California Self-Assessment Worksheet

Category:

State:

Multi-State

Control #:

US-04029BG

Format:

Word;

Rich Text

Instant download

Description

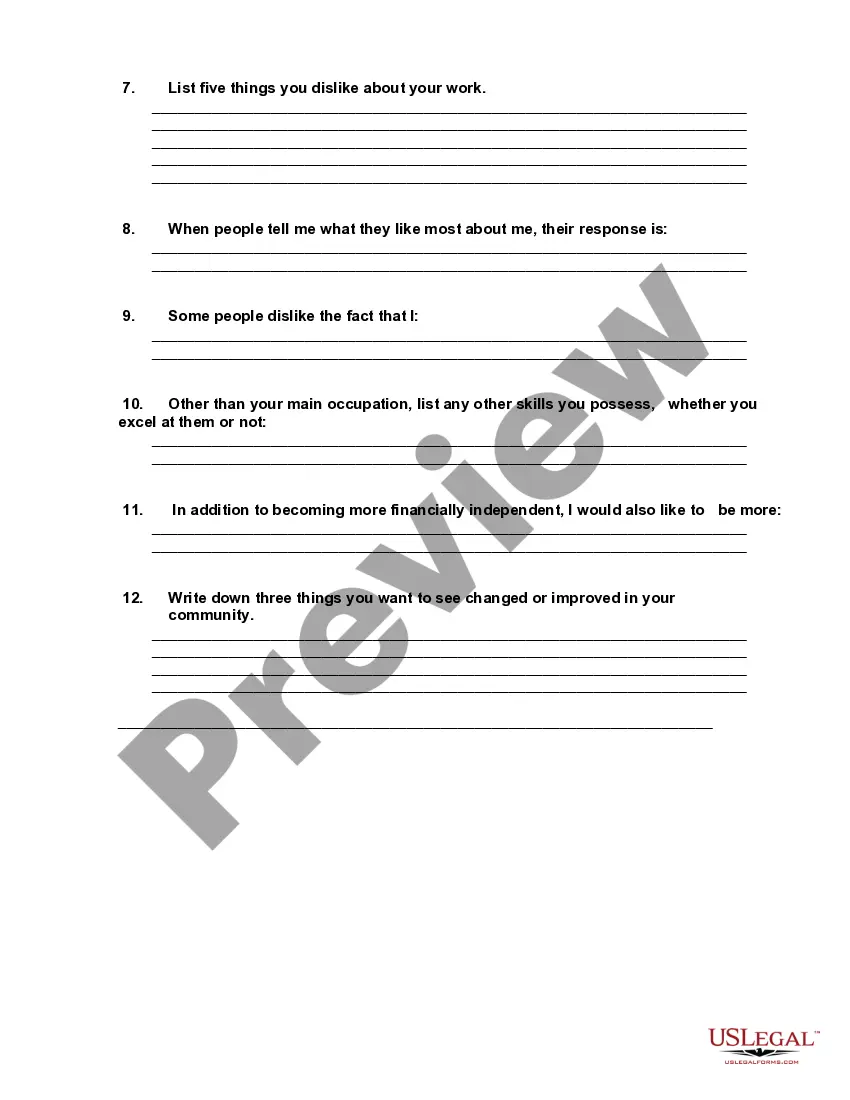

Complete the following self-assessment work sheet as honestly as you can. Just write down whatever comes to mind; don't over-think the exercise. Most likely, your first response will be your best. Once you've finished the exercises, look for patterns (i.e., is there a need for a business doing one of the things you like or are good at?)

Free preview

How to fill out Self-Assessment Worksheet?

If you wish to finalize, acquire, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Employ the site's straightforward and efficient search to retrieve the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and provide your credentials to sign up for an account.

Step 5. Complete the transaction. You can use your Misa or credit card or PayPal account to execute the transaction.

- Use US Legal Forms to acquire the California Self-Assessment Worksheet with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to obtain the California Self-Assessment Worksheet.

- You can also access forms you previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the content of the form. Do not forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find different versions of the legal form format.