California Sample Letter for Explanation of Insurance Rate Increase

Description

How to fill out Sample Letter For Explanation Of Insurance Rate Increase?

If you want to accumulate, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the site's simple and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Acquire now button. Select the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to obtain the California Sample Letter for Explanation of Insurance Rate Increase with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and select the Acquire option to receive the California Sample Letter for Explanation of Insurance Rate Increase.

- You can also access forms you've previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct region/state.

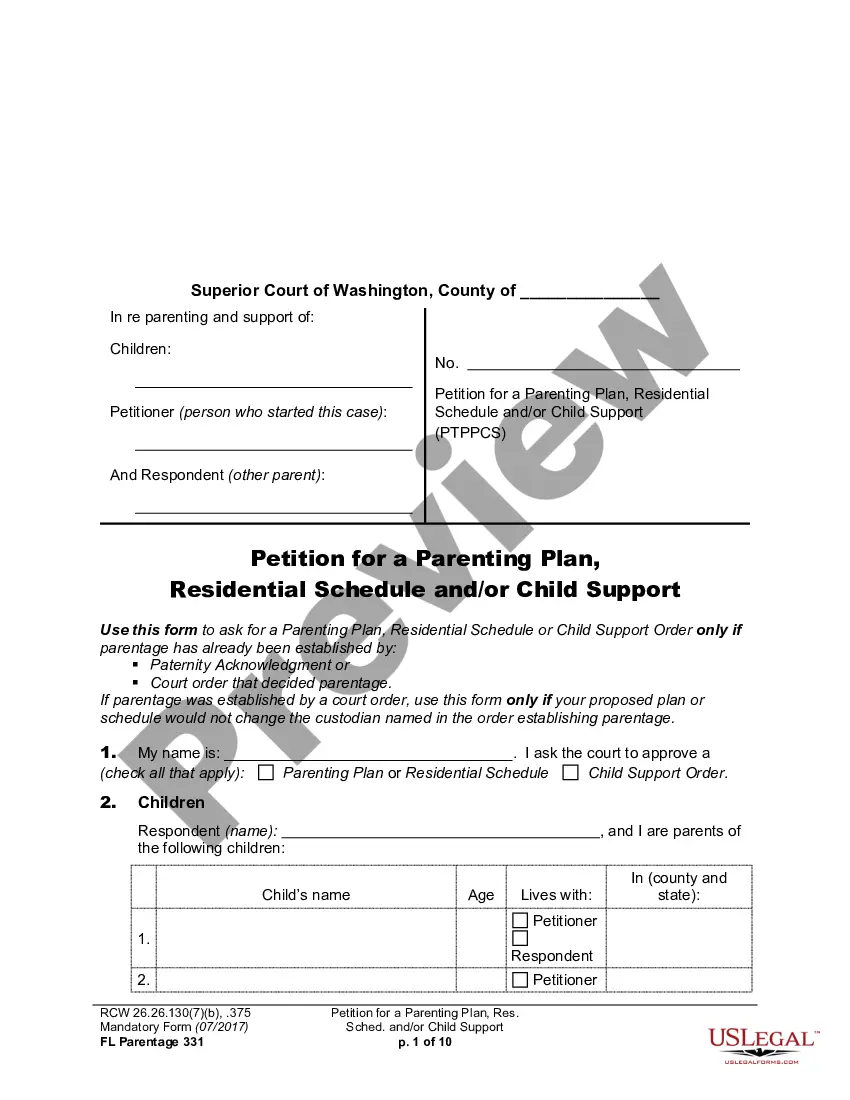

- Step 2. Use the Preview option to review the form's content. Don’t forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Health insurance rates have generally increased in California, reflecting rising medical costs and changes in policy coverage. This increase can often leave consumers confused, prompting the need for a clear explanation. Utilizing a California Sample Letter for Explanation of Insurance Rate Increase can help formally address these differences with your insurance provider.

Yes, many insurance rates have seen increases in California due to various factors, including higher costs associated with healthcare and repair services. This trend may affect your current policy, and a California Sample Letter for Explanation of Insurance Rate Increase could help clarify these changes to your insurer. Always stay informed about market trends to better understand your insurance rates.

To obtain a letter of coverage from your insurance provider, you should start by contacting their customer service. Provide your insurance policy details, and request a letter that outlines your coverage. For a more formal approach, you can use a California Sample Letter for Explanation of Insurance Rate Increase to facilitate this request directly.

Many employers are seeking innovative solutions to manage rising health care costs. Some companies are exploring wellness programs, while others are increasing employee contributions to insurance premiums. To address these changes, a California Sample Letter for Explanation of Insurance Rate Increase can guide employers in communicating with their staff transparently. This letter serves as an essential tool for fostering understanding and collaboration during challenging times.

Yes, employers must notify employees of any changes to health insurance policies. This requirement ensures that employees understand how changes affect their coverage and costs. A California Sample Letter for Explanation of Insurance Rate Increase can help employers communicate these changes clearly and effectively. Proper notification builds trust and helps employees make informed decisions.

Health insurance premiums may rise due to increased healthcare utilization, rising medical costs, and new treatments or medications entering the market. Additionally, insurer adjustments in risk assessments can lead to premium hikes. Using a California Sample Letter for Explanation of Insurance Rate Increase to communicate these changes can help maintain transparency with employees.

Yes, employers can reimburse employees for their health insurance premiums, offering a tax-advantaged way to support their workers. However, it's important to ensure compliance with any applicable regulations. This process can be better understood and communicated through resources such as a California Sample Letter for Explanation of Insurance Rate Increase.

Five primary factors that influence insurance premiums include your age, overall health, claims history, the type of coverage selected, and the geographic area you reside in. Each of these factors can significantly impact the calculations used by insurers. Utilizing resources like a California Sample Letter for Explanation of Insurance Rate Increase can help provide context to these determining factors.

Insurance premiums can increase due to multiple reasons, such as higher claim rates, changes in healthcare provider networks, and regulatory adjustments. Additionally, demographic shifts, like an aging workforce, can also influence costs. Using a California Sample Letter for Explanation of Insurance Rate Increase can help clarify these changes for employees, fostering a better understanding.

Several factors contribute to health insurance premium increases, including rising healthcare costs, changes in the risk pool, and enhancements in coverage. Insurance companies regularly adjust premiums to align with these costs. Understanding these factors can help companies better explain increases through documents like the California Sample Letter for Explanation of Insurance Rate Increase.