A California General Letter of Credit with Account of Shipment is a financial instrument that serves as a commitment by a bank to pay the beneficiary (exporter) on behalf of the account party (importer) for goods/services that have been shipped or delivered as agreed upon in a contract. It ensures that the exporter will receive payment for their goods/services, providing a level of security and trust for both parties involved in international trade. This type of letter of credit is commonly used in international transactions, especially in California, as it helps reduce the risks associated with cross-border trade. It provides reassurance to exporters that they will be paid for their shipped goods, while importers can be confident that they will only pay for goods that have been delivered as agreed upon. There are different types of California General Letter of Credit with Account of Shipment, including: 1. Revocable Letter of Credit: This type of letter of credit can be modified or canceled by the issuing bank without the consent of the beneficiary or the account party. It provides less security to the exporter as the letter of credit can be revoked at any time. 2. Irrevocable Letter of Credit: In contrast to a revocable letter of credit, an irrevocable letter of credit cannot be modified or canceled without the agreement of all parties involved. It provides more security to the exporter as it assures payment upon fulfillment of the specified conditions. 3. Confirmed Letter of Credit: In a confirmed letter of credit, the advising bank (usually located in the beneficiary's country) adds its own guarantee on behalf of the issuing bank. This additional confirmation minimizes the risk for the exporter by adding another level of assurance of payment. 4. Transferable Letter of Credit: This type of letter of credit allows the beneficiary to transfer their rights to another party, usually to a manufacturer or a supplier, who can then fulfill the terms of the credit on behalf of the beneficiary. 5. Standby Letter of Credit: A standby letter of credit acts as a guarantee of payment in case the account party fails to fulfill their financial obligations or commitments. It is typically used in situations where a primary payment method is unavailable or to provide backup and security for contractual obligations. California General Letter of Credit with Account of Shipment plays a vital role in facilitating international trade and ensuring that both exporters and importers are protected throughout the transaction process. It provides reliability and security, making it a preferred method of payment in global business interactions.

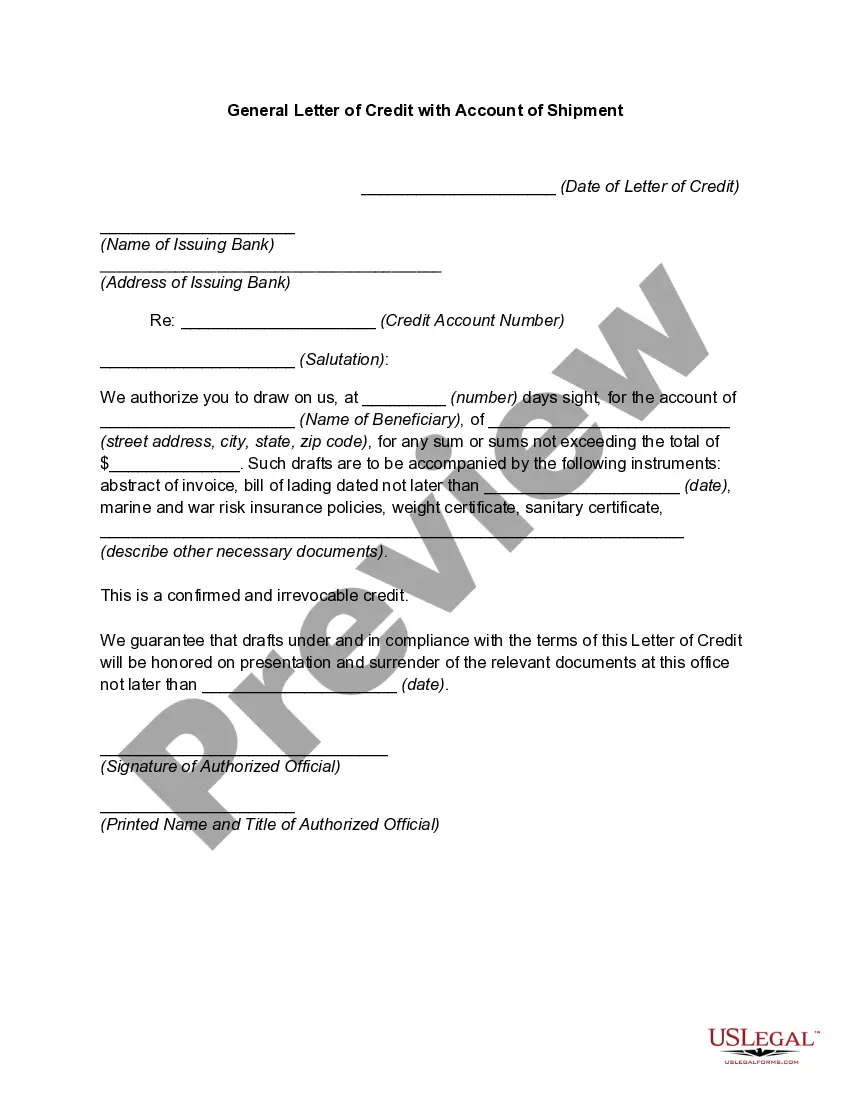

California General Letter of Credit with Account of Shipment

Description

How to fill out California General Letter Of Credit With Account Of Shipment?

Finding the right legal papers design could be a have a problem. Naturally, there are a variety of templates available on the net, but how will you get the legal form you need? Use the US Legal Forms website. The services provides thousands of templates, like the California General Letter of Credit with Account of Shipment, which can be used for enterprise and private demands. All the types are checked by professionals and fulfill state and federal requirements.

In case you are currently authorized, log in to your account and click the Down load key to find the California General Letter of Credit with Account of Shipment. Utilize your account to check throughout the legal types you may have acquired earlier. Check out the My Forms tab of your respective account and acquire an additional backup from the papers you need.

In case you are a new user of US Legal Forms, allow me to share easy recommendations so that you can adhere to:

- Initially, ensure you have selected the proper form to your metropolis/county. You can examine the form using the Preview key and browse the form explanation to guarantee this is basically the best for you.

- If the form does not fulfill your preferences, utilize the Seach discipline to discover the correct form.

- Once you are positive that the form is proper, go through the Buy now key to find the form.

- Opt for the pricing program you would like and enter in the required information. Make your account and buy the order utilizing your PayPal account or bank card.

- Pick the document formatting and download the legal papers design to your gadget.

- Complete, change and printing and indicator the attained California General Letter of Credit with Account of Shipment.

US Legal Forms is definitely the most significant catalogue of legal types for which you can see different papers templates. Use the service to download expertly-manufactured paperwork that adhere to condition requirements.

Form popularity

FAQ

The seller needs to ensure that he gets paid by the buyer either before or upon delivery of the goods. How are these specific issues addressed? This is where a letter of credit or LC comes in handy. It is a guarantee issued by a bank for payment to the buyer while ensuring that the goods are shipped in good order.

Export Letter of Credit (LC) LCs provide Exporters with the confidence to allow them to ship their goods in advance of the receipt of payment. An LC is a conditional payment guarantee provided by the Importer's bank to the Exporter. The Exporter normally receives the payment guarantee prior to the shipment of goods.

What is a Letter of Credit? A Letter of Credit is a contractual commitment by the foreign buyer's bank to pay once the exporter ships the goods and presents the required documentation to the exporter's bank as proof. As a trade finance tool, Letters of Credit are designed to protect both exporters and importers.

The Letter of Credit Process The issuing bank transmits the LC to the nominated bank, which forwards it to the exporter. The exporter forwards the goods and documents to a freight forwarder. The freight forwarder dispatches the goods and either the dispatcher or the exporter submits documents to the nominated bank.

A bank guarantee is a promise from a lending institution that ensures the bank will step up if a debtor can't cover a debt. Letters of credit are also financial promises on behalf of one party in a transaction and are especially significant in international trade.

The Letter of Credit Process The issuing bank transmits the LC to the nominated bank, which forwards it to the exporter. The exporter forwards the goods and documents to a freight forwarder. The freight forwarder dispatches the goods and either the dispatcher or the exporter submits documents to the nominated bank.

A letter of credit is a document that guarantees the buyer's payment to the sellers. It is issued by a bank and ensures the timely and full payment to the seller. If the buyer is unable to make such a payment, the bank covers the full or the remaining amount on behalf of the buyer.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.