Title: California Sample Letter for Tax Clearance Letters: Comprehensive Overview and Types Introduction: Understanding the process of obtaining tax clearance in California is crucial for individuals and businesses. This detailed description will guide you through the process and provide essential information on the various types of California sample letters for tax clearance letters. 1. California Tax Clearance Letters: An Overview: Tax clearance letters play a vital role in California, as they confirm that an individual or business has complied with all state tax obligations. These letters are typically required during business transactions, mergers, acquisitions, or when closing a business entity. 2. Key Elements of a California Sample Tax Clearance Letter: A sample tax clearance letter from California should contain vital information, such as the taxpayer's name, address, and taxpayer identification number. It should also mention the effective date of the clearance and confirm that the taxpayer has met all their tax obligations. 3. Types of California Sample Letter for Tax Clearance Letters: a) Individual Tax Clearance Letters: Individuals seeking tax clearance in California may need to provide a specific sample letter declaring their tax compliance history. This letter is typically required for personal transactions, property transfers, or immigration purposes. b) Business Entity Tax Clearance Letters: Different types of businesses in California, such as partnerships, corporations, and limited liability companies (LCS), may require tax clearance letters before transferring ownership, merging with other entities, or during dissolution. Each business entity type may have specific requirements for the tax clearance letter. c) Sales and Use Tax Clearance Letters: Businesses involved in sales and use tax activities in California may need a clearance letter to ensure their tax compliance. This type of tax clearance is particularly vital for acquisitions, mergers, or obtaining financing for business expansion. d) Employment Tax Clearance Letters: Employers who have paid all required employment taxes may require an employment tax clearance letter from the California Employment Development Department (EDD). This type of clearance is often needed during the sale, transfer, or termination of a business. e) Franchise Tax Board (FT) Clearance Letters: The California Franchise Tax Board issues clearance letters as proof of tax compliance for various transactions and activities. These clearance letters are commonly required during real estate transactions, loan applications, or the restructuring of entities. Conclusion: Obtaining tax clearance in California is important for individuals and businesses to ensure compliance with state tax obligations. The various types of California sample letters for tax clearance mentioned above cater to different scenarios, such as personal transactions, business transfers, mergers, and dissolution. By understanding the different types of tax clearance letters available, individuals and businesses can navigate the process more efficiently and ensure smooth transactions.

California Sample Letter for Tax Clearance Letters

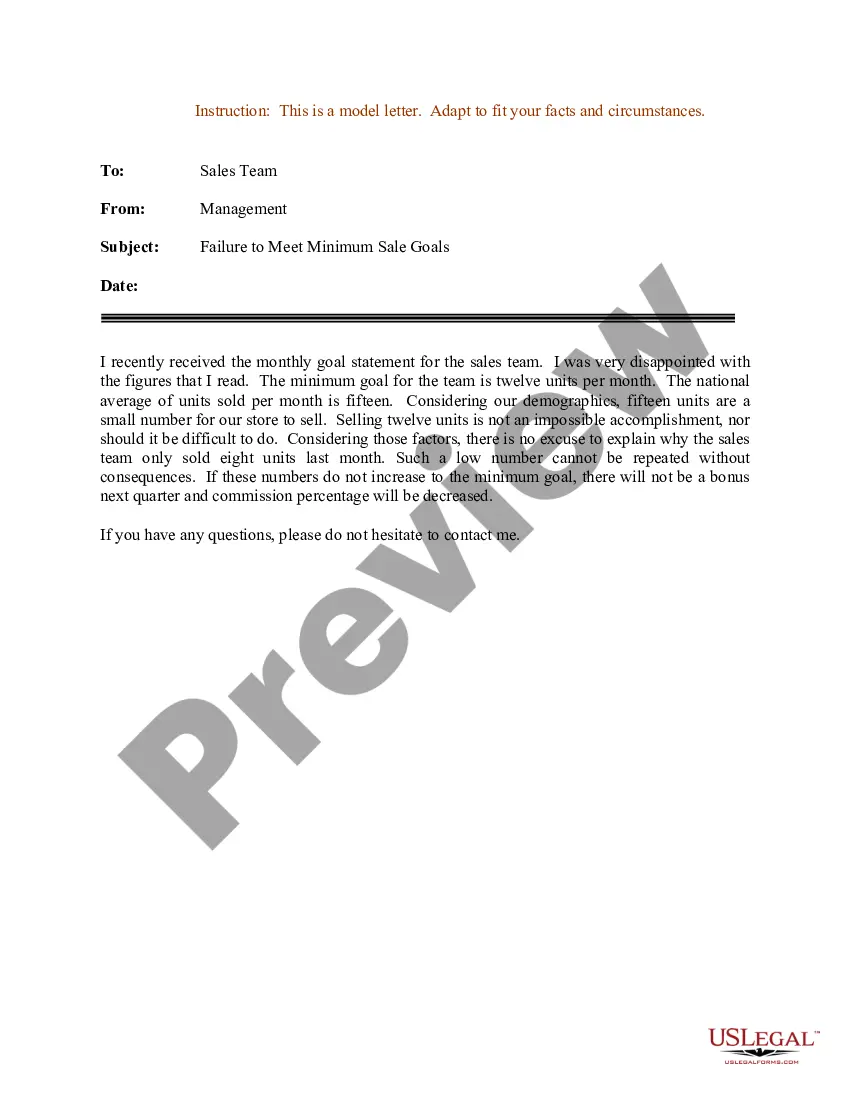

Description

How to fill out California Sample Letter For Tax Clearance Letters?

If you want to full, obtain, or print legal record themes, use US Legal Forms, the most important collection of legal types, which can be found online. Take advantage of the site`s easy and handy research to find the files you will need. Numerous themes for organization and specific functions are categorized by categories and says, or key phrases. Use US Legal Forms to find the California Sample Letter for Tax Clearance Letters with a couple of click throughs.

In case you are presently a US Legal Forms client, log in for your accounts and then click the Acquire option to obtain the California Sample Letter for Tax Clearance Letters. You may also gain access to types you in the past delivered electronically inside the My Forms tab of the accounts.

Should you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for the right area/country.

- Step 2. Use the Preview solution to examine the form`s content. Do not forget to read the description.

- Step 3. In case you are not satisfied using the form, utilize the Lookup discipline towards the top of the display screen to get other types of the legal form web template.

- Step 4. After you have discovered the form you will need, click the Buy now option. Pick the pricing program you prefer and add your credentials to sign up for the accounts.

- Step 5. Procedure the purchase. You can utilize your bank card or PayPal accounts to accomplish the purchase.

- Step 6. Find the file format of the legal form and obtain it on the gadget.

- Step 7. Complete, revise and print or indicator the California Sample Letter for Tax Clearance Letters.

Every legal record web template you purchase is the one you have permanently. You possess acces to every single form you delivered electronically with your acccount. Click the My Forms segment and pick a form to print or obtain once more.

Remain competitive and obtain, and print the California Sample Letter for Tax Clearance Letters with US Legal Forms. There are many professional and state-specific types you can use for the organization or specific requires.