Title: A Comprehensive Guide to California Sample Letter for Compromise on a Debt Introduction: In the state of California, individuals burdened with overwhelming debt have the option to negotiate a settlement with their creditors through a compromise on a debt. This process involves crafting a formal letter to the creditor, explaining the financial situation and proposing a reduced payment amount. This article aims to provide a detailed description of what a California Sample Letter for Compromise on a Debt entails, while highlighting different types of such letters. 1. Key Elements of a California Sample Letter for Compromise on a Debt: — Sender's Information: Include your full name, address, and contact details in the top left corner of the letter. — Date: The date should be mentioned below the sender's information. — Creditor's Information: Begin the letter by including the creditor's name, address, phone number, and any relevant account numbers. — Salutation: Greet the creditor formally by using "Dear" followed by their name or department. — Description of Financial Hardship: Provide a concise explanation of the financial difficulties you are currently facing, such as job loss, medical issues, or other significant life events impacting your ability to repay the debt. — Debt Details: Explicitly state the outstanding balance, the original amount owed, and the creditor's information related to the debt. — Proposed Settlement Amount: Present a clear and reasonable offer indicating the reduced payment you can afford or find suitable. — Explanation of Proposal: Elaborate on the reasons behind your proposed settlement amount, emphasizing your financial constraints and inability to meet the full debt obligation. — Financial Documentation: Attach supporting financial documents like bank statements, pay stubs, or medical bills, if applicable, to substantiate your financial hardship claims. — Request for Agreement Confirmation: Politely ask the creditor to confirm their agreement to the proposed settlement amount in writing. — Closing and Signature: Express appreciation for their consideration, use a professional closing like "Sincerely," and leave space for your signature. 2. Different Types of California Sample Letters for Compromise on a Debt: a. Medical Debt Compromise Letter: Specifically designed for individuals facing excessive medical bills and expenses, this letter focuses on the impact of medical circumstances on the debtor's ability to repay the debt. b. Credit Card Debt Compromise Letter: Tailored for individuals with overwhelming credit card debt, this particular letter highlights the financial challenges faced due to high interest rates, penalties, or unforeseen circumstances. c. Personal Loan Debt Compromise Letter: Crafted by individuals seeking to settle their personal loan debts, this letter emphasizes personal financial hardships experienced and inability to meet the original debt terms. In conclusion, California Sample Letters for Compromise on a Debt are powerful tools for individuals seeking financial relief by negotiating debt settlement with their creditors. By utilizing the key elements outlined above and customizing the content to address specific debt types, individuals can improve the chances of reaching an agreement that is mutually beneficial and relieves the burden of excessive debt.

California Sample Letter for Compromise on a Debt

Description

How to fill out California Sample Letter For Compromise On A Debt?

Are you presently in a position the place you will need files for possibly organization or personal purposes just about every day? There are tons of legal record web templates accessible on the Internet, but locating kinds you can rely isn`t straightforward. US Legal Forms gives thousands of kind web templates, much like the California Sample Letter for Compromise on a Debt, that are created to meet state and federal needs.

Should you be currently familiar with US Legal Forms site and have a free account, merely log in. Following that, it is possible to down load the California Sample Letter for Compromise on a Debt format.

If you do not have an bank account and wish to begin to use US Legal Forms, follow these steps:

- Obtain the kind you will need and make sure it is to the proper metropolis/region.

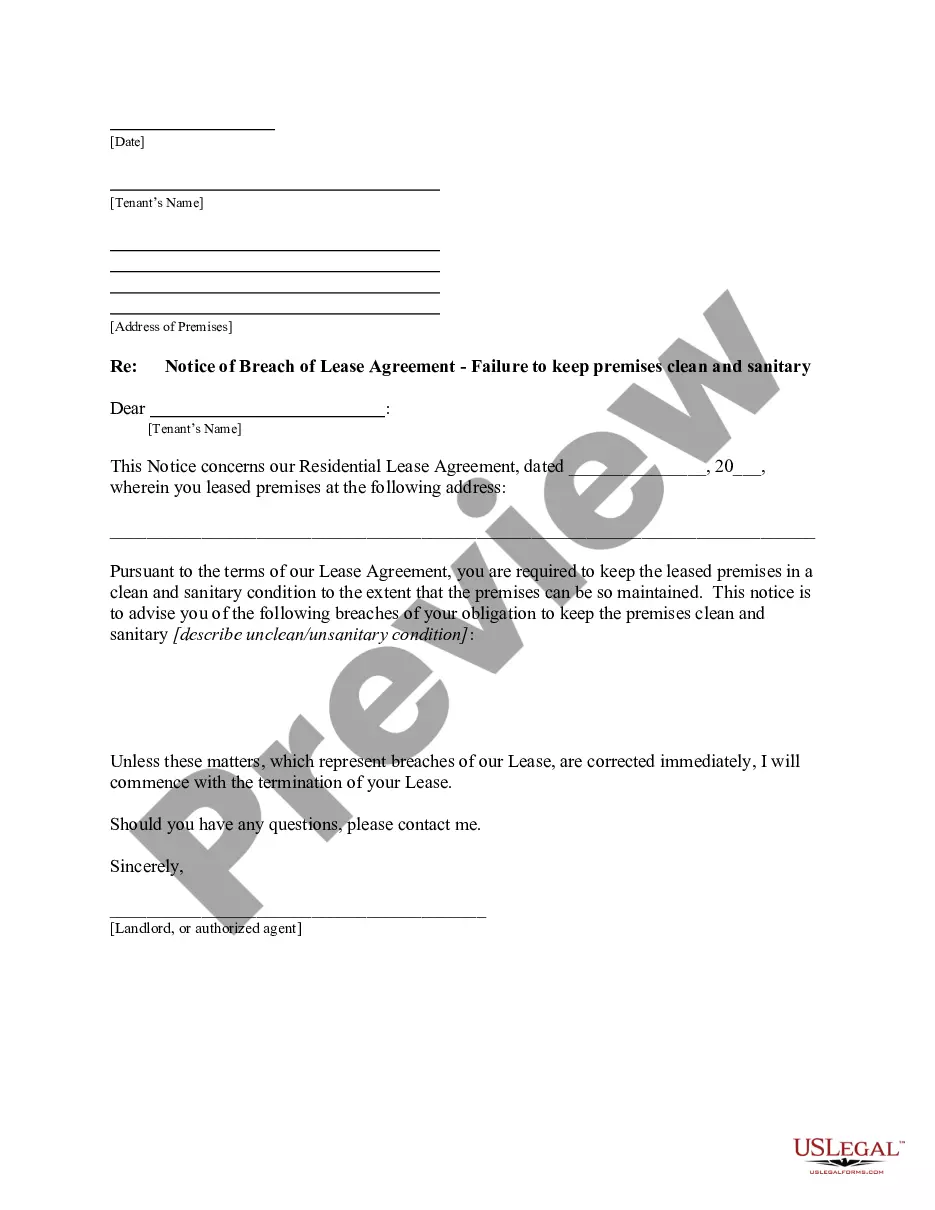

- Use the Preview button to review the form.

- Browse the explanation to ensure that you have chosen the proper kind.

- If the kind isn`t what you are trying to find, make use of the Lookup industry to obtain the kind that suits you and needs.

- Once you find the proper kind, just click Acquire now.

- Select the rates strategy you want, fill out the necessary details to create your money, and buy the order with your PayPal or charge card.

- Pick a handy data file formatting and down load your backup.

Locate every one of the record web templates you possess purchased in the My Forms food selection. You may get a additional backup of California Sample Letter for Compromise on a Debt at any time, if possible. Just click the needed kind to down load or print the record format.

Use US Legal Forms, by far the most considerable variety of legal varieties, in order to save efforts and stay away from mistakes. The services gives expertly produced legal record web templates that you can use for a selection of purposes. Produce a free account on US Legal Forms and start producing your daily life a little easier.