Pre-approved credit card offers must provide with each written solicitation a clear and conspicuous statement that a credit reporting agency was the source of the information and that the consumer can opt out. The follow form is an example of such a notice.

California Notice to Accompany Credit Card Offer - Right to Prohibit Use of

Description

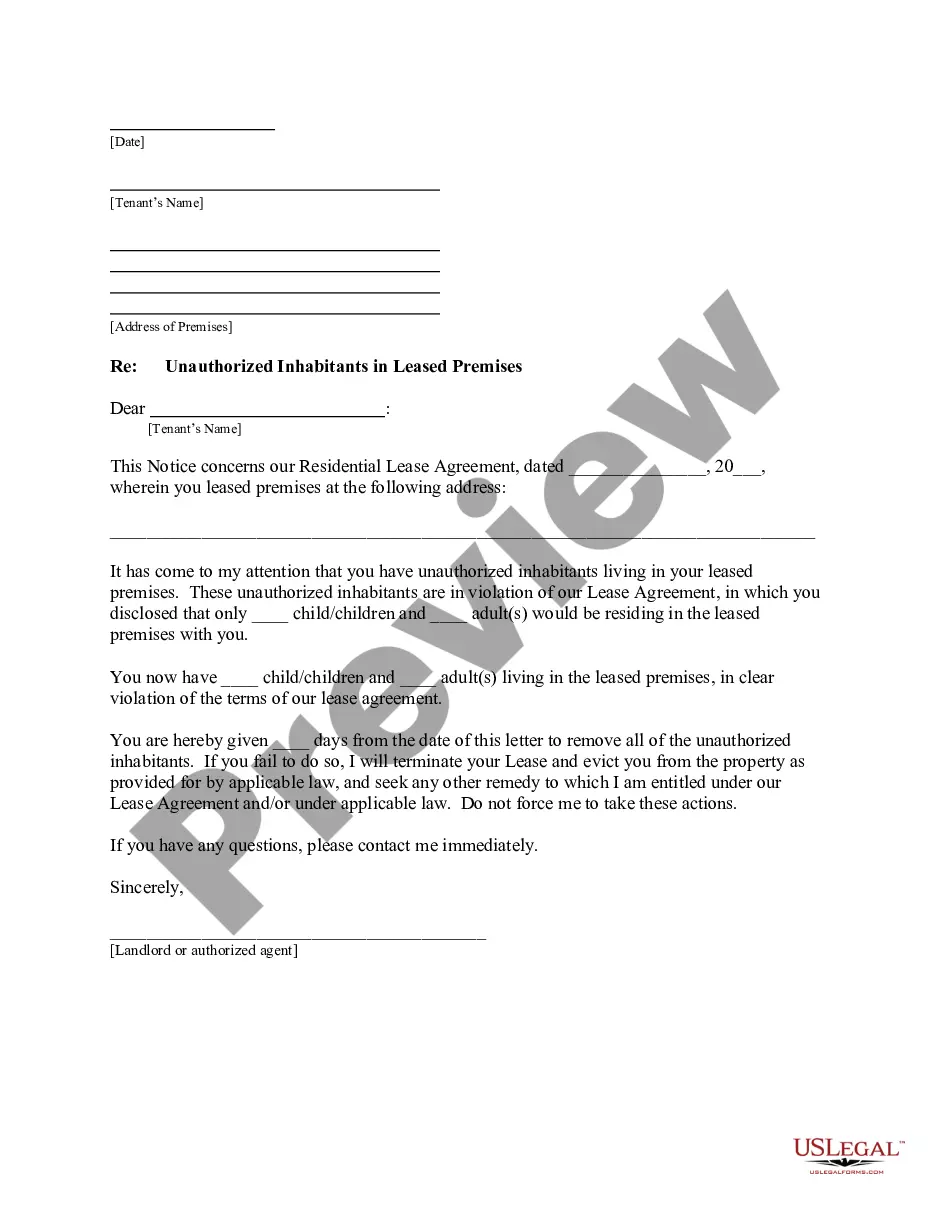

How to fill out Notice To Accompany Credit Card Offer - Right To Prohibit Use Of?

Are you currently within a position that you need documents for either business or personal functions nearly every working day? There are tons of legitimate record layouts available online, but getting kinds you can rely on isn`t easy. US Legal Forms delivers a large number of develop layouts, like the California Notice to Accompany Credit Card Offer - Right to Prohibit Use of, which are composed to satisfy state and federal specifications.

Should you be previously acquainted with US Legal Forms web site and possess your account, simply log in. Afterward, you are able to download the California Notice to Accompany Credit Card Offer - Right to Prohibit Use of format.

Unless you have an bank account and need to begin to use US Legal Forms, follow these steps:

- Discover the develop you require and make sure it is for that proper town/region.

- Use the Review option to examine the form.

- Read the explanation to ensure that you have chosen the right develop.

- In case the develop isn`t what you are trying to find, take advantage of the Search area to obtain the develop that fits your needs and specifications.

- Once you obtain the proper develop, simply click Acquire now.

- Pick the costs strategy you need, submit the necessary details to create your account, and buy the order with your PayPal or Visa or Mastercard.

- Decide on a convenient file formatting and download your version.

Locate every one of the record layouts you possess purchased in the My Forms menu. You can get a additional version of California Notice to Accompany Credit Card Offer - Right to Prohibit Use of any time, if possible. Just click the needed develop to download or printing the record format.

Use US Legal Forms, probably the most comprehensive assortment of legitimate forms, to conserve time as well as steer clear of faults. The assistance delivers skillfully created legitimate record layouts which you can use for a selection of functions. Generate your account on US Legal Forms and commence making your lifestyle a little easier.

Form popularity

FAQ

Know your rights Your interest rate on existing balances generally cannot increase unless you're late on your payments. A card issuer cannot take more than 90 days to resolve a billing error. If you report a lost or stolen card before it's used, you can't be held responsible for unauthorized charges.

You are going to get charged with a felony count of grand larceny (because larceny involving a credit card is a felony), as well as (possibly) identity theft, and possession of stolen property.

If someone has used your card in a store or online, you're covered under the Payment Services Regulations. This means you must be refunded immediately if you've had money taken from your account without your permission. Always report the loss of your debit card, or any unauthorised payments, as soon as possible.

How much money can I use on someone else's credit card before it's a crime? Unless the card owner has explicitly granted you permission to use their card, then even a small purchase on the card is illegal. This is a type of fraud, and you may be subject to criminal and financial liability even for a small transaction.

Can You Track Someone Who Used Your Credit Card Online? No. However, if you report the fraud in a timely manner, the bank or card issuer will open an investigation. Banks have a system for investigating credit card fraud, including some standard procedures.

The Consumer Credit Protection Act Of 1968 (CCPA) protects consumers from harm by creditors, banks, and credit card companies. The federal act mandates disclosure requirements that must be followed by consumer lenders and auto-leasing firms.

The Song-Beverly Credit Card Act does not prohibit a California merchant from requiring a consumer who pays for goods or services by credit card from showing identification such as a California driver's license or California ID. However, the store may not write or record any information from these documents.

Contact your bank immediately If you claim the use of the card was not authorised by you, it is for your bank to prove otherwise. The bank may be able to cancel the payment or put the money back into your account. If your card provider will not give you your money back, report them to Trading Standards.