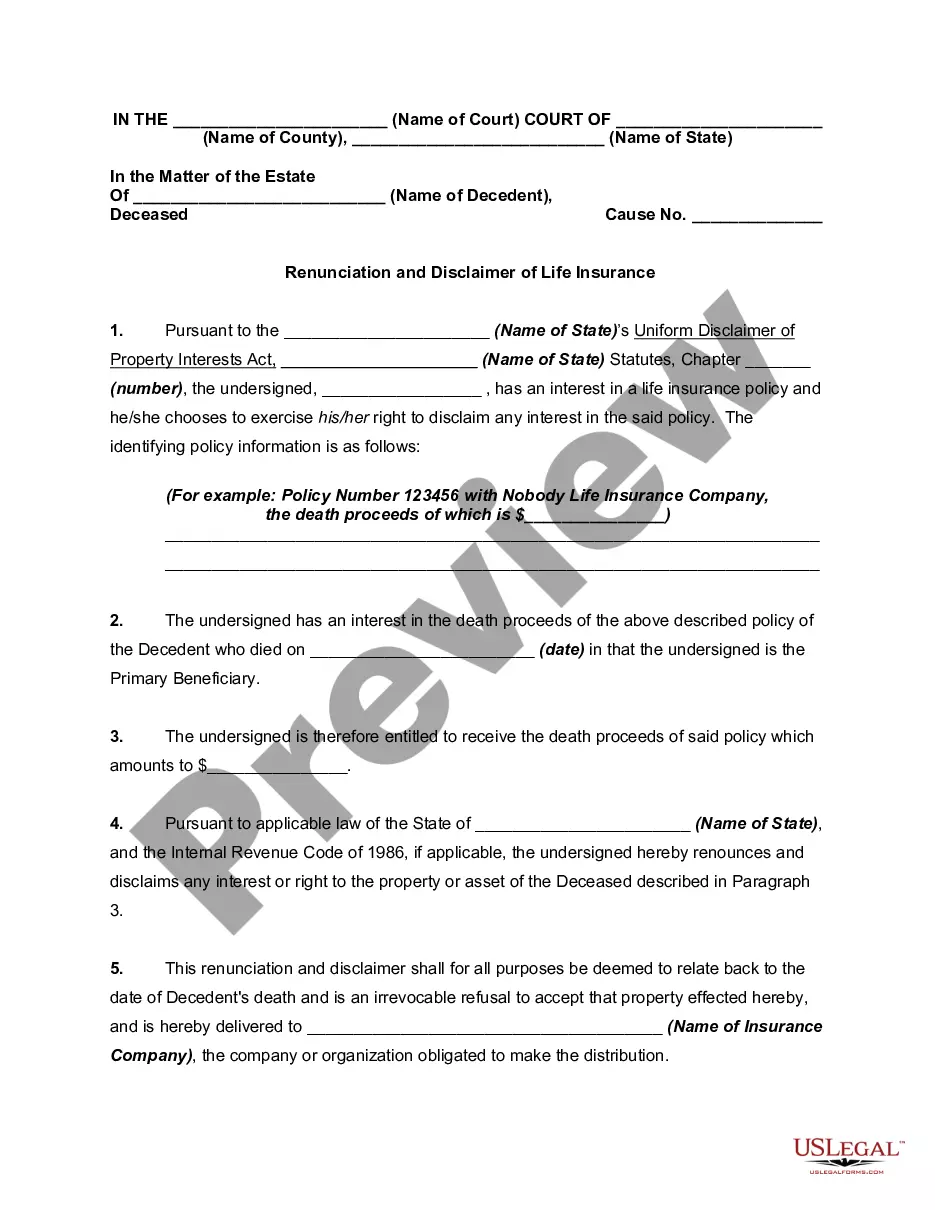

If you want to full, acquire, or print out lawful papers templates, use US Legal Forms, the most important assortment of lawful varieties, which can be found on the Internet. Utilize the site`s simple and easy handy research to obtain the paperwork you require. A variety of templates for company and personal purposes are categorized by classes and states, or search phrases. Use US Legal Forms to obtain the California Renunciation and Disclaimer of Interest in Life Insurance Proceeds with a handful of mouse clicks.

In case you are already a US Legal Forms customer, log in to the account and click on the Download switch to have the California Renunciation and Disclaimer of Interest in Life Insurance Proceeds. You may also access varieties you in the past saved inside the My Forms tab of the account.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Make sure you have chosen the shape for the correct metropolis/nation.

- Step 2. Utilize the Review method to check out the form`s content. Do not forget about to learn the outline.

- Step 3. In case you are unsatisfied with the develop, take advantage of the Research discipline near the top of the monitor to locate other types of your lawful develop format.

- Step 4. When you have found the shape you require, select the Buy now switch. Select the rates program you choose and add your accreditations to sign up to have an account.

- Step 5. Approach the financial transaction. You should use your credit card or PayPal account to complete the financial transaction.

- Step 6. Choose the structure of your lawful develop and acquire it on your own gadget.

- Step 7. Full, modify and print out or signal the California Renunciation and Disclaimer of Interest in Life Insurance Proceeds.

Every lawful papers format you purchase is yours eternally. You might have acces to each and every develop you saved within your acccount. Go through the My Forms section and decide on a develop to print out or acquire once more.

Contend and acquire, and print out the California Renunciation and Disclaimer of Interest in Life Insurance Proceeds with US Legal Forms. There are millions of specialist and state-distinct varieties you can utilize for your personal company or personal demands.