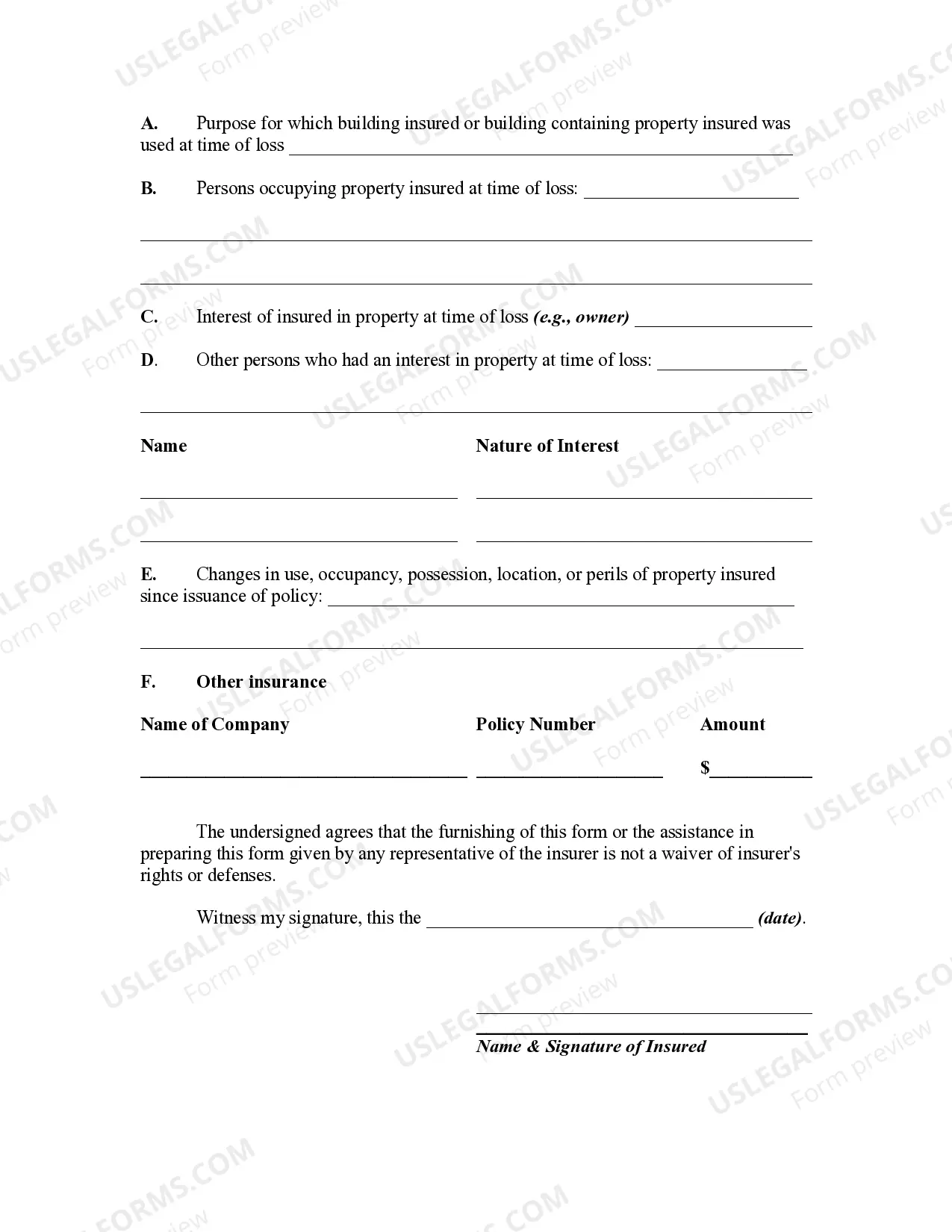

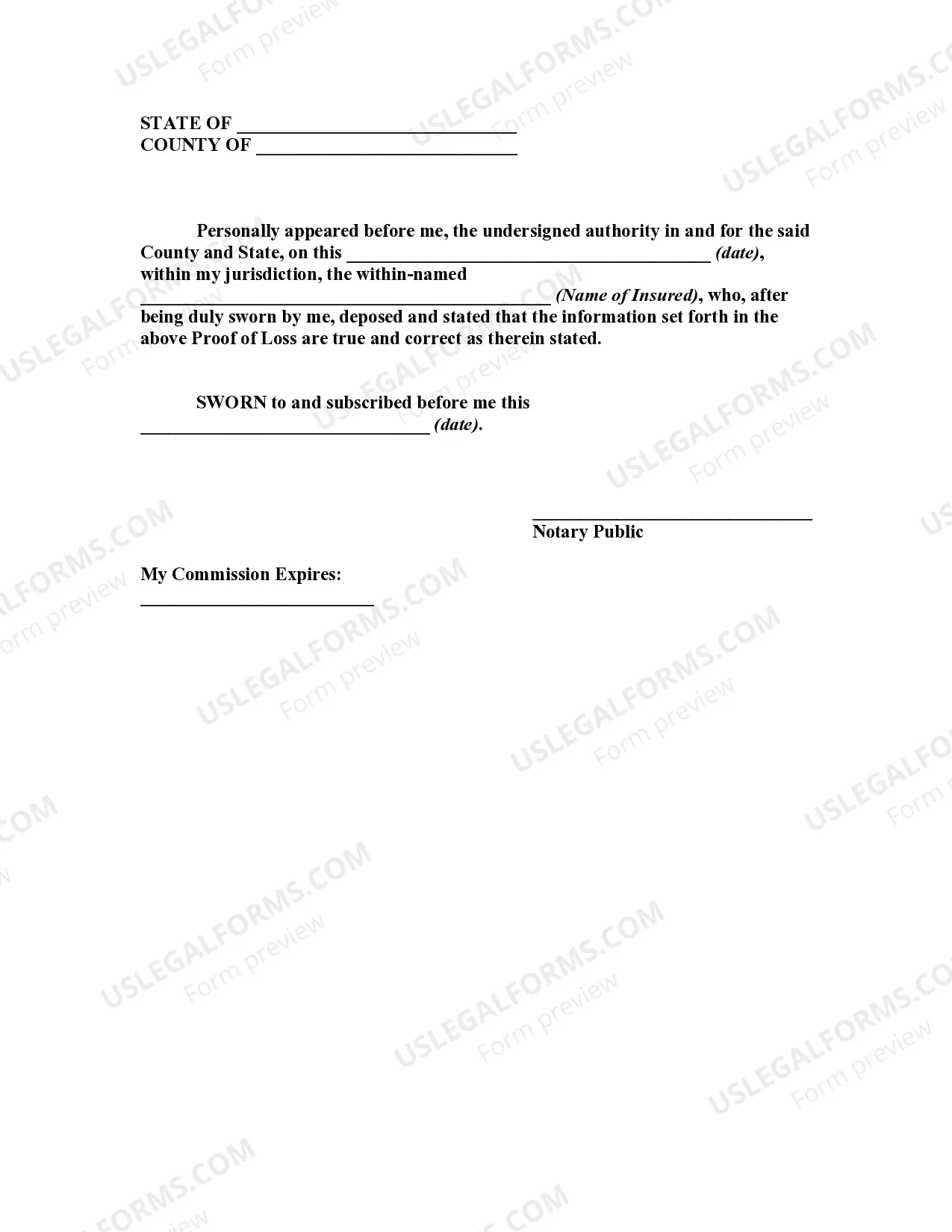

A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

California Proof of Loss for Fire Insurance Claim is a document required by insurance companies in California to substantiate and support an insured individual's claim for damages caused by a fire incident. This proof of loss is a comprehensive statement or report that outlines the details of the loss or damage incurred and the amount being claimed. It plays a crucial role in the claims process, helping ensure that the insured party receives fair compensation for their losses. Keywords: California, proof of loss, fire insurance claim, document, damages, claim, fire incident, comprehensive statement, insured party, compensation. There are two types of California Proof of Loss for Fire Insurance Claim: 1. Standard California Proof of Loss: The standard proof of loss form is a formal document provided by the insurance company that the policyholder must complete and submit after a fire incident. It typically requires detailed information about the loss, including the date and cause of the fire, a description of the damaged property or belongings, estimated repair or replacement costs, and any supporting documentation, such as receipts, photographs, or appraisals. 2. Supplementary California Proof of Loss: In some cases, additional information or documentation may be required to supplement the standard proof of loss form. This supplementary proof of loss can include further evidence of ownership, such as purchase records or inventory lists, and any other relevant details requested by the insurance company to fully assess the claim. Keywords: standard California proof of loss, supplementary California proof of loss, formal document, complete, submit, fire incident, detailed information, date, cause, damaged property, estimated costs, supporting documentation, receipts, photographs, appraisals, supplementary information, evidence of ownership, purchase records, inventory lists, assess claim.