A California Angel Investor Agreement refers to a legally binding contract between an angel investor and a startup company based in California. This agreement outlines the terms and conditions under which the angel investor provides funding to the startup in exchange for equity or convertible debt. California is renowned for its thriving startup ecosystem, making it a hub for angel investments. The California Angel Investor Agreement typically covers multiple key aspects to protect the rights and interests of both parties. These aspects may include the investment amount, ownership percentage, preferred stock or convertible debt terms, governance rights, anti-dilution provisions, liquidation preferences, and various other terms related to the investment. There are different types of California Angel Investor Agreements, each with their own specific characteristics and purposes. Some of these types include: 1. Equity Financing Agreement: This agreement involves the angel investor providing funds in exchange for shares of stock in the startup. The ownership percentage is determined based on the agreed-upon valuation of the company. 2. Convertible Note Agreement: In this type of agreement, the angel investor provides a loan to the startup, which can be converted into equity at a later stage, usually during a future financing round. Convertible notes often offer benefits such as discount rates or caps to incentivize the investor's early support. 3. SAFE (Simple Agreement for Future Equity): A relatively newer type of agreement, SAFE allows for a more streamlined and standardized investment process. It grants the investor the right to acquire shares in the future, upon the occurrence of specified triggering events, such as a subsequent equity financing round. 4. Revenue Share Agreement: This agreement is less common in the angel investing world but still utilized in certain cases. It involves the angel investor receiving a percentage of the startup's revenues until a predetermined return on investment is achieved. When drafting a California Angel Investor Agreement, both parties should seek legal counsel to ensure compliance with applicable state laws and regulations. Additionally, the agreement should consider the specific circumstances of the startup and the angel investor to tailor the terms accordingly. It is crucial for both parties to clearly understand and negotiate the terms of the agreement to foster a mutually beneficial and successful partnership.

California Angel Investor Agreement

Description

How to fill out California Angel Investor Agreement?

If you have to comprehensive, obtain, or produce lawful document templates, use US Legal Forms, the biggest assortment of lawful varieties, that can be found on-line. Utilize the site`s basic and practical lookup to discover the paperwork you will need. Various templates for enterprise and person reasons are sorted by classes and suggests, or keywords and phrases. Use US Legal Forms to discover the California Angel Investor Agreement in a few clicks.

When you are already a US Legal Forms buyer, log in to your accounts and then click the Download key to obtain the California Angel Investor Agreement. Also you can entry varieties you in the past saved from the My Forms tab of your own accounts.

If you are using US Legal Forms the first time, follow the instructions under:

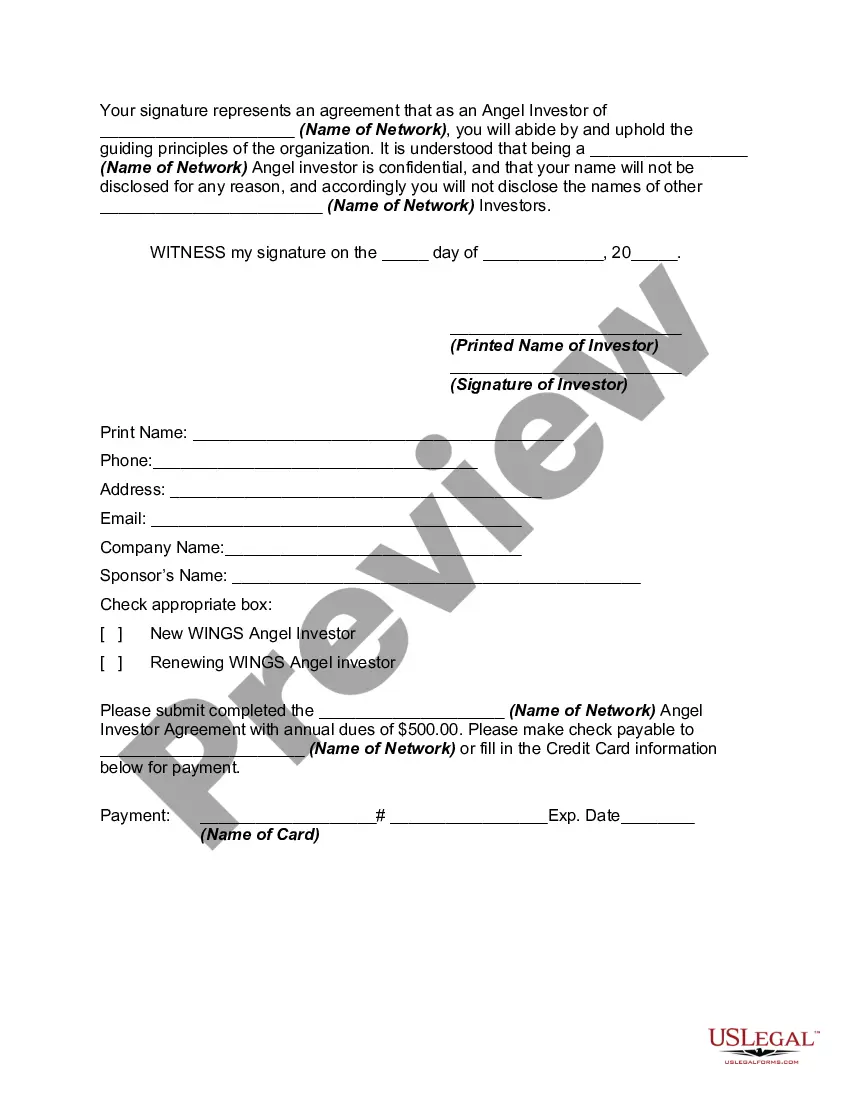

- Step 1. Be sure you have chosen the form to the right area/region.

- Step 2. Make use of the Preview choice to check out the form`s information. Never neglect to learn the description.

- Step 3. When you are unsatisfied together with the form, use the Search area on top of the screen to find other types of your lawful form design.

- Step 4. When you have located the form you will need, go through the Get now key. Pick the rates prepare you choose and include your credentials to register to have an accounts.

- Step 5. Process the purchase. You may use your bank card or PayPal accounts to finish the purchase.

- Step 6. Choose the structure of your lawful form and obtain it on the gadget.

- Step 7. Total, revise and produce or indicator the California Angel Investor Agreement.

Each lawful document design you get is your own property permanently. You possess acces to every single form you saved in your acccount. Click on the My Forms section and pick a form to produce or obtain once more.

Compete and obtain, and produce the California Angel Investor Agreement with US Legal Forms. There are millions of expert and condition-particular varieties you can utilize for the enterprise or person demands.