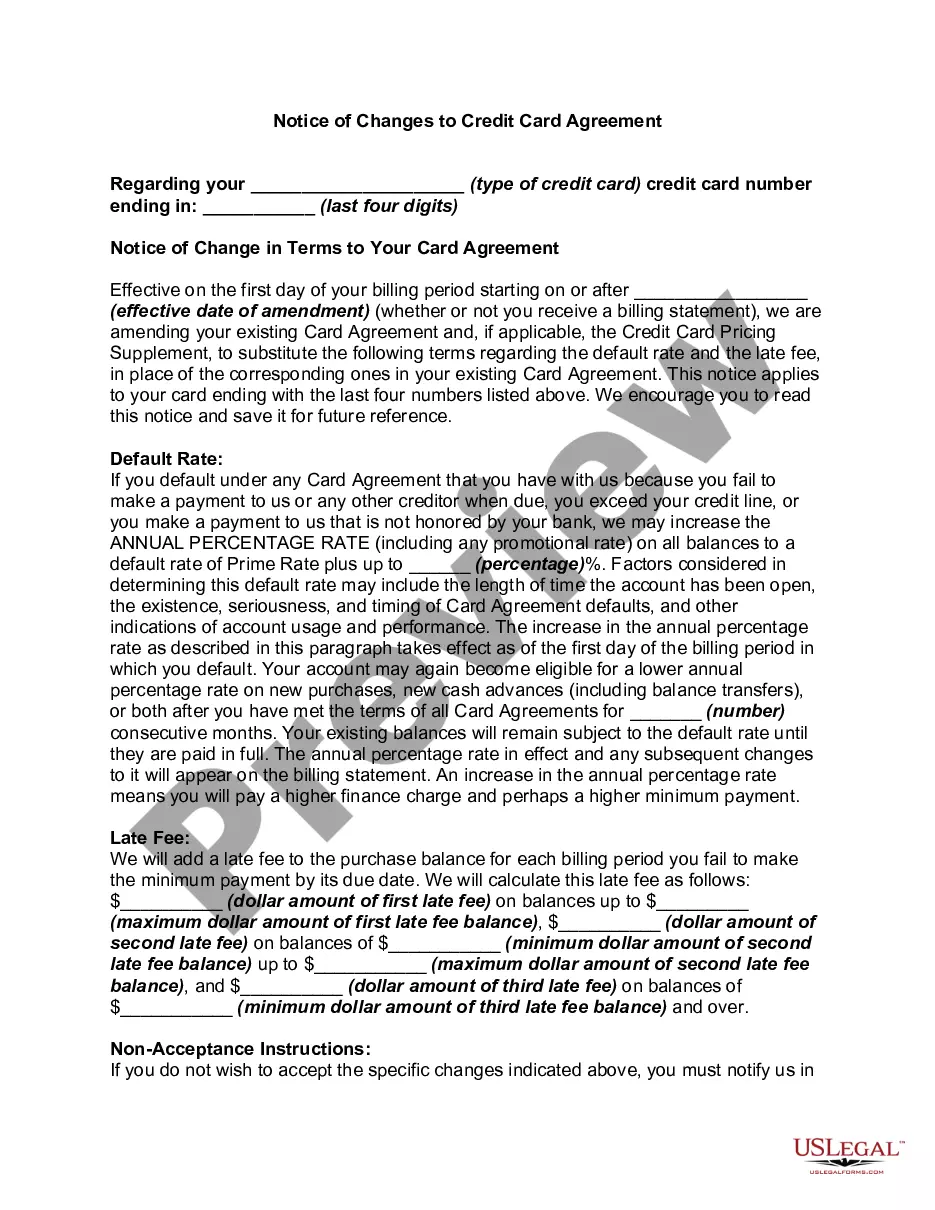

California Notice of Changes to Credit Card Agreement

Description

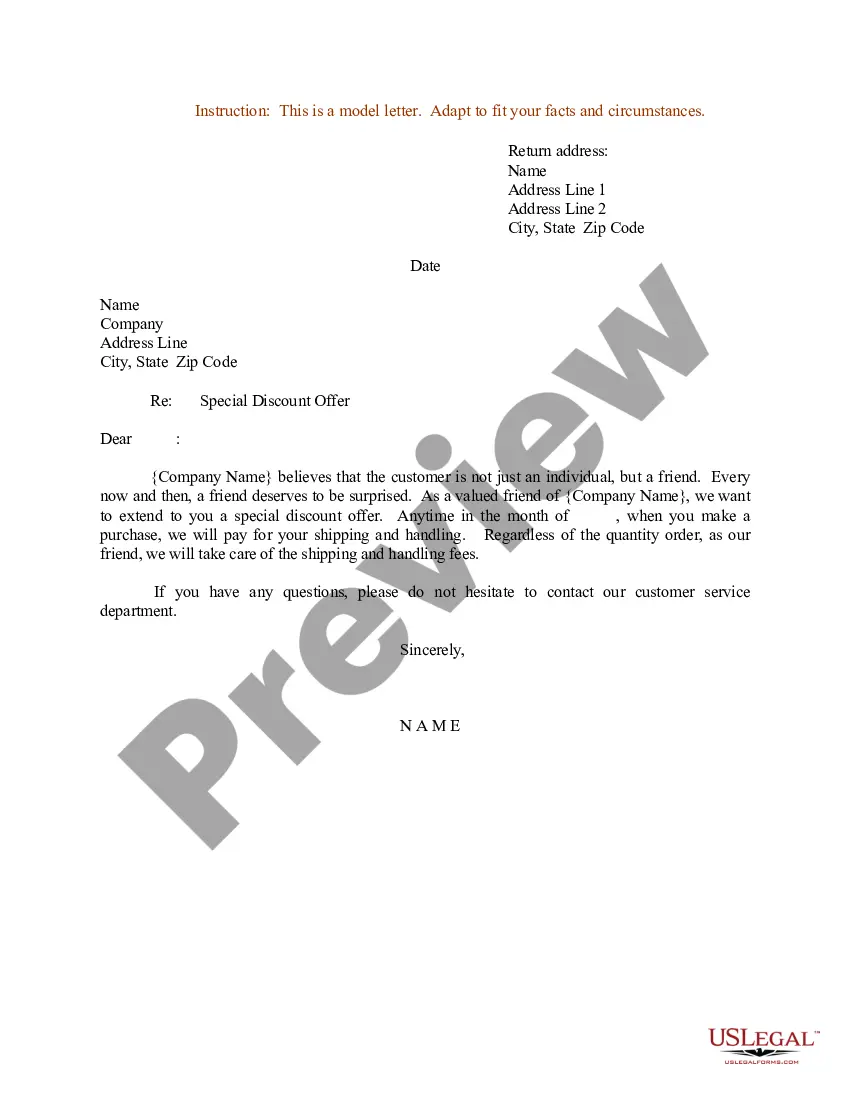

How to fill out Notice Of Changes To Credit Card Agreement?

Are you currently in the situation the place you will need files for sometimes business or specific reasons virtually every time? There are plenty of legal file themes available on the Internet, but discovering ones you can rely isn`t straightforward. US Legal Forms provides thousands of develop themes, such as the California Notice of Changes to Credit Card Agreement, that happen to be composed to fulfill state and federal requirements.

When you are presently knowledgeable about US Legal Forms internet site and possess your account, just log in. Afterward, it is possible to download the California Notice of Changes to Credit Card Agreement design.

Should you not offer an bank account and wish to start using US Legal Forms, abide by these steps:

- Obtain the develop you require and ensure it is for that appropriate metropolis/region.

- Make use of the Review button to analyze the shape.

- Read the outline to ensure that you have selected the proper develop.

- If the develop isn`t what you`re searching for, utilize the Look for field to obtain the develop that meets your requirements and requirements.

- If you get the appropriate develop, just click Acquire now.

- Opt for the rates program you need, fill in the desired information and facts to generate your money, and buy the transaction utilizing your PayPal or credit card.

- Decide on a hassle-free data file structure and download your duplicate.

Discover all of the file themes you might have bought in the My Forms menus. You can get a additional duplicate of California Notice of Changes to Credit Card Agreement whenever, if required. Just click the required develop to download or printing the file design.

Use US Legal Forms, by far the most extensive collection of legal varieties, to save time and avoid faults. The service provides expertly produced legal file themes which can be used for a range of reasons. Generate your account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

How the Credit CARD Act Protects Consumers No Interest on Paid-Off Balances From Previous Billing Cycles. ... Limitations on When Card Issuers Can Raise Your Interest Rate. ... Fewer and Capped Fees. ... You Have at Least 21 Days to Pay Your Bill. ... Payments Must be Applied in a Way That Favors Cardholders.

When they plan to increase your rate or other fees. Your credit card company must send you a notice 45 days before they can increase your interest rate; change certain fees (such as annual fees, cash advance fees, and late fees) that ap- ply to your account; or make other significant changes to the terms of your card.

The CARD Act is federal legislation that regulates credit card issuers in the U.S. by adding extra layers of protection for consumers as an extension of the Truth in Lending Act. For example, it places limits on certain fees and interest charges faced by consumers and improves the transparency of terms and conditions.

The Truth in Lending Act ensures that creditors provide complete and honest information. The Fair Credit Reporting Act regulates credit reports. The Equal Credit Opportunity Act prevents creditors from discriminating against individuals.

The CARD Act, as it's more commonly known, is a major piece of federal legislation that regulates credit card issuers in the U.S. It expanded the Truth in Lending Act by adding transparency related to credit cards terms and conditions and placing limits on certain fees and interest charges credit card customers ...

Generally, the notice must be provided to you at least 45 days before the change takes effect. There are some exceptions: If you agreed to a particular change, the bank must still provide you with a written notice, but it does not have to be provided before the change takes effect.

The CARD Act requires card issuers to provide written notice to consumers at least 45 days before the effective date of an increase in an annual percentage rate (APR) or any other "significant change."8 This requirement addresses the concern that some issuers were increasing APRs or adversely changing other account ...

This legislation would help preserve small business owners' freedom of choice between multiple credit card networks by injecting much-needed competition into the credit card processing market, allowing small business owners to choose the option that is best for their business.