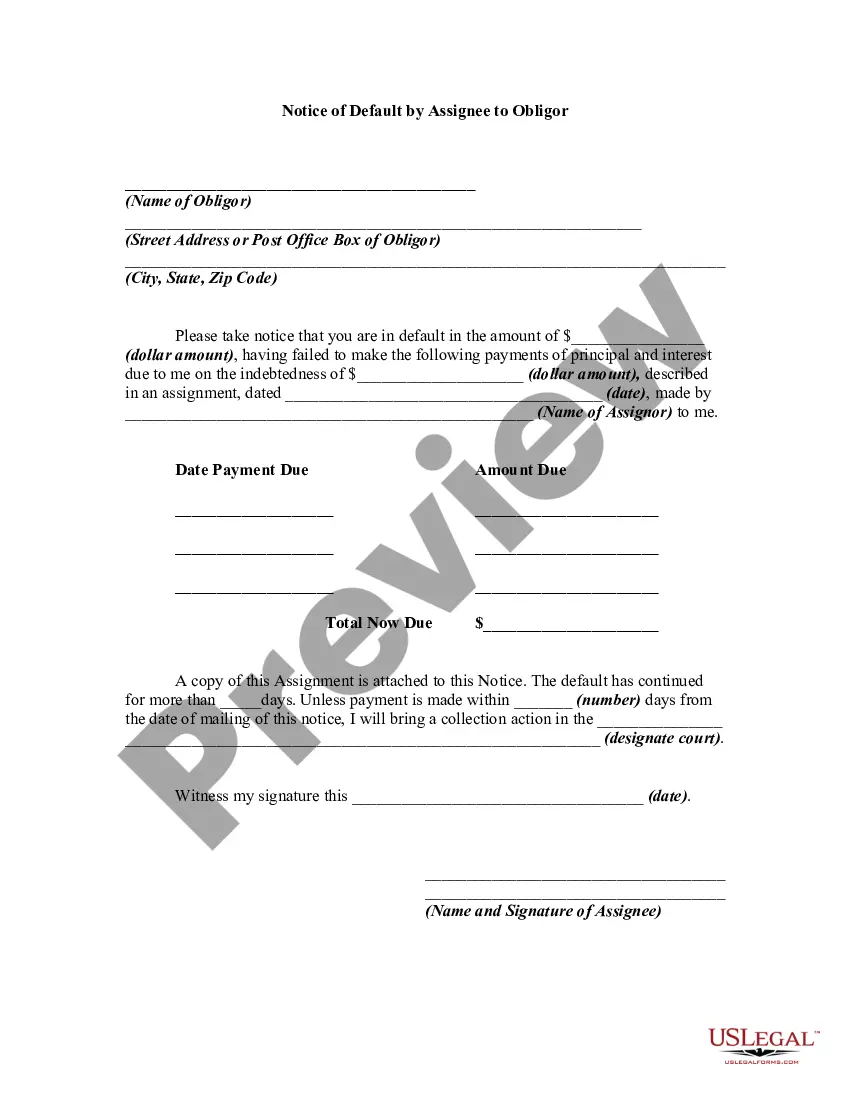

California Notice of Default on Promissory Note Installment

Description

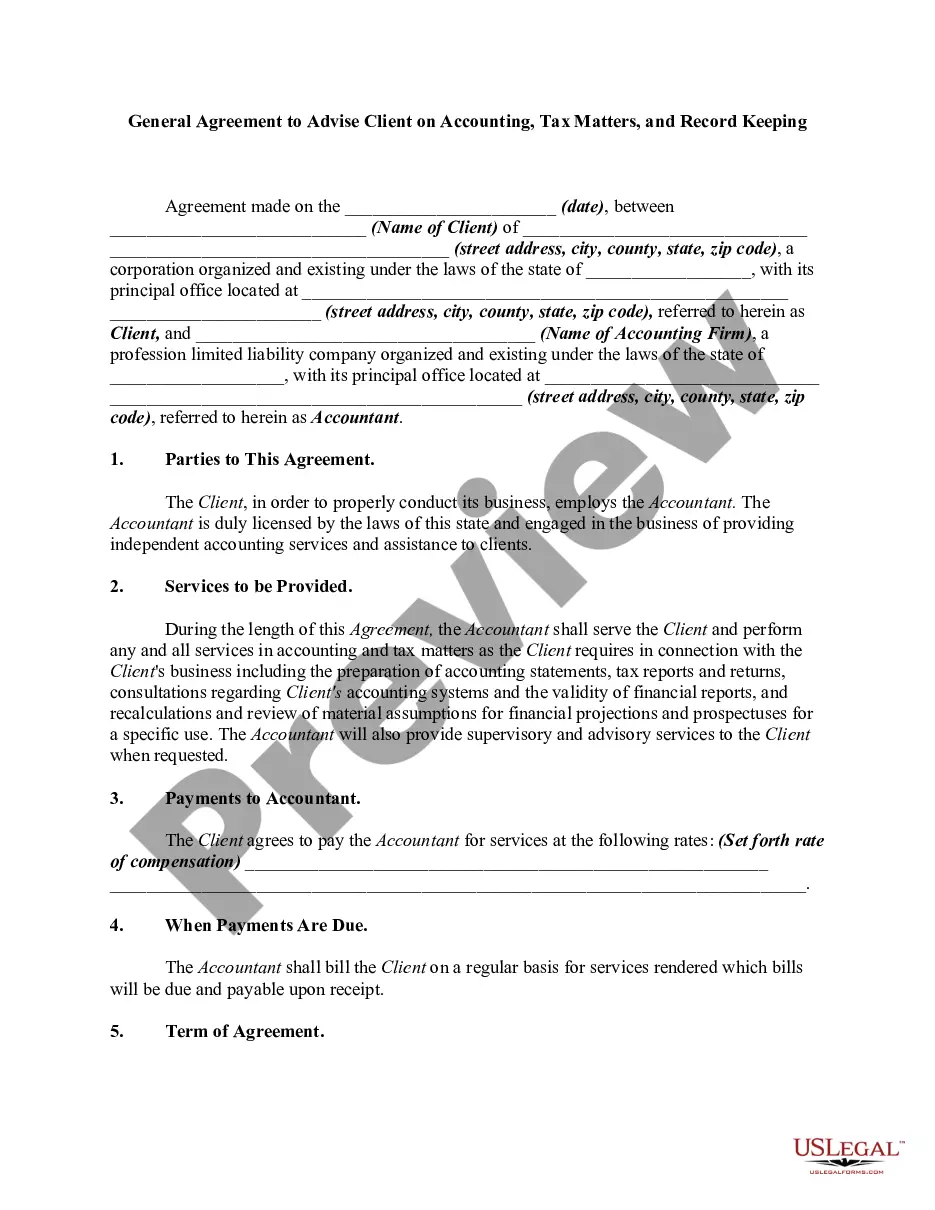

How to fill out Notice Of Default On Promissory Note Installment?

It is feasible to utilize many hours online searching for the legal document template that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that can be reviewed by professionals.

You can download or print the California Notice of Default on Promissory Note Installment from this service.

If available, use the Review button to inspect the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the California Notice of Default on Promissory Note Installment.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your state/city of choice.

- Check the form description to confirm you have chosen the right form.

Form popularity

FAQ

To write a California Notice of Default on Promissory Note Installment, start by clearly identifying the parties involved in the agreement. Include details such as the date the notice is issued, the amount due, and any late fees applicable. Be sure to specify the consequences of not addressing the default, such as potential foreclosure or other legal actions. For assistance and templates, consider exploring the uslegalforms platform, which can guide you through the process efficiently.

If someone defaults on a promissory note, the lender may initiate a legal process to recover the owed amount. This can involve sending a notice of default, potentially followed by foreclosure actions if the debt remains unpaid. It’s important for lenders to understand their rights and methods of collection available to them. Uslegalforms offers helpful tools to guide you through each step of the process.

When someone defaults on a promissory note, your first step should be to review the agreement for terms regarding defaults. Next, consider reaching out to the borrower to discuss possible resolutions. Options might include negotiating a modified payment plan or exploring debt recovery methods. Using resources from uslegalforms can provide templates and legal advice tailored to your circumstances.

When you receive a default notice, it acts as a warning that you need to take immediate action. Ignoring this notice can lead to more severe legal consequences, including the potential loss of property. You have options, such as settling your debt or restructuring your payments. Engaging with uslegalforms can provide you with the necessary documentation and support in navigating this challenging situation.

Receiving a notice of default means you have officially failed to adhere to the terms of your promissory note. This notice can lead to serious consequences, including foreclosure proceedings if the issue isn’t addressed. It’s essential to respond swiftly by either making payments or negotiating with the lender. Tools and resources available through uslegalforms can guide you through the next steps.

Writing a default notice requires clarity and precision. Start with identifying the borrower and outlining the specific terms they have breached. Include details such as the outstanding amount and a deadline for remedying the default. Using templates from uslegalforms can help ensure your notice is comprehensive and legally sound.

A notice of default on a promissory note is a formal declaration indicating that a borrower has failed to meet an obligation outlined in the agreement. This notice serves as an initial step in the foreclosure process and informs the borrower of their overdue payments. Upon receiving the California Notice of Default on Promissory Note Installment, borrowers should take it seriously and respond promptly to avoid further legal action.

If you face a situation involving the California Notice of Default on Promissory Note Installment, understanding your remedies is crucial. Common remedies include demanding immediate payment, initiating foreclosure, or seeking a judgment. Legal options may vary depending on the terms outlined in the promissory note. It's advisable to consult a legal professional to evaluate your options effectively.

Writing a notice of default letter for a California Notice of Default on Promissory Note Installment involves starting with a clear heading that includes the borrower's name and account number. Next, state the specifics of the default, including the amount due and relevant dates. Be sure to lay out potential consequences of inaction to encourage compliance, and consider using platforms like uslegalforms to streamline the process.

To send a notice of default for a California Notice of Default on Promissory Note Installment, ensure you send it via certified mail for proof of delivery. Include clear details concerning the reason for the notice and any actions required to remedy the situation. Document the sending process, as this may be important if legal proceedings arise.