California Security Agreement Regarding Aircraft and Equipment is a legal document that outlines the terms and conditions between a creditor and a debtor regarding the financing or leasing of aircraft and related equipment in the state of California. This agreement serves to secure the creditor's interest in the aircraft and equipment as collateral. A California Security Agreement Regarding Aircraft and Equipment typically contains various key elements such as: 1. Parties Involved: The agreement identifies the creditor and the debtor, outlining their legal names, addresses, and relevant contact information. 2. Description of Collateral: It includes a comprehensive description of the aircraft and related equipment being financed or leased. This may encompass details such as make, model, serial numbers, N-number (aircraft registration number), engine specifications, and any other relevant identifying information. 3. Security Interest: The agreement outlines the security interest held by the creditor over the collateral. It explains that the creditor has a right to the aircraft and equipment as collateral if the debtor defaults on the loan or lease agreement. 4. Obligations of the Debtor: This section specifies the debtor's responsibilities, including maintaining and insuring the aircraft and equipment, complying with relevant regulations and laws, and providing accurate records of the collateral. 5. Payment and Default: The agreement explains the terms and conditions for repayment, including the amount, interest rates, payment schedule, and consequences of default. It may outline the rights of the creditor in case of default, such as repossession and sale of the collateral to recover the debt. 6. Perfection of Security Interest: This part discusses the steps required to perfect the security interest, such as filing necessary documents with the appropriate Federal Aviation Administration (FAA) offices and complying with California state laws regarding security agreements. 7. Indemnification and Insurance: The agreement may include provisions relating to insurance requirements, ensuring the collateral is adequately insured against risks such as damage, loss, or liability. Apart from the general California Security Agreement Regarding Aircraft and Equipment, there may be specialized types or variations of this agreement used in specific scenarios, such as: 1. Aircraft Lease Security Agreement: This type of agreement is used when an aircraft lessor finances the leasing of an aircraft to a lessee. It outlines the terms and conditions specific to aircraft leasing transactions, addressing aspects like rental payments, maintenance obligations, and end-of-lease arrangements. 2. Aircraft Mortgage Security Agreement: In this variation, the creditor provides a loan to the debtor secured by a mortgage on the aircraft. It establishes the terms for repayment, the creditor's rights upon default, and how the mortgage is to be executed and recorded. 3. Equipment Security Agreement: While an aircraft is the primary collateral in the general agreement, an equipment security agreement may specifically focus on financing or leasing aviation-related equipment, excluding the aircraft itself. This might include items like avionics, engines, or ground support equipment. It is important to approach legal matters with professional advice from an attorney familiar with aviation law and specific regulations outlined by California law. This description is for informational purposes only and should not be considered as legal advice.

California Security Agreement Regarding Aircraft and Equipment

Description

How to fill out California Security Agreement Regarding Aircraft And Equipment?

US Legal Forms - one of the most significant libraries of lawful types in the USA - delivers a wide range of lawful record themes it is possible to download or produce. Using the website, you may get thousands of types for company and individual purposes, categorized by classes, states, or search phrases.You will discover the most recent versions of types just like the California Security Agreement Regarding Aircraft and Equipment within minutes.

If you already possess a membership, log in and download California Security Agreement Regarding Aircraft and Equipment from the US Legal Forms library. The Acquire key will appear on every single develop you see. You have access to all previously delivered electronically types inside the My Forms tab of your respective bank account.

If you would like use US Legal Forms the first time, listed below are easy recommendations to get you began:

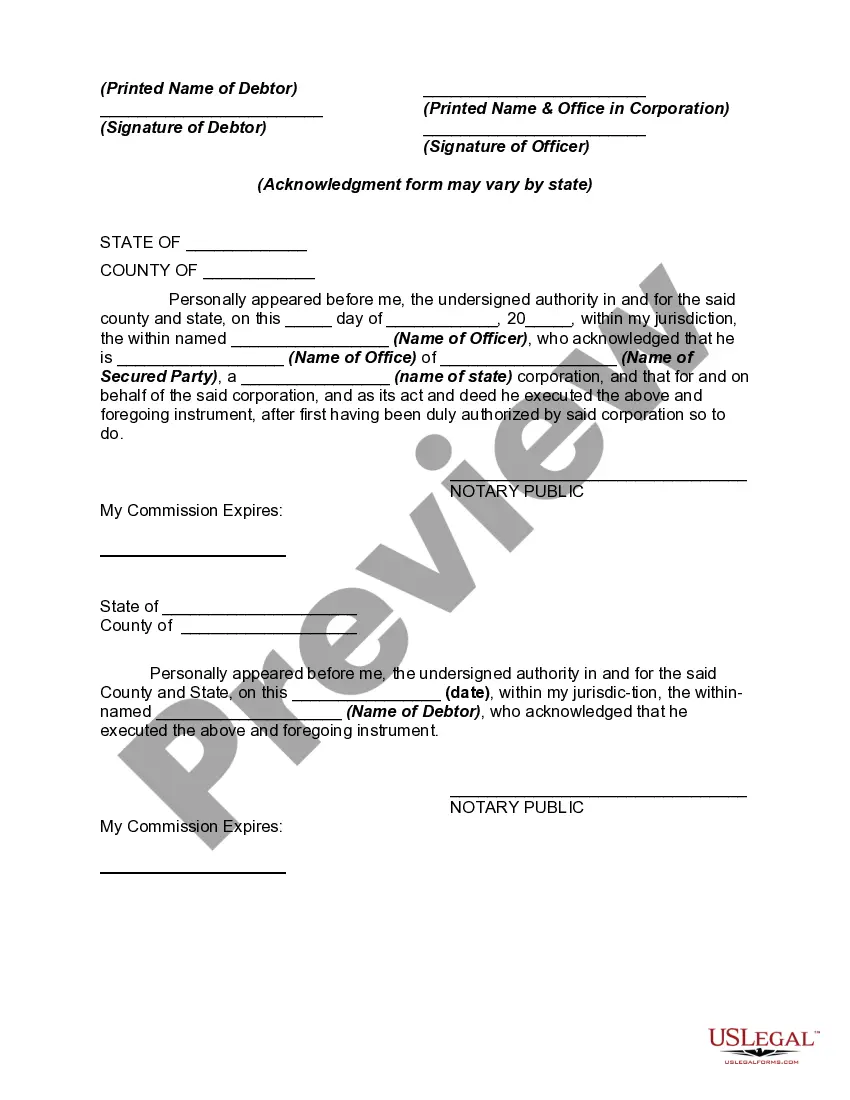

- Ensure you have picked the best develop for your personal area/region. Select the Review key to examine the form`s content material. Read the develop explanation to ensure that you have selected the appropriate develop.

- In case the develop doesn`t satisfy your demands, take advantage of the Look for industry on top of the display to discover the one which does.

- Should you be happy with the form, verify your option by clicking the Buy now key. Then, select the rates prepare you like and provide your qualifications to register for an bank account.

- Approach the transaction. Make use of credit card or PayPal bank account to complete the transaction.

- Pick the formatting and download the form on your product.

- Make changes. Complete, revise and produce and sign the delivered electronically California Security Agreement Regarding Aircraft and Equipment.

Every single design you included with your bank account lacks an expiry date and is the one you have for a long time. So, if you would like download or produce one more backup, just visit the My Forms section and click around the develop you require.

Get access to the California Security Agreement Regarding Aircraft and Equipment with US Legal Forms, one of the most considerable library of lawful record themes. Use thousands of specialist and state-certain themes that satisfy your small business or individual demands and demands.