California Early Possession Agreement

Description

How to fill out Early Possession Agreement?

US Legal Forms - one of the largest repositories of legal documents in the USA - offers a selection of legal document templates that you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent forms like the California Early Possession Agreement within minutes.

If you hold a membership, Log In to retrieve the California Early Possession Agreement from the US Legal Forms library. The Download option will appear on each form you view. You can access all previously downloaded forms from the My documents section of your account.

Then, choose your payment plan and provide your credentials to sign up for an account.

Complete the transaction. Use a Visa or Mastercard or PayPal account to finalize the payment. Select the format and download the document to your device. Edit. Fill out, modify, and print and sign the downloaded California Early Possession Agreement. Each template you added to your account has no expiration date and is yours forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- If this is your first time using US Legal Forms, here are simple steps to help you get started.

- Make sure you select the appropriate form for your city/state.

- Click on the Review option to view the form's details.

- Read the description of the form to ensure you have chosen the correct document.

- If the form does not meet your needs, utilize the Search feature at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking on the Download now button.

Form popularity

FAQ

Allowing buyers possession before closing can lead to significant risks. A California Early Possession Agreement may seem convenient, but it exposes sellers to potential liability if the sale falls through. Additionally, you lose leverage in negotiations and could face challenges if any damage occurs to the property before the official closing. It is essential to consult with legal professionals to ensure your interests are protected.

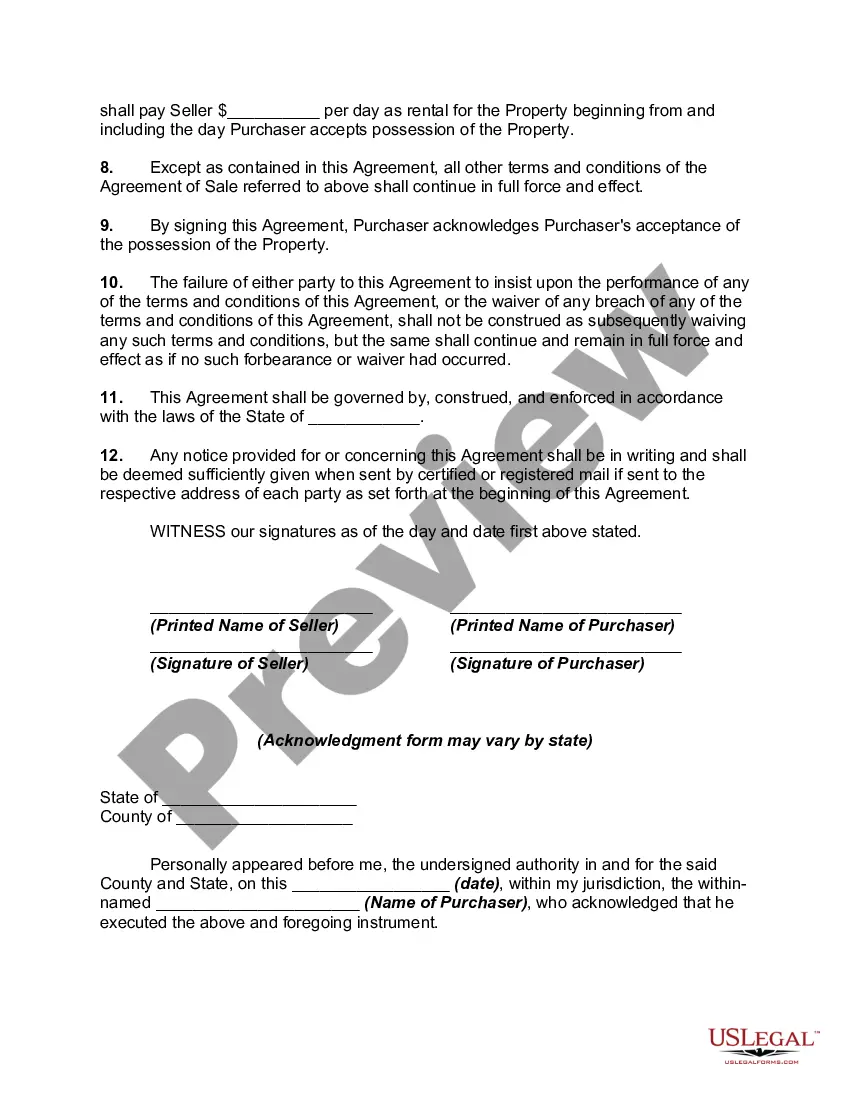

The early occupancy clause is a provision included in a lease that outlines the terms for a tenant's early move-in. This clause defines the conditions under which the tenant can occupy the property before the lease officially begins. By incorporating a California Early Possession Agreement, both parties can clarify their expectations and avoid potential disputes. Utilizing US Legal Forms can guide you in creating a comprehensive clause.

Early occupancy allows tenants to move into a property before the official lease start date. Under a California Early Possession Agreement, landlords and tenants agree on specific terms and conditions that govern the early move-in. It's important to outline responsibilities for utilities, maintenance, and any rent due during this time. Using a platform like US Legal Forms can help you draft a clear and effective agreement.

Early occupancy can be a beneficial strategy for buyers who want to settle into their new homes quickly. However, it is crucial to have a well-defined California Early Possession Agreement in place to mitigate risks and clarify responsibilities. You should weigh the benefits and potential complications, and consider using resources like US Legal Forms to ensure that you create a secure and effective agreement.

Early possession refers to the situation where a buyer is allowed to take physical control of a property before the closing process is complete. This can happen through arrangements outlined in a California Early Possession Agreement, which specifies the rights and obligations of both the buyer and seller. It’s an advantageous option for buyers who need to move in quickly, but it requires careful planning and clear terms.

Moving into a house before closing is not illegal, but it usually requires a legal framework like a California Early Possession Agreement to protect both the buyer and seller. Without this agreement, complications may arise regarding liability, repairs, or property damage. It's essential to consult legal resources or platforms like US Legal Forms to draft an appropriate agreement that safeguards your interests.

An early possession agreement is a legal document that allows buyers to move into a property before the official closing date. This agreement outlines the terms and conditions under which the buyer can occupy the property early, ensuring that both parties are protected. Understanding the California Early Possession Agreement is crucial, as it helps clarify responsibilities regarding payments and property maintenance before ownership officially transfers.