California General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures: The Federal Truth in Lending Act (TILL) enforces regulations that ensure transparency and protect borrowers when engaging in credit transactions. In the state of California, TILL applies to Retail Installment Contracts and mandates certain disclosures that must be provided to consumers. These disclosures help borrowers understand the terms, costs, and obligations associated with their loans. Here are some key California General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures: 1. Annual Percentage Rate (APR): The APR is the total cost of the loan, including finance charges, expressed as an annual percentage. It allows borrowers to compare different loan offers and understand the true cost of credit. Lenders are required to disclose the APR prominently in the loan agreement. 2. Finance Charge: The finance charge represents the cost of credit, including interest and any other charges or fees associated with the loan. It helps borrowers understand the total amount they will repay over the term of the loan. Lenders must clearly disclose the finance charge in the loan agreement. 3. Total Loan Amount: This disclosure represents the total amount of the loan, including the principal amount borrowed plus any finance charges or fees rolled into the loan. It helps borrowers understand the total financial commitment they are undertaking. 4. Payment Schedule: Lenders must provide a clear payment schedule, which includes the number of payments, the due dates, and the amount due for each payment. This disclosure ensures that borrowers understand their repayment obligations and can plan their finances accordingly. 5. Late Payment Fees: If applicable, lenders must disclose any late payment fees and the conditions under which they may be charged. This disclosure ensures that borrowers are aware of the consequences of late or missed payments. 6. Prepayment Penalties: If the loan includes prepayment penalties, lenders must disclose this information and outline the conditions under which penalties will be imposed. This disclosure allows borrowers to understand any extra costs associated with paying off the loan early. It is important to note that while these are general disclosures required by the Federal Truth in Lending Act, additional state-specific disclosures may be required in California. These may include specific language requirements, additional forms, or other disclosures mandated by state law. It is advisable for lenders and borrowers to consult the relevant California laws and regulations to ensure compliance with all necessary disclosures.

California General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out California General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures?

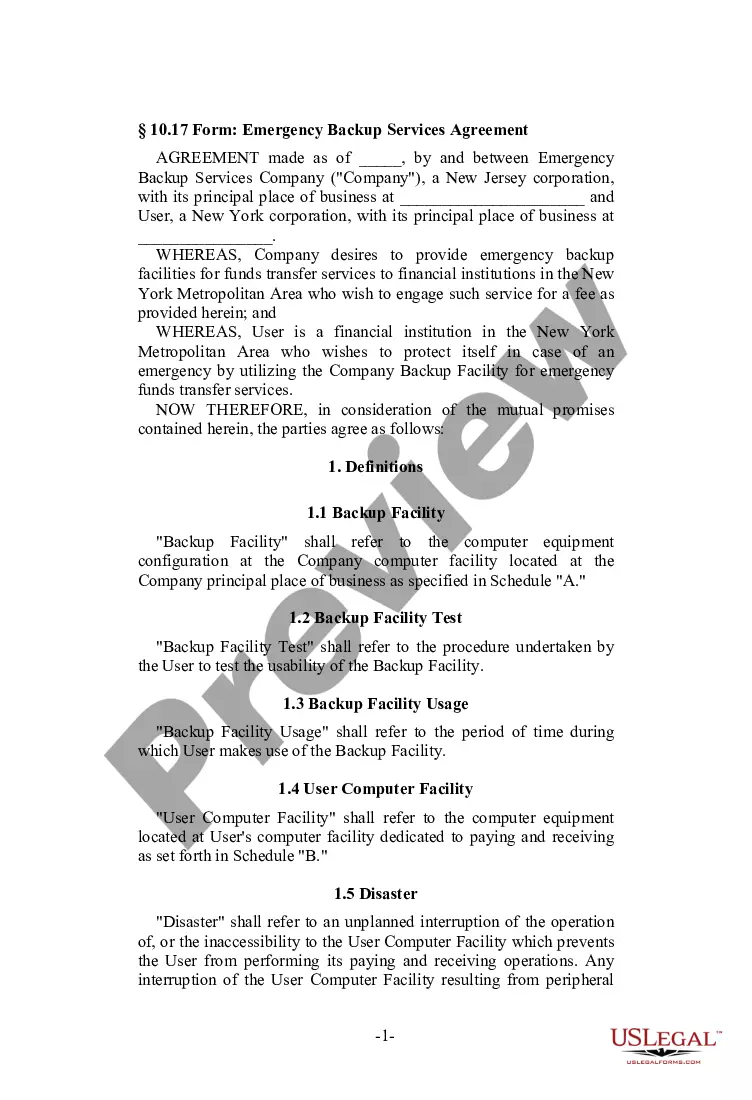

If you want to complete, obtain, or print out authorized record web templates, use US Legal Forms, the most important collection of authorized varieties, that can be found on the web. Take advantage of the site`s easy and handy look for to discover the files you require. Different web templates for business and individual functions are sorted by classes and claims, or keywords. Use US Legal Forms to discover the California General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures within a few mouse clicks.

In case you are previously a US Legal Forms consumer, log in for your profile and then click the Acquire switch to get the California General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures. You can even accessibility varieties you previously saved within the My Forms tab of your respective profile.

If you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the form for the right city/country.

- Step 2. Utilize the Preview method to look through the form`s articles. Do not neglect to see the description.

- Step 3. In case you are unhappy using the type, utilize the Lookup field near the top of the monitor to find other versions from the authorized type format.

- Step 4. After you have identified the form you require, click the Buy now switch. Choose the rates prepare you like and include your references to sign up for the profile.

- Step 5. Method the financial transaction. You may use your bank card or PayPal profile to complete the financial transaction.

- Step 6. Select the format from the authorized type and obtain it on your system.

- Step 7. Total, change and print out or indicator the California General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures.

Each and every authorized record format you purchase is your own eternally. You may have acces to each and every type you saved within your acccount. Click on the My Forms segment and select a type to print out or obtain yet again.

Be competitive and obtain, and print out the California General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures with US Legal Forms. There are many expert and state-distinct varieties you can use for the business or individual requires.