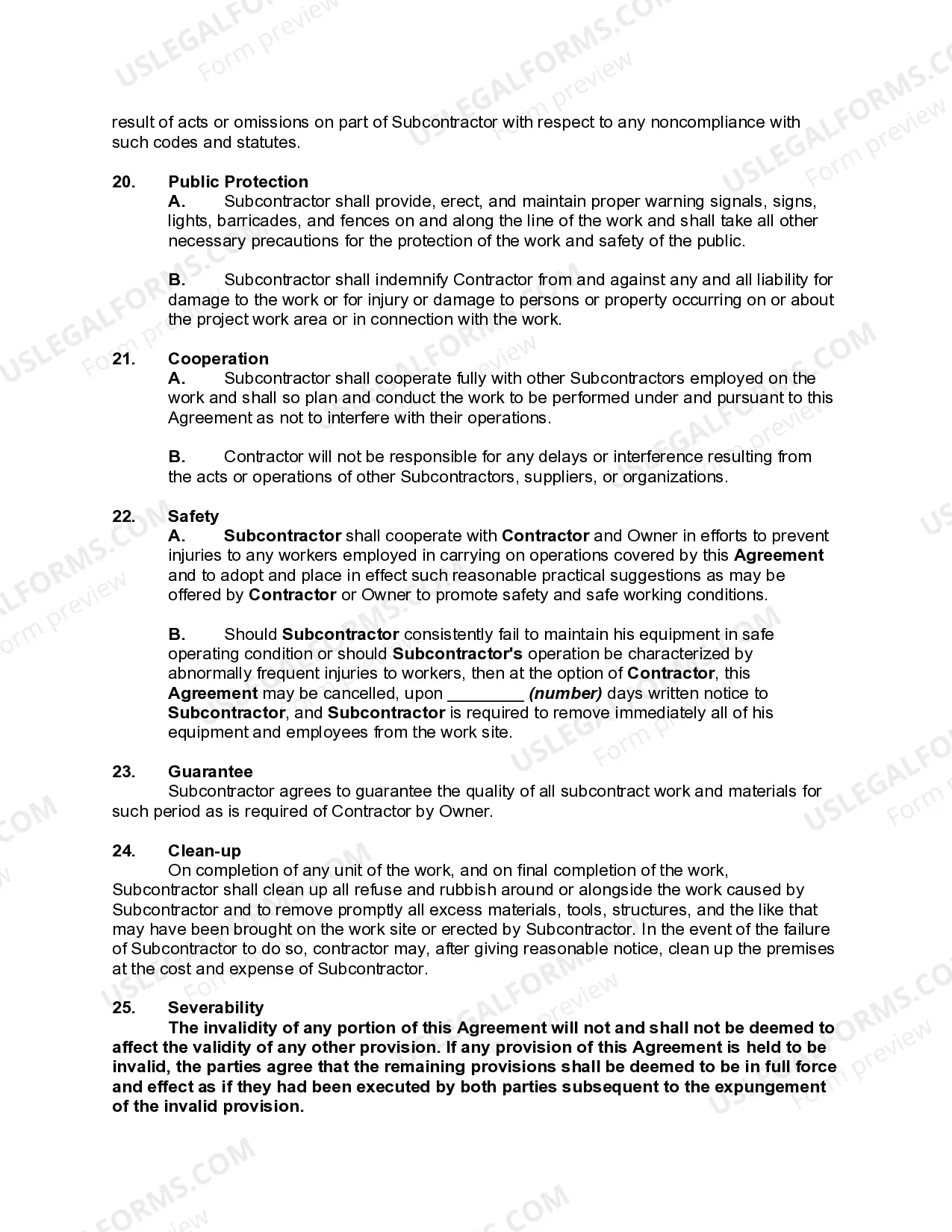

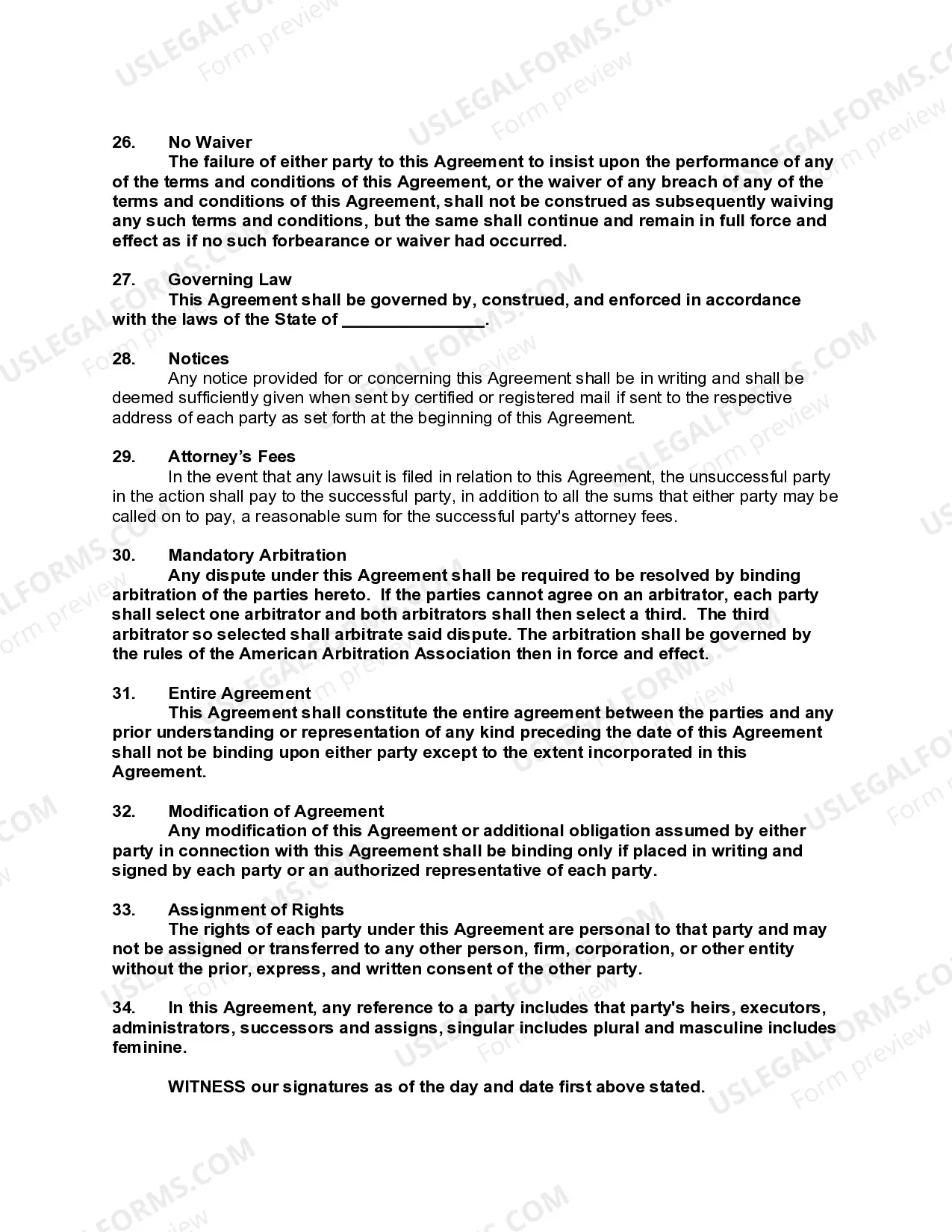

A California Subcontractor Agreement for Insurance is a legally binding contract that outlines the terms and conditions between an insurance company and a subcontractor. This agreement ensures that subcontractors hired by insurance companies adhere to specific rules, regulations, and guidelines set forth by the state of California. The purpose of a California Subcontractor Agreement for Insurance is to protect the rights and interests of all parties involved, including the insurance company, subcontractor, and clients. It clearly defines the responsibilities, obligations, and liabilities of each party, minimizing the potential for disputes or misunderstandings during the course of the subcontractor's engagement. Key components of this agreement typically include: 1. Parties involved: The agreement identifies the insurance company (referred to as the "principal") and the subcontractor (referred to as the "subcontractor"). Any relevant details regarding their legal names and addresses are included. 2. Scope of work: It mentions the specific services or tasks that the subcontractor is responsible for. This could relate to claim processing, customer service, policy administration, or any other specific duties outlined in the agreement. 3. Performance expectations: The agreement outlines the quality standards, performance metrics, and deadlines that the subcontractor is required to meet. It may specify key performance indicators, response times, and service levels to ensure high-quality service delivery. 4. Payment terms: Details regarding the subcontractor's compensation, including the payment structure, frequency, and any additional conditions, are clearly stated in the agreement. It may cover the billing process, invoicing, and terms of reimbursement. 5. Confidentiality and data protection: Since subcontractors often deal with sensitive client information, the agreement typically includes provisions on how the subcontractor should handle and protect confidential data. This ensures compliance with privacy laws, such as the California Consumer Privacy Act (CCPA). 6. Insurance and indemnification: The agreement outlines the insurance coverage requirements that the subcontractor must maintain, including liability insurance or errors and omissions insurance. It may also mention the indemnification clause, which holds the subcontractor responsible for any claims or losses resulting from their actions or negligence. 7. Term and termination: The agreement specifies the duration of the subcontractor's engagement, including any provisions for renewal or termination. It should outline the conditions under which either party can terminate the agreement, with or without cause, and the consequences of such termination. Different types of California Subcontractor Agreements for Insurance may exist based on the specific services provided by the subcontractor or the insurance sector involved. Examples of such agreements include: 1. Claims Processing Subcontractor Agreement: This agreement is specific to subcontractors responsible for handling insurance claims, ensuring efficient and accurate processing while adhering to California regulations. 2. Underwriting Subcontractor Agreement: This agreement is tailored for subcontractors involved in assessing and evaluating insurance risks, assisting insurance companies in the underwriting process. 3. Customer Service Subcontractor Agreement: Designed for subcontractors providing customer service support, this agreement focuses on maintaining a high level of customer satisfaction and resolving client inquiries or concerns. In conclusion, a California Subcontractor Agreement for Insurance is a crucial document that defines the responsibilities, expectations, and obligations of subcontractors in the insurance industry. By outlining the terms and conditions, this agreement safeguards the rights and interests of all parties involved and ensures compliance with California regulatory requirements.

California Subcontractor Agreement for Insurance

Description

How to fill out California Subcontractor Agreement For Insurance?

US Legal Forms - one of several biggest libraries of legal types in the USA - offers a wide range of legal file themes you may obtain or print out. Making use of the web site, you can find a large number of types for business and specific purposes, sorted by groups, claims, or key phrases.You can find the most recent versions of types just like the California Subcontractor Agreement for Insurance in seconds.

If you already have a monthly subscription, log in and obtain California Subcontractor Agreement for Insurance in the US Legal Forms library. The Down load option will show up on every form you see. You have accessibility to all previously delivered electronically types inside the My Forms tab of your own profile.

If you would like use US Legal Forms for the first time, listed below are easy guidelines to help you get began:

- Make sure you have selected the proper form for your town/area. Go through the Preview option to examine the form`s content material. Read the form information to actually have selected the right form.

- In the event the form doesn`t suit your needs, make use of the Research industry at the top of the monitor to obtain the the one that does.

- Should you be satisfied with the shape, validate your option by clicking on the Get now option. Then, choose the pricing program you want and supply your accreditations to sign up on an profile.

- Procedure the financial transaction. Use your charge card or PayPal profile to complete the financial transaction.

- Choose the formatting and obtain the shape on your own device.

- Make modifications. Load, modify and print out and sign the delivered electronically California Subcontractor Agreement for Insurance.

Every design you put into your account does not have an expiry day and is yours permanently. So, if you would like obtain or print out another backup, just proceed to the My Forms area and click on about the form you require.

Gain access to the California Subcontractor Agreement for Insurance with US Legal Forms, by far the most considerable library of legal file themes. Use a large number of professional and express-particular themes that meet up with your organization or specific demands and needs.

Form popularity

FAQ

Yes, California contractors must carry insurance to protect themselves and their clients from potential liabilities. This insurance often includes general liability and workers' compensation. When drafting a California Subcontractor Agreement for Insurance, it's important to detail the insurance obligations to ensure compliance and protection for all parties involved.

To become a subcontractor, you need to possess relevant skills, proper licensing, and insurance coverage. Additionally, it’s essential to understand the legal requirements in California, such as those covered in a California Subcontractor Agreement for Insurance. Making sure you have all necessary documentation can prevent future disputes.

Creating a subcontractor agreement involves outlining the terms of the working relationship, including scope, payment, and timelines. You should also specify insurance requirements and dispute resolution processes. Utilizing resources from uslegalforms can significantly streamline drafting an effective California Subcontractor Agreement for Insurance.

Indeed, an independent contractor in California often requires a business license, depending on their specific trade and location. A business license not only legitimizes your operation but also shields you from potential legal issues. Crafting a clear California Subcontractor Agreement for Insurance can also guide you through the licensing process effectively.

Absolutely, subcontractors in California typically need to be licensed to perform certain types of work. This requirement exists to protect both the subcontractors and clients from unqualified services. It’s advisable to ensure that any subcontractor agreement includes proof of licensing to maintain compliance with California laws.

Yes, in California, most subcontractors must obtain a valid license relevant to their trade. The state requires licenses to ensure that subcontractors meet specific standards of skill and competency. Therefore, having a proper California Subcontractor Agreement for Insurance can help you clarify these requirements and protections for both parties.

In California, hiring an unlicensed subcontractor can lead to significant legal issues. If a contractor engages an unlicensed subcontractor, they may face penalties and could be liable for damages caused by that subcontractor. Therefore, it’s essential to draft a California Subcontractor Agreement for Insurance that includes clauses about licensing and compliance with state regulations.

A 1099 contractor may need a business license in California depending on the nature of their services and local regulations. It’s important to check with local authorities to ensure compliance. A California Subcontractor Agreement for Insurance can outline responsibilities regarding necessary licenses. You can create a detailed agreement using our platform to ensure all legal requirements are met.

Independent contractors in California are not required by law to carry insurance, but it is highly recommended. Having insurance protects both the contractor and the client from potential liabilities. A California Subcontractor Agreement for Insurance often includes clauses about insurance that can define coverage expectations. Utilizing our services allows you to draft an agreement that clearly establishes these insurance requirements.

Yes, subcontractors typically need to hold a valid license in California to legally operate. This requirement ensures that they meet certain standards of quality and professionalism. A California Subcontractor Agreement for Insurance can help clarify the expectations and responsibilities of both parties, ensuring compliance with state laws. By using our platform, you can easily create a comprehensive agreement that protects your interests.