California Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank

Description

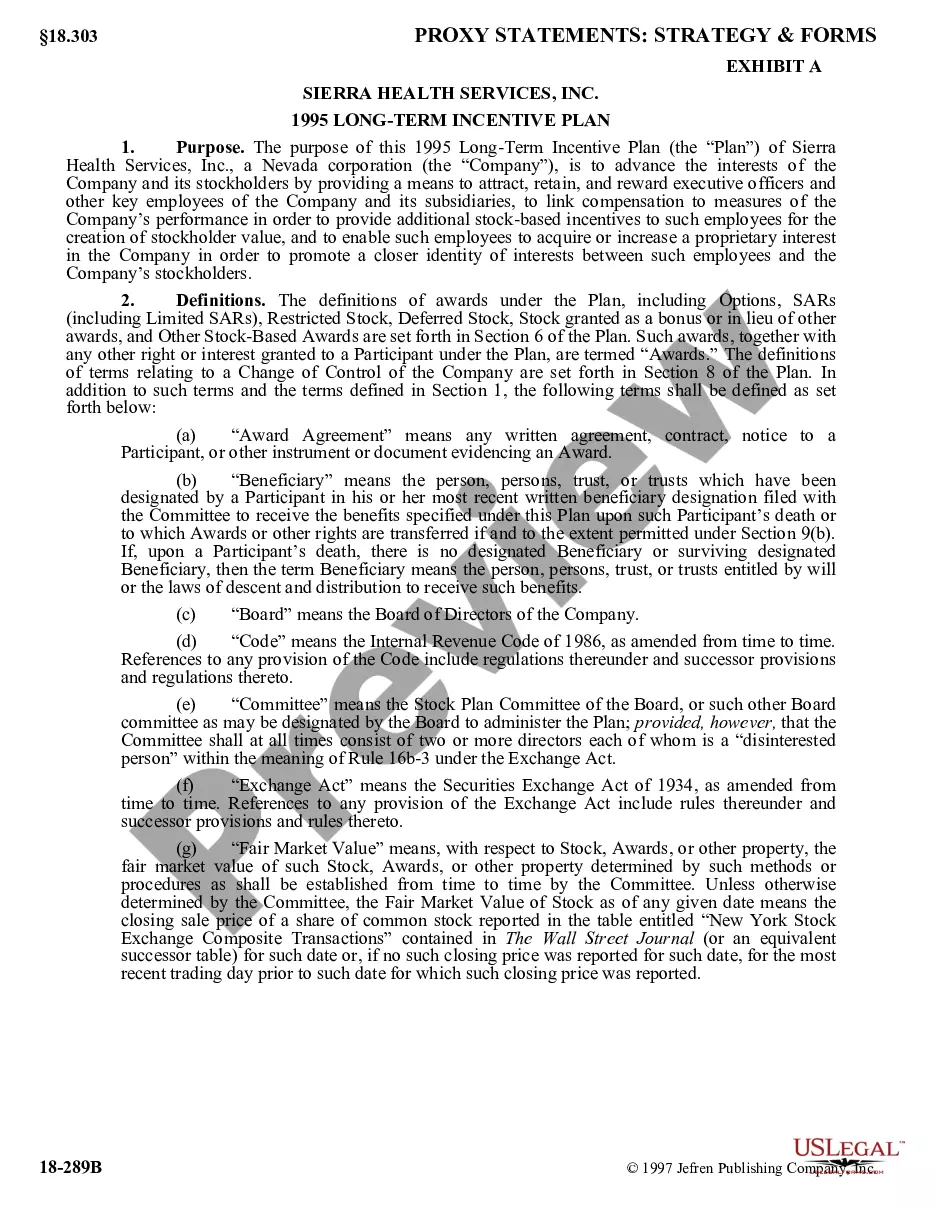

The Federal Truth in Lending Act and the regulations promulgated under the Act apply to certain credit transactions, primarily those involving loans made to a natural person and intended for personal, family, or household purposes and for which a finance charge is made, or loans that are payable in more than four installments. However, said Act and regulations do not apply to a business loan of this type.

How to fill out Line Of Credit Or Loan Agreement Between Corporate Or Business Borrower And Bank?

Choosing the best lawful record template might be a struggle. Naturally, there are a variety of themes accessible on the Internet, but how will you find the lawful type you require? Take advantage of the US Legal Forms web site. The service gives a large number of themes, such as the California Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank, that you can use for company and personal requires. All the types are checked by pros and fulfill federal and state needs.

Should you be currently registered, log in to the bank account and click on the Obtain button to have the California Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank. Make use of bank account to check throughout the lawful types you may have acquired formerly. Proceed to the My Forms tab of your respective bank account and have another backup of your record you require.

Should you be a new customer of US Legal Forms, listed here are basic guidelines for you to follow:

- Initial, be sure you have chosen the right type for your personal city/area. You can look through the shape utilizing the Review button and look at the shape explanation to guarantee this is basically the right one for you.

- When the type fails to fulfill your expectations, make use of the Seach field to find the appropriate type.

- When you are sure that the shape would work, click the Buy now button to have the type.

- Choose the prices program you would like and enter in the essential information. Build your bank account and pay money for your order using your PayPal bank account or bank card.

- Select the document file format and acquire the lawful record template to the gadget.

- Total, edit and produce and indication the received California Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank.

US Legal Forms is definitely the largest collection of lawful types for which you can find a variety of record themes. Take advantage of the company to acquire professionally-created paperwork that follow condition needs.

Form popularity

FAQ

Loans and credits are different finance mechanisms. While a loan provides all the money requested in one go at the time it is issued, in the case of a credit, the bank provides the customer with an amount of money, which can be used as required, using the entire amount borrowed, part of it or none at all.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

Here's some of the critical information you should ensure is included in every business loan agreement: Step 1 ? Set an Effective Date. ... Step 2 ? Identify the Parties. ... Step 3 ? Include the Loan Amount. ... Step 4 ? Create a Repayment Schedule. ... Step 5 ? Define Security Interests or Collateral. ... Step 6 ? Set an Interest Rate.

An intercompany loan agreement, also known as an intracompany loan agreement, outlines the terms and conditions of a loan between one company and another. For example, if a company has short-term financial needs, it may opt for an intercompany loan instead of an outside financing source.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

However, the do-it-yourself approach is perfectly acceptable and just as legally enforceable. Once you have both agreed on the terms, you may want to have the personal loan contract notarized or ask a third party to act as a witness during the signing.

Here's some of the critical information you should ensure is included in every business loan agreement: Step 1 ? Set an Effective Date. ... Step 2 ? Identify the Parties. ... Step 3 ? Include the Loan Amount. ... Step 4 ? Create a Repayment Schedule. ... Step 5 ? Define Security Interests or Collateral. ... Step 6 ? Set an Interest Rate.