A California Revocable Trust for Property is a legal document that allows an individual, known as the settler, to transfer ownership of their assets and property into a trust during their lifetime. This trust is "revocable" because the settler maintains the flexibility to modify or revoke the trust at any time during their life. This type of trust provides numerous benefits, including privacy, avoidance of probate, and flexibility in managing assets. By transferring assets into the trust, the settler retains control over the property and can manage it as if it were still in their possession. Furthermore, revocable trusts do not require court involvement, unlike probate, ensuring a faster and more efficient distribution of assets upon the settler's passing. California's law recognizes various types of revocable trusts for property, each with subtle differences catering to the settler's specific needs. Some important types of California revocable trusts are: 1. Revocable Living Trust: This is the most common type of trust used to hold a wide range of assets, such as real estate, bank accounts, investments, and personal belongings. It allows the settler to retain full control and enjoy the benefits of the trust during their lifetime. After the settler's death, the trust becomes irrevocable and provides for the distribution of assets according to the terms specified in the trust document. 2. Pour-over Trust: A pour-over trust is designed to work in conjunction with a will. It ensures that any assets or property not directly transferred to the living trust during the settler's lifetime will be "poured over" into the trust upon their death. This type of trust helps ensure all assets are appropriately distributed according to the trust's terms. 3. Marital or Spousal Trust: This trust is often used by married couples to provide security and asset protection for the surviving spouse upon the passing of the first spouse. By establishing a marital trust, the surviving spouse can continue to manage and utilize the trust assets while also benefiting from potential tax advantages. 4. AB Trust: The AB Trust, also known as the "credit shelter trust" or "bypass trust," minimizes estate taxes for married couples. It divides the assets into two trusts upon the death of the first spouse: the A trust, which is used for the surviving spouse's benefit, and the B trust, which shelters assets from estate taxes and provides for the eventual distribution to other beneficiaries, such as children or grandchildren. In summary, a California Revocable Trust for Property offers individuals a flexible tool for managing and distributing their assets. Whether through a living trust, pour-over trust, spousal trust, or an AB trust, Californians can customize their revocable trusts to suit their specific needs and intentions. Consulting with an experienced estate planning attorney is essential in establishing the most appropriate trust type to ensure assets are protected, efficiently distributed, and potentially minimize tax burdens.

California Revocable Trust for Property

Description

How to fill out California Revocable Trust For Property?

Locating the appropriate sanctioned document template can be quite challenging. Of course, there are numerous templates available online, but how can you locate the specific legal form you require? Refer to the US Legal Forms site.

The platform offers thousands of templates, including the California Revocable Trust for Property, which you can utilize for both business and personal needs. All documents are reviewed by experts and comply with federal and state standards.

If you are already registered, Log In to your account and click the Download button to obtain the California Revocable Trust for Property. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents section of your account to download another copy of the document you need.

US Legal Forms is the largest repository of legal templates where you can find various document templates. Utilize the service to acquire properly drafted paperwork that adheres to state regulations.

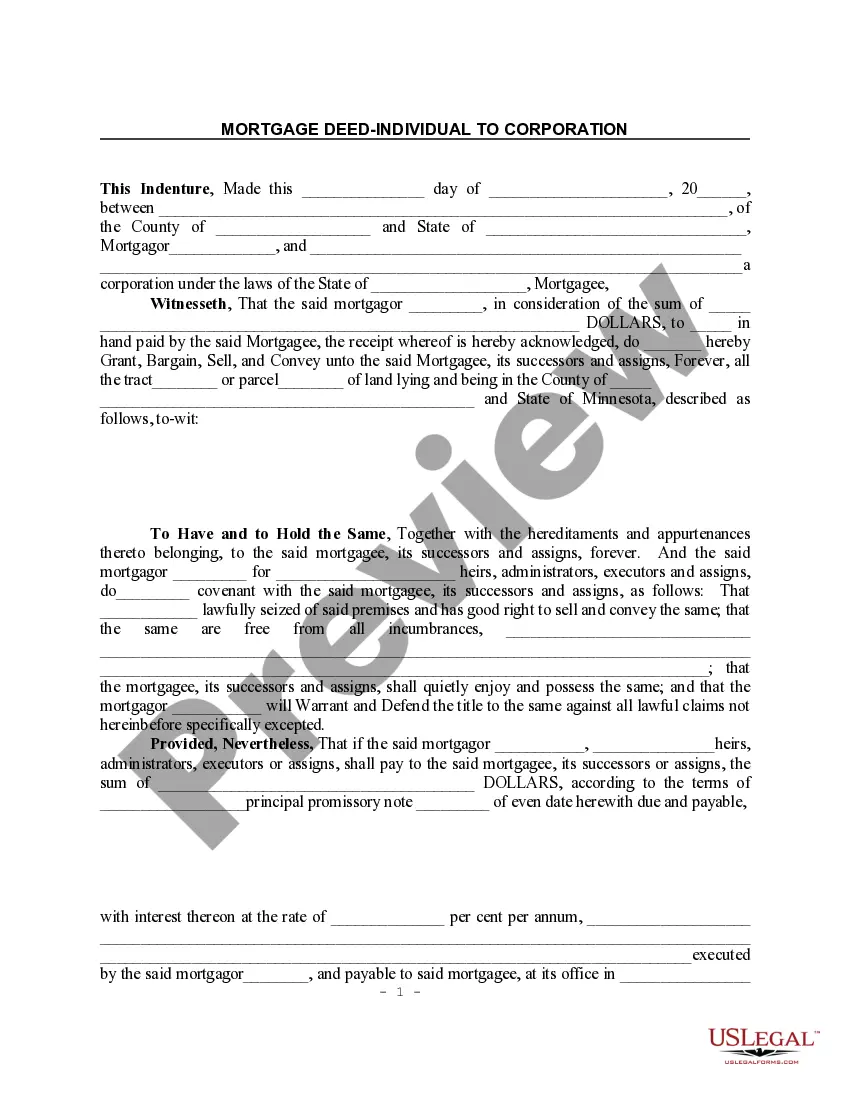

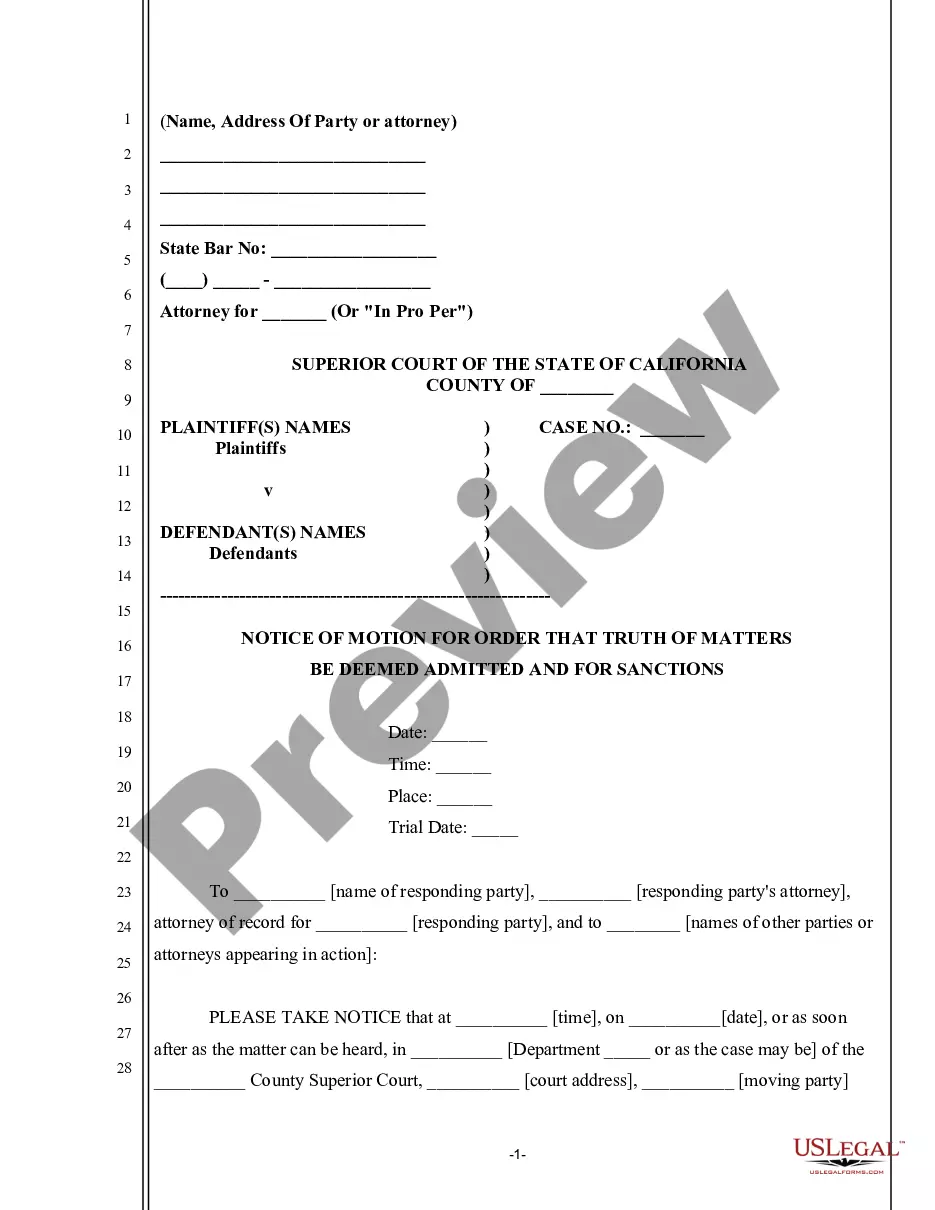

- First, ensure that you have selected the appropriate form for your locality/county. You can preview the document using the Preview button and read the form description to confirm it’s the right choice for you.

- If the document doesn't meet your requirements, use the Search field to find the correct form.

- Once you're certain that the form is suitable, click the Get now button to obtain the document.

- Select your desired pricing plan and input the necessary information. Create your account and complete the purchase using your PayPal account or credit card.

- Choose the file format and download the legal document template to your system.

- Complete, edit, print, and sign the downloaded California Revocable Trust for Property.

Form popularity

FAQ

Creating a California Revocable Trust for Property involves several steps. First, you need to select a trustee, usually yourself, who will manage the trust assets. Next, you should draft the trust document, which outlines the terms of the trust and specifies how you want your property distributed. Finally, transfer your property into the trust, ensuring that it is held in the name of the trust to avoid probate and simplify estate management.

A California Revocable Trust for Property works by allowing you to place your assets in the trust during your lifetime. You maintain full control over the trust and can change or dissolve it at any time. Upon your passing, the trust ensures a smooth transfer of assets to your beneficiaries without the lengthy probate process, preserving your estate's value and honoring your wishes.

One of the biggest mistakes parents often make when establishing a trust fund is failing to communicate their intentions to their children. A California Revocable Trust for Property should include clear guidelines on how the assets will be used and distributed, helping to prevent misunderstandings or disputes later. Transparency fosters trust and helps beneficiaries understand the purpose behind the trust.

While a California Revocable Trust for Property provides many advantages, there are some potential disadvantages to consider. Setting up the trust may involve initial costs, and you must ensure the trust is properly funded by transferring assets. Additionally, since a revocable trust does not offer tax benefits or creditor protection during your life, it's crucial to evaluate whether a trust is the best option for your unique situation.

The legal title of the property in a California Revocable Trust for Property remains in the name of the trust itself. This means that you, as the trustee, manage and control the property while living. The structure allows for easy transfer of the title to your beneficiaries after your death, avoiding complex legal processes.

In a California Revocable Trust for Property, you retain ownership of the house while you are alive. You act as both the trustee and the beneficiary, which means you control the property and can manage it as you see fit. Upon your passing, the trust directs how the property is to be handled, ensuring your intentions are honored.

Putting your home in a California Revocable Trust for Property can offer benefits such as avoiding probate and ensuring ease of management. This arrangement allows you to maintain control over your property during your lifetime while simplifying the transfer process for your heirs. However, it's essential to consider your personal situation and whether a trust aligns with your financial and estate planning goals.

No, a revocable trust does not need to be recorded in California. The trust document remains confidential and does not require court filing, ensuring your information stays private. However, for properties like real estate, you must update the title to reflect the trust's name. For assistance with creating your California Revocable Trust for Property, uslegalforms offers valuable tools and templates.

A living trust does not require registration in California. Instead, it serves as a private agreement that details how your property will be managed and distributed after your passing. While registration is not necessary, transferring your property into the trust is essential. For accurate guidance on these steps, consider the resources available through uslegalforms.

In California, a trust generally does not need to be filed with the court, as it remains a private document. However, if the trust becomes irrevocable or if disputes arise, court involvement may be necessary. Having a California Revocable Trust for Property allows you to maintain privacy and manage your assets without immediate legal oversight. Utilizing resources like uslegalforms can help simplify this process.