This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

California Agreement between Mortgage Brokers to Find Acceptable Lender for Client

Description

How to fill out Agreement Between Mortgage Brokers To Find Acceptable Lender For Client?

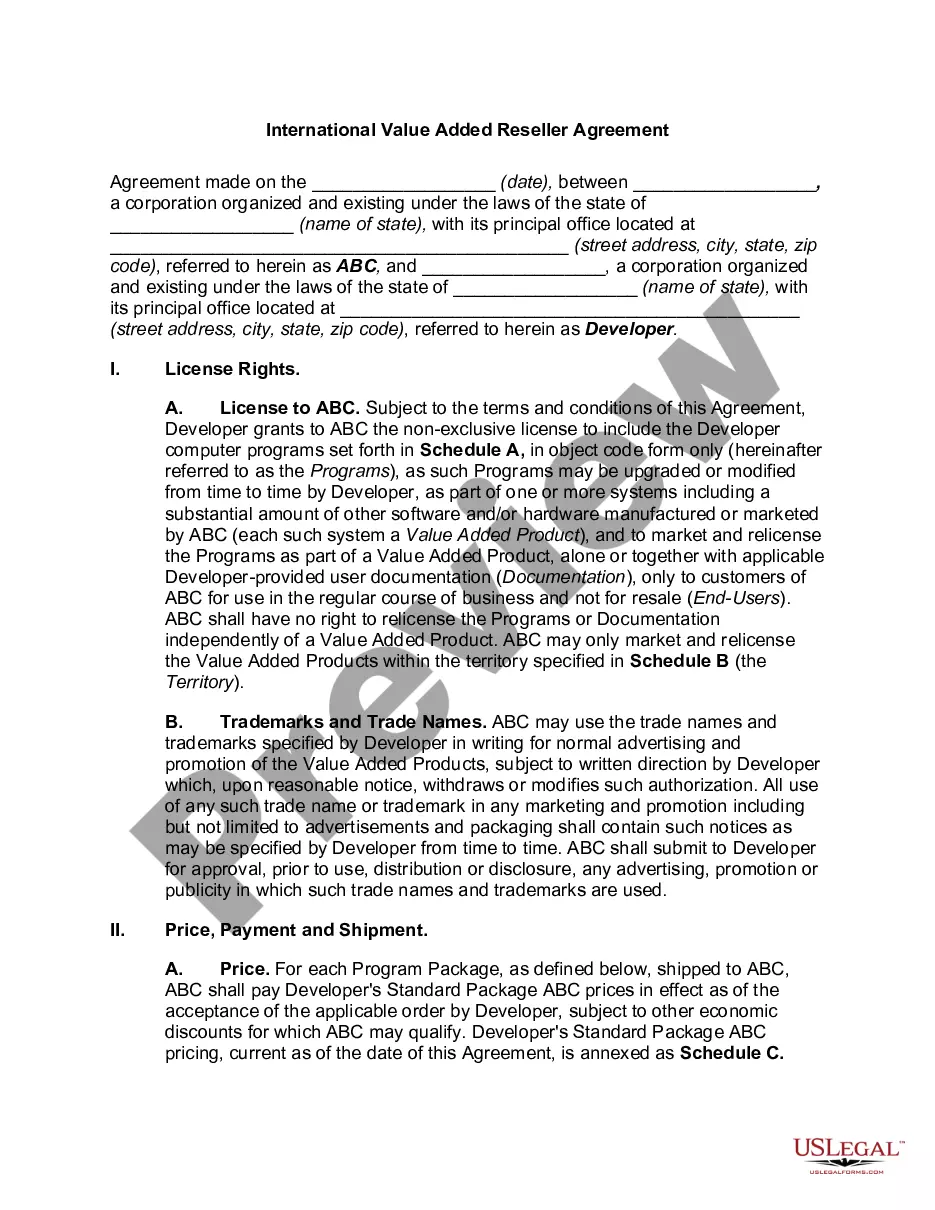

Are you in a place where you need to have paperwork for possibly business or specific purposes almost every time? There are tons of legitimate file layouts accessible on the Internet, but discovering versions you can rely on is not easy. US Legal Forms offers thousands of form layouts, such as the California Agreement between Mortgage Brokers to Find Acceptable Lender for Client, which can be created to fulfill state and federal requirements.

Should you be previously knowledgeable about US Legal Forms site and also have a free account, basically log in. After that, you can download the California Agreement between Mortgage Brokers to Find Acceptable Lender for Client web template.

Should you not provide an account and want to start using US Legal Forms, abide by these steps:

- Discover the form you will need and make sure it is for your correct area/region.

- Take advantage of the Review button to analyze the shape.

- See the information to actually have selected the appropriate form.

- When the form is not what you`re looking for, use the Lookup discipline to find the form that suits you and requirements.

- If you discover the correct form, just click Purchase now.

- Choose the costs prepare you desire, complete the specified information and facts to make your money, and pay money for your order with your PayPal or credit card.

- Decide on a convenient data file formatting and download your duplicate.

Discover every one of the file layouts you may have purchased in the My Forms food selection. You may get a extra duplicate of California Agreement between Mortgage Brokers to Find Acceptable Lender for Client whenever, if needed. Just click on the required form to download or print out the file web template.

Use US Legal Forms, the most substantial assortment of legitimate kinds, to conserve some time and stay away from errors. The assistance offers skillfully made legitimate file layouts that can be used for a selection of purposes. Make a free account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

10 Lead Generation Strategies for Mortgage Brokers Network. Networking is an extremely important way of finding new leads. ... Buy leads. ... Utilise social media. ... Use MLS listings. ... Get published. ... Optimise your website. ... Ask for referrals. ... Create a Google my business page.

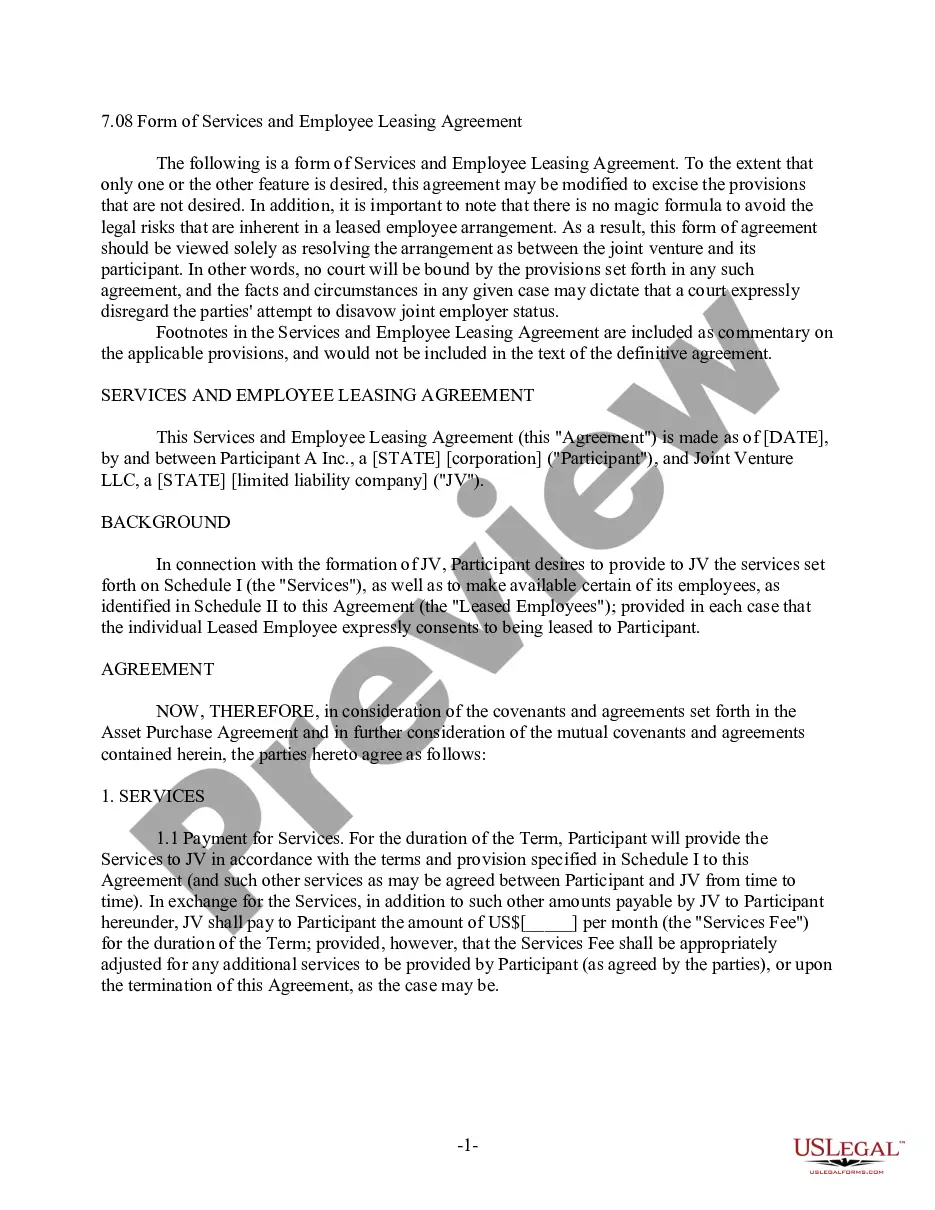

A brokerage agreement is a type of contract wherein one party agrees to act as a sales agent of another, who is called the principal. Updated October 29, 2020: A brokerage agreement is a type of contract wherein one party agrees to act as a sales agent of another, who is called the principal.

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you've borrowed plus interest. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own.

A mortgage broker is a financial intermediary who matches home borrowers with potential lenders in order to obtain the best possible mortgage terms for the borrower. A mortgage broker can save a borrower time and effort during the application process, and potentially a lot of money over the life of the loan.

A buyer broker agreement is a contract that legalizes the relationship between a buyer and a broker. Furthermore, it is a legally binding contract that outlines the rights and responsibilities of both parties.

Using multiple brokers can be advantageous especially if you have already used a broker that isn't whole of market and they're struggling to provide you with a mortgage. But, in most cases it is best to vet your broker upfront and use a whole of market broker with an exemplary reputation.

A mortgage broker agreement is a contract that outlines the terms of service and compensation, typically between a bank and a mortgage company or brokerage. Both parties sign this document before any work begins, ensuring that expectations are clear from the beginning.

(a) Every real estate broker, upon acting within the meaning of subdivision (d) of Section 10131, who negotiates a loan to be secured directly or collaterally by a lien on real property shall, within three business days after receipt of a completed written loan application or before the borrower becomes obligated on ...