California Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons

Description

How to fill out Letter To Foreclosure Attorney - General Demand To Stop Foreclosure And Reasons?

Are you inside a position the place you require files for either organization or personal functions just about every day? There are plenty of authorized file layouts available on the Internet, but getting kinds you can rely is not effortless. US Legal Forms gives a large number of form layouts, much like the California Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons, which are created to satisfy federal and state demands.

Should you be currently knowledgeable about US Legal Forms website and also have a merchant account, merely log in. Following that, you may down load the California Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons design.

Unless you have an bank account and want to start using US Legal Forms, follow these steps:

- Find the form you will need and ensure it is to the appropriate area/county.

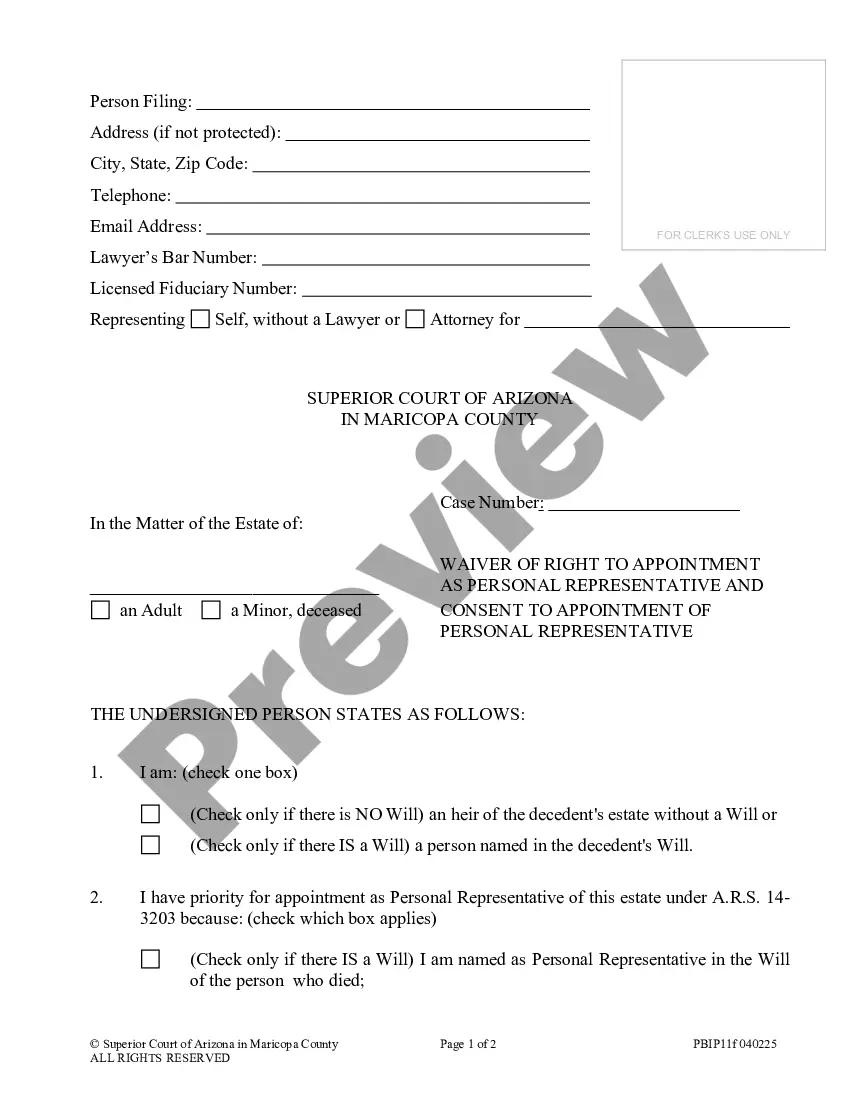

- Utilize the Review button to check the form.

- Read the explanation to ensure that you have selected the appropriate form.

- When the form is not what you are trying to find, utilize the Look for field to obtain the form that fits your needs and demands.

- Once you get the appropriate form, click Get now.

- Opt for the rates plan you want, fill out the desired information to make your bank account, and pay money for your order making use of your PayPal or bank card.

- Choose a practical paper formatting and down load your duplicate.

Get every one of the file layouts you possess bought in the My Forms menu. You may get a more duplicate of California Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons at any time, if required. Just click the required form to down load or print the file design.

Use US Legal Forms, probably the most considerable selection of authorized types, to save efforts and prevent mistakes. The support gives skillfully created authorized file layouts that can be used for a selection of functions. Make a merchant account on US Legal Forms and start creating your lifestyle a little easier.

Form popularity

FAQ

California changed its law at the beginning of the 2023 to require that certain sellers of foreclosed properties containing one to four residential units only accept offers from eligible bidders during the first 30 days after a property is listed.

In addition to paying off your remaining mortgage debt, selling with equity provides the most flexibility and avoids the credit damage caused by foreclosure.

Foreclosure and Keeping Your Equity You don't forfeit the equity in your property after banks auction off your home in foreclosure. However, once the home is sold at auction, the adverse effects of foreclosure will chip away at that equity before you are paid the remainder.

It's theoretically possible to refinance your mortgage to avoid foreclosure by getting into a more affordable payment, but you have to do so before you enter foreclosure.

In today's market, many homeowners, including those potentially facing foreclosure, have sufficient equity in their homes that a traditional sale could be a better alternative to foreclosure. Servicers can remind homeowners that a traditional sale might be one option to avoid foreclosure.

Additional resources for avoiding foreclosure An expert from a housing counseling agency can guide you as you try to work with your mortgage company to avoid foreclosure. You can find a local HUD-approved expert online, or call HUD's Office of Housing Counseling at (800) 569-4287.

The fastest way to avoid foreclosure is to reinstate your loan, by paying the amount provided on the reinstatement quote. The reinstatement quote can be obtained from the lender, along with a good through date. If you cannot pay your mortgage, or can only pay a portion, contact your servicer.

6 ways to stop foreclosure Mortgage repayment plan. ... Loan modification. ... Deed-in-lieu of foreclosure. ... Short sale. ... Short refinance. ... Refinance with a hard money loan.