A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

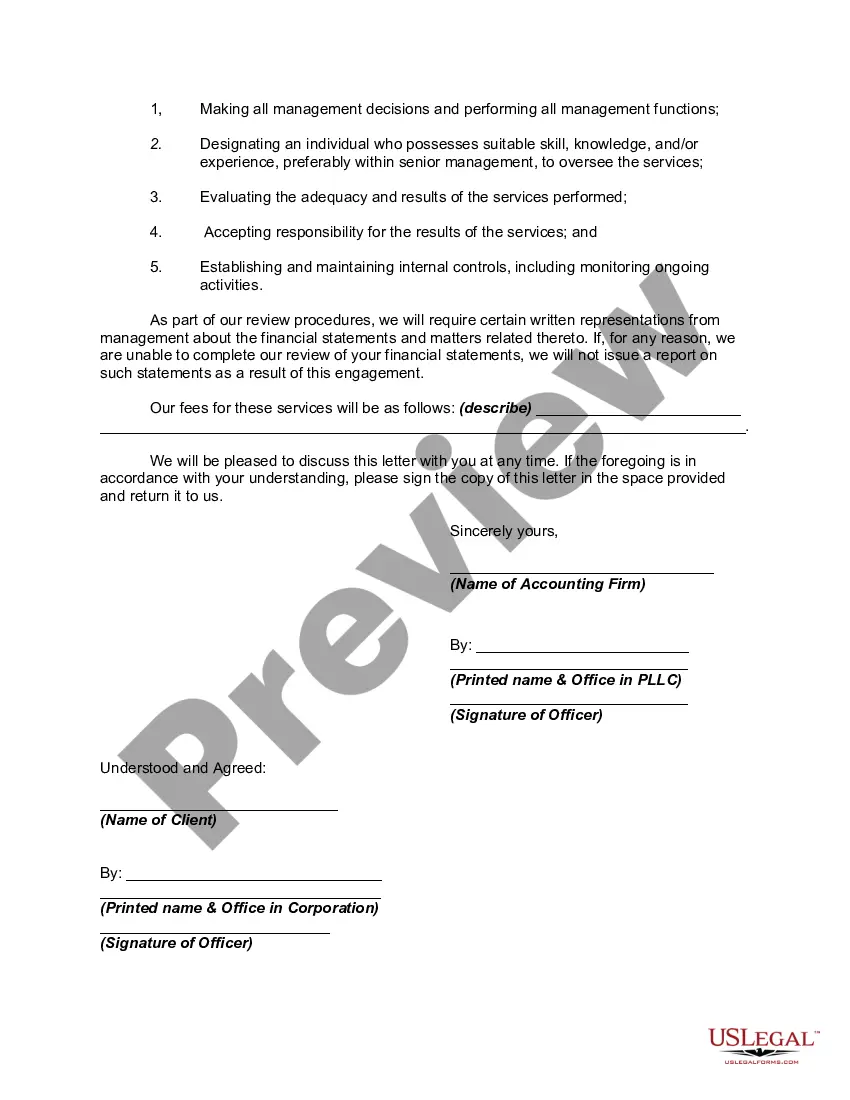

A California Engagement Letter for Review of Financial Statements by an Accounting Firm is a formal agreement between the accounting firm and its client, outlining the scope and terms of the engagement for conducting a review of the client's financial statements. This letter serves as a binding contract that ensures both parties are on the same page regarding the responsibilities, objectives, and limitations of the review engagement. The engagement letter typically includes various relevant keywords such as "California," "engagement letter," "review of financial statements," and "accounting firm," among others. By incorporating these keywords, the content becomes more targeted and tailored to the specific requirements of California engagement letters. In California, there can be different types of engagement letters for reviews of financial statements, depending on the specific needs and circumstances of the client. Some common variations include: 1. General California Engagement Letter for Review of Financial Statements: This type of engagement letter is widely used and covers the basic framework and requirements for conducting a standard review of financial statements in compliance with applicable accounting standards and regulatory requirements in California. 2. Industry-Specific California Engagement Letter for Review of Financial Statements: Certain industries, such as healthcare, real estate, or technology, may have unique reporting requirements. In such cases, the engagement letter needs to address the specific industry standards and regulations that apply to the client's financial statements. 3. Publicly Traded Companies California Engagement Letter for Review of Financial Statements: Companies listed on U.S. stock exchanges must comply with additional regulations and reporting requirements, such as those imposed by the Securities and Exchange Commission (SEC). The engagement letter for publicly traded companies in California needs to include specific clauses to address these additional compliance obligations. 4. Nonprofit Organizations California Engagement Letter for Review of Financial Statements: Nonprofits often have different financial reporting requirements compared to for-profit entities. Therefore, a specialized engagement letter is needed to address the specific needs, regulations, and industry best practices applicable to nonprofit organizations in California. Each type of engagement letter for review of financial statements in California should outline the objectives, responsibilities, and limitations of the review engagement, including the time frame, arrangement for access to the client's records, confidentiality, fees, and any other particular requirements dictated by the client or prescribed by California state laws or industry-specific regulations. It is crucial for both the accounting firm and the client to carefully review and mutually agree upon the engagement letter before commencing the review engagement. This ensures clear communication, sets expectations, and establishes a foundation of trust and understanding between all parties involved.A California Engagement Letter for Review of Financial Statements by an Accounting Firm is a formal agreement between the accounting firm and its client, outlining the scope and terms of the engagement for conducting a review of the client's financial statements. This letter serves as a binding contract that ensures both parties are on the same page regarding the responsibilities, objectives, and limitations of the review engagement. The engagement letter typically includes various relevant keywords such as "California," "engagement letter," "review of financial statements," and "accounting firm," among others. By incorporating these keywords, the content becomes more targeted and tailored to the specific requirements of California engagement letters. In California, there can be different types of engagement letters for reviews of financial statements, depending on the specific needs and circumstances of the client. Some common variations include: 1. General California Engagement Letter for Review of Financial Statements: This type of engagement letter is widely used and covers the basic framework and requirements for conducting a standard review of financial statements in compliance with applicable accounting standards and regulatory requirements in California. 2. Industry-Specific California Engagement Letter for Review of Financial Statements: Certain industries, such as healthcare, real estate, or technology, may have unique reporting requirements. In such cases, the engagement letter needs to address the specific industry standards and regulations that apply to the client's financial statements. 3. Publicly Traded Companies California Engagement Letter for Review of Financial Statements: Companies listed on U.S. stock exchanges must comply with additional regulations and reporting requirements, such as those imposed by the Securities and Exchange Commission (SEC). The engagement letter for publicly traded companies in California needs to include specific clauses to address these additional compliance obligations. 4. Nonprofit Organizations California Engagement Letter for Review of Financial Statements: Nonprofits often have different financial reporting requirements compared to for-profit entities. Therefore, a specialized engagement letter is needed to address the specific needs, regulations, and industry best practices applicable to nonprofit organizations in California. Each type of engagement letter for review of financial statements in California should outline the objectives, responsibilities, and limitations of the review engagement, including the time frame, arrangement for access to the client's records, confidentiality, fees, and any other particular requirements dictated by the client or prescribed by California state laws or industry-specific regulations. It is crucial for both the accounting firm and the client to carefully review and mutually agree upon the engagement letter before commencing the review engagement. This ensures clear communication, sets expectations, and establishes a foundation of trust and understanding between all parties involved.