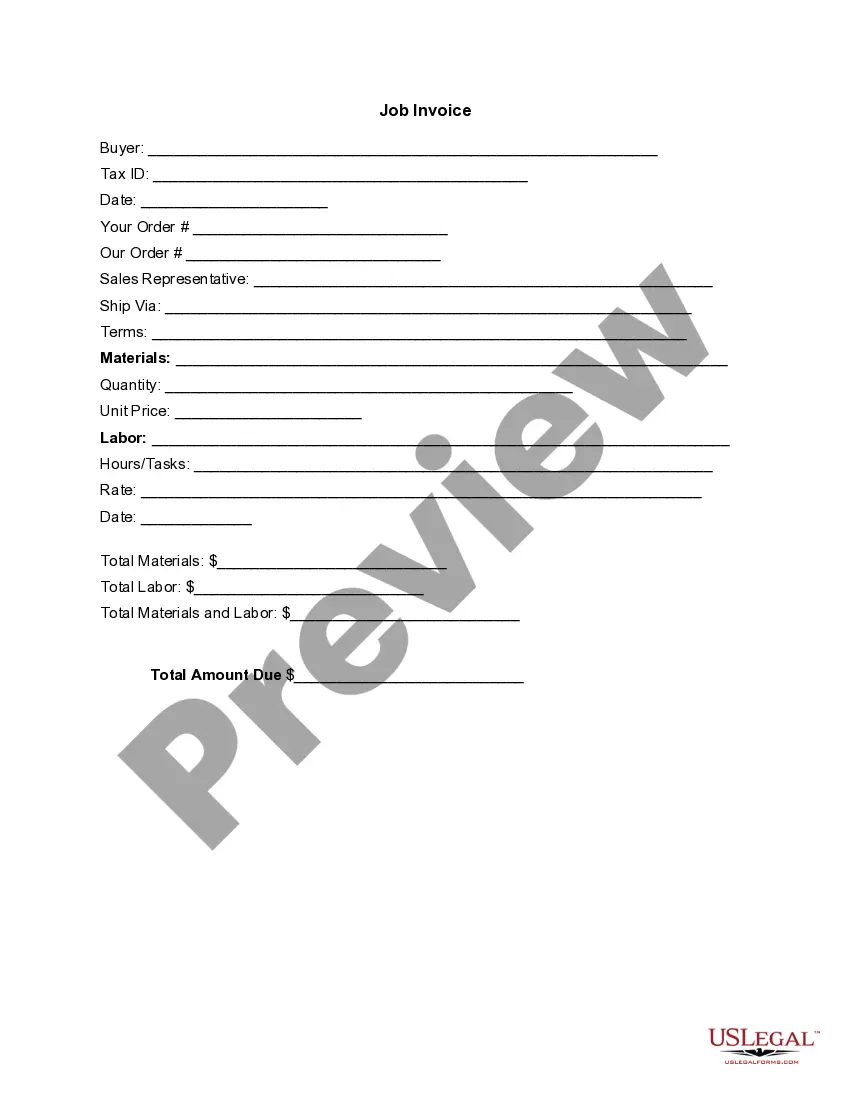

California Invoice Template for Marketing Services

Description

How to fill out Invoice Template For Marketing Services?

You can allocate time online searching for the valid form template that complies with both federal and state regulations you will require.

US Legal Forms offers a wide array of authorized templates that have been reviewed by specialists.

It is easy to access or create the California Invoice Template for Marketing Services from my service.

If available, utilize the Review button to browse through the form template as well.

- If you possess a US Legal Forms account, you may Log In and click on the Obtain button.

- Subsequently, you can fill out, modify, print, or sign the California Invoice Template for Marketing Services.

- Every legal form template you purchase is yours indefinitely.

- To retrieve another version of a purchased form, visit the My documents section and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, confirm that you have selected the correct form template for the county/city of your choice.

- Review the form description to ensure you have picked the right form.

Form popularity

FAQ

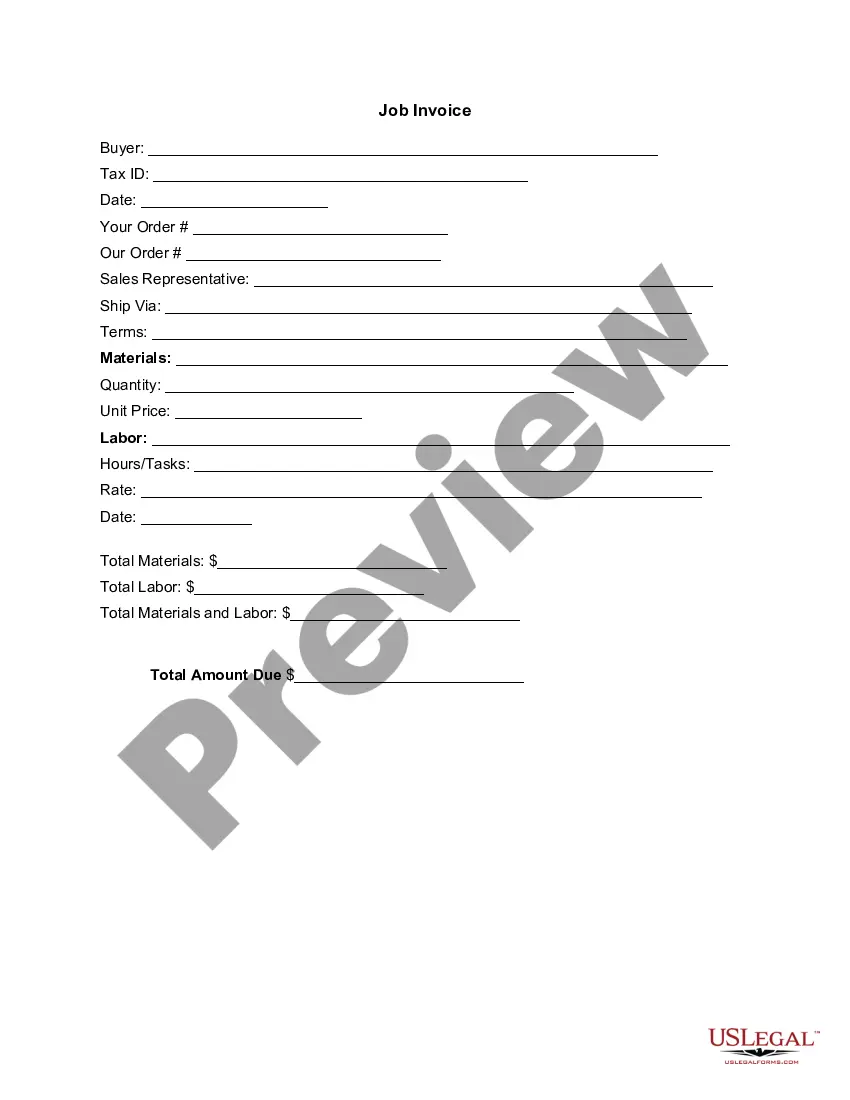

To issue a service invoice, start with a completed California Invoice Template for Marketing Services. Ensure all details, including service description, client information, and payment terms, are accurate. Once reviewed, you can easily send this invoice to your client through their preferred contact method, ensuring you maintain professionalism and clarity.

Creating an e-invoice for a service can be easily achieved by using a California Invoice Template for Marketing Services. Convert the template into a digital format such as PDF or use invoicing software to create it online. Make sure to send the e-invoice via email and include a payment link if applicable; this enhances convenience for your clients.

Issuing an invoice template, such as a California Invoice Template for Marketing Services, involves preparing the template with your branding and specific service details. Once your template is ready, you can share it with clients or use it for your own invoicing purposes. This standardizes your invoices and reduces the time spent on creating new ones for each transaction.

To submit an invoice for a service, first ensure that you have a completed California Invoice Template for Marketing Services. You can submit the invoice via email, post, or through digital tools that facilitate invoicing. It is a good practice to follow up with your client to confirm receipt and clarify any questions they may have regarding the invoice.

Yes, you can create your own invoice template using a California Invoice Template for Marketing Services as your base. Many users find it helpful to start with a pre-designed template that captures all necessary elements and then modify it to reflect their brand. This approach saves time while ensuring that all vital information is included.

Creating an invoice for services is straightforward with a California Invoice Template for Marketing Services. Begin by selecting a template that suits your service type. Fill in the essential information, including service descriptions, rates, and due date. Finally, ensure to review the invoice for accuracy before sending it to your client.

To create an invoice for your services, start with a California Invoice Template for Marketing Services. This template typically includes your business name, client details, itemized services, and payment instructions. You can customize this template to meet your specific needs, ensuring you capture all necessary information. Once completed, save it in a preferred format and send it to your client.

Invoicing yourself is not illegal, but it is essential to use accurate details and follow standard practices. This is often done for record-keeping purposes or when tracking expenses. Using a California Invoice Template for Marketing Services can help create clear and professional invoices, even for your own records.

Yes, it is legal to create your own invoice, as long as it meets all necessary requirements. Ensure it includes your business information, customer details, a description of services, and payment terms. Utilizing a California Invoice Template for Marketing Services can help ensure your invoice complies with legal standards and looks professional.

There are several websites that can help you generate invoices, but platforms like uslegalforms stand out due to their user-friendly interface and tailored templates. You can easily find a California Invoice Template for Marketing Services that suits your needs. These platforms often provide additional tools that help you manage invoices and payments efficiently.