An addendum is a thing to be added; an addition. For example, it may be used to add supplemental terms or conditions to a contract or make corrections or supply omissions to a document. An addendum is often used to supply additional terms to standardized contracts, such as leases. Addendum is singular; the plural form is addenda.

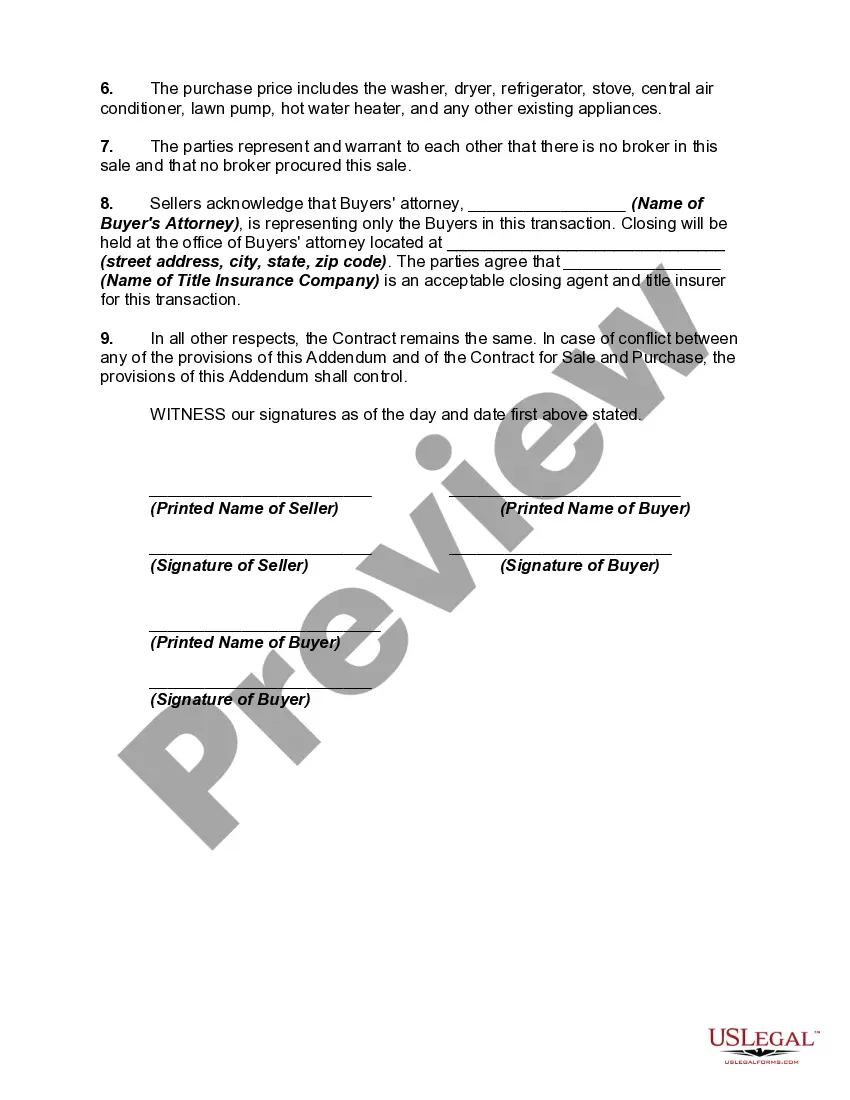

California Addendum to Contract for Sale and Purchase of Real Property

Description

How to fill out Addendum To Contract For Sale And Purchase Of Real Property?

Finding the right lawful document format might be a battle. Obviously, there are a variety of web templates accessible on the Internet, but how do you get the lawful kind you want? Use the US Legal Forms web site. The assistance delivers 1000s of web templates, for example the California Addendum to Contract for Sale and Purchase of Real Property, which can be used for organization and personal requires. Every one of the forms are examined by specialists and meet federal and state demands.

In case you are presently signed up, log in to your accounts and then click the Download option to obtain the California Addendum to Contract for Sale and Purchase of Real Property. Utilize your accounts to search with the lawful forms you might have acquired earlier. Check out the My Forms tab of your respective accounts and get one more version in the document you want.

In case you are a brand new consumer of US Legal Forms, allow me to share simple instructions that you should comply with:

- Initial, make sure you have chosen the right kind for your personal metropolis/region. You may look over the form while using Preview option and look at the form outline to ensure it is the right one for you.

- When the kind is not going to meet your needs, use the Seach industry to find the proper kind.

- When you are certain the form would work, select the Acquire now option to obtain the kind.

- Opt for the rates plan you desire and enter in the necessary details. Build your accounts and purchase the order making use of your PayPal accounts or Visa or Mastercard.

- Choose the file file format and download the lawful document format to your device.

- Full, change and print out and signal the acquired California Addendum to Contract for Sale and Purchase of Real Property.

US Legal Forms will be the greatest catalogue of lawful forms in which you can find various document web templates. Use the company to download appropriately-manufactured paperwork that comply with status demands.

Form popularity

FAQ

An addendum is used to clarify and add things that were not initially part of the original contract or agreement. Think of addendums as additions to the original agreement (for example, adding a deadline where none existed in the original version).

An addendum is an attachment to a contract that modifies the terms and conditions of the original contract. Addendums are used to efficiently update the terms or conditions of many types of contracts.

While an amendment alters the core terms of the contract, an addendum provides supplementary information without changing the original content.

In real estate, a contract addendum is an attachment to the original agreement that details additional terms that were not outlined in the original contract. These terms typically include things like contingencies, financing details, and disclosures about the state of the home.

A Buyer may assign the Agreement to another person only if receiving agreement from the Seller. Total Assignment ? This rarely occurs, but the AOAA is needed to properly document this assignment and must be signed by both Seller & Buyer.

The addendum should detail all the terms different from the original purchase agreement: changes, alterations, deletions, and additions the document is making to the original contract. Furthermore, the addendum should reference the specific section or provision number in the contract affected by the change.

An addendum is an additional document that gets added to the purchase and sale agreement. The document will include any additional information or requests that the buyer did not put into the original purchase and sale agreement.

An addendum or appendix, in general, is an addition required to be made to a document by its author subsequent to its printing or publication. It comes from the gerundive addendum, plural addenda, "that which is to be added," from addere ( lit. ''give toward'', compare with memorandum, agenda, corrigenda).