California Equipment Lease - Detailed

Description

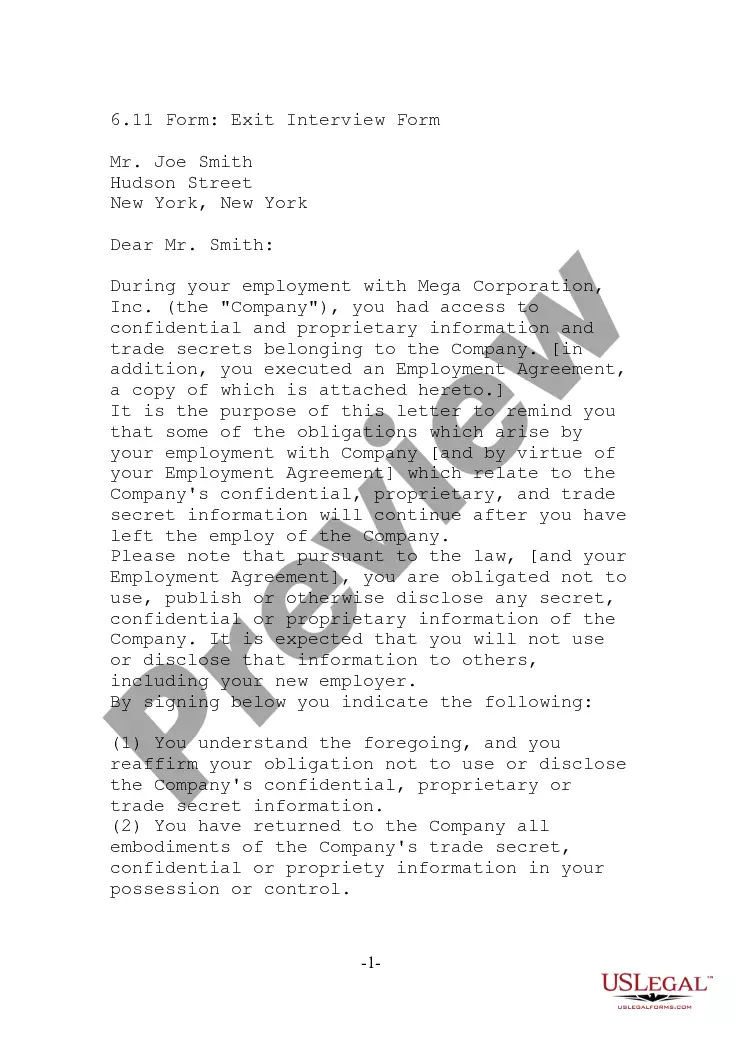

How to fill out Equipment Lease - Detailed?

It is feasible to dedicate hours online searching for the authentic document template that fulfills the federal and state requirements you need.

US Legal Forms offers a multitude of legal templates that are evaluated by experts.

You can easily acquire or print the California Equipment Lease - Detailed from their service.

If you need to find another version of the form, use the Search field to discover the template that meets your specifications and requirements.

- If you already possess a US Legal Forms account, you can sign in and click the Get button.

- Subsequently, you can fill out, modify, print, or sign the California Equipment Lease - Detailed.

- Every legal document template you purchase belongs to you indefinitely.

- To obtain another copy of any purchased form, go to the My documents tab and click the appropriate button.

- If you are visiting the US Legal Forms site for the first time, adhere to the simple instructions below.

- First, ensure you have selected the correct document template for the locality/city of your choice. Check the form description to ensure you have chosen the correct type.

- If available, utilize the Preview button to view the document template as well.

Form popularity

FAQ

Yes, equipment leases can be tax deductible, depending on the lease structure. Generally, lease payments on operating leases are fully deductible as business expenses. Understanding the tax implications is essential for effective financial planning, particularly with a California Equipment Lease - Detailed. Consulting with a tax professional can ensure you maximize your deductions.

A master lease agreement for equipment is a comprehensive contract that outlines terms for leasing multiple equipment items. This type of agreement allows for greater flexibility and easier management of multiple leases. Utilizing a master lease can streamline operations, especially when exploring options for a California Equipment Lease - Detailed.

Yes, equipment leases fall under ASC 842, which provides specific guidance on lease accounting. This standard changes how lessees record leases on financial statements. Understanding ASC 842's implications is vital when you engage in a California Equipment Lease - Detailed, as it affects both current and future financial reporting.

To record a lease of equipment, you must first determine the type of lease you have. For capital leases, you will list the asset and corresponding liability on your balance sheet. For operating leases, you typically record lease payments as expenses. Being informed about how to handle these entries is crucial, particularly when dealing with a California Equipment Lease - Detailed.

Equipment leases can be classified as either operating leases or capital leases. Operating leases do not transfer ownership and generally involve shorter terms. On the other hand, capital leases provide the lessee with benefits similar to owning the equipment. When considering a California Equipment Lease - Detailed, it's important to identify which lease type fits your financial strategy.

Yes, leased equipment is typically considered an asset. However, the classification may depend on the type of lease. In a capital lease, for example, the lessee can record the equipment as an asset on their balance sheet. Understanding the nuances of equipment leases, especially under California Equipment Lease - Detailed, can help clarify these financial impacts.

In California, leases are subject to sales tax if the lessee does not have an option to buy the equipment at the end of the lease term. This means that the California Equipment Lease - Detailed needs to outline the tax implications clearly. Depending on the type of equipment, tax rates may vary. Engaging with platforms like uslegalforms can ensure that your lease agreement includes all necessary tax provisions.

Leased equipment is generally treated as an expense for tax purposes, allowing businesses to deduct lease payments from their taxable income. However, specifics can vary under the California Equipment Lease - Detailed guidelines. It's recommended to consult a tax professional to ensure compliance with local laws and maximize deductions. Platforms like uslegalforms can also provide templates that address these tax considerations.

To set up an equipment lease, begin by identifying the equipment and its fair market value. Next, outline your lease terms, including duration and payment amounts, ensuring to align with the California Equipment Lease - Detailed guidelines. It’s wise to draft and review the lease document carefully, preferably using templates from uslegalforms for accuracy and comprehensiveness. Lastly, clarify the roles and responsibilities for both parties involved.

Structuring a lease involves defining clear terms that both parties agree on. For a California Equipment Lease - Detailed, you should specify the lease duration, payment schedule, and equipment details. It's essential to include responsibilities, such as maintenance and insurance, which will protect both the lessor and lessee. Utilizing platforms like uslegalforms can help simplify this process.