California Sample Letter for Complaint to an Insurance Company: When dealing with unsatisfactory experiences and issues with insurance companies, it is essential to know how to effectively voice your concerns through a well-crafted complaint letter. In California, where numerous insurance providers operate, having a detailed complaint letter is crucial for obtaining a satisfactory resolution. This article will guide you on how to write a comprehensive complaint letter to an insurance company in California, providing you with a template and relevant keywords to enhance your letter's effectiveness. 1. Introduction: Begin the letter by addressing it to the appropriate department or individual within the insurance company. Include relevant details such as the policy number, date of issuance, and the primary insured person's name. Keywords: insurance company, policy number, insured person. 2. Explanation of the Problem: Clearly describe the issue you are experiencing with the insurance company. Provide specific information regarding the incident or claim, including dates, details, and any supporting documents that are applicable. Keywords: issue, problem, incident, claim, supporting documents. 3. Communication History: Outline any previous attempts you have made to address the issue, including phone calls, emails, or in-person visits. Mention the names and job titles of any insurance company representatives you have interacted with. Keywords: communication history, attempts, representatives. 4. Desired Outcome: Clearly state what resolution or action you expect from the insurance company to rectify the problem. Whether it's a claim settlement, reconsideration of a denied claim, or reimbursement for out-of-pocket expenses, make your desired outcome explicit. Keywords: resolution, action, claim settlement, denied claim, reimbursement. 5. Supporting Evidence: Attach copies of relevant documents, such as claim forms, denial letters, medical records, receipts, or any other evidence that strengthens your case. Mention the enclosed documents in your letter as well. Keywords: supporting evidence, claim forms, denial letters, medical records, receipts. 6. Legal Reference: If applicable, cite specific California insurance laws or regulations pertinent to your complaint. This demonstrates your understanding of relevant legal provisions and can strengthen your argument. Keywords: California insurance laws, regulations, legal reference. 7. Conclusion: Summarize your main points and reiterate your desired outcome, expressing your expectation of a prompt and satisfactory response from the insurance company. Provide your contact information, including your phone number and email address, for further communication. Keywords: conclusion, summary, prompt response, contact information. Types of California Sample Letter for Complaint to an Insurance Company: 1. California Sample Letter for Complaint about Denial of Health Insurance Claim 2. California Sample Letter for Complaint about Delayed Property Insurance Claim 3. California Sample Letter for Complaint about Unresponsive Auto Insurance Provider 4. California Sample Letter for Complaint about Wrongful Termination of Insurance Policy 5. California Sample Letter for Complaint about Inadequate Life Insurance Settlement By utilizing this detailed guide and incorporating the relevant keywords, you can effectively write a strong complaint letter to an insurance company in California. Remember to adapt the template to fit your specific situation and ensure your letter is professional, precise, and concise.

California Sample Letter for Complaint to an Insurance Company

Description

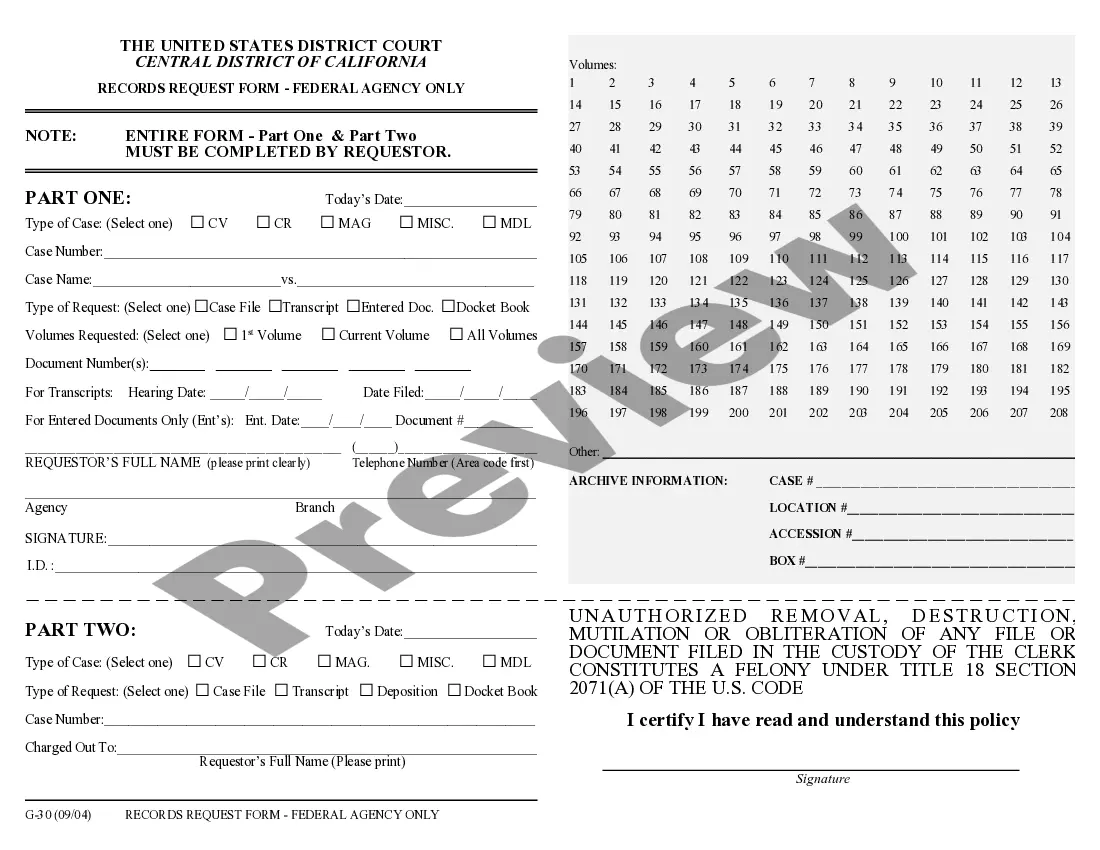

How to fill out California Sample Letter For Complaint To An Insurance Company?

If you want to full, down load, or produce authorized papers web templates, use US Legal Forms, the greatest assortment of authorized types, that can be found on the web. Make use of the site`s simple and easy convenient search to obtain the papers you need. Various web templates for business and person functions are categorized by categories and states, or keywords. Use US Legal Forms to obtain the California Sample Letter for Complaint to an Insurance Company within a couple of clicks.

If you are already a US Legal Forms customer, log in in your bank account and click on the Obtain key to get the California Sample Letter for Complaint to an Insurance Company. You can even entry types you previously delivered electronically in the My Forms tab of your respective bank account.

If you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Ensure you have chosen the shape for that appropriate town/nation.

- Step 2. Utilize the Review solution to examine the form`s content. Don`t forget about to read through the information.

- Step 3. If you are not satisfied together with the kind, use the Look for industry at the top of the display to get other types in the authorized kind format.

- Step 4. Once you have located the shape you need, click the Acquire now key. Pick the costs plan you favor and include your accreditations to register to have an bank account.

- Step 5. Procedure the financial transaction. You can utilize your bank card or PayPal bank account to accomplish the financial transaction.

- Step 6. Find the file format in the authorized kind and down load it on the device.

- Step 7. Total, edit and produce or indicator the California Sample Letter for Complaint to an Insurance Company.

Every single authorized papers format you purchase is the one you have eternally. You might have acces to every kind you delivered electronically in your acccount. Go through the My Forms area and decide on a kind to produce or down load yet again.

Contend and down load, and produce the California Sample Letter for Complaint to an Insurance Company with US Legal Forms. There are thousands of professional and state-distinct types you can utilize for your personal business or person requires.

Form popularity

FAQ

To dispute the insurer's decision, you first need to know why they made that decision. Ask the insurer to send you, in writing: The reason for rejecting your claim. A copy of any evidence they relied on in making their decision, such as assessor/expert reports or photos.

7 Tips for Writing a Demand Letter To the Insurance Company Organize your expenses. ... Establish the facts. ... Share your perspective. ... Detail your road to recovery. ... Acknowledge and emphasize your pain and suffering. ... Request a reasonable settlement amount. ... Review your letter and send it!

Types of Insurance Fraud False or inflated theft repair claim. Owner ?give up? (false stolen car report) ?Jump in? (someone not in vehicle at time of accident) Staged accident. Intentional damage claim. Falsifying the date or circumstances of an accident to get coverage. Rate evasion.

Information To Include in Your Letter Give the basics. Tell your story. Tell the company how you want to resolve the problem. Be reasonable. File your complaint. Your Address. Your City, State, Zip Code. [Your email address, if sending by email] Date.

Bad faith insurance refers to an insurer's attempt to renege on its obligations to its clients, either through refusal to pay a policyholder's legitimate claim or investigate and process a policyholder's claim within a reasonable period.

Send the complaint through Email to complaints@irdai.gov.in.

My complaint is that [list what you think went wrong or wasn't done properly. Be as clear as you can. It can help to make it short and to the point]. This situation has caused me [describe the impact this issue has had on you, your family or others who have been affected by the problem].

Give all the relevant facts concerning the claim. Refer to any documents that will help substantiate your position. Include a specific request for action you feel will correct the situation. Explain anything you intend to do to resolve the problem, but to not threaten legal action until negotiation has failed.