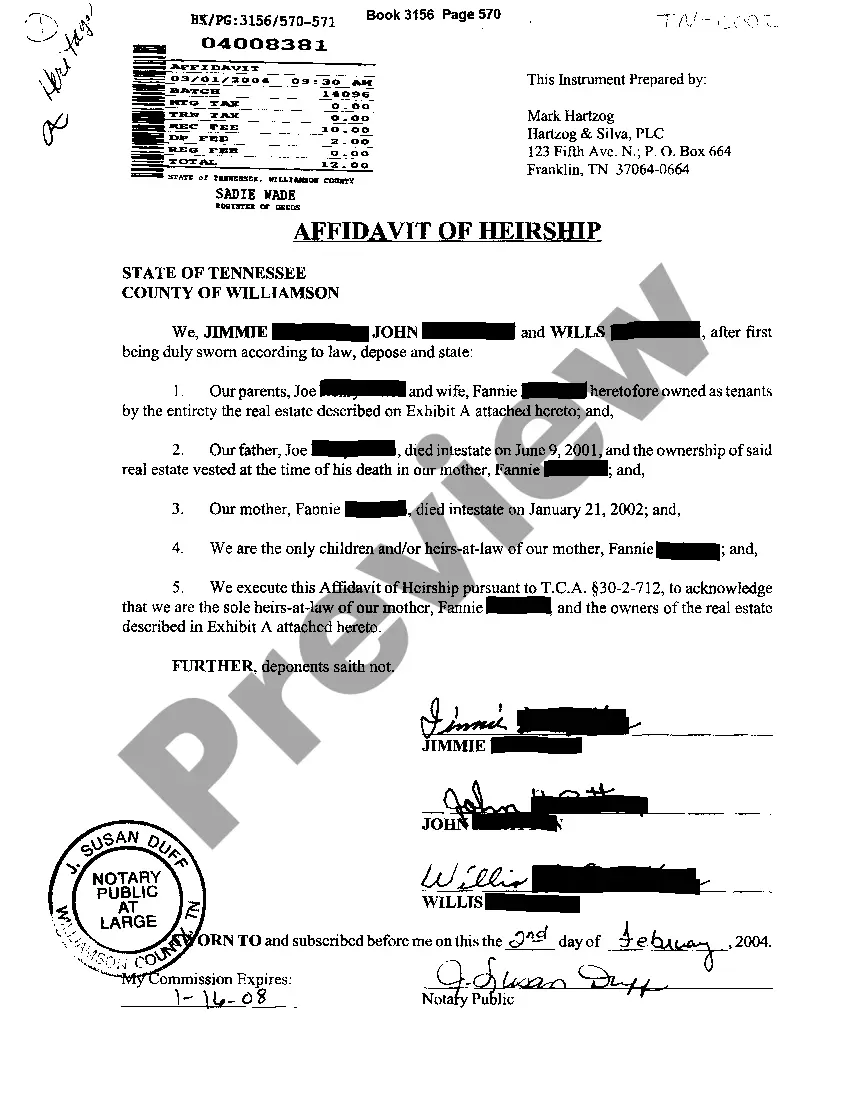

Title: California Sample Letter Sending Check for Copying Expense: Detailed Description and Types Introduction: In this article, we will provide a detailed description of a California sample letter used for sending a check for copying expenses. This type of letter is typically used when an individual or organization needs to reimburse or provide payment for the expenses incurred in making copies of documents. Subsequently, we will also explore different types of California sample letters designed to cater to specific situations. Detailed Description: 1. Purpose and Necessity: The California sample letter sending a check for copying expenses serves as a formal communication to send payment or reimbursement for copying documents. It demonstrates transparency and professionalism by including important details such as the amount being reimbursed, the purpose of the copying, and any relevant reference numbers. 2. Content and Structure: The letter typically includes the sender's and recipient's information (name, address, contact details), the current date, and a formal salutation. The main body of the letter highlights the reason for copying, the total expenses incurred, and any supporting information or documentation. It is crucial to mention the exact amount being reimbursed, enclose a physical or electronic copy of the check, and specify the recipient's preferred method of receiving the payment. Finally, the letter concludes with a polite closing and the sender's signature. Types of California Sample Letters Sending Check for Copying Expense: 1. Personal Reimbursement: This type of letter is used when an individual needs to reimburse someone for copying expenses. It can involve personal documents, such as medical records, academic transcripts, or legal documents. 2. Business Reimbursement: Business entities often encounter scenarios where employees or departments need to copy documents for various purposes, such as client reports, project documentation, or legal filings. This type of letter is drafted by the business to reimburse the employee or department responsible for the copying expenses. 3. Non-profit Organization Funding: Non-profit organizations may frequently need to copy documents for program activities, events, or fundraising purposes. This type of letter serves as a formal request for reimbursement from sponsoring entities, donors, or granters. 4. Legal Reimbursement: In legal matters, attorneys or law firms regularly make copies of important documents for case preparation, court filings, or discovery purposes. A specialized sample letter is used in such instances to send payment for the incurred copying expenses, often to the client or a third-party vendor. Conclusion: California sample letters sending checks for copying expenses streamline the reimbursement process and ensure clear communication between parties. By utilizing these letters, individuals, businesses, non-profit organizations, and legal entities can provide prompt and transparent payment for copying expenses. The types mentioned above cater to various contexts and enable customization based on specific needs.

California Sample Letter sending Check for Copying Expense

Description

How to fill out California Sample Letter Sending Check For Copying Expense?

If you have to comprehensive, obtain, or print legitimate record layouts, use US Legal Forms, the largest assortment of legitimate forms, which can be found on the web. Take advantage of the site`s simple and practical search to obtain the documents you will need. Various layouts for business and person uses are sorted by groups and suggests, or key phrases. Use US Legal Forms to obtain the California Sample Letter sending Check for Copying Expense in a few clicks.

In case you are previously a US Legal Forms consumer, log in to your bank account and then click the Download key to get the California Sample Letter sending Check for Copying Expense. You can even accessibility forms you earlier acquired from the My Forms tab of your respective bank account.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Ensure you have chosen the shape for your appropriate metropolis/country.

- Step 2. Take advantage of the Preview choice to check out the form`s information. Never neglect to read through the explanation.

- Step 3. In case you are unhappy together with the type, use the Research field on top of the display screen to find other versions from the legitimate type web template.

- Step 4. Upon having identified the shape you will need, click on the Purchase now key. Opt for the prices prepare you prefer and include your credentials to sign up for the bank account.

- Step 5. Method the purchase. You can use your credit card or PayPal bank account to perform the purchase.

- Step 6. Select the structure from the legitimate type and obtain it on your own system.

- Step 7. Complete, revise and print or indication the California Sample Letter sending Check for Copying Expense.

Each and every legitimate record web template you get is your own for a long time. You may have acces to each and every type you acquired in your acccount. Select the My Forms area and choose a type to print or obtain again.

Contend and obtain, and print the California Sample Letter sending Check for Copying Expense with US Legal Forms. There are thousands of professional and state-distinct forms you can use for the business or person requirements.