The California Estoppel Affidavit of Mortgagor is a legal document used in real estate transactions that helps establish the rights and obligations of the mortgagor (borrower) related to a mortgage loan. It is a sworn statement provided by the mortgagor, usually during the refinancing or sale of a property, to confirm important information about the mortgage to potential buyers or lenders. The Estoppel Affidavit of Mortgagor serves as a declaration stating certain vital facts regarding the mortgage, preventing any misrepresentations or misunderstandings. It typically includes key information such as the outstanding balance, interest rate, payment terms, due dates, and any other significant details that may impact the validity or conditions of the mortgage. By providing this affidavit, the mortgagor assures potential buyers or lenders that the information provided is accurate and complete, preventing any subsequent disputes or discrepancies between parties involved in the transaction. The affidavit is signed under oath and is legally binding to the mortgagor, ensuring they are held accountable for the accuracy of the information provided. In California, there are additional types of Estoppel Affidavits that can be used, depending on the specific circumstances of the mortgage transaction. These may include: 1. Estoppel Affidavit of Mortgagor — Refinance: This type of affidavit is used when a borrower is refinancing their existing mortgage. It outlines the terms and conditions of the new loan, including any changes or modifications compared to the original mortgage. 2. Estoppel Affidavit of Mortgagor — Loan Assumption: If a borrower is transferring their mortgage to another party, this affidavit will detail the original mortgage terms, as well as any modifications or alterations made during the assumption process. 3. Estoppel Affidavit of Mortgagor — Subordination: This specific affidavit type applies when a subsequent mortgage is being placed on a property that already has an existing mortgage. It outlines the priorities of the mortgages and explains how the new mortgage will interact with the previous mortgage. In conclusion, the California Estoppel Affidavit of Mortgagor is an essential document in real estate transactions. It provides a comprehensive and accurate representation of the mortgage details, protecting all parties involved from potential disputes or misunderstandings. By utilizing various types of Estoppel Affidavits, borrowers can ensure the correct information is presented in situations such as refinancing, loan assumptions, or subordination.

California Estoppel Affidavit of Mortgagor

Description

How to fill out Estoppel Affidavit Of Mortgagor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse assortment of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the California Estoppel Affidavit of Mortgagor in just a few moments.

If you already possess a subscription, Log In and retrieve the California Estoppel Affidavit of Mortgagor from your US Legal Forms collection. The Download button will appear on every form you view. You can access all forms previously downloaded in the My documents area of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form onto your device. Edit. Fill out, modify, print, and sign the downloaded California Estoppel Affidavit of Mortgagor. Every template you add to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the California Estoppel Affidavit of Mortgagor with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and requirements.

- Before using US Legal Forms for the first time, here are simple steps to help you begin.

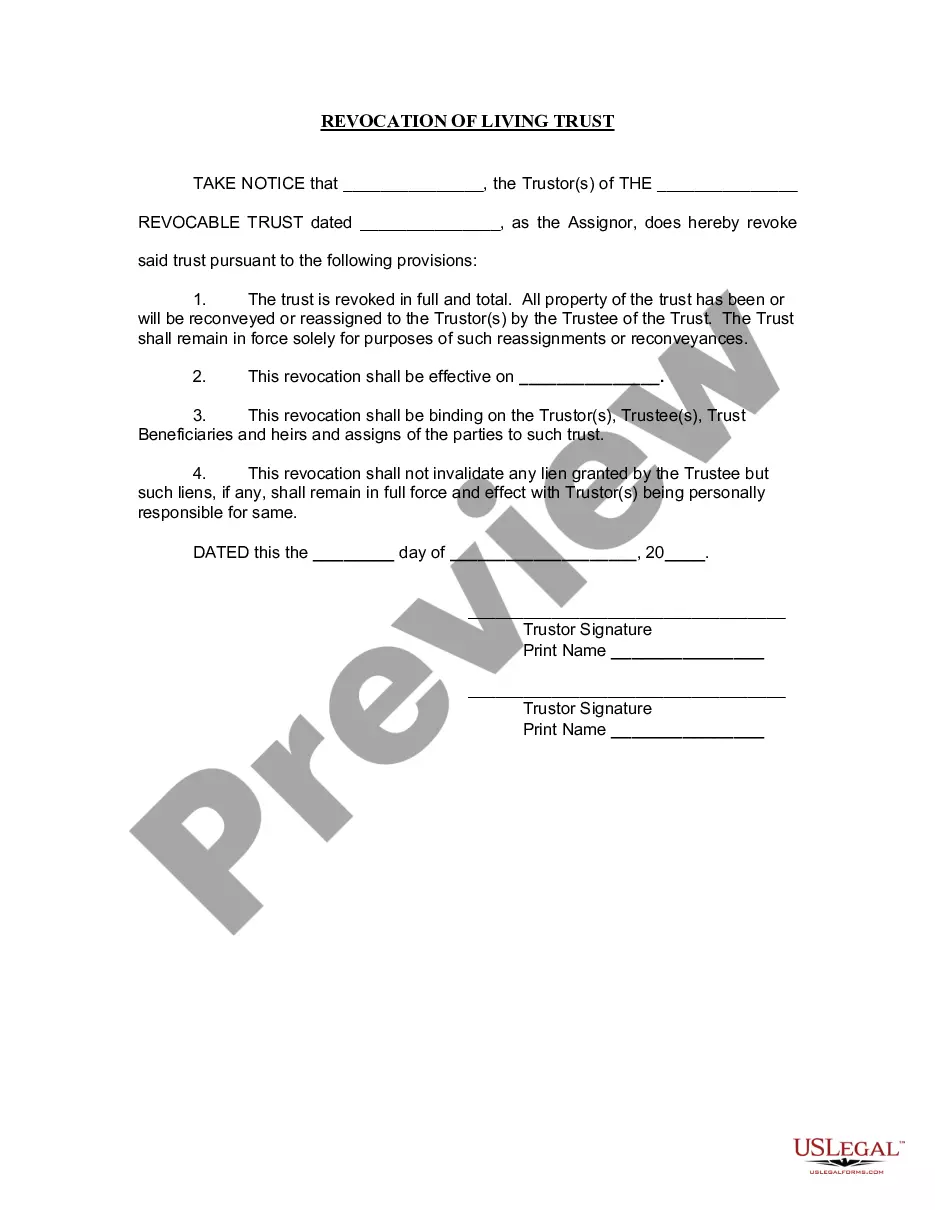

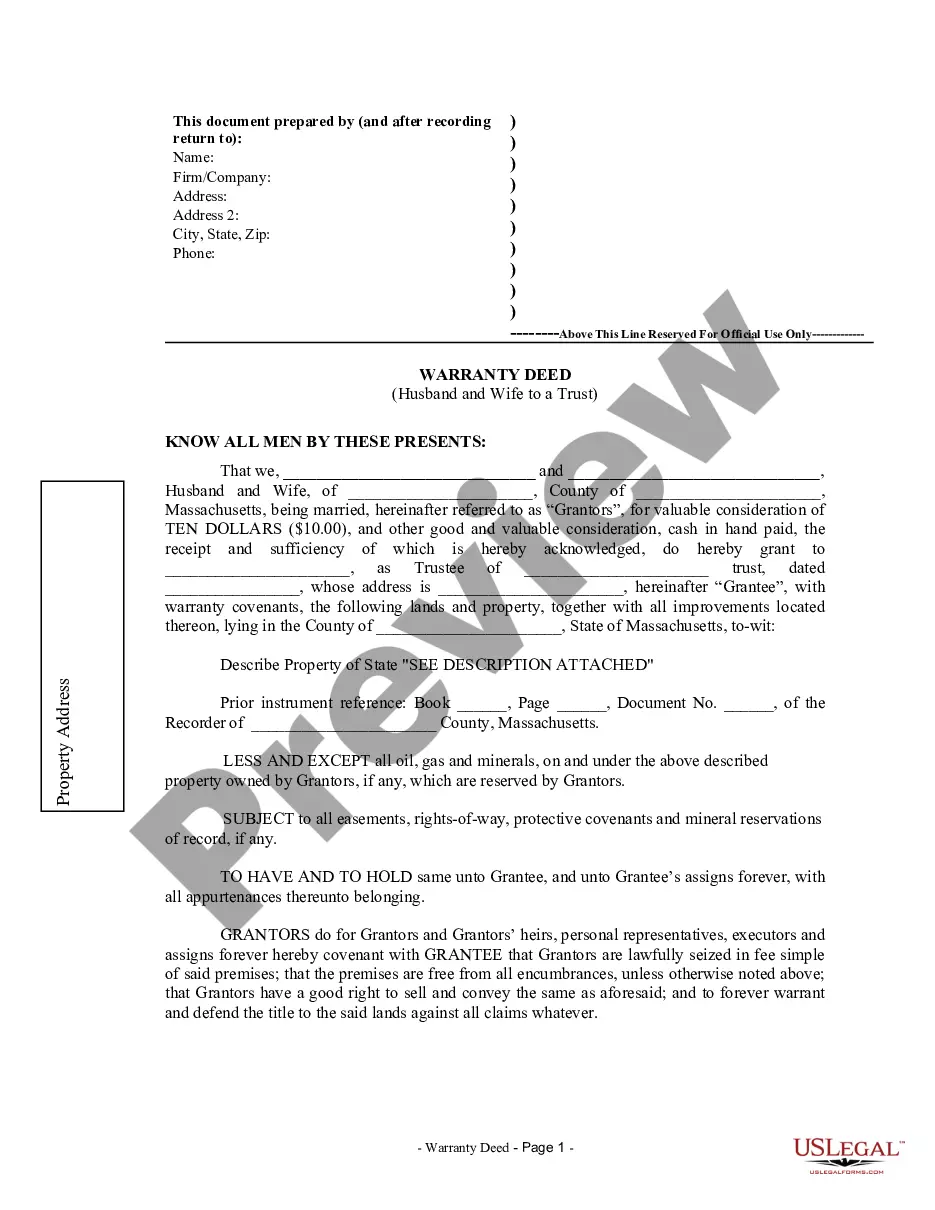

- Verify that you have selected the correct form for your area/county. Click the Preview button to review the contents of the form.

- Examine the form details to ensure that you have selected the appropriate form.

- If the form does not meet your requirements, utilize the Search bar at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your decision by clicking the Purchase now button.

- Next, choose your payment plan and enter your information to register for an account.

Form popularity

FAQ

The primary purpose of an estoppel is to provide certainty about a mortgage's current status. It protects both the borrower and lender by confirming the terms and outstanding amounts tied to the California Estoppel Affidavit of Mortgagor. Having this document helps prevent disputes and serves as an official record of your mortgage obligations.

To obtain an estoppel, you should request it from your lender or servicer. They will provide you with the California Estoppel Affidavit of Mortgagor after verifying your mortgage details. Consider using US Legal Forms for ease and efficiency in preparing your request, ensuring you have everything needed for a smooth process.

An affidavit for death of a trustee is a legal document that confirms the death of a trustee and identifies the subsequent trustee if applicable. This document is crucial for the continued management of the trust as it ensures the transition of duties is documented legally. It helps to avoid any complications regarding trust administration. For a reliable resource, consider the California Estoppel Affidavit of Mortgagor found on the US Legal Forms platform, which can simplify this process.

Filling out an affidavit example typically involves inserting accurate information that pertains to your specific situation. Begin with a clear title, followed by your full name, address, and a statement about the truthfulness of your claims. Next, detail the facts involved and sign the document under penalty of perjury. If you need a template or guidance, the California Estoppel Affidavit of Mortgagor available on US Legal Forms can provide helpful insights.

To fill out an affidavit of death of trustee in California, you will need the name of the deceased trustee, the date they passed, and relevant details about the trust. Include proof of the trustee's death, such as a death certificate, which needs to be attached. Sign and date the form in front of a notary public to verify its authenticity. The California Estoppel Affidavit of Mortgagor from US Legal Forms can assist you in properly completing this affidavit.

When a trustee dies in California, the trust administration process continues, but a successor trustee must be appointed to take over their responsibilities. If there is no named successor, then the trust can be escalated to court for appointment of a new trustee. It is important to follow proper legal procedures to prevent complications. To navigate this issue smoothly, look into the California Estoppel Affidavit of Mortgagor service on US Legal Forms.

To fill out an affidavit of death form, start by gathering information about the deceased, including their full name, date of death, and social security number. Next, provide information about yourself as the affiant, such as your name and relationship to the deceased. Finally, complete the affidavit by signing it in front of a notary to ensure its legality. For assistance, consider using the California Estoppel Affidavit of Mortgagor on the US Legal Forms platform.