This form is a type of asset-financing arrangement in which a company uses its receivables (money owed by customers) as collateral in a financing agreement. The company receives an amount that is equal to a reduced value of the receivables pledged. The age of the receivables have a large effect on the amount a company will receive. The older the receivables, the less the company can expect.

This type of financing helps companies free up capital that is stuck in accounts receivables. Accounts receivable financing transfers the default risk associated with the accounts receivables to the financing company. This transfer of risk can help the company using the financing to shift focus from trying to collect receivables to current business activities.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

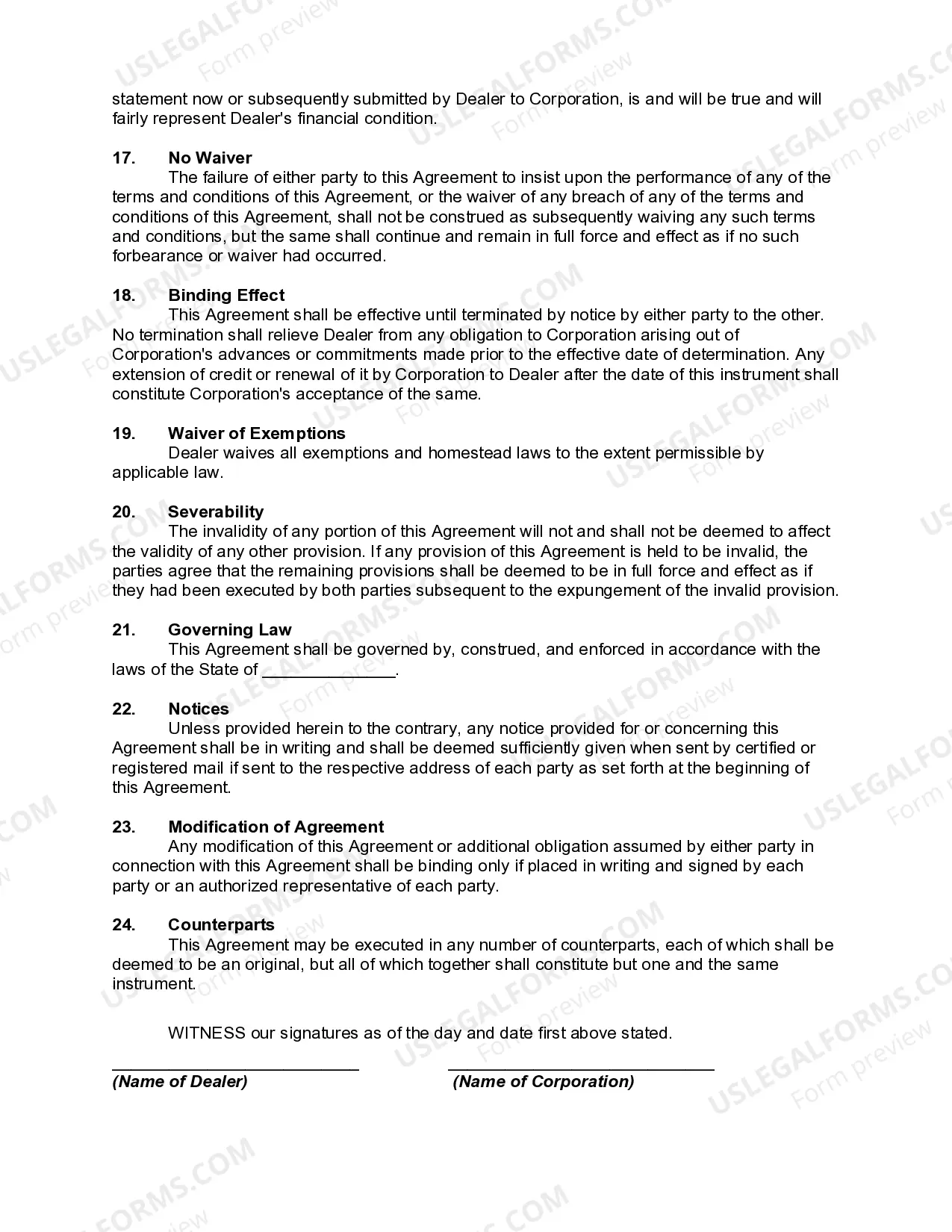

A California Financing Agreement between a Dealer and Credit Corporation for Wholesale Financing with Security interest in Accounts and General Intangibles is a legally binding contract that outlines the terms and conditions under which a credit corporation provides wholesale financing to a dealer in California. This agreement ensures that the credit corporation receives collateral (security interest) in the form of the dealer's accounts and general intangibles in case of default on the financing. This type of financing agreement serves as a vital tool for dealers in California as it enables them to obtain funds necessary for purchasing wholesale inventory or financing their operations. In return, the credit corporation obtains security interests to minimize the risk of financial loss. California's law recognizes different variations of the Financing Agreement between Dealer and Credit Corporation for Wholesale Financing with Security interest in Accounts and General Intangibles. Some distinguished types or variations of this agreement may include: 1. Revolving Line of Credit Financing Agreement: This type of agreement allows dealers to access a predetermined maximum line of credit, similar to a credit card, to finance their ongoing wholesale operations. The credit corporation provides the dealer with the flexibility to borrow and repay funds within the assigned credit limit, charging interest only on the amounts utilized. 2. Fixed-Term Financing Agreement: This agreement establishes specific terms regarding the repayment schedule, interest rates, and maturity of the loan. It sets a predetermined timeframe within which the dealer must repay the principal loan amount along with applicable interest. Fixed-term financing agreements are often utilized for larger-scale dealer financing needs or major investments. 3. Conditional Sales Contract: Under these agreements, a dealer purchases vehicles or equipment from the credit corporation using financing provided. The agreement stipulates that ownership of the purchased goods remains with the credit corporation until the dealer completes the agreed-upon installments or payments. Once the dealership fully repays the outstanding amount, the ownership transfers to the dealer. 4. Floor Plan Financing Agreement: Commonly used in the automotive industry, a floor plan financing agreement allows dealerships to obtain funds to purchase inventory such as automobiles, motorcycles, or RVs. The credit corporation provides a line of credit specifically for inventory purchases, using the acquired inventory as collateral. As vehicles are sold, the dealer repays the financing, while new inventory can be added under the agreed-upon credit limit. These are just a few examples of the different types of California Financing Agreements between Dealers and Credit Corporations for Wholesale Financing with Security interest in Accounts and General Intangibles. Each agreement may have unique provisions tailored to the specific needs and circumstances of the parties involved. It is vital for dealers and credit corporations to carefully review and negotiate the terms to ensure a mutually beneficial and legally compliant agreement.