California Raffle Contract and Agreement: A Comprehensive Overview In California, a raffle contract and agreement refers to a legally binding document that governs the operation and conduct of a raffle event. Raffles are common fundraising practices conducted by various nonprofit organizations, schools, religious institutions, and other charitable entities to generate funds for a specific cause or project. California's law strictly regulates raffles to ensure fairness, transparency, and adherence to specific guidelines. The California Penal Code, Section 320.5, sets forth the legal framework for conducting raffles within the state. This statute outlines the requirements and provisions that organizations must follow to conduct lawful raffles. The key components of a California Raffle Contract and Agreement typically include: 1. Purpose: A clear statement defining the purpose of the raffle event. This may include raising funds for a charitable cause, educational program, community project, or any other nonprofit initiative. 2. Organizer Information: The agreement must provide detailed information about the organization organizing the raffle, including its legal name, address, and contact details. It may also include the organization's tax identification number or registration details, highlighting its nonprofit status. 3. Licensing and Compliance: The agreement should stipulate the organization's compliance with the California law regarding raffles, including obtaining the necessary permits or licenses from the California Department of Justice (CA DOJ) or other relevant authorities. 4. Raffle Terms and Conditions: This section outlines the rules and guidelines for participating in the raffle, including ticket pricing, eligibility, prize details, draw date, and any additional requirements or restrictions. It may also specify the organization's right to amend or cancel the raffle in certain circumstances. 5. Privacy and Data Protection: Organizations must include provisions to protect the privacy of participants' personal information and ensure compliance with applicable data protection laws. 6. Record-keeping and Reporting: The agreement may require the organization to maintain accurate records of ticket sales, prize distribution, and financial transactions related to the raffle. It should also define the reporting obligations, including submission of financial reports to relevant authorities. Some specific types of California Raffle Contracts and Agreements include: 1. Standard Raffle Agreement: This refers to a basic agreement that covers all the essential elements of a raffle event and complies with the general requirements prescribed by California law. 2. Online Raffle Agreement: As online raffles gain popularity, this agreement addresses the particular aspects of conducting raffles through digital platforms. It may include provisions related to online ticket sales, technology requirements, and data protection measures. 3. Multiple Raffle Agreements: When an organization plans to conduct multiple raffles, separate agreements may be necessary to ensure clarity and specificity for each event. These agreements would outline the unique details of each raffle, including prizes, ticket prices, and draw dates. In conclusion, a California Raffle Contract and Agreement is a crucial document that outlines the rules, terms, and legal compliance requirements for conducting raffles within the state. It ensures transparency, fairness, and protects the interests of both organizers and participants.

California Raffle Contract and Agreement

Description

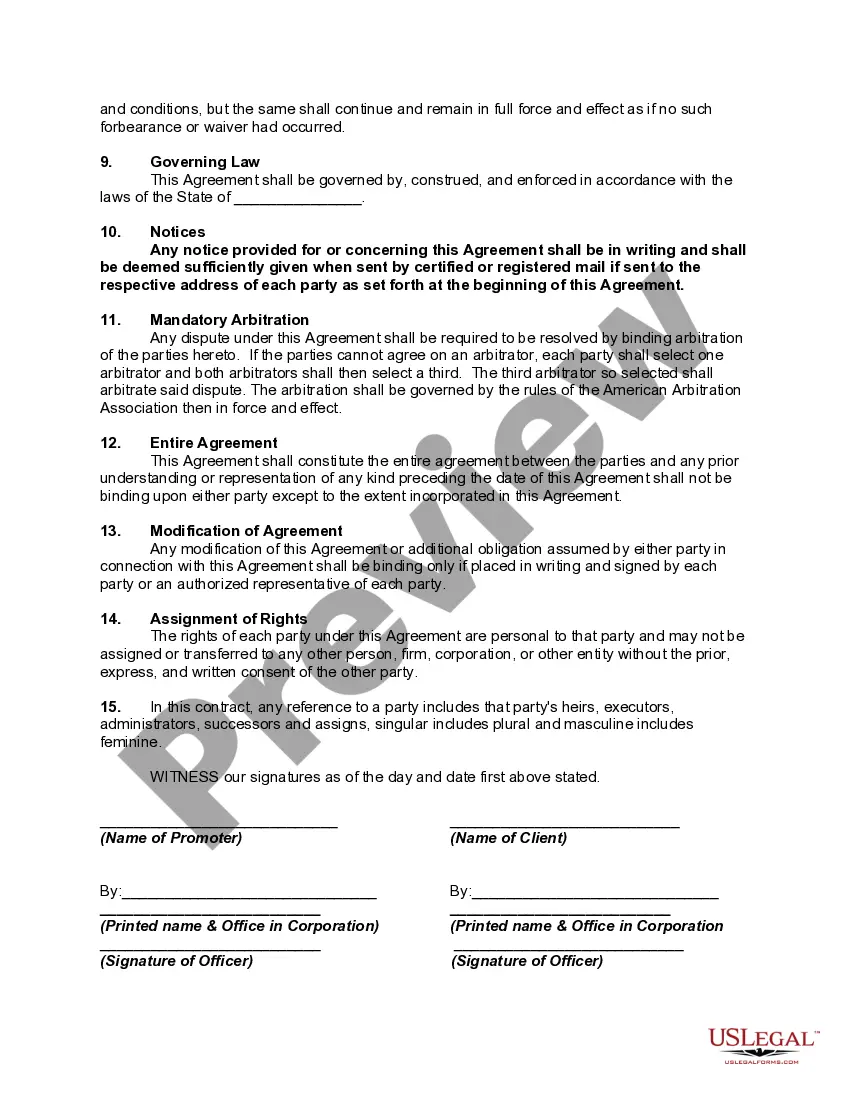

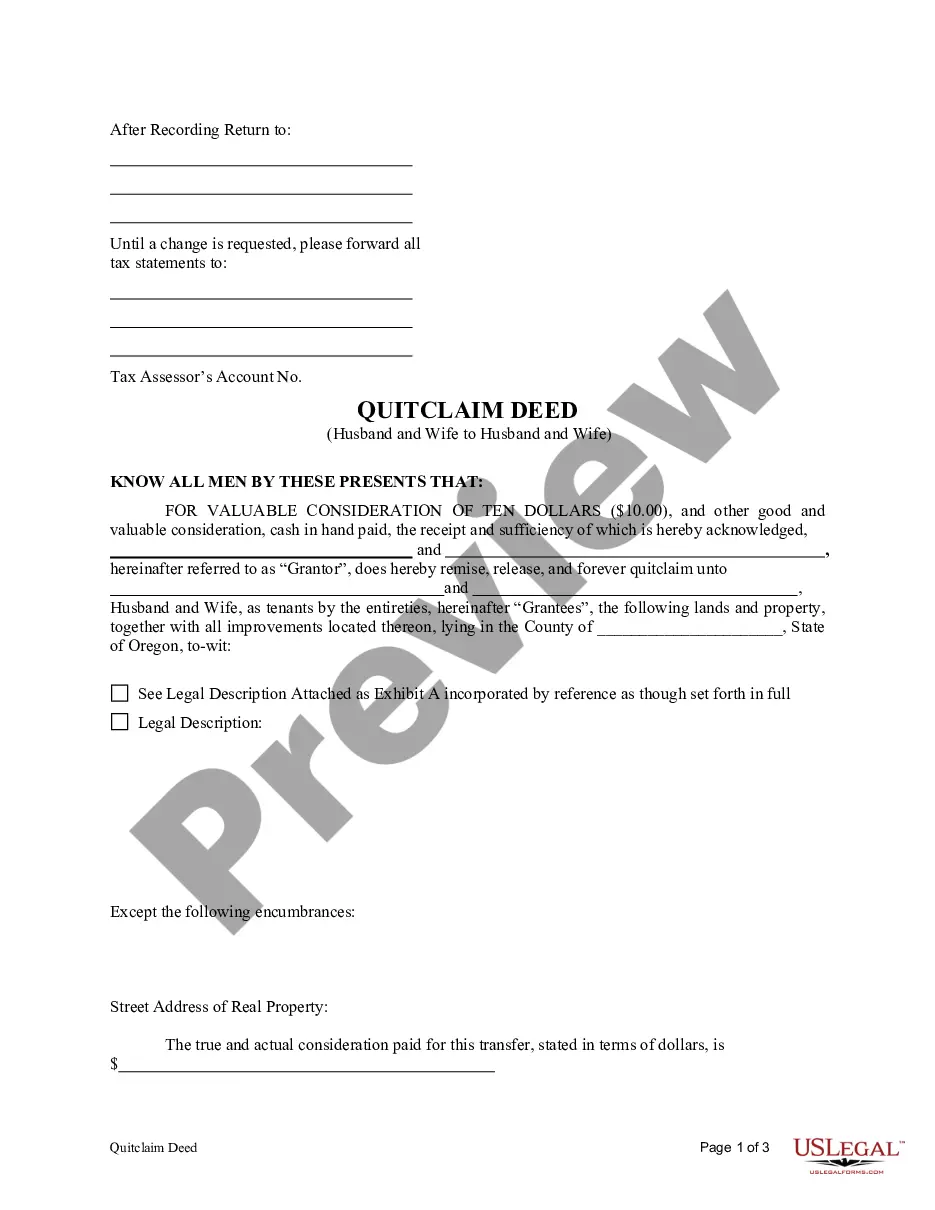

How to fill out California Raffle Contract And Agreement?

If you have to comprehensive, down load, or printing legitimate record layouts, use US Legal Forms, the biggest assortment of legitimate types, which can be found on-line. Use the site`s easy and handy lookup to get the papers you will need. A variety of layouts for business and person reasons are categorized by types and suggests, or key phrases. Use US Legal Forms to get the California Raffle Contract and Agreement in just a number of mouse clicks.

Should you be currently a US Legal Forms client, log in in your account and then click the Acquire switch to have the California Raffle Contract and Agreement. Also you can accessibility types you formerly delivered electronically within the My Forms tab of your own account.

Should you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Ensure you have chosen the shape for your right area/country.

- Step 2. Make use of the Review choice to look through the form`s content material. Don`t forget about to read the explanation.

- Step 3. Should you be not happy using the type, take advantage of the Lookup industry on top of the display to discover other versions in the legitimate type web template.

- Step 4. After you have found the shape you will need, click the Buy now switch. Choose the pricing program you choose and add your accreditations to sign up for an account.

- Step 5. Method the financial transaction. You can utilize your credit card or PayPal account to accomplish the financial transaction.

- Step 6. Pick the format in the legitimate type and down load it on the gadget.

- Step 7. Comprehensive, change and printing or sign the California Raffle Contract and Agreement.

Each and every legitimate record web template you get is your own property forever. You may have acces to every type you delivered electronically within your acccount. Go through the My Forms segment and select a type to printing or down load once more.

Be competitive and down load, and printing the California Raffle Contract and Agreement with US Legal Forms. There are millions of specialist and condition-certain types you may use for your personal business or person requires.

Form popularity

FAQ

The IRS requires that raffle prizes be reported as income by the winner, regardless of the bingo or lottery state laws. When adhering to a California Raffle Contract and Agreement, ensure that the prize value is accurately reported for tax purposes. Organizers should also provide winners with documentation for their tax records to streamline the process.

Yes, there are specific laws governing raffles in California. Organizations must adhere to regulations set forth in the California Raffle Contract and Agreement, which ensure fair practices and transparency. This includes registering the raffle with the state if the total prize value exceeds a certain limit, so it is essential to familiarize yourself with these rules to operate legally.

Tickets purchased for fundraisers may be tax-deductible, but it largely depends on the structure of the event and the type of organization hosting it. If the fundraising event is linked to a California Raffle Contract and Agreement, only the amount exceeding the fair market value of the ticket may qualify for a tax deduction. It's important to keep records and consult with a tax professional to understand your specific situation.

Yes, raffles are legal in many parts of the USA, but the legality varies by state and local jurisdiction. To operate a raffle, you often need to secure the appropriate licenses and follow the defined rules in your state. A well-structured California Raffle Contract and Agreement can help ensure you meet these legal requirements. For clarity on these laws, you can explore the forms and guidance offered by USLegalForms.

Holding a raffle legally in the US requires adherence to specific state laws. Generally, you need permits or licenses, especially for large-scale events. Be sure to draft a California Raffle Contract and Agreement that clearly outlines the rules, prize details, and the use of proceeds. Using platforms like USLegalForms can simplify the process by providing templates that ensure compliance with local regulations.

Nonprofits in California typically need to file their statement of information every two years. This routine filing ensures that any changes to your organization's leadership or address are reported in a timely fashion. If you are planning a fundraiser, remember to pair this with a California Raffle Contract and Agreement to cover all your bases. Staying on top of these filings helps maintain your nonprofit's credibility.

Any nonprofit organization registered in California must file a statement of information. This requirement ensures the state has current information about your organization's leadership and operational address. If you're involved in fundraising activities, you might also be required to submit a California Raffle Contract and Agreement. Therefore, keeping your documentation in order is essential.

In California, nonprofits must file several key forms, including the Articles of Incorporation and the Statement of Information. Additionally, if your organization conducts fundraising events, a California Raffle Contract and Agreement may be necessary to ensure compliance. Keeping these forms up to date is vital for maintaining your nonprofit's good standing.

Yes, nonprofits in California are required to file statements of information. This filing provides crucial updates about your nonprofit's leadership and operations. Such transparency helps maintain legal compliance and builds trust within the community. Consider using a California Raffle Contract and Agreement to further ensure your fundraising activities align with state regulations.

The rules around raffles in California include limitations on who can conduct them, the amount of profit that can be retained, and the stipulation that proceeds must support a charitable cause. Organizations need to maintain transparency and adhere to the guidelines outlined in their California Raffle Contract and Agreement. For clarity and compliance, it is always wise to consult legal experts or resources like uslegalforms.

More info

b) enter any of your e-mail address using the input field c) entering email address in the input field will include: — email address — contact email — futuredontics website. d) Enter your name on the promotional period page as follows: a) entering your name shall include: — name — your email address — your address (e) You will be selected winners on page, based on the numbers of hits. b) Winners for winners will be chosen each month via a random number generator. c) Winners may be changed to a winner by futuredontics and Futuredontics sole discretion. d) All applicable taxes as required by law are the sole responsibility and sole responsibility to winners who are required by law by which winner is required to pay any and all taxes. e) Futuredontics shall bear no responsibility if winners are unable to collect prizes. Winners may request to have the prize(s) shipped to the address provided on the winners' confirmation.