California Triple Net Lease for Industrial Property

Description

How to fill out Triple Net Lease For Industrial Property?

US Legal Forms - one of the largest compilations of legal documents in the US - offers a wide variety of legal form templates that you can download or print.

Through the website, you can access a vast array of forms for business and personal use, organized by categories, states, or keywords. You'll find the most recent versions of forms such as the California Triple Net Lease for Industrial Property in moments.

If you currently hold a subscription, Log In and retrieve the California Triple Net Lease for Industrial Property from the US Legal Forms library. The Download button will appear on every form you access. You can find all previously saved forms in the My documents tab of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Complete, modify, and print or sign the downloaded California Triple Net Lease for Industrial Property. Each template you save to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another version, simply navigate to the My documents section and click on the form you desire. Access the California Triple Net Lease for Industrial Property with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you're using US Legal Forms for the first time, here are straightforward steps to get you started.

- Ensure you have selected the correct form for your city/county.

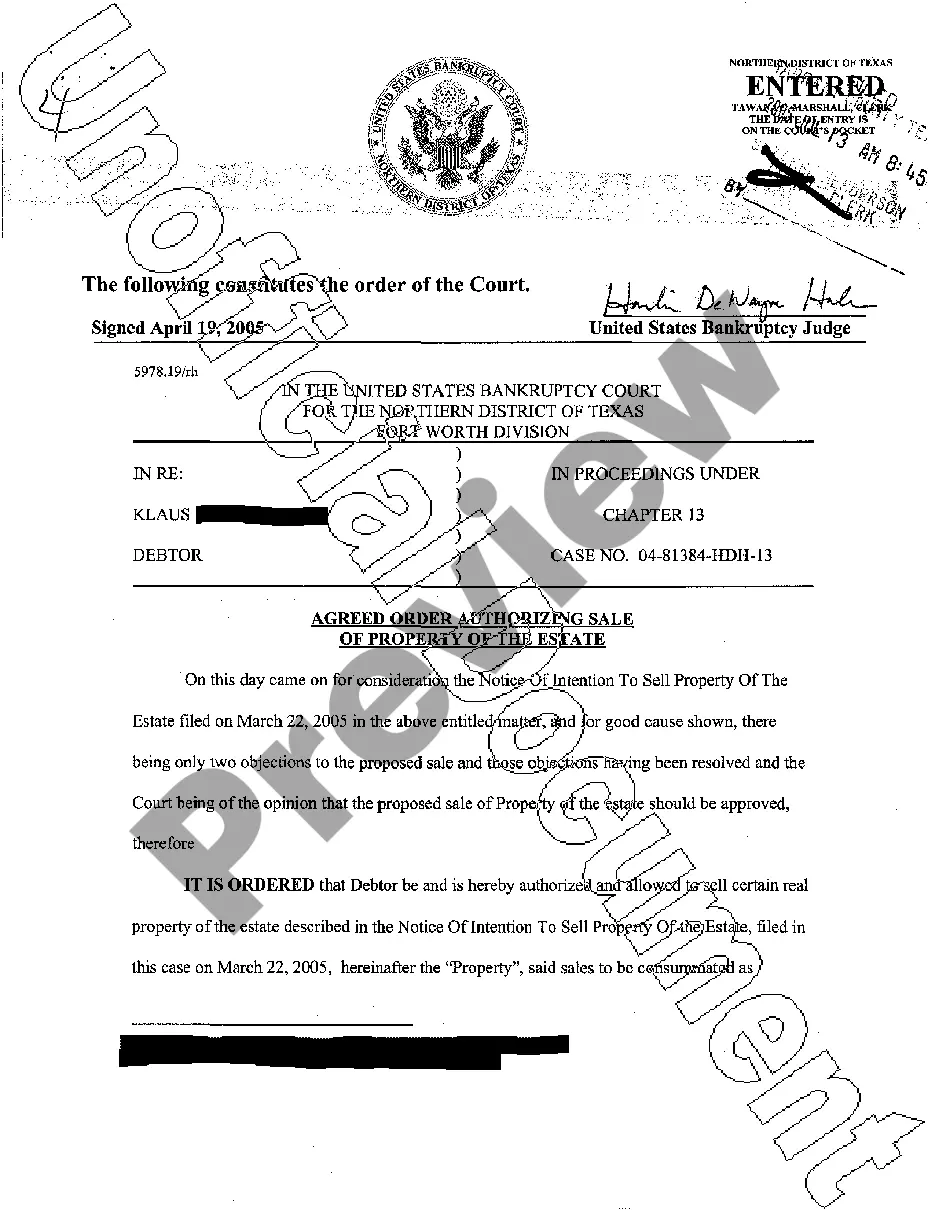

- Click on the Preview button to review the content of the form.

- Read the form description to confirm that you have chosen the right one.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- Once satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose your preferred payment plan and provide your information to create an account.

Form popularity

FAQ

To structure a triple net lease, start by defining the base rent, which will serve as the primary income for the landlord. Then, outline the obligations of the tenant, including property taxes, insurance, and maintenance costs. Clearly documenting these responsibilities in the lease agreement minimizes disputes and enhances trust between parties. Leveraging uslegalforms can streamline this process, making it easier to create a compliant and clear California Triple Net Lease for Industrial Property.

When calculating commercial rent under a California Triple Net Lease for Industrial Property, you consider the base rent along with property expenses like taxes, insurance, and maintenance. Each of these expenses is usually divided by the square footage of the property to determine a rent per square foot. This method provides transparency and allows tenants to understand their total financial commitment. Utilizing uslegalforms can help you navigate these calculations accurately to ensure fair agreements.

While a California Triple Net Lease for Industrial Property offers financial predictability, it also carries risks for tenants. Tenants may face unexpected expenses, such as significant repairs or fluctuations in property taxes, which can affect their budget. Additionally, the responsibility for maintenance means tenants must be proactive in managing the property's condition. For some, this can become a burden without proper planning.

When structuring a California Triple Net Lease for Industrial Property, it's crucial to outline the responsibilities of each party clearly. This includes detailing who pays for property taxes, insurance, and maintenance costs. Additionally, including clauses for potential rent increases and renewal options can protect both parties' interests. Working with a legal expert can ensure that the lease aligns with current regulations and the property’s requirements.

Commercial leases can encompass a wide range of property types, including retail and office spaces, while industrial leases specifically refer to properties designated for manufacturing or distribution. A California Triple Net Lease for Industrial Property typically includes specific clauses tailored to the operational needs of industrial businesses. Understanding these differences can help tenants find the right lease that suits their specific business activities.

California rent control laws generally do not apply to commercial properties, including those under California Triple Net Leases for Industrial Property. Typically, these laws are designed to protect residential tenants and do not extend to commercial lease agreements. Therefore, landlords and tenants have more flexibility in negotiating lease terms and rental rates in commercial real estate.

A major advantage of a gross lease is the predictability in costs for tenants. Since the landlord handles most expenses, tenants know exactly what their rent will be without worrying about fluctuating operational costs. In contrast, a California Triple Net Lease for Industrial Property shifts those responsibilities to the tenant, which can lead to more financial uncertainty. Hence, businesses may prefer a gross lease for budgeting stability.

The main difference between an industrial gross lease and a triple net lease lies in expense responsibilities. In an industrial gross lease, the landlord typically covers most operating expenses, such as property taxes and insurance. However, in a California Triple Net Lease for Industrial Property, tenants are responsible for these costs, in addition to rent. This arrangement often results in lower base rent for tenants, but they must manage more variable expenses.

Qualifying for a triple net lease typically involves showcasing financial health and operational experience. Landlords will look for tenants who can reliably cover the costs associated with a California Triple Net Lease for Industrial Property, including taxes, insurance, and maintenance. Providing a strong business plan and evidence of prior leasing success can further strengthen your application.

To get approved for a triple net lease, it's important to demonstrate financial stability and a solid business plan. Lenders and landlords in the realm of California Triple Net Lease for Industrial Property will often review your creditworthiness, rental history, and the nature of your business. By providing thorough documentation and a clear understanding of your responsibilities under the lease, you can enhance your chances of approval.