Keywords: California Bill of Sale, Corporation, all or Substantially all of its Assets Description: The California Bill of Sale by Corporation of all or Substantially all of its Assets is a legal document that facilitates the transfer of ownership rights and assets from a corporation to another party. This bill of sale is crucial when a corporation intends to sell all or a significant portion of its assets to a new owner. There are two main types of California Bill of Sale by Corporation of all or Substantially all of its Assets: 1. Bill of Sale for the Transfer of All Assets: This type of bill of sale is used when a corporation decides to sell all of its assets to a buyer. It includes a comprehensive list of all assets, such as real estate, tangible property, intellectual property rights, contracts, and any other assets owned by the corporation. The document outlines the terms and conditions of the sale, purchase price, payment terms, and any warranties or representations made by the corporation. 2. Bill of Sale for the Transfer of Substantially all the Assets: This type of bill of sale is utilized when a corporation intends to sell a significant portion of its assets but not all. The bill of sale specifies the assets being transferred, along with their respective values, and the terms of the sale. Typically, the bill of sale will outline any restrictions or limitations on the transfer of assets, any liabilities or encumbrances associated with the assets, and any warranties or indemnities provided by the corporation to the buyer. Both types of California Bill of Sale by Corporation of all or Substantially all of its Assets ensure a smooth and legally binding transfer of assets. It protects the interests of both the corporation and the buyer by clearly outlining the terms, conditions, and expectations of the transaction. It also serves as evidence of the ownership transfer, offering legal protection in case of any future disputes or claims. Furthermore, it's essential to consult a qualified legal professional to draft and review the California Bill of Sale by Corporation of all or Substantially all of its Assets. This ensures compliance with California state laws, adherence to corporate governance principles, and adequate protection of the parties involved in the asset transfer.

California Bill of Sale by Corporation of all or Substantially all of its Assets

Description

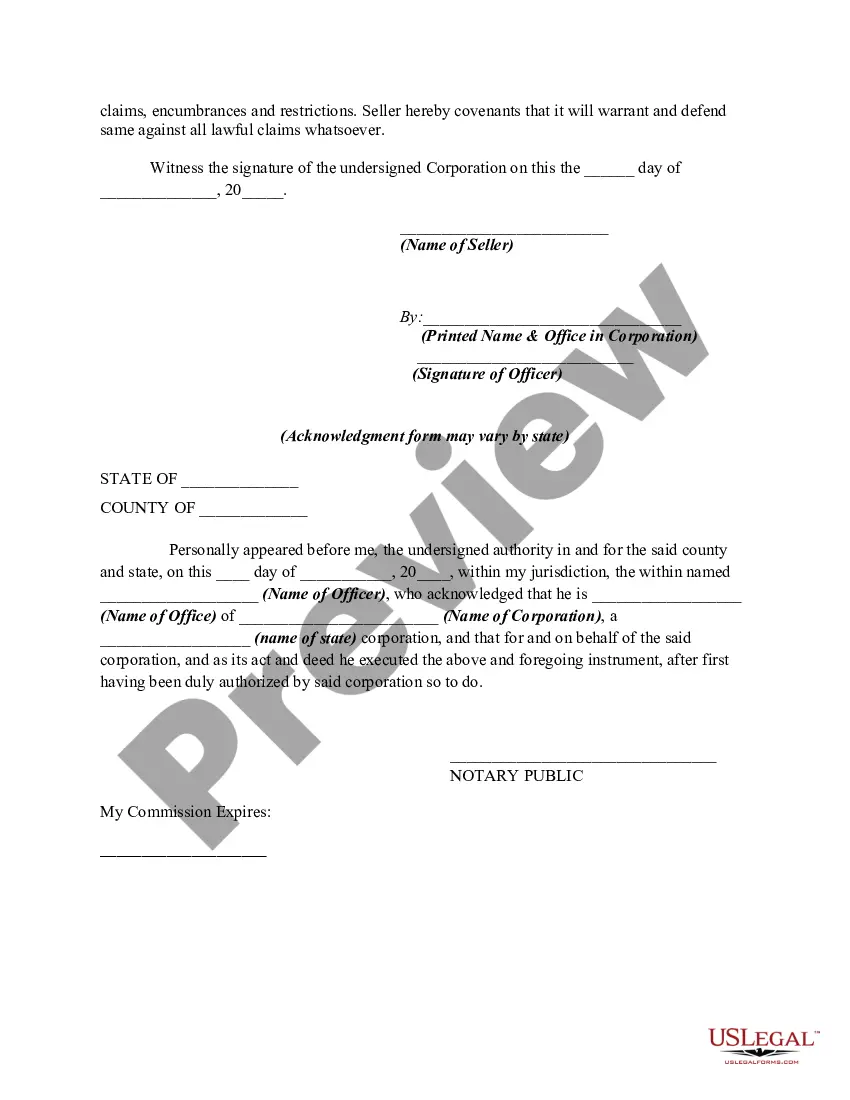

How to fill out Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

Have you ever found yourself in a situation where you require documents for either organizational or personal purposes nearly every day.

There are numerous legal document templates accessible on the internet, yet finding ones that you can trust is challenging.

US Legal Forms provides a vast selection of template documents, such as the California Bill of Sale by Corporation for all or substantially all of its Assets, which can be tailored to comply with state and federal regulations.

Utilize US Legal Forms, one of the most extensive collections of legal documents, to save time and minimize errors.

The service offers well-crafted legal document templates that you can employ for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the California Bill of Sale by Corporation for all or substantially all of its Assets template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct area/county.

- Use the Review button to verify the form.

- Examine the description to confirm that you have chosen the right form.

- If the form does not meet your needs, utilize the Search field to find the document that suits your requirements.

- Once you find the correct form, click Purchase now.

- Select your preferred pricing plan, provide the necessary information to create your account, and complete the transaction using your PayPal or Visa or MasterCard.

- Choose a suitable file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can download another copy of the California Bill of Sale by Corporation for all or substantially all of its Assets at any time, if needed. Simply click on the necessary form to download or print the document template.

Form popularity

FAQ

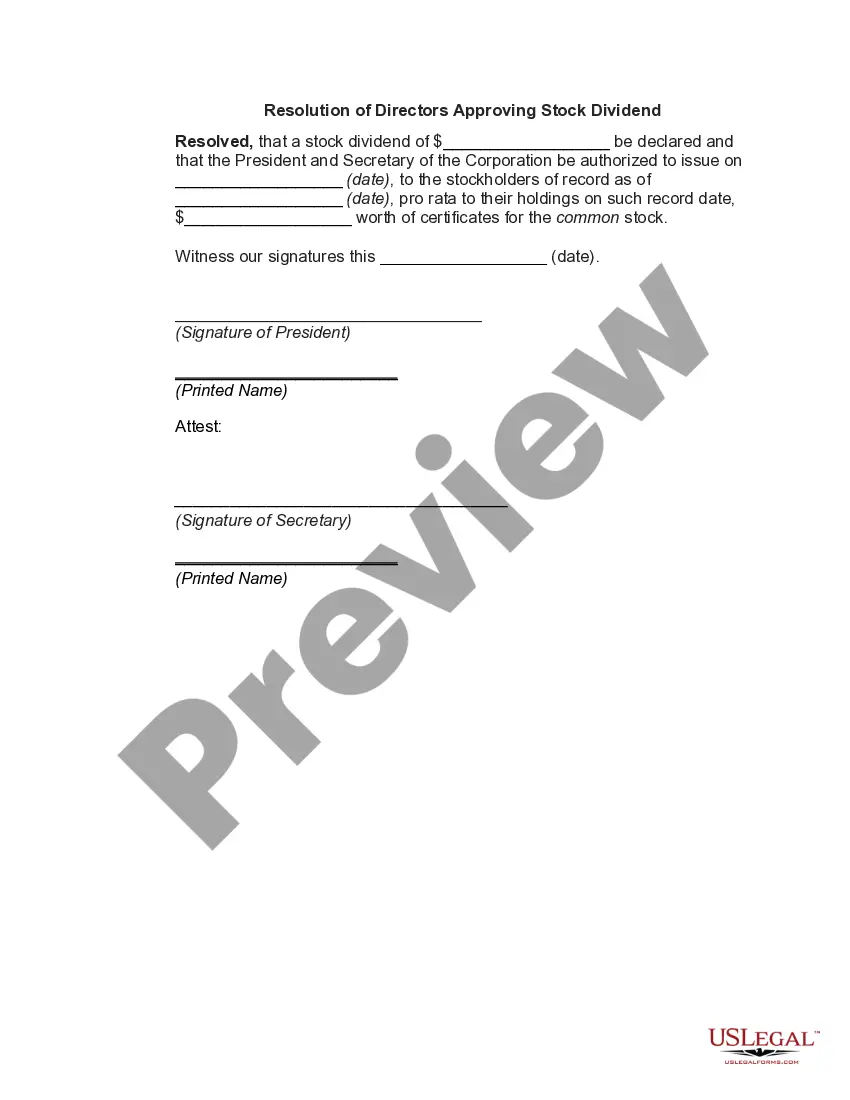

The sale of all a corporation's assets requires approval from both the board of directors and the shareholders. The board formulates a sale plan, which shareholders then review and vote on. This structure not only adheres to legal standards but also promotes the ethical responsibility of conducting a California Bill of Sale by Corporation of all or Substantially all of its Assets, keeping all stakeholders informed and involved.

When a corporation plans to sell all or a majority of its assets, both the board of directors and shareholders must give their approval. The board initiates the sale process, while shareholders vote to finalize the decision, ensuring that all parties have a say in significant outcomes. Engaging in a California Bill of Sale by Corporation of all or Substantially all of its Assets underscores the importance of collective agreement in corporate governance.

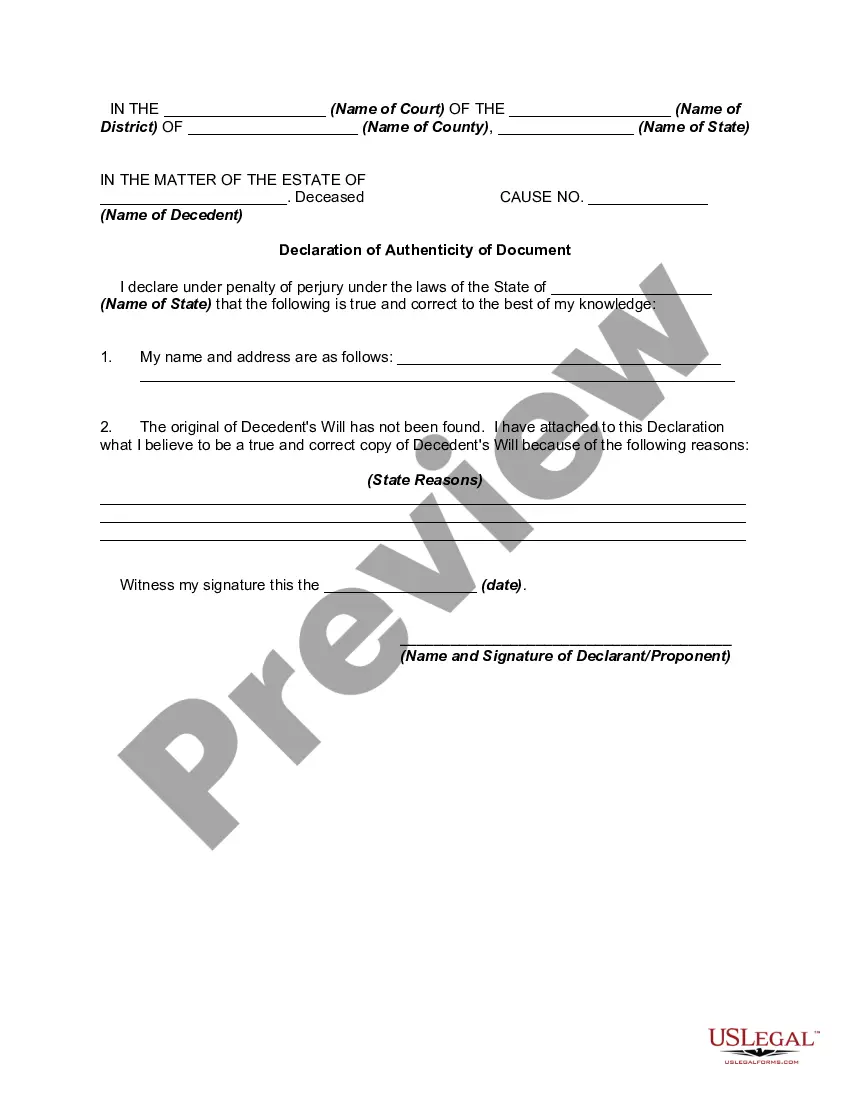

Yes, generally, shareholder approval is necessary for an asset sale, particularly when it involves all or a majority of the corporation’s assets. This requirement protects shareholder interests and ensures transparency in major transactions. When navigating a California Bill of Sale by Corporation of all or Substantially all of its Assets, it is crucial to involve shareholders in the decision-making process.

The approval of a company sale typically involves the board of directors and shareholders. The board recommends the sale, and shareholders then vote to approve it. This process ensures that both management and stakeholders agree on the significant decision to engage in a California Bill of Sale by Corporation of all or Substantially all of its Assets.

Yes, a handwritten bill of sale is legal in California, provided it meets specific requirements. It must be clear, complete, and include all essential details like buyer and seller information, item description, and transaction date. However, using a standardized form can simplify the process and ensure that you cover all necessary points. You might find the California Bill of Sale by Corporation of all or Substantially all of its Assets to be a effective and organized solution.

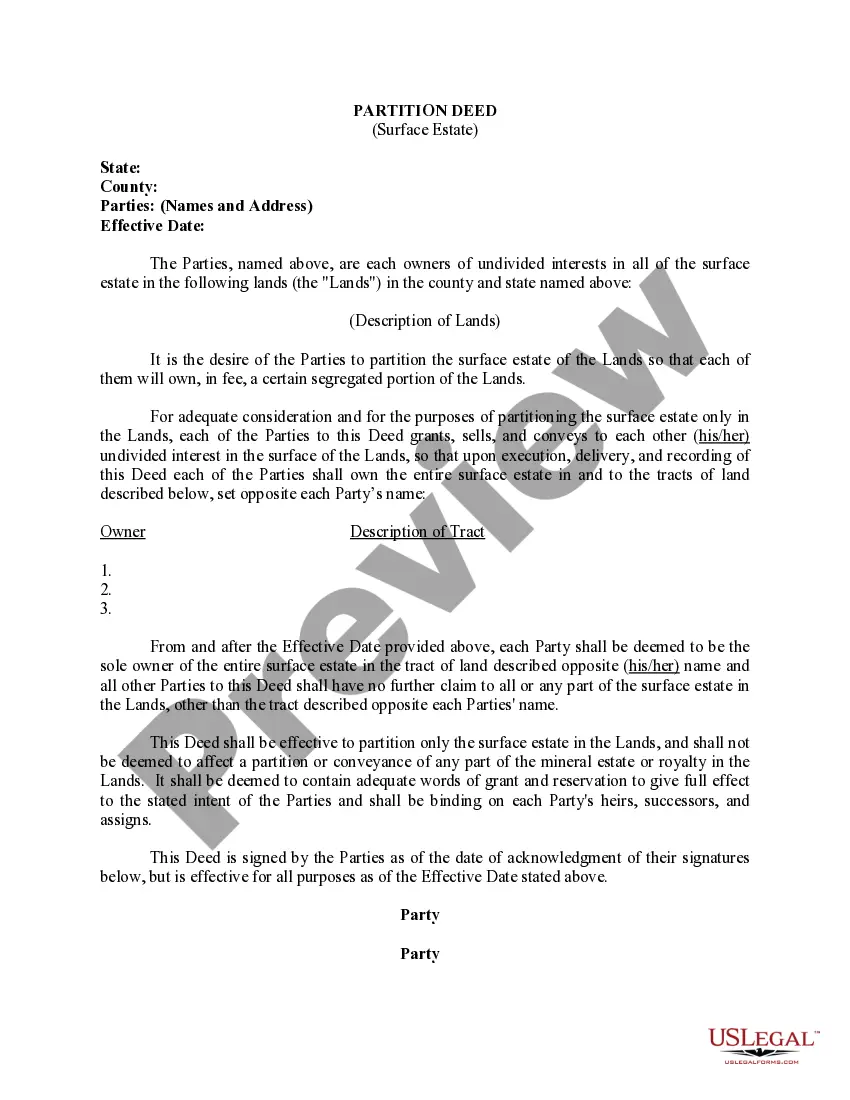

Section 9633 of the California Corporation Code deals with the disposition of a corporation's assets under certain conditions. This section is vital for understanding how and when a corporation may sell its assets, especially in the context of ensuring compliance with state law. For anyone creating a California Bill of Sale by Corporation of all or Substantially all of its Assets, familiarity with this section will help ensure a smooth transaction.

The California Corporation Code that governs the sale of assets is primarily found in Sections 2000 to 2099. These sections outline the procedures and obligations for corporations when selling their assets, ensuring that transactions are conducted fairly and transparently. Businesses looking to create a California Bill of Sale by Corporation of all or Substantially all of its Assets should carefully review these codes to ensure adherence to legal standards.

Yes, California has a bulk sales law that aims to protect creditors in the event of a business asset transfer. This law requires sellers to notify creditors in advance of a bulk sale to give them an opportunity to protect their interests. For those drafting a California Bill of Sale by Corporation of all or Substantially all of its Assets, understanding this law is crucial to avoid potential legal complications.

A bulk sale generally involves the transfer of a significant portion of a business's inventory, while an asset sale entails selling specific assets of a corporation. It's important to recognize that a bulk sale may trigger additional legal requirements in California, particularly regarding notifications to creditors. When creating a California Bill of Sale by Corporation of all or Substantially all of its Assets, understanding this distinction helps ensure compliance with all relevant laws.

California Corporation Code 25206 provides guidelines regarding the sale of a corporation's assets under specific conditions. This code specifies the obligations a corporation has during the sale process, which is crucial for protecting both buyers and sellers. By following these guidelines, corporations can effectively draft a California Bill of Sale by Corporation of all or Substantially all of its Assets.