California Return Authorization Form

Description

How to fill out Return Authorization Form?

If you need to complete, acquire, or generate sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's easy and user-friendly search to find the files you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

Step 6. Retrieve the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the California Return Authorization Form.

- Utilize US Legal Forms to obtain the California Return Authorization Form with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the California Return Authorization Form.

- You can also retrieve forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

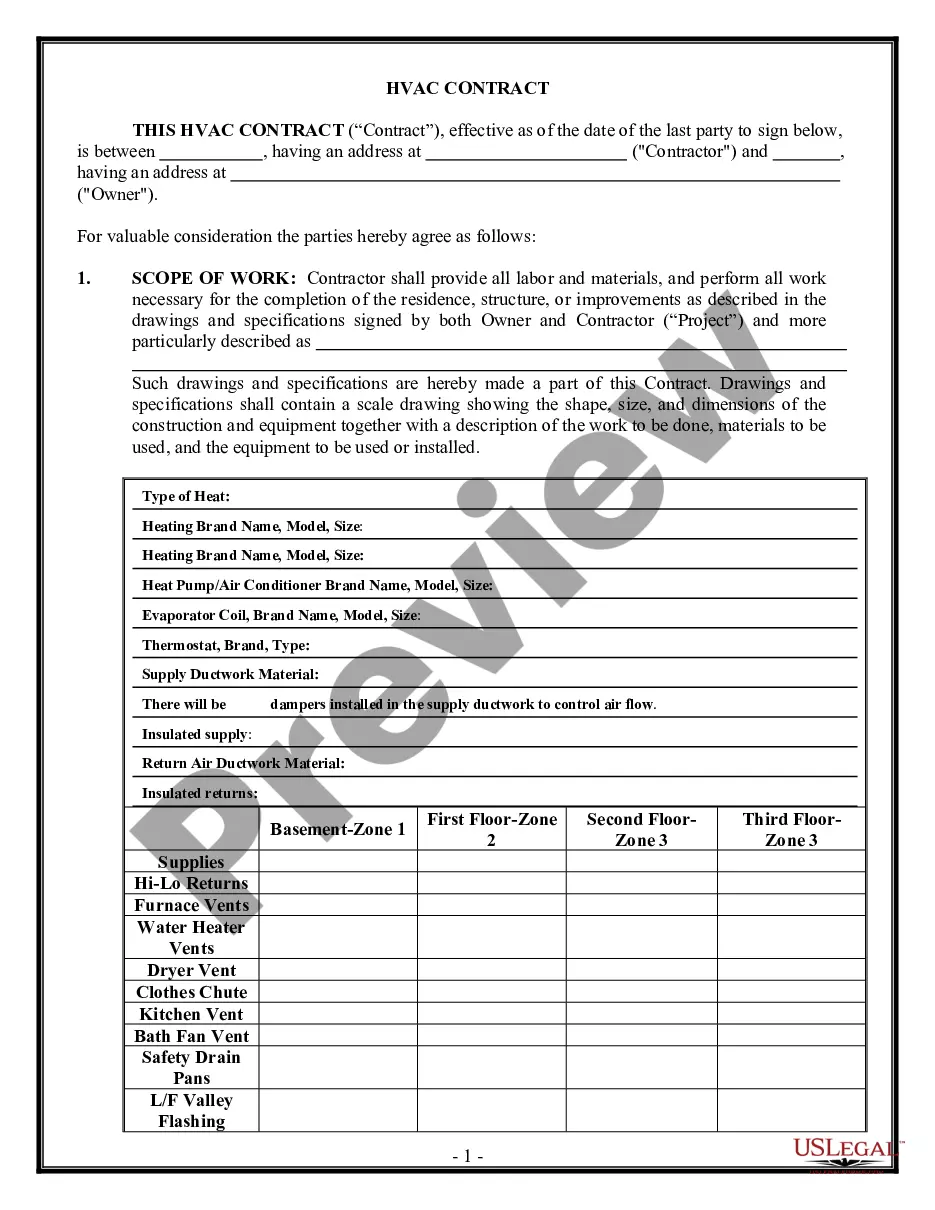

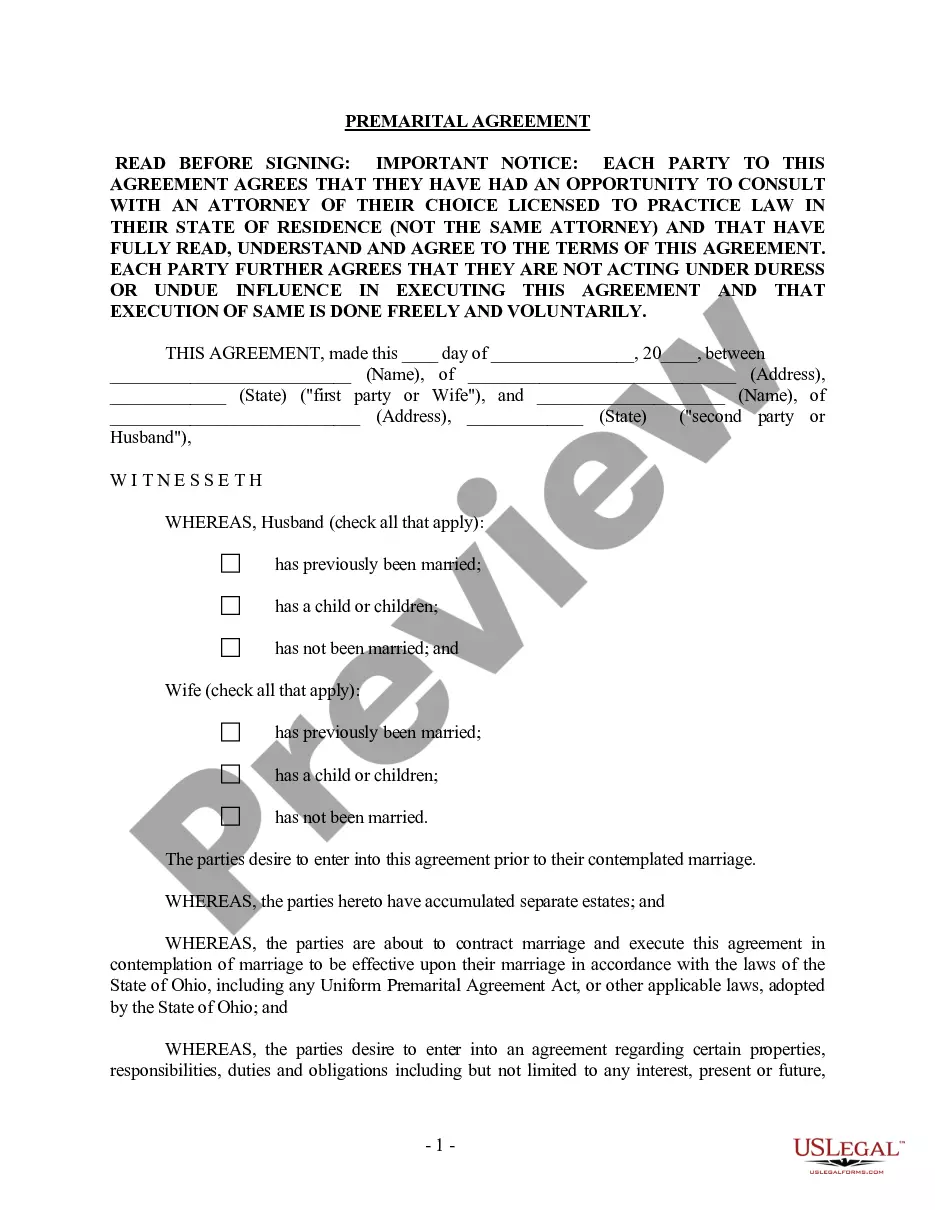

- Step 2. Use the Preview option to review the form's content. Don't forget to check the details.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Download now button. Choose the pricing plan you prefer and enter your information to register for the account.

Form popularity

FAQ

To obtain a copy of your California tax return online, you can visit the California FTB's official website. They have a user-friendly system where you can access your previous filings. Ensure you have necessary information ready, such as your Social Security number and filing status. For an efficient process, the California Return Authorization Form can assist you in retrieving and managing your records.

The state tax form for California is typically the 540 form for residents and the 540NR for non-residents. These forms allow taxpayers to compute their state tax liability accurately. Filing the correct forms is crucial for compliance and can offer benefits, such as potential refunds. Make sure to check out our California Return Authorization Form to help with your submission.

The IRS (Internal Revenue Service) and FTB (Franchise Tax Board) are not the same entities. The IRS is a federal agency that collects taxes across the United States, while the FTB handles California state taxes. Each has its rules and forms, which you need to follow based on your location. To ensure you meet your obligations, use resources such as the California Return Authorization Form for guidance.

California tax form 568 is specifically designed for limited liability companies (LLCs) to report income, deductions, and taxes. This form is essential for LLCs operating in California as it ensures compliance with state tax laws. Properly completing this form can help you avoid penalties or additional taxes. For assistance with your filings, consider using the California Return Authorization Form for clarity and efficiency.

Filing a California state tax return is generally required if you earn income above a certain threshold. Even if you don't meet this threshold, you might benefit from filing to claim a refund or tax credits. It's crucial to assess your financial situation to determine your filing requirements. You can use tools such as the California Return Authorization Form to streamline this process.

You can pick up California state tax forms at various locations, including local libraries, post offices, and tax offices. Additionally, you can download these forms directly from the California FTB website. This access simplifies the process, offering you a way to quickly obtain the necessary documentation. If you prefer a digital approach, the California Return Authorization Form is available through our platform.

The California state tax return form is a document that individuals use to report their yearly income to the California Franchise Tax Board (FTB). It helps determine the amount of tax you owe or the refund you can receive. This form is essential for fulfilling your tax obligations within the state. If you're looking for a clear way to manage your taxes, consider using the California Return Authorization Form.

Yes, business tax returns can be filed electronically in California. This option greatly simplifies the filing process for businesses, reducing paperwork and improving efficiency. The California Return Authorization Form can facilitate this electronic submission, ensuring that all pertinent information is accurate and complete.

Form 109 is a specific form used for California franchise tax credit claims. This form is crucial for businesses looking to take advantage of available incentives. Utilizing the California Return Authorization Form ensures that your submission aligns with state guidelines, providing more clarity in tax processing.

Absolutely, you can electronically file a California amended return using the relevant tax software. This feature allows you to make adjustments seamlessly while tracking your changes. Including the California Return Authorization Form will further ensure that your amended return is processed without any issues.