Any interested party in an estate of a decedent generally has the right to make objections to the accounting of the executor, the compensation paid or

proposed to be paid, or the proposed distribution of assets. Such objections must be filed within within a certain period of time from the date of service of the Petition for approval of the accounting.

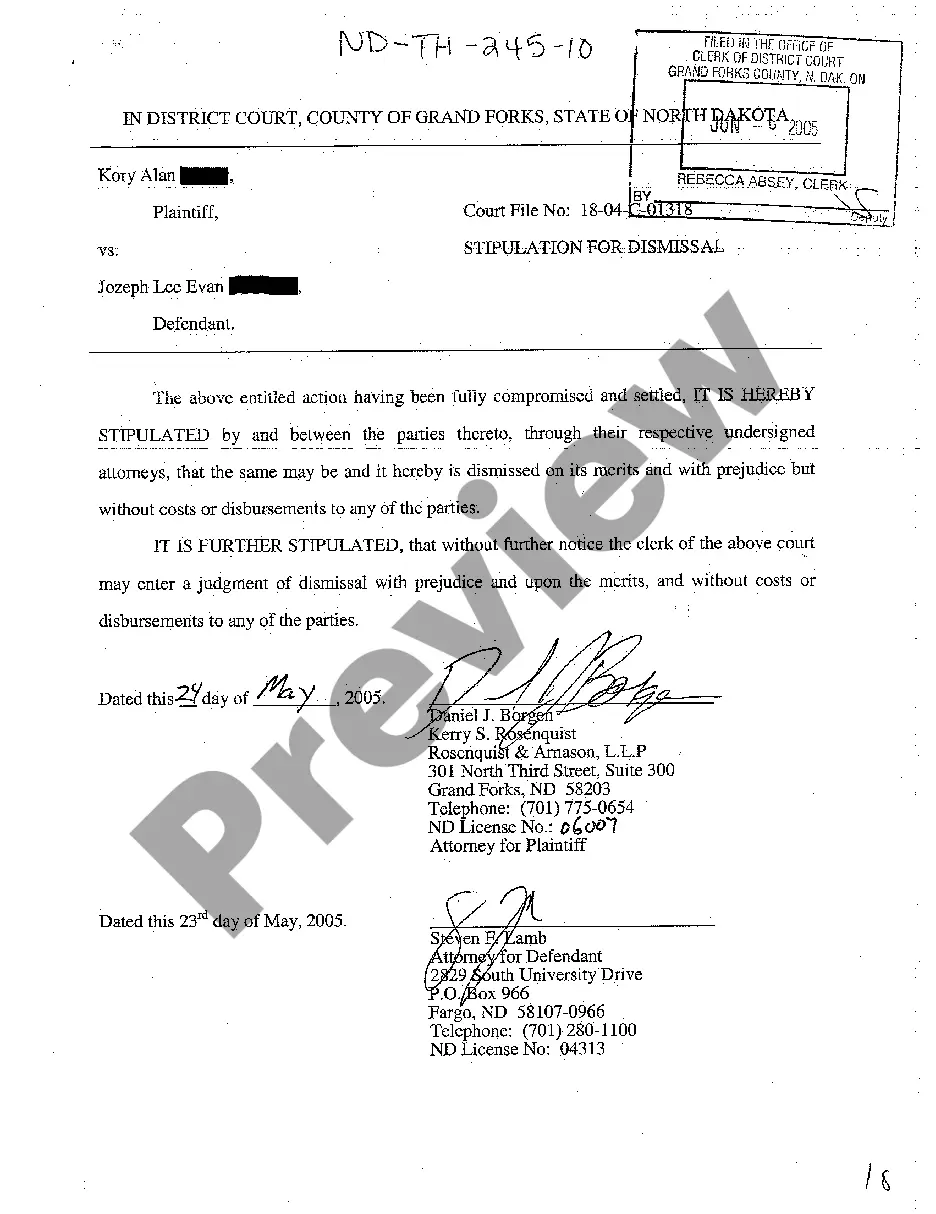

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

California Objection to Allowed Claim in Accounting is a legal process that allows parties involved in a bankruptcy case to challenge the legitimacy or accuracy of a creditor's claim. It serves as a means to ensure fairness and protect the interests of debtors and other stakeholders in the proceedings. In this detailed description, we will delve into the concept of California Objection to Allowed Claim in Accounting, exploring its purpose, process, and relevant keywords. California Bankruptcy Law provides a framework for managing bankruptcy cases, including the determination of claims made by creditors. When a debtor files for bankruptcy, creditors are required to submit proof of their claim, detailing the amount owed and the basis for the claim. These claims are then reviewed and subsequently allowed or disallowed by the court-appointed trustee. However, California Objection to Allowed Claim in Accounting allows interested parties, such as debtors, other creditors, or even the trustee, to raise objections if they believe the claim is unjustified, inaccurate, or incomplete. These objections aim to dispute the validity of the creditor's claim and can be based on various grounds. One common type of objection in accounting is a substantive objection. This occurs when the objecting party believes that the creditor's claim is incorrect or inadequate in some way. For instance, if a creditor claims an excessive amount, fails to provide proper documentation, or incorrectly calculates interest or fees, a substantive objection can be filed to rectify the issue. Another type of objection is procedural in nature. Procedural objections focus on errors or discrepancies in the process of filing or submitting claims. This can include claims that were filed after the court's deadline, failure to follow proper notification procedures, or insufficient documentation to support the claim. To initiate an objection in California, the objecting party must file a written objection with the bankruptcy court within the specified time frame. This objection should clearly state the grounds for objection and provide supporting evidence, such as documents or expert opinions, if necessary. Once the objection is filed, the court will review the objection and allow the creditor an opportunity to respond. Evidence and arguments from both parties will be considered, and a hearing may be scheduled to resolve any disputes or hold further discussions. Ultimately, the court will make a decision on whether the objection holds merit and will determine the final allowable amount of the claim. Keywords: California, Objection to Allowed Claim in Accounting, bankruptcy, creditors, debtor, legal process, legitimacy, accuracy, fairness, trustee, objections, substantive objection, procedural objection, court-appointed, claim, validity, dispute, objection grounds, documentation, notification procedures, written objection, evidence, hearing, allowable amount. Note: It is important to consult with a legal professional or bankruptcy attorney to fully understand the specific laws and processes related to California Objection to Allowed Claim in Accounting, as this description is for informational purposes only.