California Investment Letter is a crucial document that provides detailed information on the Intrastate Offering regulations and guidelines for individuals or entities who wish to invest in California-based ventures. This letter is essential for potential investors looking to engage in intrastate securities offerings within the state of California. The California Investment Letter aims to ensure compliance with all relevant laws and regulations while enabling businesses and investors to benefit from intrastate investments within the state. Intrastate Offerings are securities offerings limited to investors who reside within the state of California. These offerings provide an opportunity for local businesses to raise capital from in-state residents, promoting economic growth within the state. The California Investment Letter outlines the various types of Intrastate Offerings in compliance with the state's securities laws, offering detailed explanations and guidelines to assist potential investors in making informed decisions. Some different types of California Investment Letter regarding Intrastate Offering might include: 1. General Intrastate Offering: This type of offering generally represents the common method through which local businesses can raise funds from residents of California. The California Investment Letter provides specific instructions on how to conduct such offerings, including the required documentation, investor requirements, and compliance regulations. 2. Crowdfunding Intrastate Offering: Crowdfunding has gained popularity as an alternative financing method. The California Investment Letter may provide information on how intrastate crowdfunding offerings work, including the limitations, exemptions, and compliance requirements set forth by the state. 3. Small Business Investment Company (SIC) Intrastate Offering: Sics are investment firms licensed by the Small Business Administration (SBA) that provide funding to small businesses. The California Investment Letter may outline the opportunities and guidelines for Sics to carry out Intrastate Offerings, ensuring compliance with both state and federal regulations. 4. Local Government Intrastate Offering: This type of offering involves local governments and municipalities issuing securities to finance specific projects or initiatives that benefit the community. The California Investment Letter may provide details about the requirements and process for local governments to conduct such offerings while adhering to securities laws. In conclusion, the California Investment Letter serves as a comprehensive guide for investors and businesses interested in participating in Intrastate Offerings within the state. It ensures compliance with state securities laws while promoting economic growth and investment opportunities for both local businesses and residents.

California Investment Letter regarding Intrastate Offering

Description

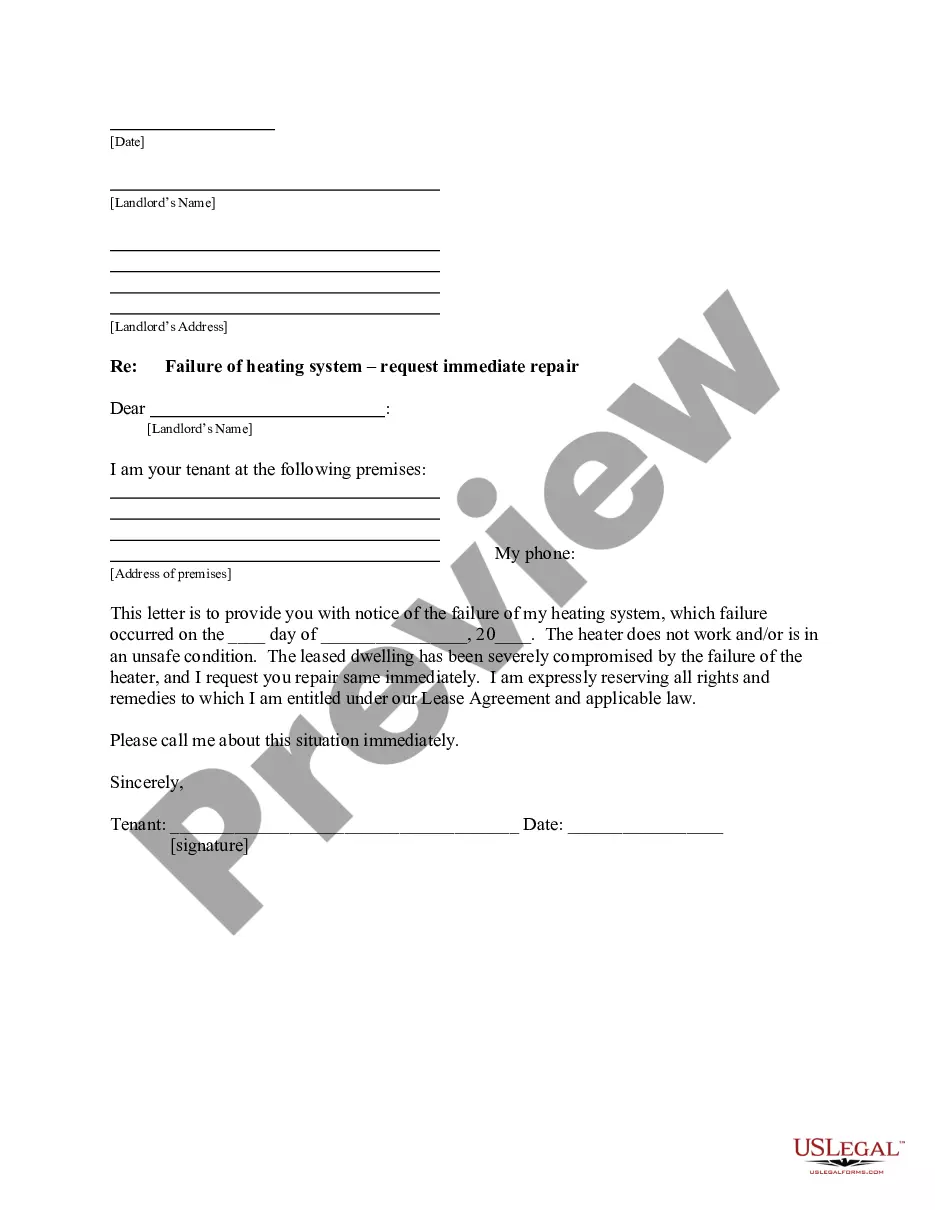

How to fill out Investment Letter Regarding Intrastate Offering?

If you aim to finalize, acquire, or produce lawful document templates, utilize US Legal Forms, the premier collection of legal forms, accessible online.

Employ the site’s user-friendly and efficient search to locate the documents you require. A selection of templates for professional and personal purposes are categorized by types and states, or keywords.

Leverage US Legal Forms to find the California Investment Letter regarding Intrastate Offering with just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to each form you downloaded in your account. Click the My documents section and choose a form to print or download again.

Complete and download, and print the California Investment Letter regarding Intrastate Offering with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to access the California Investment Letter concerning Intrastate Offering.

- You can also reach forms you previously downloaded in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct state/region.

- Step 2. Use the Preview option to review the form’s content. Be sure to read the description.

- Step 3. If you are not satisfied with the type, use the Search field at the top of the screen to find other templates in the legal form catalog.

- Step 4. After locating the form you need, choose the Buy now button. Select your preferred pricing plan and provide your details to register for an account.

- Step 5. Process the payment. You can utilize your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the California Investment Letter concerning Intrastate Offering.

Form popularity

FAQ

Section 25120 of the California Corporation Code addresses the general requirements for securities filings and establishes the essential conditions for the sales of securities. It plays a pivotal role in ensuring that all material information is disclosed to investors, promoting transparency. If you are drafting a California Investment Letter regarding Intrastate Offering, understanding Section 25120 is vital. It helps you navigate the complexities of securities regulations to effectively inform potential investors.

To file a notice for an investment adviser in California, you must complete the appropriate forms and submit them to the California Department of Financial Protection and Innovation. This process involves providing detailed information about your business and the services you offer. When engaging in any investment activity, including creating your California Investment Letter regarding Intrastate Offering, ensure that you follow these filing requirements. Using a platform like uslegalforms can simplify this process and help you stay compliant.

Investment companies in California are primarily regulated by the California Department of Financial Protection and Innovation. This agency ensures that companies comply with state securities laws and protects investors from deceptive practices. When preparing your California Investment Letter regarding Intrastate Offering, it is essential to understand the role of this regulatory body. Knowing the regulatory landscape can foster a compliant and trustworthy investment opportunity.

Section 25102 F of the California Corporation Code relates to the exemption for certain types of securities offerings, particularly those made to accredited investors. This filing is crucial for minimizing regulatory burdens while ensuring compliance with state laws. When preparing your California Investment Letter regarding Intrastate Offering, referencing this section can help you design a successful strategy. It provides pathways to raise funds effectively while adhering to legal standards.

Section 25104 A of the California Corporation Code pertains to the limited offering exemption, which allows specific small offerings to avoid the full registration process. This section provides clarity on the types of securities and situations eligible for exemption. When drafting your California Investment Letter regarding Intrastate Offering, it is essential to understand this section to ensure compliance. This knowledge can aid in maximizing your fundraising potential.

The California Securities Law of 1968 establishes the framework for regulating the securities industry in California. It aims to protect investors from fraud by requiring transparency in securities transactions. This law is fundamental for anyone preparing a California Investment Letter regarding Intrastate Offering, as it outlines the legal obligations companies must meet. Familiarizing yourself with this law can enhance investor trust in your offerings.

Regulation 147 establishes guidelines for intrastate offerings, providing a framework under which a company can offer securities to residents of its state. This regulation is critical for businesses seeking to streamline fundraising efforts while staying compliant with state and federal laws. By leveraging the California Investment Letter regarding Intrastate Offering, companies can engage local investors and access much-needed capital tailored to their state's specific needs.

Tax Rule 147 pertains to the taxation of securities sold under Rule 147 in intrastate offerings. Specifically, it may involve the determination of tax obligations concerning income generated from these investments. If you're preparing a California Investment Letter regarding Intrastate Offering, understanding Tax Rule 147 can help you navigate potential tax implications effectively, ensuring your investors are informed and compliant.

Rule 147 allows companies to offer and sell their securities within their home state, fostering local investment opportunities. In the context of the California Investment Letter regarding Intrastate Offering, this rule enables businesses to raise capital from California residents without extensive federal registration. Embracing Rule 147, businesses can ensure compliance while attracting investors from their own community, promoting local economic growth.

Certain securities are exempt from registration at the state level under specific conditions. Common exemptions include securities issued by government entities, small business investment companies, and certain intrastate offerings. The California Investment Letter regarding Intrastate Offering can outline these exemptions, helping you identify potential opportunities while remaining compliant with state regulations. Knowing these details gives you an advantage when considering investment options.