California Contract for Part-Time Assistance from Independent Contractor

Description

How to fill out Contract For Part-Time Assistance From Independent Contractor?

Are you in a situation where you need documents for either professional or personal reasons almost every day.

There are numerous legal document templates available online, but locating ones you can trust isn't simple.

US Legal Forms provides thousands of template documents, including the California Contract for Part-Time Assistance from Independent Contractor, which are designed to comply with federal and state regulations.

Access all the document templates you have purchased in the My documents section.

You can retrieve an additional copy of the California Contract for Part-Time Assistance from Independent Contractor at any time if needed. Just click the desired template to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the California Contract for Part-Time Assistance from Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/state.

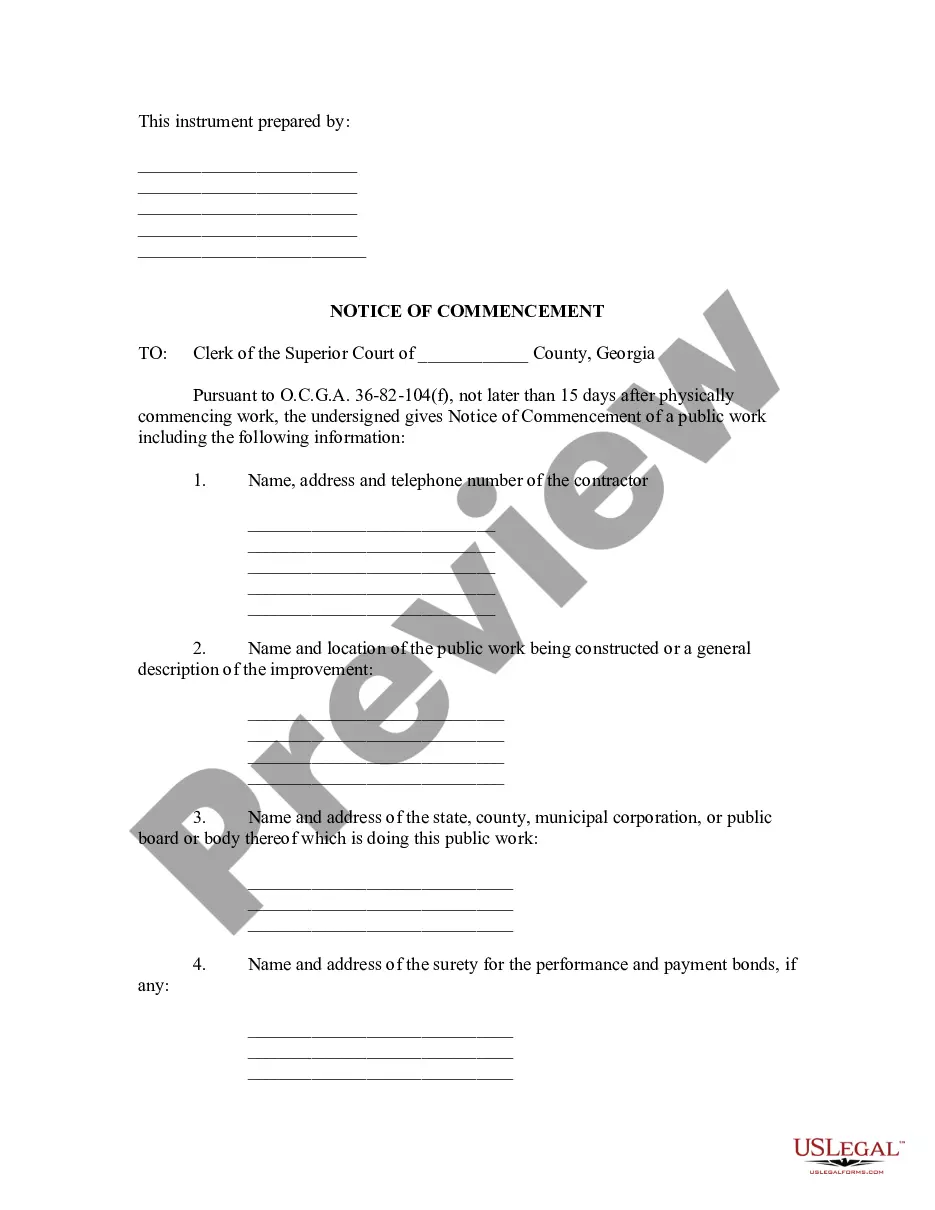

- Use the Review button to inspect the document.

- Check the details to ensure you have selected the right template.

- If the document isn't what you are looking for, use the Search field to find the template that fits your needs and requirements.

- Once you find the correct document, click Buy now.

- Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete your purchase using PayPal or Visa or MasterCard.

- Select a convenient document format and download your copy.

Form popularity

FAQ

Typically, the hiring party creates the independent contractor agreement, outlining the terms of the work arrangement. However, it's essential for both parties to review and potentially negotiate the terms to ensure mutual understanding. By using services like uslegalforms, you can create a comprehensive California Contract for Part-Time Assistance from Independent Contractor, securing a solid foundation for your business relationship.

To make your own contract agreement, you should first determine the essential terms, such as the services provided and compensation structure. Next, write the document in clear language, ensuring all relevant details are included to protect both parties. Utilizing resources like uslegalforms can simplify the process of drafting a California Contract for Part-Time Assistance from Independent Contractor that meets all necessary legal requirements.

Creating an independent contractor agreement requires outlining specific terms and conditions relevant to the engagement. Begin by including both parties’ contact information, the services to be performed, and compensation details. Additionally, consider using online platforms like uslegalforms for templates to help craft a California Contract for Part-Time Assistance from Independent Contractor that complies with legal standards.

To structure an effective independent contractor agreement, start by clearly defining the scope of work, payment terms, and duration of the contract. Incorporate confidentiality clauses and detail the expectations regarding deliverables. This framework is essential for a California Contract for Part-Time Assistance from Independent Contractor to ensure all parties understand their rights and responsibilities.

The 2-year contractor rule refers to a guideline used in California that influences how businesses classify their independent contractors. Specifically, if you hire someone as an independent contractor for more than two years, you may need to justify their classification and ensure compliance with labor laws. This has implications for the California Contract for Part-Time Assistance from Independent Contractor, so it's crucial to understand its nuances.

Yes, while independent contractors are not entitled to the same benefits as employees, you can offer certain perks to make your contract more attractive. Common benefits include flexible work hours or bonuses based on performance. However, ensure your arrangement adheres to the guidelines of a California Contract for Part-Time Assistance from Independent Contractor to maintain lawful compliance. If you need further assistance, consider using uslegalforms to navigate these options.

To write a contract for a 1099 employee, start by clearly identifying the parties involved and outlining the scope of work. Include payment terms, deadlines, and any specific requirements for the job. It is crucial to specify that the agreement is a California Contract for Part-Time Assistance from Independent Contractor, ensuring that the contractor understands their responsibilities. Utilizing a reliable platform like uslegalforms can help you create a compliant and comprehensive contract.

If you operate without a contract, your work relationship remains unclear, which can lead to disputes over payment and responsibilities. Without the protection of a California Contract for Part-Time Assistance from Independent Contractor, you might find yourself at a disadvantage if complications arise. It is always better to establish written agreements to create a clear understanding from the start.

Yes, independent contractors should always have a contract to define the terms of their engagement. A California Contract for Part-Time Assistance from Independent Contractor not only stipulates payment and tasks but also protects you legally. This document serves as a roadmap for the working relationship and helps prevent disputes down the line.

Technically, you can work as a 1099 contractor without a written contract, but it is not advisable. Without a California Contract for Part-Time Assistance from Independent Contractor, you risk misunderstandings about terms and payment. A well-defined contract protects your interests and clarifies the scope of work, making it a vital tool for any independent contractor.