California Invoice Template for Software Developer is a professional document that helps software developers in the state of California create and manage their invoices effectively. This template is specifically designed to cater to the unique needs and requirements of software developers operating in California. The California Invoice Template for Software Developer includes all the essential elements needed to create a comprehensive and legally compliant invoice. It typically consists of the developer's contact information, the client's details, a unique invoice number, invoice date, and payment terms. In addition to the basic details, this invoice template includes sections for itemized billing, where software developers can list the specific services they provided, including software development, coding, debugging, and any other related tasks. Each item is accompanied by a description, quantity, rate, and subtotal, allowing for precise and transparent billing. The California Invoice Template for Software Developer also incorporates relevant tax information and calculates sales tax based on the state's regulations. This ensures compliance with California's tax laws and helps software developers accurately determine the final amount due. Moreover, this template may have different variations to meet specific requirements. Some common types of California Invoice Templates for Software Developer include: 1. Hourly Rate Invoice Template: This template is used when software developers charge their clients based on an hourly rate for the time spent on a project. It allows developers to track their hours and invoice accordingly. 2. Project-based Invoice Template: This template is utilized when software developers charge a fixed price for a particular project, regardless of the number of hours spent. It helps clearly define the scope of work and includes milestones for invoicing purposes. 3. Retainer Invoice Template: In situations where software developers work on retainer, this template is employed. It outlines the retainer fee paid by the client at the start of the engagement and deducts the fee from the subsequent invoices until the retainer is exhausted. Software developers in California can benefit greatly from utilizing the California Invoice Template for Software Developer as it streamlines the invoicing process, ensures accuracy, and maintains compliance with state tax laws. By using this template, software developers can focus more on their core tasks, while maintaining professionalism and efficiency in their invoicing procedures.

California Invoice Template for Software Developer

Description

How to fill out California Invoice Template For Software Developer?

If you have to comprehensive, obtain, or printing authorized document web templates, use US Legal Forms, the largest selection of authorized types, which can be found on-line. Make use of the site`s basic and convenient research to get the documents you need. Various web templates for organization and personal reasons are sorted by classes and says, or search phrases. Use US Legal Forms to get the California Invoice Template for Software Developer in a number of mouse clicks.

When you are currently a US Legal Forms customer, log in to your account and then click the Download button to get the California Invoice Template for Software Developer. Also you can accessibility types you earlier delivered electronically in the My Forms tab of your account.

If you are using US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form to the proper town/nation.

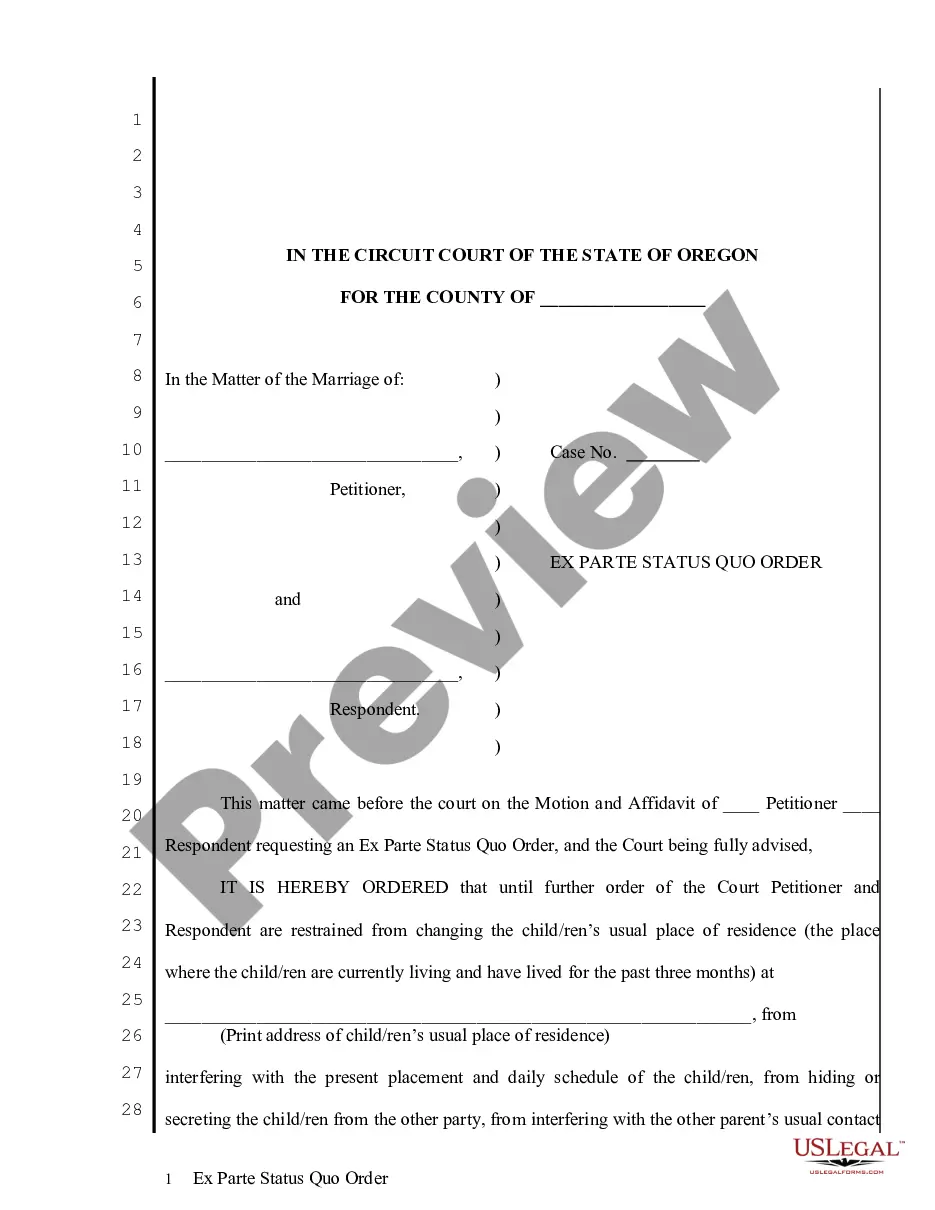

- Step 2. Utilize the Preview choice to look over the form`s articles. Never neglect to read the outline.

- Step 3. When you are not satisfied using the develop, make use of the Lookup area towards the top of the display screen to discover other models in the authorized develop design.

- Step 4. Once you have discovered the form you need, select the Acquire now button. Choose the pricing strategy you favor and put your accreditations to sign up for the account.

- Step 5. Approach the transaction. You can use your credit card or PayPal account to perform the transaction.

- Step 6. Pick the structure in the authorized develop and obtain it on your device.

- Step 7. Full, edit and printing or indicator the California Invoice Template for Software Developer.

Each authorized document design you acquire is yours eternally. You possess acces to every single develop you delivered electronically in your acccount. Go through the My Forms area and choose a develop to printing or obtain once more.

Contend and obtain, and printing the California Invoice Template for Software Developer with US Legal Forms. There are many expert and express-particular types you can use for your organization or personal demands.

Form popularity

FAQ

To set up an invoices template, begin by determining what information should be included—like your name, client information, service descriptions, and payment details. Using a California Invoice Template for Software Developer allows for quick adjustments. Ensure that your template includes clear payment instructions and, if applicable, any tax requirements.

To create a system-generated invoice, start by using invoicing software that offers templates, such as a California Invoice Template for Software Developer. This software can automatically fill in necessary details, such as date and invoice number, enhancing efficiency. Ensure your software allows for customization to meet your business’s specific needs.

Filling in an invoice template involves entering your business information at the top, including your name and contact details. Use a California Invoice Template for Software Developer for better organization, ensuring you list services, quantities, prices, and the total payment clearly. Don't forget to include payment terms for proper guidance.

As an independent contractor, you can send an invoice by completing a California Invoice Template for Software Developer. Make sure to include the services you provided and the accepted payment method. Deliver the invoice via email or a preferred online platform to ensure timely receipt and processing of payment.

To submit an invoice to an independent contractor, fill out the necessary sections indicating the services provided and the total amount due. A California Invoice Template for Software Developer is particularly advantageous, as it helps organize the information clearly. Send it through your chosen communication method, ensuring the contractor receives it promptly.

Legally sending an invoice involves ensuring that it contains all the required elements, such as your name, tax ID, and payment details. You can send your invoice electronically via email or through an invoicing platform using a California Invoice Template for Software Developer. Always retain a copy for your records in case of future inquiries.

The correct format for an invoice includes your business name, client details, a unique invoice number, dates, a description of services, and payment terms. A California Invoice Template for Software Developer provides a clean layout that ensures all necessary components are present. By maintaining a professional appearance, you foster greater trust with your clients.

Filling out an invoice template starts with entering your details at the top, followed by the client's information. Next, list the services you provided, their costs, and the total amount due. Utilizing a California Invoice Template for Software Developer simplifies this process, presenting a structured format to follow.

To send a self-employed invoice, fill out a California Invoice Template for Software Developer with your information and the services rendered. Make sure to include your payment details and any tax information if applicable. Once completed, send it to your client via email or a secure file-sharing service for immediate processing.

To invoice as a beginner, start with a simple California Invoice Template for Software Developer. Include your name, your client's name, the services provided, and the amount due. Keep it clear and concise, and ensure that your payment terms are easily visible. Finally, send it through email or any preferred method.