Judicial lien is a lien obtained by judgment, levy, sequestration or other legal or equitable process or proceeding. If a court finds that a debtor owes money to a creditor and the judgment remains unsatisfied, the creditor can ask the court to impose a lien on specific property owned and possessed by the debtor. After imposing the lien, the court issues a writ directing the local sheriff to seize the property, sell it and turn over the proceeds to the creditor.

Under Bankruptcy proceedings, a creditor can obtain a judicial lien by filing a final judgment issued against a debtor through a lawsuit filed in state court. A certified copy of a final judgment may be filed in the county in which the debtor owns real property. A bankruptcy debtor can file a motion to avoid Judicial Lien. A Motion to avoid Judicial Lien can be filed by a debtor in either a chapter 7 or chapter 13 bankruptcy proceeding. In a Chapter 7 proceeding, an Order Avoiding Judicial Lien will remove the debt totally.

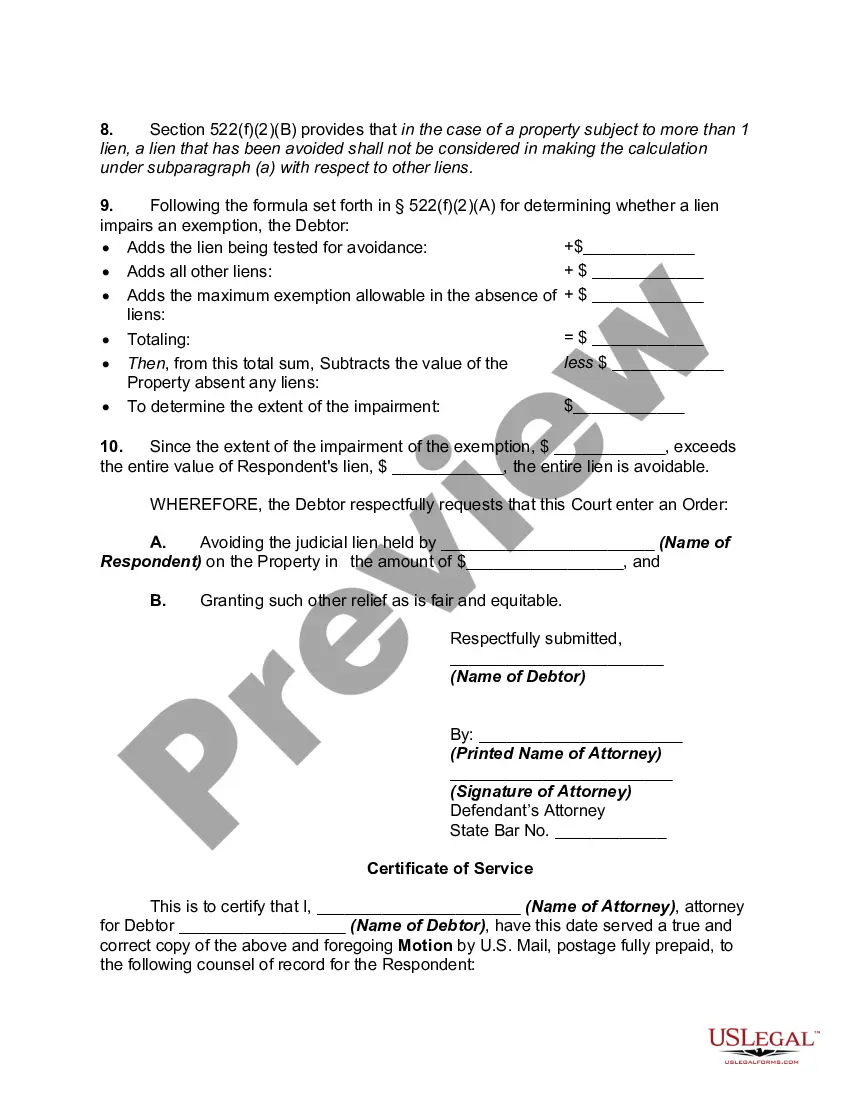

California Motion to Avoid Creditor's Lien is a legal process that allows individuals or businesses to request the court to remove a creditor's lien from their property. This motion is often filed in bankruptcy cases when a creditor has placed a lien on the debtor's property, and the debtor believes that the lien impairs their exempt property or causes an undue burden. In the state of California, there are two main types of motions to avoid a creditor's lien: 1. California Motion to Avoid Judicial Lien: This type of motion is filed when a creditor secures a judgment against the debtor through a lawsuit. If the debtor believes that this judgment lien impairs their exempt property (property protected from creditor claims), they can file a California Motion to Avoid Judicial Lien to request its removal. 2. California Motion to Avoid Nonpossessory, Nonpurchase Money Security Interest: This motion is filed when a creditor has acquired a nonpossessory, nonpurchase money security interest on the debtor's property. Examples of such security interests include those for motor vehicles, household goods, or any personal property. If the debtor feels that the value of their exempt property is affected by this type of lien, they can file a California Motion to Avoid Nonpossessory, Nonpurchase Money Security Interest. In both types of motions, the debtor needs to demonstrate to the court that the lien impairs their exempt property or causes an undue burden. These motions require a detailed and accurate description of the property, the nature of the lien, and the reasons for seeking its avoidance. It is crucial to present supporting evidence and legal arguments to ensure a successful outcome. When filing a California Motion to Avoid Creditor's Lien, it is essential to adhere to the local court rules and procedures. The debtor should consult with an experienced bankruptcy attorney who can guide them through the process and provide expert advice, increasing the chances of a favorable resolution. In conclusion, a California Motion to Avoid Creditor's Lien is a legal remedy available to debtors in bankruptcy cases who believe that a creditor's lien impairs their exempt property or causes an undue burden. By filing this motion, individuals or businesses can seek the court's intervention to remove the lien and protect their exempt assets.California Motion to Avoid Creditor's Lien is a legal process that allows individuals or businesses to request the court to remove a creditor's lien from their property. This motion is often filed in bankruptcy cases when a creditor has placed a lien on the debtor's property, and the debtor believes that the lien impairs their exempt property or causes an undue burden. In the state of California, there are two main types of motions to avoid a creditor's lien: 1. California Motion to Avoid Judicial Lien: This type of motion is filed when a creditor secures a judgment against the debtor through a lawsuit. If the debtor believes that this judgment lien impairs their exempt property (property protected from creditor claims), they can file a California Motion to Avoid Judicial Lien to request its removal. 2. California Motion to Avoid Nonpossessory, Nonpurchase Money Security Interest: This motion is filed when a creditor has acquired a nonpossessory, nonpurchase money security interest on the debtor's property. Examples of such security interests include those for motor vehicles, household goods, or any personal property. If the debtor feels that the value of their exempt property is affected by this type of lien, they can file a California Motion to Avoid Nonpossessory, Nonpurchase Money Security Interest. In both types of motions, the debtor needs to demonstrate to the court that the lien impairs their exempt property or causes an undue burden. These motions require a detailed and accurate description of the property, the nature of the lien, and the reasons for seeking its avoidance. It is crucial to present supporting evidence and legal arguments to ensure a successful outcome. When filing a California Motion to Avoid Creditor's Lien, it is essential to adhere to the local court rules and procedures. The debtor should consult with an experienced bankruptcy attorney who can guide them through the process and provide expert advice, increasing the chances of a favorable resolution. In conclusion, a California Motion to Avoid Creditor's Lien is a legal remedy available to debtors in bankruptcy cases who believe that a creditor's lien impairs their exempt property or causes an undue burden. By filing this motion, individuals or businesses can seek the court's intervention to remove the lien and protect their exempt assets.