Indemnification is the act of making another "whole" by paying any loss another might suffer. This usually arises from a clause in a contract where a party agrees to pay for any monetary damages which arise or have arisen.

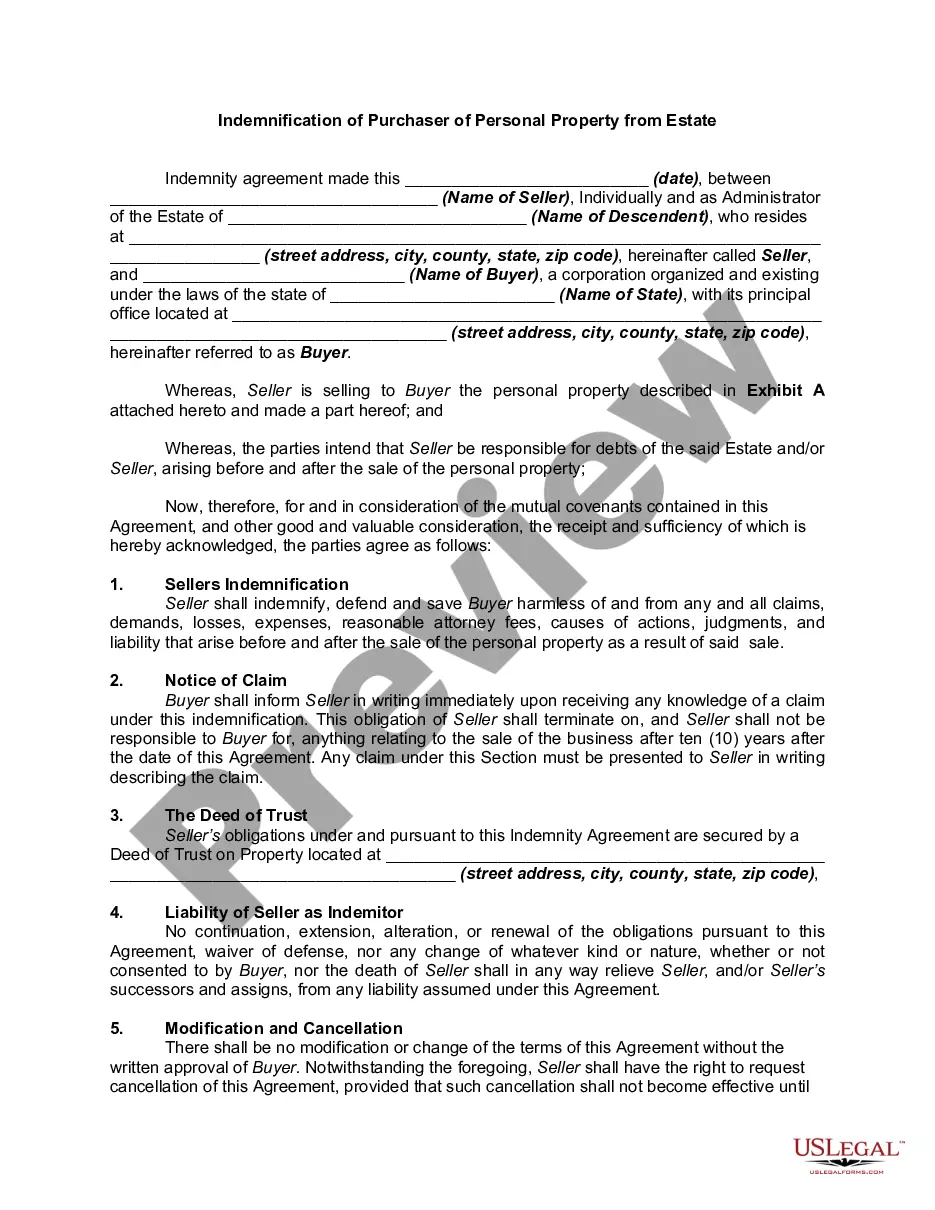

California Indemnification of Purchaser of Personal Property from Estate

Description

How to fill out Indemnification Of Purchaser Of Personal Property From Estate?

Are you currently in a situation where you require documents for both professional or personal purposes almost daily? There are numerous authentic document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of form templates, including the California Indemnification of Purchaser of Personal Property from Estate, which are designed to meet state and federal standards.

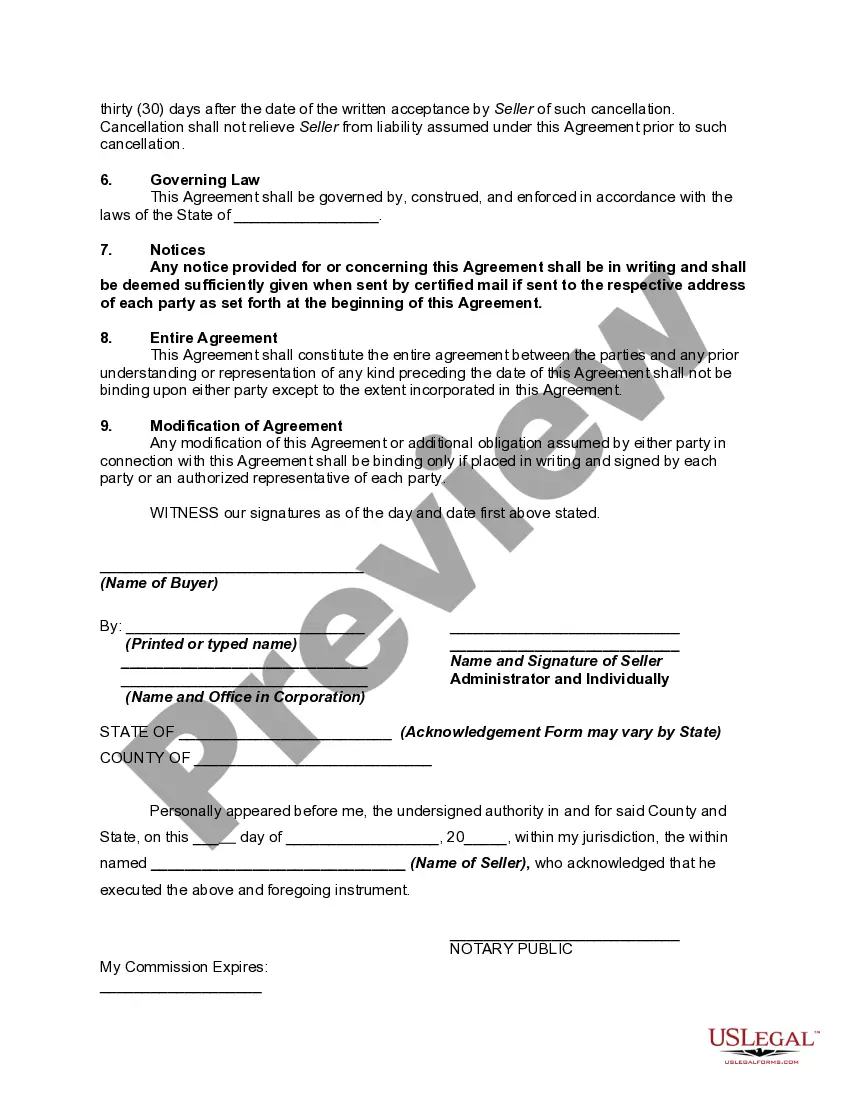

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the California Indemnification of Purchaser of Personal Property from Estate template.

- Obtain the document you need and ensure it is for the correct city/region.

- Utilize the Review option to verify the form.

- Read the description to ensure that you have selected the right document.

- If the document is not what you are looking for, use the Search field to find the form that meets your needs and specifications.

- Once you find the correct document, click Buy now.

- Choose the pricing plan you prefer, fill in the necessary details to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Creditors typically have one year to collect a debt from an estate in California, starting from the date of death of the individual. This timeframe can vary depending on the type of debt and probate proceedings involved. During this time, the estate must settle any debts before distributing assets, which relates closely to the California Indemnification of Purchaser of Personal Property from Estate. By understanding these timelines, purchasers can better protect their interests in estate transactions.

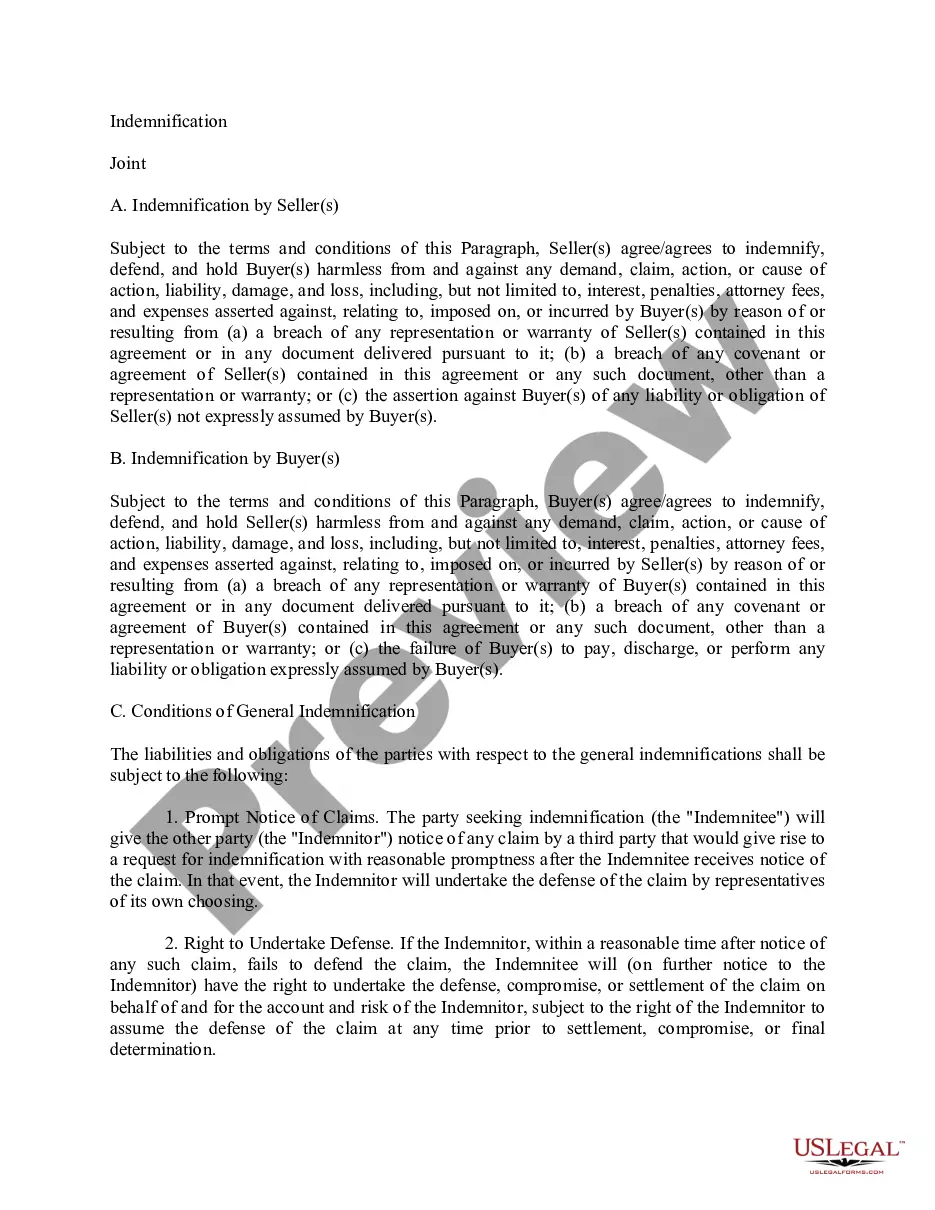

Yes, indemnity clauses are generally enforceable, but their effectiveness can depend on their wording and context. In California, particularly regarding the California Indemnification of Purchaser of Personal Property from Estate, these clauses must be clear and specific to withstand legal scrutiny. They should outline the responsibilities of each party involved in the transaction, which helps avoid disputes down the line. Consulting with legal experts can ensure these clauses are appropriately structured.

Indemnification clauses generally hold up in court, provided they are clearly stated and agreed upon by all involved parties. In the context of the California Indemnification of Purchaser of Personal Property from Estate, such clauses offer protection against losses or claims that may arise after the sale. Courts will typically uphold these clauses unless they are deemed unconscionable or violate public policy. Therefore, it’s important to draft these clauses carefully to ensure their enforceability.

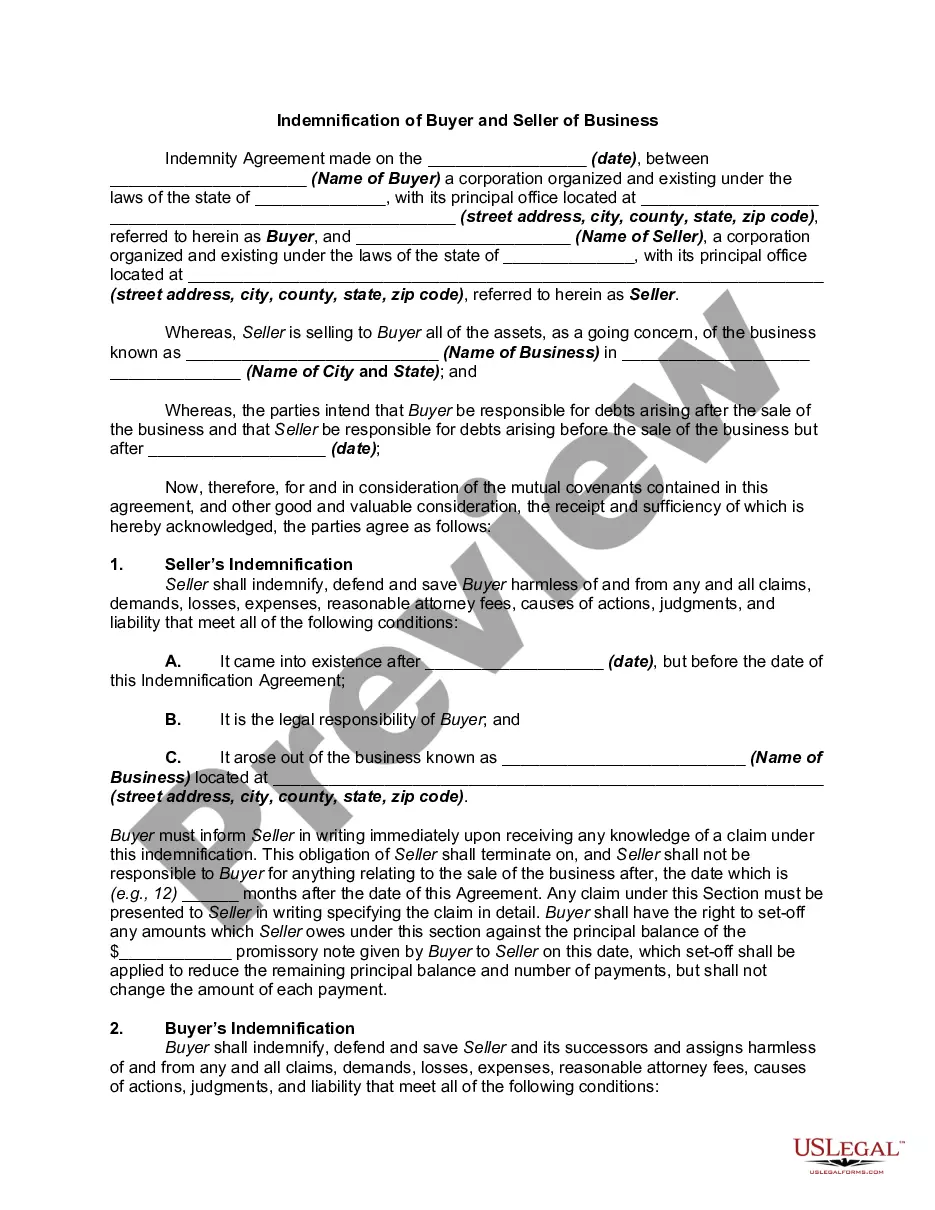

There are three main types of indemnity clauses: broad indemnity, intermediate indemnity, and limited indemnity. Broad indemnity offers the most protection, covering all potential liabilities, while intermediate indemnity covers liabilities directly related to the buyer's actions. Limited indemnity, on the other hand, only addresses specific situations. In the context of California indemnification of purchaser of personal property from estate, knowing these types can help you select the right protection for your purchasing situation.

The indemnity clause for a buyer outlines the conditions under which the buyer agrees to protect the seller from any legal claims after the sale of the property. It plays a crucial role in the California indemnification of purchaser of personal property from estate, ensuring that the seller is shielded from unforeseen liabilities. This clause typically details the scope of indemnification and any limitations applicable. Understanding this clause empowers buyers to make informed decisions and safeguard their interests.

Indemnification by the purchaser refers to the buyer's responsibility to protect the seller or estate from any claims arising after the property is sold. This concept is essential in the California indemnification of purchaser of personal property from estate, as it clarifies the accountability of the purchaser. By agreeing to indemnify, the buyer accepts any risks associated with the property's ownership. This arrangement provides peace of mind for both parties involved.

An estate indemnity agreement serves as a legal contract between parties involved in the transfer of personal property from an estate. This agreement ensures that the purchaser is protected from potential claims or liabilities related to the estate. In the context of California indemnification of purchaser of personal property from estate, this agreement helps clarify responsibilities and mitigate risks. It fosters trust, making transactions smoother and more secure.