A buy-sell agreement is an agreement between the owners of the business for purchase of each others interest in the business. Such an agreement will spell out the terms governing sale of company stock to an outsider and thus protect control of the company. It can be triggered in the event of the owner's death, disability, retirement, withdrawal from the business or other events. Life insurance owned by the corporation is often used to provide the funds to purchase the shares of a closely held company if one of the owners dies.

The time to prevent disputes is before they occur. Experience proves that owners anxieties created in dealing with one another are inversely proportional to the effort they spend addressing business problems in the event that they should happen. Dealing with these contingencies before they manifest themselves is the secret to a harmonious business relationship with other owners, Use the checklist below to determine areas where you may need assistance.

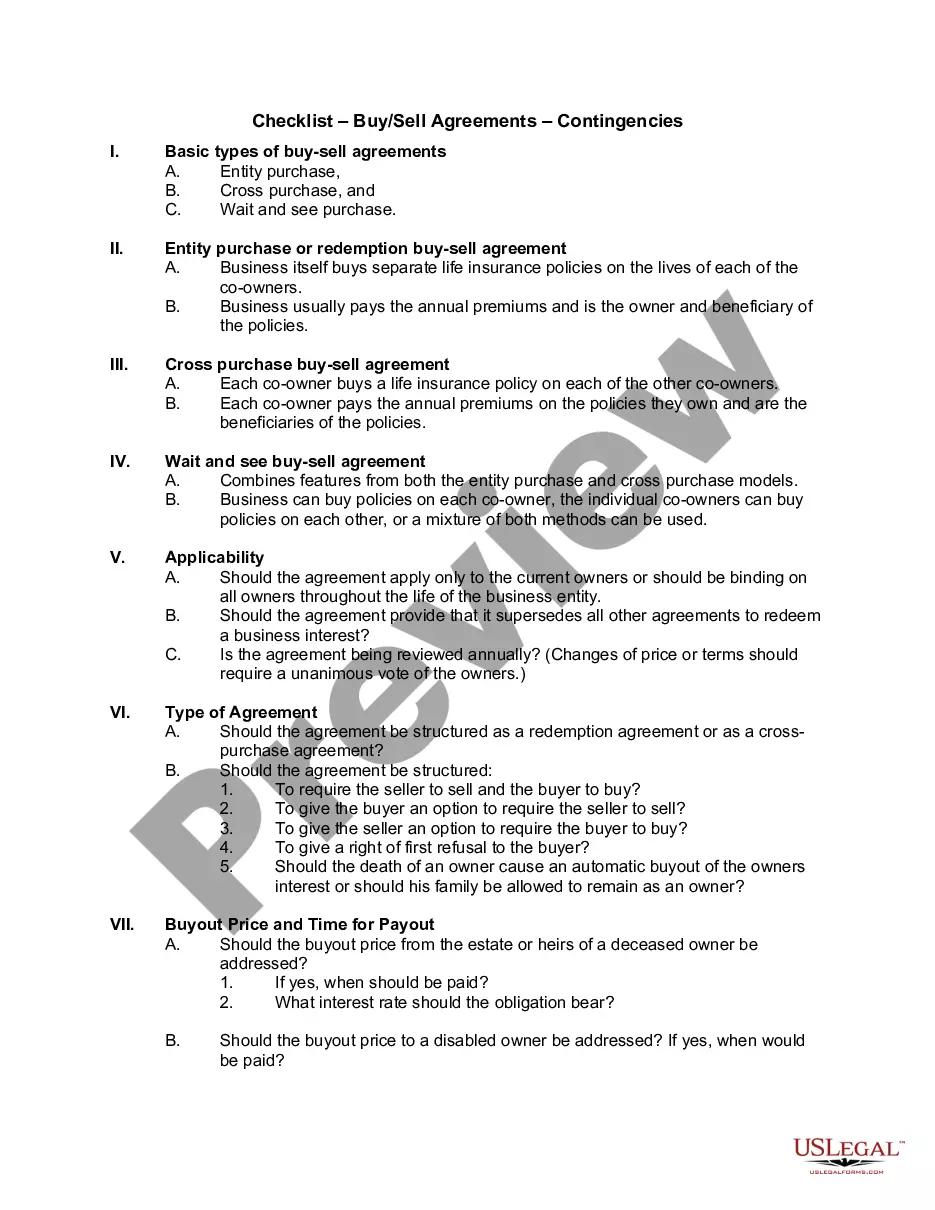

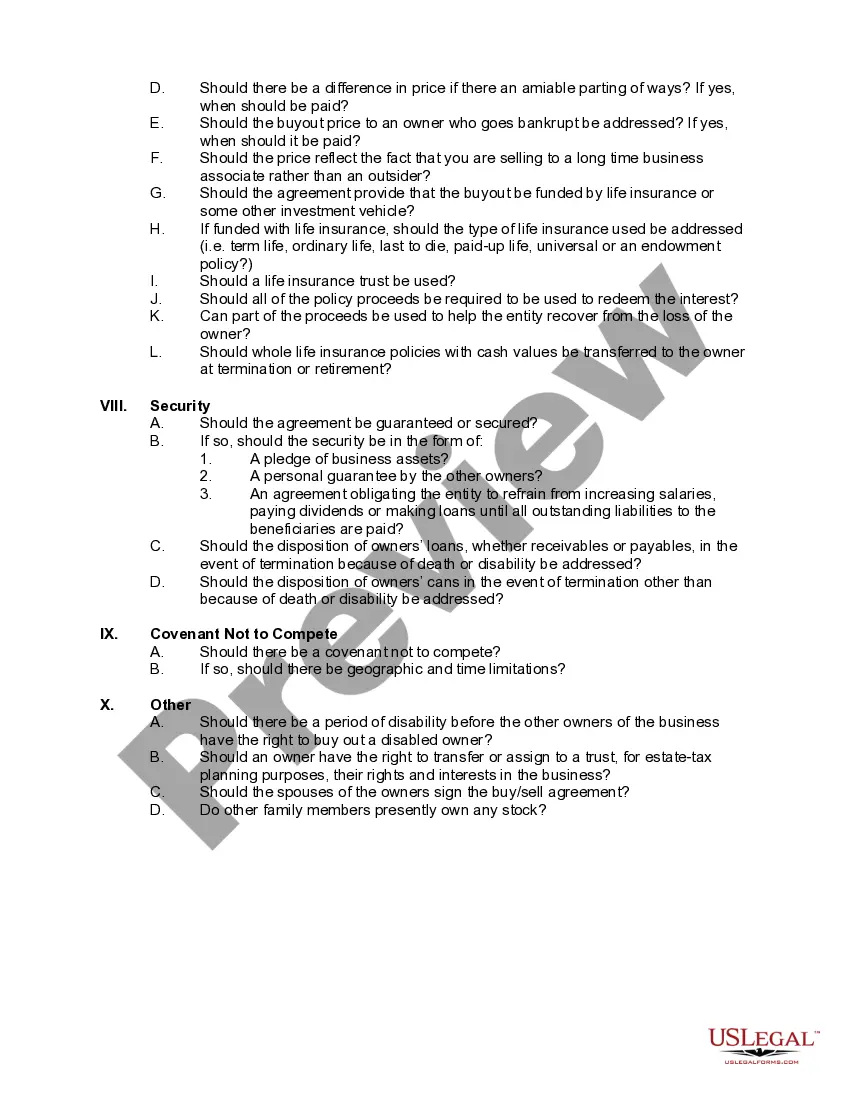

California Checklist — Buy/Sell Agreement— - Contingencies Buy/Sell agreements are legally binding contracts that outline the terms and conditions for the purchase or sale of a business or its assets. In California, there are certain checklists and contingencies that buyers and sellers must consider ensuring a smooth transaction. This article provides a detailed description of these considerations, including relevant keywords. 1. Due Diligence: Before entering into a buy/sell agreement, both buyers and sellers should conduct thorough due diligence. This involves assessing the financial and legal aspects of the business, including its assets, liabilities, contracts, licenses, permits, intellectual property, and any outstanding legal or tax issues. 2. Purchase Price and Payment Terms: The buy/sell agreement should clearly state the agreed-upon purchase price, including any adjustments or allocations for inventory, equipment, or real estate. The payment terms, such as down payment amount, financing options, and a payment schedule, should also be outlined. 3. Contingencies: Contingencies are clauses that protect the buyer and allow them to back out of the transaction if certain conditions are not met. In California, common contingencies in buy/sell agreements include: a. Financing Contingency: This contingency allows the buyer to back out of the agreement if they are unable to secure financing within a specified timeframe. b. Inspection Contingency: This contingency gives the buyer the right to inspect the business premises, equipment, and other assets before completing the purchase. If there are any significant defects or issues found during the inspection period, the buyer may negotiate repairs or terminate the agreement. c. Licenses and Permits Contingency: This contingency ensures that the business has all the necessary licenses, permits, and certifications to operate legally. If any required licenses or permits are missing or expired, the buyer may request their acquisition or terminate the agreement. d. Legal and Regulatory Contingency: This contingency considers potential legal or regulatory hurdles that could impact the business's operations. If the buyer discovers any pending litigation, regulatory violations, or non-compliance with laws, they may have the option to terminate the agreement. 4. Representations and Warranties: Buy/sell agreements typically include representations and warranties made by the seller regarding the business's condition, ownership of assets, financial statements, tax compliance, and any other relevant information. These representations and warranties protect the buyer in case of any misrepresentation or inaccuracies by the seller. 5. Dispute Resolution: The buy/sell agreement should outline the methods for resolving disputes, such as negotiation, mediation, or arbitration. Specifying the jurisdiction and venue for legal proceedings in California is important in case litigation becomes necessary. Different Types of California Checklist — Buy/Sell Agreement— - Contingencies: 1. Asset Purchase Agreement: This type of agreement involves the sale of specific assets or liabilities of a business, rather than the entire entity. It typically includes contingencies related to asset valuation, transferability, and allocation. 2. Stock Purchase Agreement: In a stock purchase agreement, the buyer acquires the entire ownership interest in the business, including its assets, liabilities, and legal obligations. Contingencies in this agreement may focus on due diligence related to the stock's ownership, stockholder approval, and any restrictions on the transfer of stock. 3. Merger Agreement: A merger agreement involves the combination of two or more businesses into one entity. This agreement may include contingencies related to the merger terms, shareholder approvals, regulatory compliance, and financial statements. In summary, California Checklists — Buy/Sell Agreement— - Contingencies are essential for smooth business transactions. Buyers and sellers should consider due diligence, purchase price, contingencies, representations and warranties, and dispute resolution when crafting these agreements. Various types of buy/sell agreements include asset purchase agreements, stock purchase agreements, and merger agreements, each with their unique contingencies.California Checklist — Buy/Sell Agreement— - Contingencies Buy/Sell agreements are legally binding contracts that outline the terms and conditions for the purchase or sale of a business or its assets. In California, there are certain checklists and contingencies that buyers and sellers must consider ensuring a smooth transaction. This article provides a detailed description of these considerations, including relevant keywords. 1. Due Diligence: Before entering into a buy/sell agreement, both buyers and sellers should conduct thorough due diligence. This involves assessing the financial and legal aspects of the business, including its assets, liabilities, contracts, licenses, permits, intellectual property, and any outstanding legal or tax issues. 2. Purchase Price and Payment Terms: The buy/sell agreement should clearly state the agreed-upon purchase price, including any adjustments or allocations for inventory, equipment, or real estate. The payment terms, such as down payment amount, financing options, and a payment schedule, should also be outlined. 3. Contingencies: Contingencies are clauses that protect the buyer and allow them to back out of the transaction if certain conditions are not met. In California, common contingencies in buy/sell agreements include: a. Financing Contingency: This contingency allows the buyer to back out of the agreement if they are unable to secure financing within a specified timeframe. b. Inspection Contingency: This contingency gives the buyer the right to inspect the business premises, equipment, and other assets before completing the purchase. If there are any significant defects or issues found during the inspection period, the buyer may negotiate repairs or terminate the agreement. c. Licenses and Permits Contingency: This contingency ensures that the business has all the necessary licenses, permits, and certifications to operate legally. If any required licenses or permits are missing or expired, the buyer may request their acquisition or terminate the agreement. d. Legal and Regulatory Contingency: This contingency considers potential legal or regulatory hurdles that could impact the business's operations. If the buyer discovers any pending litigation, regulatory violations, or non-compliance with laws, they may have the option to terminate the agreement. 4. Representations and Warranties: Buy/sell agreements typically include representations and warranties made by the seller regarding the business's condition, ownership of assets, financial statements, tax compliance, and any other relevant information. These representations and warranties protect the buyer in case of any misrepresentation or inaccuracies by the seller. 5. Dispute Resolution: The buy/sell agreement should outline the methods for resolving disputes, such as negotiation, mediation, or arbitration. Specifying the jurisdiction and venue for legal proceedings in California is important in case litigation becomes necessary. Different Types of California Checklist — Buy/Sell Agreement— - Contingencies: 1. Asset Purchase Agreement: This type of agreement involves the sale of specific assets or liabilities of a business, rather than the entire entity. It typically includes contingencies related to asset valuation, transferability, and allocation. 2. Stock Purchase Agreement: In a stock purchase agreement, the buyer acquires the entire ownership interest in the business, including its assets, liabilities, and legal obligations. Contingencies in this agreement may focus on due diligence related to the stock's ownership, stockholder approval, and any restrictions on the transfer of stock. 3. Merger Agreement: A merger agreement involves the combination of two or more businesses into one entity. This agreement may include contingencies related to the merger terms, shareholder approvals, regulatory compliance, and financial statements. In summary, California Checklists — Buy/Sell Agreement— - Contingencies are essential for smooth business transactions. Buyers and sellers should consider due diligence, purchase price, contingencies, representations and warranties, and dispute resolution when crafting these agreements. Various types of buy/sell agreements include asset purchase agreements, stock purchase agreements, and merger agreements, each with their unique contingencies.