California Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

How to fill out Private Annuity Agreement With Payments To Last For Life Of Annuitant?

Selecting the ideal legal document template can be challenging. Naturally, there are numerous online templates accessible, but how will you find the legal document you need? Utilize the US Legal Forms website. The platform offers a vast array of templates, including the California Private Annuity Agreement with Payments to Last for the Lifetime of the Annuitant, suitable for both business and personal uses. All forms are verified by specialists and adhere to state and federal regulations.

If you are already registered, Log In to your account and click the Obtain button to acquire the California Private Annuity Agreement with Payments to Last for the Lifetime of the Annuitant. Use your account to review the legal forms you may have purchased earlier. Check the My documents section of your account to download another copy of the document you need.

If you are a new customer of US Legal Forms, here are simple steps you can follow.

US Legal Forms is the most extensive collection of legal forms where you can find various document templates. Utilize the service to obtain professionally crafted papers that meet state requirements.

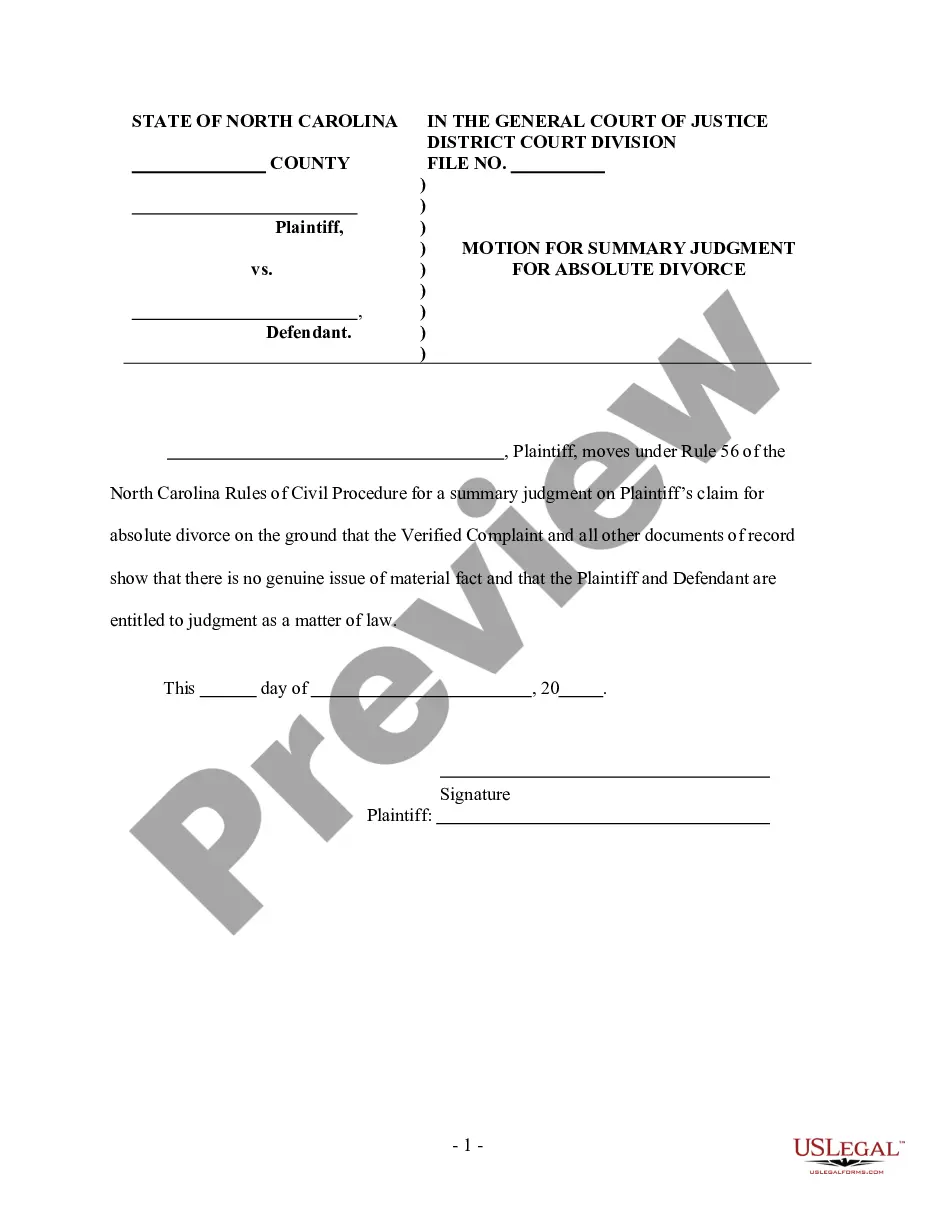

- First, ensure you have selected the correct form for your region/area. You can browse the form using the Preview option and review the form description to confirm it is the right one for you.

- If the form does not meet your expectations, use the Search field to find the appropriate form.

- Once you are certain that the form is correct, click the Buy now button to purchase the form.

- Select the pricing plan you want and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card.

- Choose the download format and receive the legal document template for your device.

- Complete, modify, print, and sign the obtained California Private Annuity Agreement with Payments to Last for the Lifetime of the Annuitant.

Form popularity

FAQ

When a California Private Annuity Agreement with Payments to Last for Life of Annuitant is set up, the payments are typically designated to continue for the lifetime of the annuitant. However, upon the annuitant's death, the structure of the agreement will dictate what happens next. In most cases, if the agreement specifies that payments cease upon death, beneficiaries will not receive further disbursements. To ensure clarity and security regarding your specific situation, consider consulting with uslegalforms, where you can find tailored solutions and comprehensive resources to navigate these complex arrangements.

A private annuity agreement is a specific type of contract where one party funds another in exchange for life-long payments. With a California Private Annuity Agreement with Payments to Last for Life of Annuitant, it typically involves transferring real estate or other assets to secure these payments. This arrangement enhances financial freedom while ensuring that the annuitant receives consistent income. If you are exploring this option, platforms like uslegalforms can guide you in drafting a solid agreement.

An annuity agreement is a contract between two parties outlining a financial arrangement where one party makes a series of payments to the other. In the specific case of a California Private Annuity Agreement with Payments to Last for Life of Annuitant, the payments continue for the annuitant's lifetime. This agreement serves to secure long-term financial stability and can be an effective retirement planning tool. Therefore, understanding its structure is essential for anyone considering this option.

While a private annuity provides steady payments, it also has drawbacks. The biggest concern is that once the property is transferred, the seller loses ownership rights. Additionally, if the annuitant passes away earlier than expected, the total financial benefit might not equate to the value of the property. Thus, considering the terms of a California Private Annuity Agreement with Payments to Last for Life of Annuitant is crucial before proceeding.

A private annuity allows individuals to convert their assets into a stream of income. Under a California Private Annuity Agreement with Payments to Last for Life of Annuitant, the seller transfers property to the buyer in exchange for lifetime payments. This arrangement secures financial support for the annuitant while shifting ownership of the property. It helps in estate planning and can also provide tax benefits.

A private annuity, including a California Private Annuity Agreement with Payments to Last for Life of Annuitant, has unique tax treatment. Generally, the annuity will generate tax consequences when payments are made to the annuitant. The taxation often stems from the earnings portion of the payment, not the principal. Engaging with platforms like uslegalforms can assist you in navigating the complexities of taxation and agreements related to private annuities.

In a California Private Annuity Agreement with Payments to Last for Life of Annuitant, the payments cease upon the death of the annuitant. This is a key feature for individuals seeking steady income that aligns with their lifespan. Such arrangements often suit those who prefer not to leave funds to heirs through the annuity. Understanding these options helps you plan better for your financial future.

Upon the death of the annuitant, private annuities are generally not subject to income tax. However, the proceeds may be included in the taxable estate, depending on the agreement's structure. In terms of a California Private Annuity Agreement with Payments to Last for Life of Annuitant, understanding the tax implications can help ensure your beneficiaries are well-informed. Consulting a tax advisor will provide clarity on how best to navigate these situations post-annuitant's passing.

A primary downside of a SPIA annuity is the lack of liquidity; once you invest your funds, accessing them can be challenging. Additionally, if you pass away early, your funds may not be returned to your estate, which can limit financial flexibility. Within the framework of a California Private Annuity Agreement with Payments to Last for Life of Annuitant, this arrangement ensures steady income but may not be the best choice for everyone. It’s wise to weigh these factors against your financial goals and consult a professional for guidance.

Typically, a single premium immediate annuity does not come with a death benefit, as it prioritizes lifetime payouts to the annuitant. However, some options may allow for a return of premium or a guaranteed period payment feature. In the context of a California Private Annuity Agreement with Payments to Last for Life of Annuitant, understanding the specifics of your chosen contract is essential. Exploring different annuity types can provide more options suited to your estate planning needs.