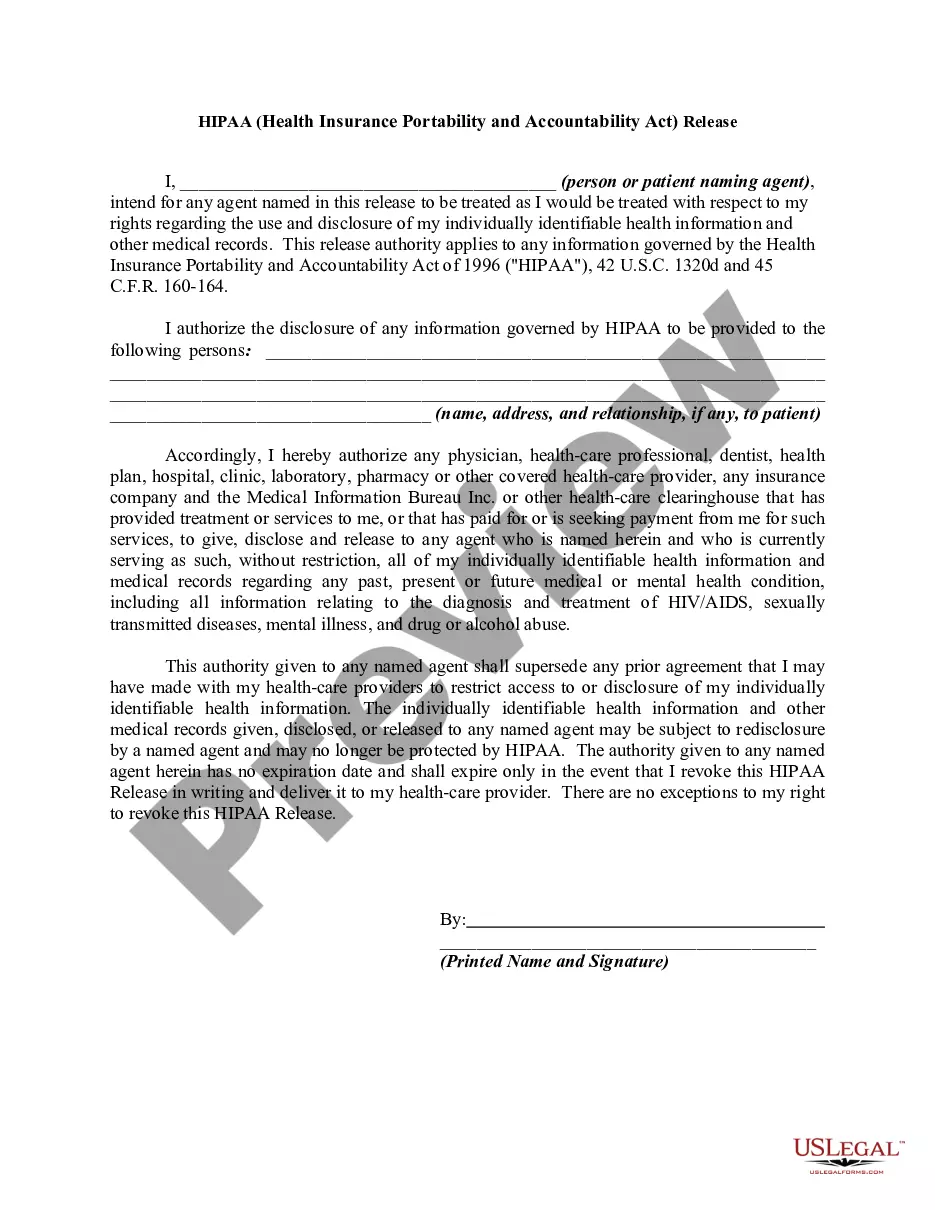

California HIPAA Release Form for Insurance: A Comprehensive Guide In California, the Health Insurance Portability and Accountability Act (HIPAA) Release Form stands as a crucial legal document in the insurance industry. It grants permission to healthcare providers and insurance companies to disclose an individual's protected health information (PHI) to specified entities or individuals. This form ensures compliance with HIPAA regulations while facilitating the exchange of relevant medical information for insurance purposes. The California HIPAA Release Form for Insurance acts as an authorization mechanism, empowering insurers to access medical records, claims, and other pertinent information that may be necessary to assess, process, or administer insurance policies. It enables seamless communication between medical providers and insurers, fostering a transparent and efficient claims settlement process. Key components of the California HIPAA Release Form include: 1. Authorization Date: The date on which the individual grants' authorization, initiating the release of PHI. 2. Individual Information: Personal details such as name, address, date of birth, contact information, and social security number to uniquely identify the person authorizing the release. 3. Recipient Information: The specific entities or individuals authorized to receive the disclosed PHI, including insurance companies, third-party administrators, or any other designated personnel. 4. Scope of Release: A detailed description of the information being released, which may include medical records, diagnostic reports, laboratory results, treatment histories, and any other relevant healthcare data. 5. Purpose of Disclosure: A statement clarifying the purpose for which the PHI is being released. This could involve filing an insurance claim, policy underwriting, claim investigation, or other insurance-related purposes. 6. Expiration Date: The length of time during which the HIPAA release form remains valid. It is important to note that HIPAA regulations dictate that authorizations generally expire no later than one year from the authorization date. 7. Revocation of Authorization: Instructions on how an individual can withdraw or revoke their authorization for the release of PHI. This ensures that individuals maintain control over their health information and can revoke consent at any time. Different Types of California HIPAA Release Form for Insurance: 1. General HIPAA Release Form: This form authorizes a healthcare provider to disclose PHI to an insurance company for standard insurance-related activities such as claims processing, policy administration, or underwriting. 2. Specific-purpose HIPAA Release Form: Tailored to address specific insurance-related requests, this form outlines the precise purpose for which the PHI will be disclosed. For example, it may be used for a disability insurance claim or an application for long-term care insurance. 3. Dual-purpose HIPAA Release Form: A combined form that serves both the insurance company and the healthcare provider, facilitating the sharing of PHI for various purposes like medical billing, treatment coordination, and insurance-related activities. In summary, the California HIPAA Release Form for Insurance is a vital tool for ensuring the secure transfer of protected health information between healthcare providers and insurers. By granting consent to disclose PHI, individuals can benefit from efficient claims processing, accurate policy underwriting, and enhanced communication within the insurance industry.

California Hippa Release Form for Insurance

Description

How to fill out California Hippa Release Form For Insurance?

Are you presently inside a situation that you need paperwork for sometimes organization or specific reasons virtually every working day? There are a lot of legal document themes available on the Internet, but getting kinds you can depend on is not straightforward. US Legal Forms delivers a large number of type themes, like the California Hippa Release Form for Insurance, which are composed in order to meet federal and state requirements.

In case you are presently familiar with US Legal Forms web site and have an account, just log in. After that, you can obtain the California Hippa Release Form for Insurance design.

Unless you come with an accounts and need to begin using US Legal Forms, adopt these measures:

- Find the type you need and make sure it is for the proper area/county.

- Use the Preview switch to check the shape.

- Look at the outline to ensure that you have selected the right type.

- When the type is not what you`re looking for, make use of the Lookup discipline to get the type that meets your requirements and requirements.

- Whenever you get the proper type, click on Purchase now.

- Select the rates plan you want, fill out the specified info to create your bank account, and purchase the transaction with your PayPal or credit card.

- Select a convenient paper file format and obtain your duplicate.

Discover each of the document themes you possess purchased in the My Forms menu. You can obtain a further duplicate of California Hippa Release Form for Insurance at any time, if possible. Just click the needed type to obtain or print the document design.

Use US Legal Forms, the most extensive collection of legal varieties, to conserve some time and stay away from errors. The support delivers appropriately created legal document themes which you can use for a range of reasons. Make an account on US Legal Forms and begin creating your lifestyle a little easier.