California Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

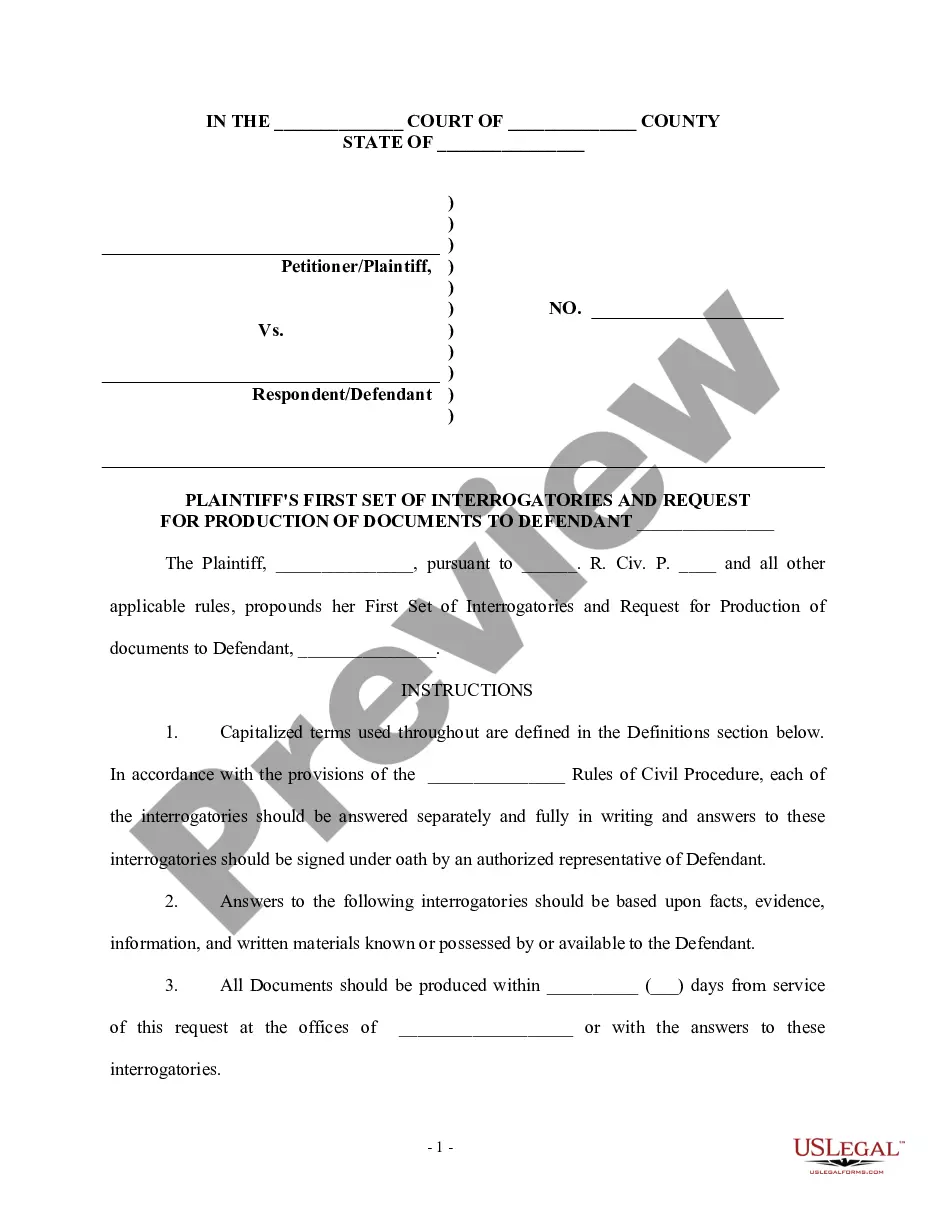

How to fill out Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

If you wish to complete, obtain, or print out authorized papers themes, use US Legal Forms, the most important collection of authorized forms, which can be found on the web. Make use of the site`s easy and handy search to obtain the paperwork you need. Different themes for enterprise and person functions are sorted by groups and suggests, or keywords. Use US Legal Forms to obtain the California Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust within a number of clicks.

When you are presently a US Legal Forms buyer, log in to your accounts and click the Download button to have the California Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust. You may also gain access to forms you in the past delivered electronically inside the My Forms tab of your own accounts.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Ensure you have selected the form for the right metropolis/land.

- Step 2. Take advantage of the Preview choice to examine the form`s articles. Don`t forget to read through the description.

- Step 3. When you are unhappy with all the develop, utilize the Research industry on top of the display to find other versions in the authorized develop design.

- Step 4. When you have found the form you need, click the Acquire now button. Choose the prices program you prefer and put your accreditations to register to have an accounts.

- Step 5. Method the purchase. You can utilize your Мisa or Ьastercard or PayPal accounts to complete the purchase.

- Step 6. Pick the file format in the authorized develop and obtain it on your own device.

- Step 7. Complete, revise and print out or signal the California Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust.

Each authorized papers design you purchase is the one you have eternally. You may have acces to every develop you delivered electronically inside your acccount. Click on the My Forms section and decide on a develop to print out or obtain yet again.

Remain competitive and obtain, and print out the California Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust with US Legal Forms. There are millions of skilled and state-certain forms you can utilize to your enterprise or person requires.

Form popularity

FAQ

For example, in her will a decedent leaves $500,000 to her nephew if he survives her, but if he does not survive her, this amount passes to her nephew's children who survive the decedent. If the nephew disclaims the property, it passes to his children who survive the decedent.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

Trusts can be used in estate planning to give individuals and couples greater control over how assets are transferred to heirs with the fewest tax consequences. Sometimes, however, disclaiming assets makes the most sense. No special form or document must be completed to disclaim inherited assets.

The following are the requirements that must be met for a disclaimer to be qualified: The beneficiary must not have accepted any of the inherited assets prior to the disclaimer. The beneficiary must provide an irrevocable and unqualified (unconditional) refusal to accept the assets. The refusal must be in writing.

There are several important reasons why you should always consult with an experienced estate planning attorney if you are considering rejecting an inheritance. For a disclaimer to be valid, it must be in writing, contain the correct language, and be delivered to the right person within a specific amount of time.

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

For example, if the deceased had significant credit card debt or outstanding medical bills, these debts may be passed on to the beneficiary. In this scenario, it may make sense for the beneficiary to disclaim the inheritance and avoid taking on these financial obligations.

They ?disclaim? any right to receive the interest that they otherwise would. Specifically, Probate Code section 275 provides: ?A beneficiary may disclaim any interest, in whole or in part, by filing a disclaimer of as provided in this part.?