This is a form for a user agreement for an online auction and shopping website in which people and businesses buy and sell goods and services worldwide.

California Website Subscription User Agreement for Online Auction and Shopping Website

Description

How to fill out Website Subscription User Agreement For Online Auction And Shopping Website?

You might dedicate time online exploring the legal document format that aligns with the state and federal requirements you require.

US Legal Forms offers a vast array of legal documents that are reviewed by professionals.

It is easy to obtain or print the California Website Subscription User Agreement for Online Auction and Shopping Website from my service.

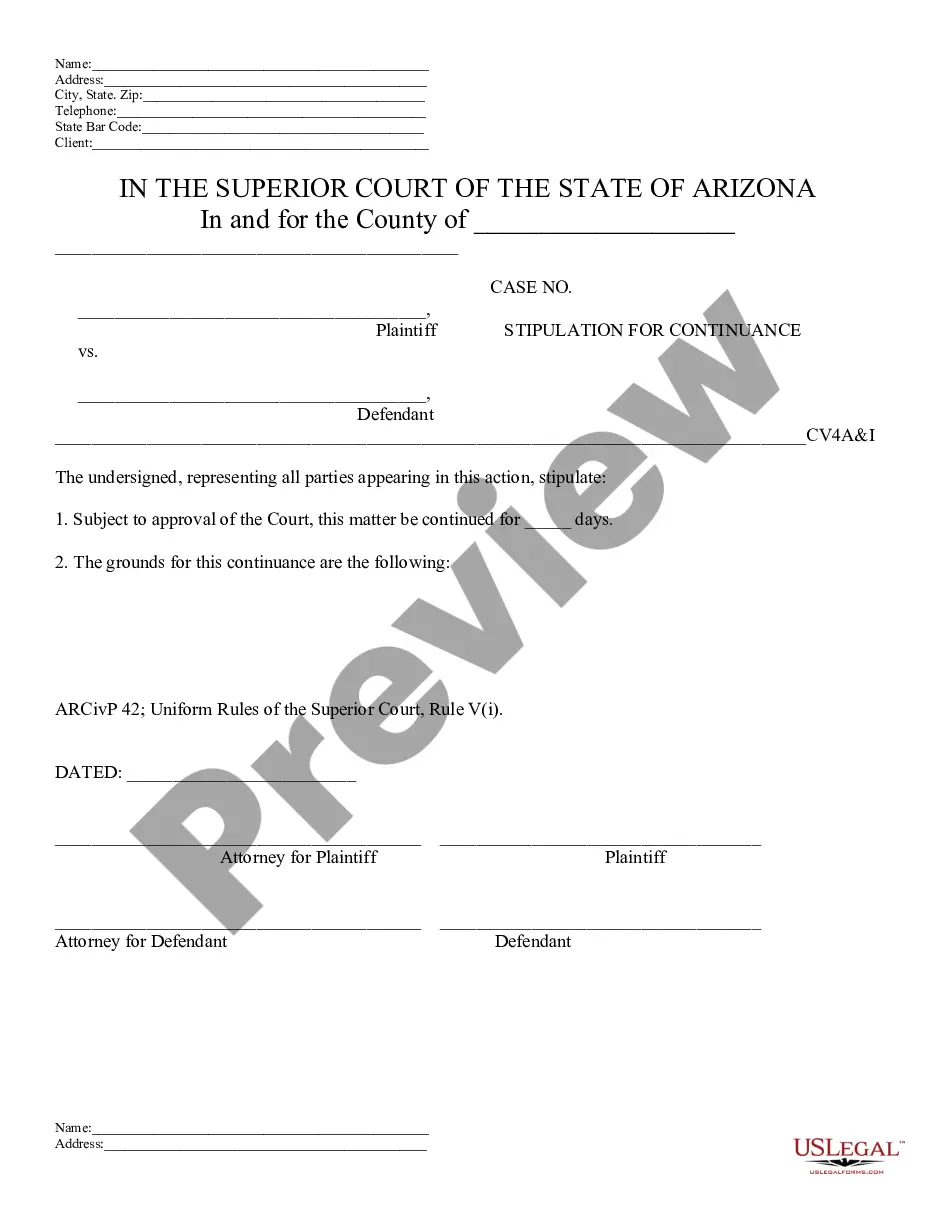

Review the form description to ensure you have chosen the correct form. If available, use the Preview button to review the document format as well.

- If you currently possess a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can fill out, alter, print, or sign the California Website Subscription User Agreement for Online Auction and Shopping Website.

- Every legal document format you purchase is yours indefinitely.

- To get another copy of the acquired form, navigate to the My documents tab and click the appropriate button.

- For first-time users of the US Legal Forms site, follow the straightforward instructions below.

- Firstly, confirm that you have selected the correct document format for the state/city of your choice.

Form popularity

FAQ

The California Consumer Privacy Act (CCPA) gives consumers greater control over their personal information. Businesses, including those that offer a California Website Subscription User Agreement for Online Auction and Shopping Website, must provide users with clear options to opt-out of data selling and data access requests. Companies must also inform consumers about their rights regarding the collection and use of their data. For businesses, complying with CCPA can enhance reputation and build customer loyalty.

California recently enacted a law that addresses digital games and their impact on consumers, particularly minors. This law mandates that game publishers disclose certain information in their California Website Subscription User Agreement for Online Auction and Shopping Website. Publishers must inform users about in-game purchases and provide transparency regarding content ratings. By following these guidelines, you can foster a safer environment for your audience and maintain compliance.

The California Privacy Rights Act (CPRA) applies to certain businesses that process personal information of California residents. If your platform offers a California Website Subscription User Agreement for Online Auction and Shopping Website and meets specific criteria, you may be subject to the CPRA. This includes companies that generate significant revenue or collect personal information from a large number of consumers. Understanding your obligations under the CPRA is essential for ensuring compliance and protecting consumer privacy.

The California Online Merchandise Disclosure Act requires businesses to disclose specific information about online purchases. Businesses must provide clear details about the terms of the sale when customers engage with the California Website Subscription User Agreement for Online Auction and Shopping Website. This includes shipping costs, return policies, and any additional fees. Compliance with this act can significantly improve user experience and trust in your online offerings.

Section 17602 of the California Automatic Renewal Law (ARL) mandates certain requirements for subscription services. This section ensures that businesses, including those offering California Website Subscription User Agreement for Online Auction and Shopping Website, clearly inform consumers about the terms of automatic renewals. As a result, businesses must provide easy ways for users to cancel their subscriptions. By adhering to this law, you enhance transparency and consumer trust.

An EIN, or Employer Identification Number, is not the same as a seller's permit. An EIN is issued by the IRS for tax identification purposes, while a seller’s permit allows a business to collect sales tax on taxable goods and services. If you operate an online auction and shopping website, you will likely need both for proper compliance with state and federal regulations, as specified in the California Website Subscription User Agreement.

In California, auctioneers are regulated by the California Bureau of Real Estate, which oversees licensing, compliance, and ethical conduct in the industry. This agency ensures that all auctioneering activities meet legal standards, including adherence to the California Website Subscription User Agreement for Online Auction and Shopping Website. For anyone new to online auctions, understanding these regulations is essential.

Sales tax for online purchases in California generally ranges from 7.25% to over 10%, depending on local city and county rates. Online retailers must collect this tax on sales when shipping to buyers within California. This responsibility emphasizes the importance of understanding the California Website Subscription User Agreement for Online Auction and Shopping Website. Always stay updated to ensure compliance.

Getting your seller's permit in California starts with completing the application process through the CDTFA. You can choose to apply online or in person. Make sure to include all relevant information about your business activities related to an online auction and shopping website. Once approved, ensure you comply with the requirements outlined in the California Website Subscription User Agreement.

In California, online subscriptions can be subject to sales tax, depending on the nature of the service provided. If your subscription offers tangible personal property, it typically falls under sales tax regulations. However, digital services may not be taxable. Understanding how this applies to your online auction and shopping website within the California Website Subscription User Agreement is crucial.