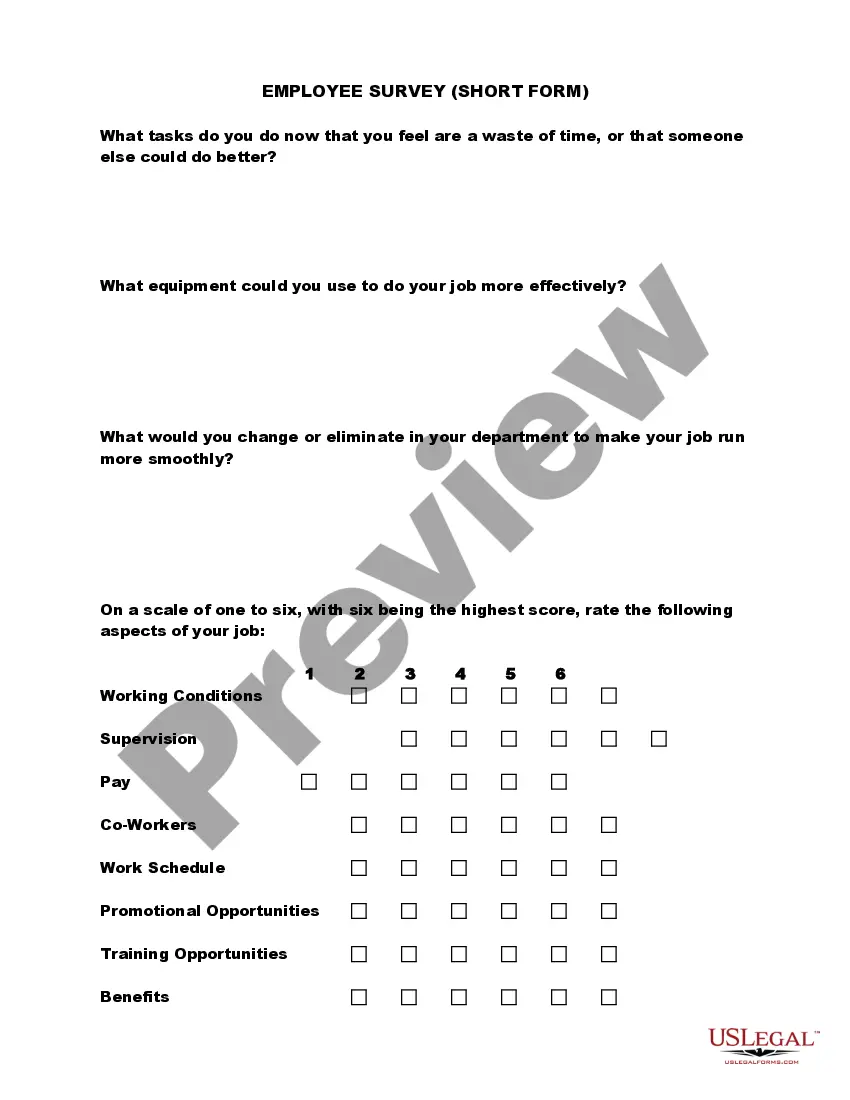

If you wish to summarize, obtain, or print sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal documents, which are accessible online.

Employ the site’s straightforward and convenient search to locate the papers you require. Various templates for corporate and private uses are categorized by types and regions, or keywords.

Use US Legal Forms to access the California Testamentary Trust Provision in Will with Spouse to Receive a Life Estate in Farmland with Remainder Interest in Land to Transfer to Trust for the Benefit of Children with just a few clicks.

Step 5. Complete the purchase process. You can use your Visa, Mastercard, or PayPal account to finalize the transaction.

Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the California Testamentary Trust Provision in Will with Spouse to Receive a Life Estate in Farmland with Remainder Interest in Land to Transfer to Trust for the Benefit of Children. Every legal document format you acquire is yours permanently. You have access to each form you purchased in your account. Navigate to the My documents section and select a form to print or download again. Be proactive and obtain, then print, the California Testamentary Trust Provision in Will with Spouse to Receive a Life Estate in Farmland with Remainder Interest in Land to Transfer to Trust for the Benefit of Children with US Legal Forms. There are countless professional and state-specific forms available for your business or personal requirements.

- If you are currently a US Legal Forms client, Log In to your account and click the Download button to obtain the California Testamentary Trust Provision in Will with Spouse to Receive a Life Estate in Farmland with Remainder Interest in Land to Transfer to Trust for the Benefit of Children.

- You can also access forms you have previously acquired through the My documents tab in your account.

- If you are using US Legal Forms for the first time, please follow the instructions outlined below.

- Step 1. Ensure you have selected the form for the correct state/region.

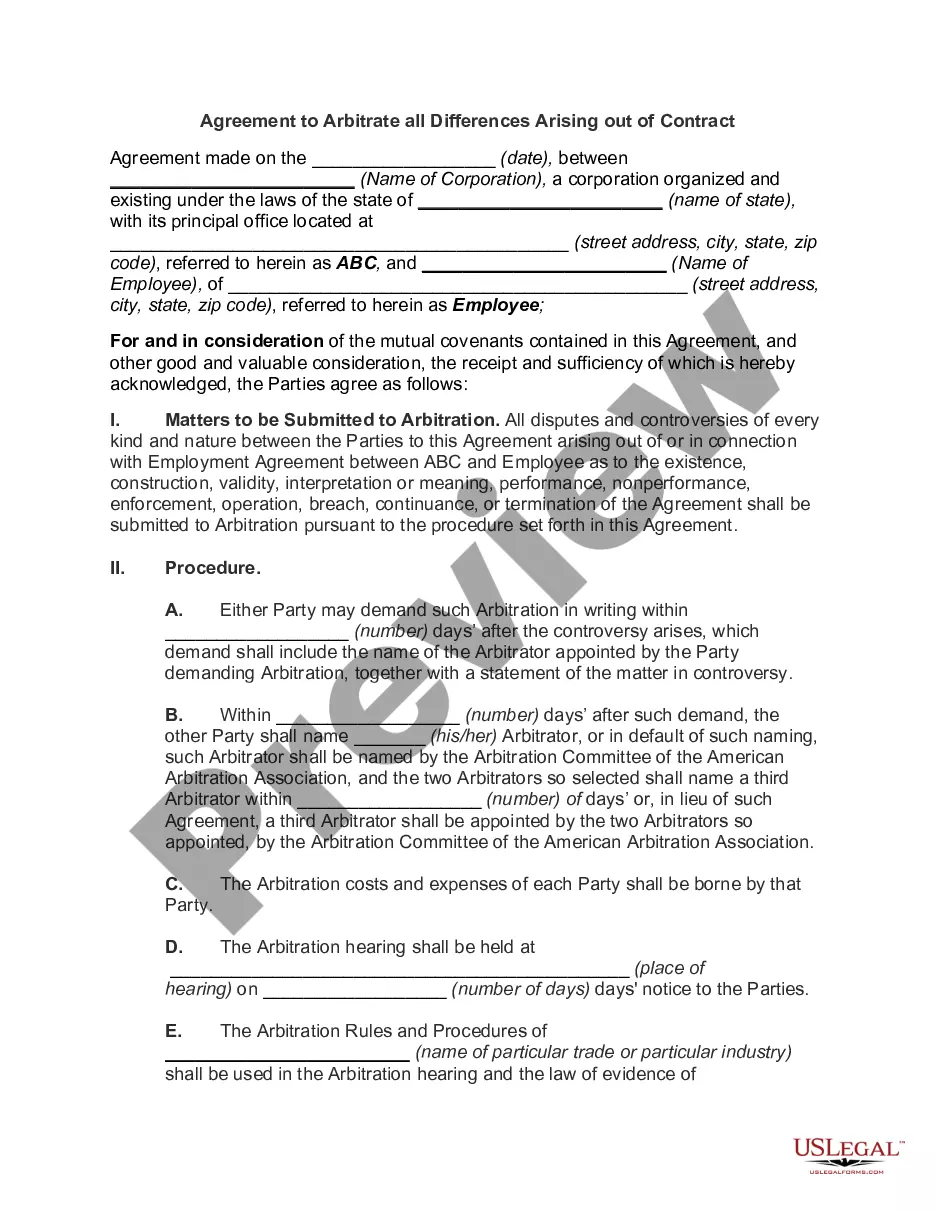

- Step 2. Use the Review option to inspect the form’s details. Be sure to read through the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the page to find other versions of the legal form template.

- Step 4. After you have located the form you need, select the Get now button. Choose the pricing option you prefer and input your details to register for an account.