In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

California Waiver of Final Accounting by Sole Beneficiary

Description

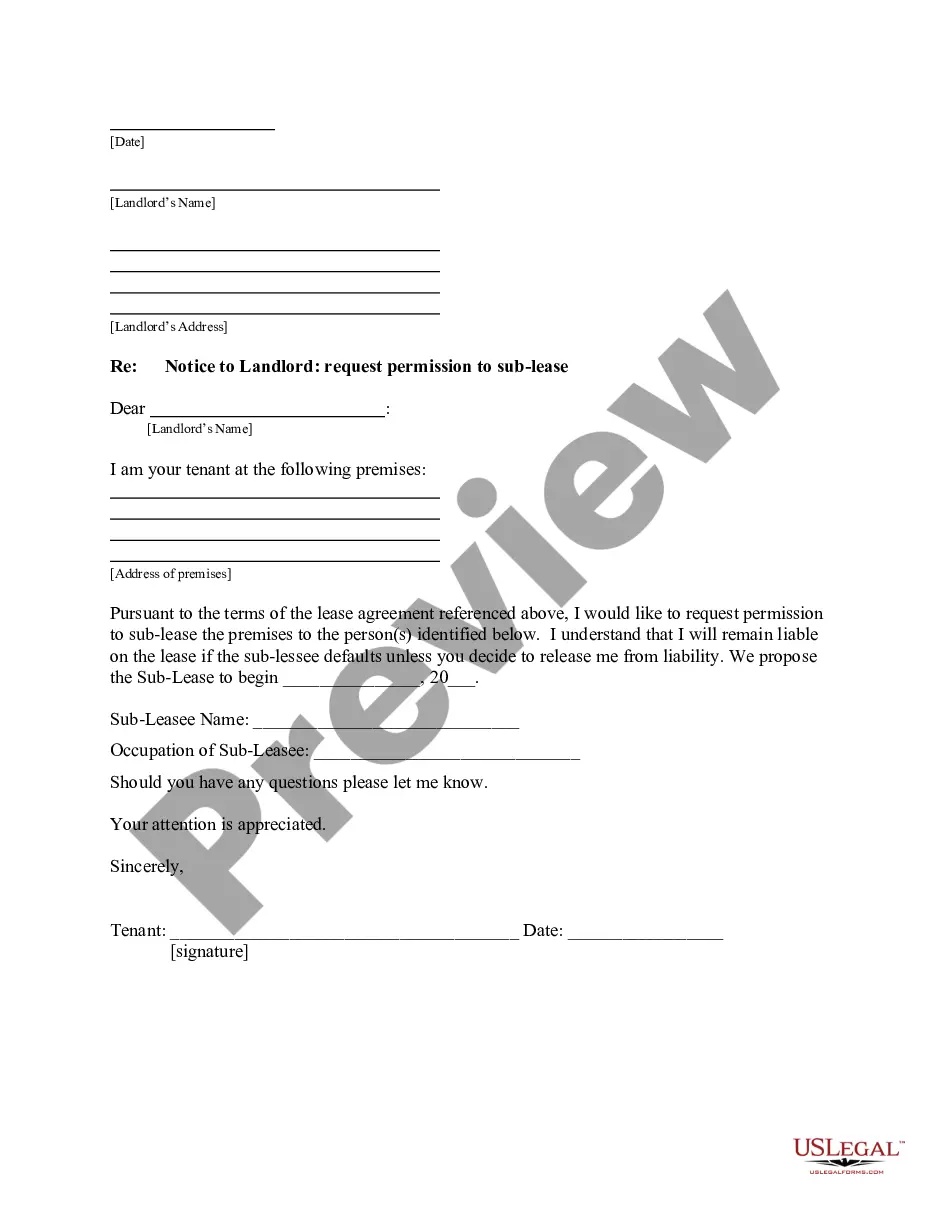

How to fill out Waiver Of Final Accounting By Sole Beneficiary?

Discovering the right legal papers format might be a struggle. Needless to say, there are tons of web templates available online, but how would you get the legal kind you want? Utilize the US Legal Forms site. The service delivers 1000s of web templates, for example the California Waiver of Final Accounting by Sole Beneficiary, which you can use for company and private needs. All of the varieties are inspected by pros and satisfy state and federal specifications.

If you are currently signed up, log in to the accounts and then click the Acquire key to obtain the California Waiver of Final Accounting by Sole Beneficiary. Make use of accounts to check throughout the legal varieties you possess bought earlier. Visit the My Forms tab of your respective accounts and acquire one more backup in the papers you want.

If you are a new consumer of US Legal Forms, allow me to share simple instructions for you to stick to:

- First, make sure you have selected the proper kind for the metropolis/area. You may examine the form utilizing the Review key and study the form information to make certain it will be the right one for you.

- In case the kind is not going to satisfy your requirements, take advantage of the Seach area to get the correct kind.

- Once you are positive that the form would work, click the Purchase now key to obtain the kind.

- Select the costs program you would like and type in the required details. Create your accounts and buy the order with your PayPal accounts or Visa or Mastercard.

- Opt for the data file formatting and acquire the legal papers format to the gadget.

- Complete, revise and printing and indicator the attained California Waiver of Final Accounting by Sole Beneficiary.

US Legal Forms may be the greatest local library of legal varieties where you can discover different papers web templates. Utilize the service to acquire skillfully-manufactured papers that stick to condition specifications.

Form popularity

FAQ

Waiver of probate accounting The need to submit a probate accounting can be waived if either of the following conditions are met: All persons entitled to a distribution from the estate have executed and filed a written waiver of account or a written acknowledgment that their interest in the estate has been satisfied.

As a beneficiary, you are entitled to review the trust's records including bank statements, the checking account ledger, receipts, invoices, etc. Before the trust administration is complete, it is recommended you request and review the trust's records which support the accounting.

Right to formal accounting: generally speaking, a trustee is required to provide a trust accounting at least annually, at the termination of the trust, and upon a change of trustees. Accountings are also required at the termination of a trust and upon a change of trustee. (See California Probate Code section 16062(a).)

Beneficiaries have up to three years to file an objection or a challenge to a trustee's accounting. If an objection is filed, you as the trustee need to prove that the information you've provided in your accounting is accurate.

Executor refuses to provide accounting If an executor withholds a proper accounting or omits required assets, beneficiaries can file a petition demanding an accounting. Consequently, the executor will be mandated to present a comprehensive report detailing the movement of assets within the estate.

Beneficiary rules Once an account owner assigns a beneficiary, the beneficiary only has access to the account upon the owner's death. The account owner may also remove or change who they designate at any time. Assigning a beneficiary doesn't override survivorship.

When a person passes away, their assets are distributed in ance with either their estate plan or California's intestate succession laws. However, certain assets, including most bank accounts, can pass directly to beneficiaries, without the need for probate or the court's intervention.

The Personal Representative is required to file an accounting of the financial transactions that have occurred in the administration of the estate unless all persons entitled to distribution of the estate have signed a written waiver of account or a written acknowledgment that the person has received his or her share ...