When the parties have not clearly indicated whether or not their business constitutes a partnership, the law has determined several guidelines to aid Courts in determining whether the parties have created a partnership. The fact that the parties share profits and losses is strong evidence of a partnership.

California Disclaimer of Partnership

Description

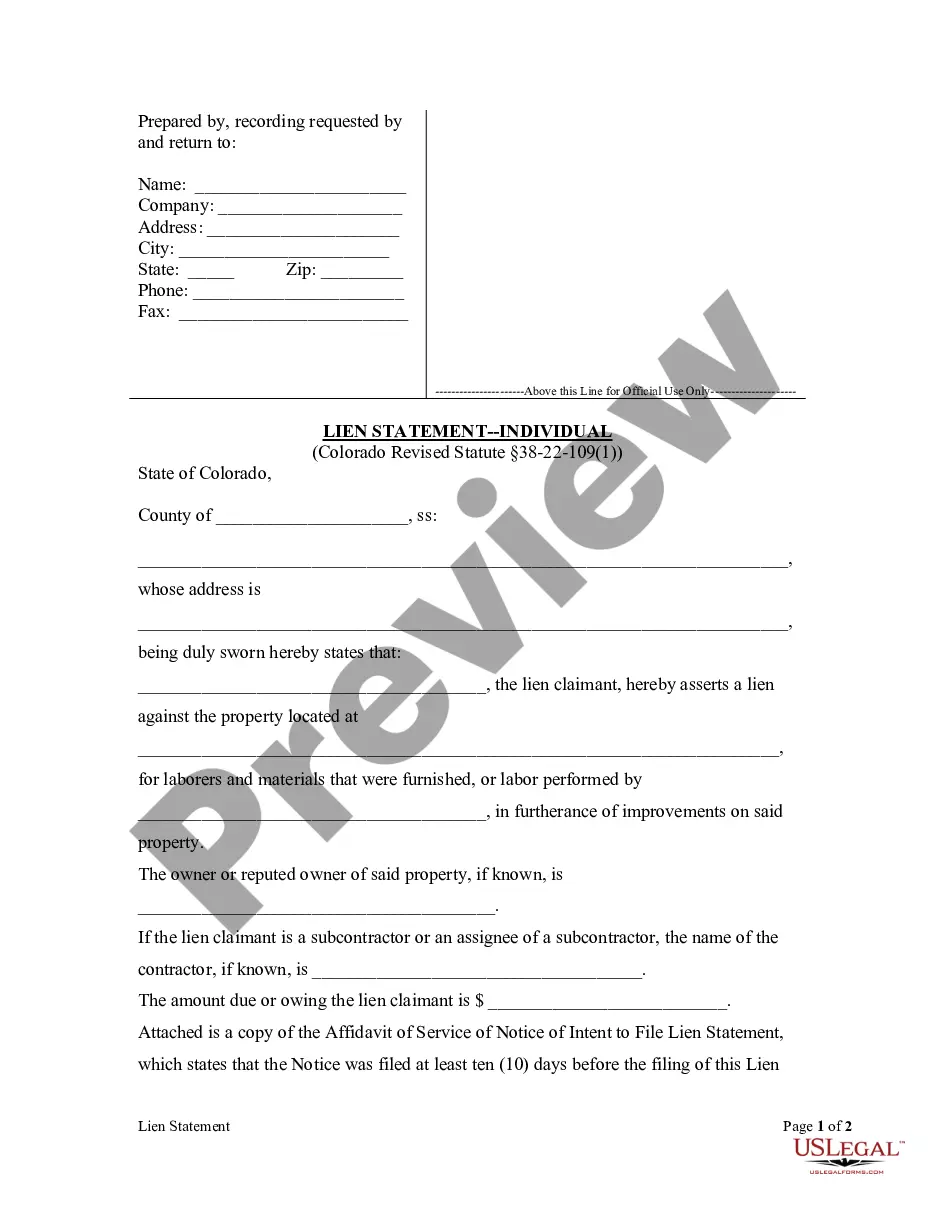

How to fill out Disclaimer Of Partnership?

Locating the correct legal document format can be challenging. Obviously, there are numerous templates available online, but how do you locate the legal document you require? Utilize the US Legal Forms platform.

This service offers thousands of templates, including the California Disclaimer of Partnership, which you can use for business and personal purposes. All documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Obtain button to download the California Disclaimer of Partnership. Use your account to browse through the legal documents you have previously purchased. Go to the My documents section of your account to get another copy of the document you need.

Select the document format and download the legal document to your device. Complete, edit, print, and sign the obtained California Disclaimer of Partnership. US Legal Forms is the largest library of legal documents where you can find various file formats. Utilize the service to download professionally crafted documents that adhere to state regulations.

- Firstly, ensure you have selected the appropriate form for your area/region.

- You can preview the form using the Review option and read the form details to confirm it is suitable for your needs.

- If the form does not meet your requirements, use the Search field to find the correct form.

- Once you are confident that the form is right, click the Purchase now button to obtain the document.

- Choose the payment plan you prefer and input the required information.

- Create your account and complete the purchase using your PayPal account or credit card.

Form popularity

FAQ

In California, partnerships must file an informational return using Form 565 to report income, deductions, and credits. Partners receive K-1 forms detailing their share of the partnership’s income. Additionally, including a California Disclaimer of Partnership in your records assures that your business structure is clear and avoids potential legal issues.

Form 565, which is used for reporting partnership income, should be filed with the California Franchise Tax Board. Ensure you file by the designated deadlines to avoid penalties. If your partnership utilizes a California Disclaimer of Partnership, it is wise to mention this detail when preparing your filing.

To fill out a partnership agreement, start by clearly identifying each partner and outlining their respective roles within the business. Include specific clauses about profit sharing and decision-making processes. When drafting this document, remember to highlight the California Disclaimer of Partnership to clarify the nature of the collaboration.

Completing a partnership agreement involves detailing the terms of the partnership, including roles, profit sharing, and responsibilities of each partner. Review the document carefully to ensure it meets both the business goals and legal standards. By including a California Disclaimer of Partnership, you can affirm that not every business relationship is a formal partnership, providing essential clarity to all involved.

To fill out a partnership form, start by gathering necessary information from all partners. Clearly state names, addresses, business roles, and profit-sharing arrangements. Don’t forget to incorporate a California Disclaimer of Partnership to prevent legal misunderstandings, which could arise if the nature of the relationship is unclear.

Yes, you can write your own partnership agreement, but it’s crucial to understand the key components needed for such a document. Include details about profit distribution, decision-making processes, and the roles of each partner. If you want to ensure that your agreement clarifies your intentions regarding a California Disclaimer of Partnership, consider using templates from platforms like US Legal Forms.

Filling out a partnership form requires you to provide essential details about each partner, including names, addresses, and business functions. Be sure to outline the profit-sharing structure and responsibilities in your form. A thorough understanding of the California Disclaimer of Partnership will ensure that all parties recognize the intended nature of their relationship.

A partnership agreement outlines the roles and responsibilities of each partner involved in a business. For instance, an agreement can specify how profits are shared, describe management duties, and establish rules for decision-making. This legal document helps prevent misunderstandings and can include a California Disclaimer of Partnership to clarify that not every relationship constitutes a formal partnership.

Gaining proof of partnership is straightforward; just request a certified copy of your domestic partnership declaration from the appropriate county office. This document serves as your legal proof under California law, particularly when dealing with matters related to health care, taxes, and legal rights. If you have registered your partnership, this certificate is crucial for verifying your status.

You can obtain a California certificate of good standing by submitting a request to the California Secretary of State's office. This certificate confirms that your registered domestic partnership is in good standing with state requirements. You can request this document online or by mail, ensuring you follow all necessary procedures.